TriMetals Mining Inc. (TSX: TMI and TMI.B; OTCQX: TMIAF and TMIBF) Advances Nevada and Utah Gold Springs Project with 100% Ownership and Positive PEA Results

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC

on 4/27/2016

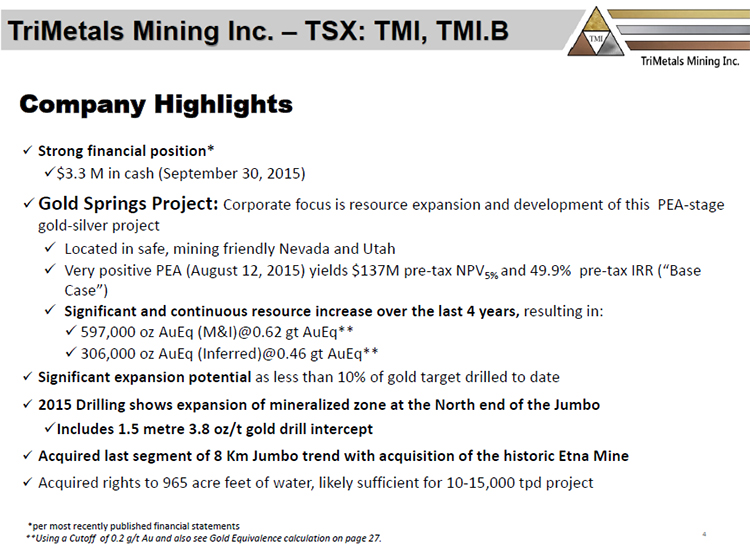

TriMetals Mining Inc. (TSX: TMI and TMI.B; OTCQX: TMIAF and TMIBF) is a Gold Mining Stock advancing its 100% owned, near-surface, Gold Springs gold-silver project in mining friendly Nevada and Utah in the USA. Ralph Fitch, Chairman, President and CEO of TriMetals Mining has a very successful career as an exploration geologist and has built a very competent team. TriMetals Mining is focused on gold exploration at their large 100% owned Gold Springs property located in Nevada and Utah. After drilling on a small portion of the property, the company has seen positive PEA results that are showing positive cash flow even at $1000/oz gold price. Investors, who are looking for an American gold play with no royalties on the resource and a large expanse of land that will give the company plenty of additional exploration space in the future, might consider TriMetals Mining.

Ralph Fitch, Chairman, President and CEO of TriMetals Mining (TSX: TMI), spoke with Dr. Alper, at the recently held PDAC conference, to share information about TriMetals Mining with readers who may be interested in investing in his company. He talked about the results of the company’s PEA study and their next steps in drilling for gold in Nevada and Utah.

Mr. Fitch said, “TriMetals Mining is focused in Nevada and Utah where we have a property called Gold Springs where we have been exploring for a few years now. There are a few key items that investors should focus on. We have a large property position, about 74 square kilometers. It is 100% owned and there are no royalties on any part of the resource blocks. It is of special interest to us as explorationists because of its potential to host a very large resource. I used to be the Chief Geologist for Chevron and have had a long history in exploration.

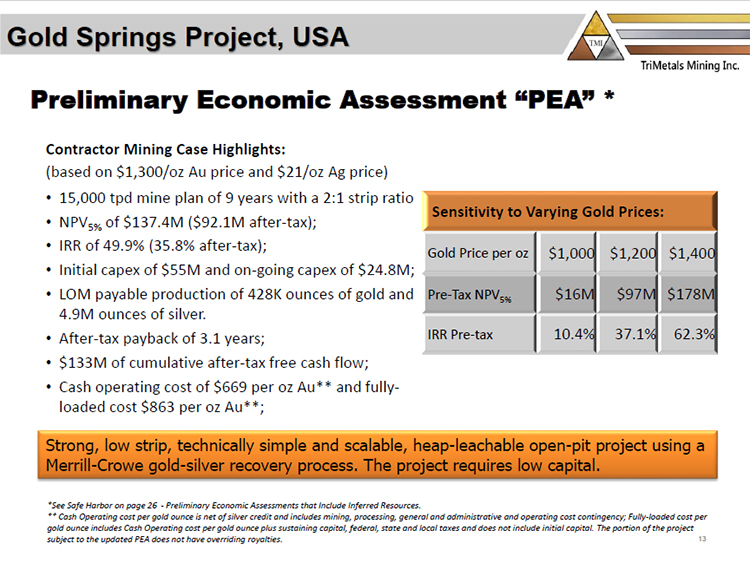

We are particularly interested in the area because there are 26 areas of outcropping gold mineralization in the plus one gram per ton category. We have drilled gold mineralization in each of these areas that we have drilled and in two of the 26, have drilled enough holes to develop a resource, a 43-101 resource. The resource, if you add up the inferred and the measured and indicated, which you have to report separately, but if you lump them all together, it is about 903,000 ounces of 0.6 grams per ton gold equivalent. We completed a resource at this early stage of exploration so that we can show we have a significant resource even though we have only completed resource drilling on two of the 26 targets. Following the definition of the resource, we also completed a PEA. The PEA came out strongly positive, with an NPV of US$137 million at 5%.”

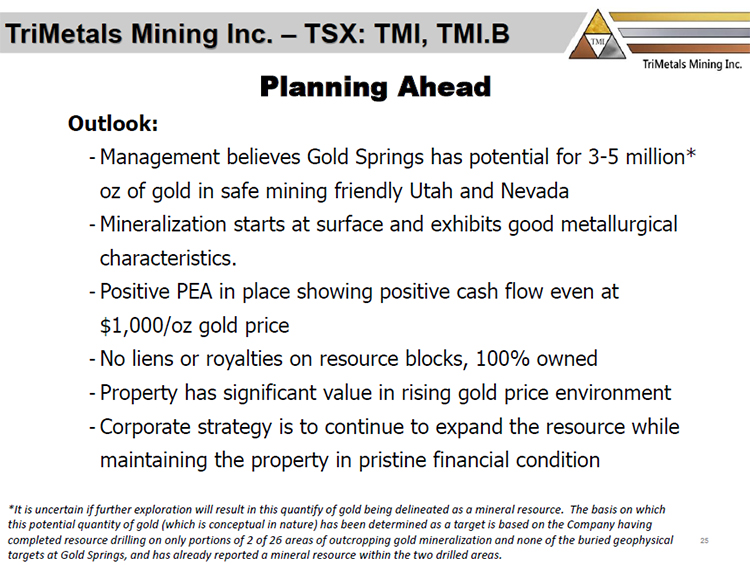

The gold discovery is located within a large land block that will give the company plenty of additional exploration space in the future. Mr. Fitch said, “So now, the picture is that we have 26 areas of outcrop in this large 74 square kilometer area. We have drilled portions of two of them. We already have 903,000 ounces and we have completed a positive PEA . We are particularly keen on the property because the other 24 areas of outcrop are very similar and we think that we have a very good chance of discovering additional resources. We believe the property may host three to five million ounces which is a very reasonable benchmark that we think we can reach. So we have a very good exploration play. We are already into the discovery stage. We are already into our first million with a positive PEA.”

This discovery is a benefit to investors, who are looking for an American gold play, according to Fitch. He said, “We have no royalties on the majority of the property and none on the present resource blocks. We have BLM permits called a “Plan of Operations” in Nevada and Utah to carry forward detailed exploration and there are no big issues environmentally. We have a very good relationship with the BLM, the government group that manages the Federal lands in the US. We think that we have a very, very good project and people can look forward to additional discovery.”

Despite the challenges in the market, Mr. Fitch and his team have continued to move the project forward. He said, “Over the last four years, we have increased the resource each year. Even though the market has been down, we have carried out a modest drill program each year to expand the resource base, but with care to maintain a strong treasury so that we don’t dilute our shareholders too much through the need for further fund raising when stock prices are low. As the market comes back up, people are noticing our story. We have a PEA that indicates that the project will be economic and we have only completed resource drilling on less than 10% of the gold target.”

Fitch credits his team with the progress at Gold Spring. He said, “All discoveries are team efforts. Randy Moore our EVP of Exploration brought the property to us. He knew it from Cambior days. They destroyed themselves by a bad financial investment. Several companies made minor forays into the area, but when it became available Randy was able to pick it up. Randy has a number of discoveries already. I also was part of the team that discovered a big mine in Chile through Chevron and won the Chairman’s Award for that. We believe that Gold Springs is our next major discovery.”

Geologically, Fitch finds the project quite interesting. He said, “The Gold Springs project is a hot springs system. We believe the heat system driving the hot springs may have been rhyolites. The host rocks are andesite volcanics. They are great host rocks and at Gold Springs have led to wide zones of disseminated mineralization. We ran an airborne survey that measures the resistivity of the rocks and have found that high resistivity rocks are related to gold, only one hole drilling these targets didn’t hit any gold. Everywhere we have followed the resistivity, we have hit gold. We think the relationship is that the heat engine for the hot spring system is the high resistivity rhyolites, and the surrounding andesite volcanics host the gold.”

Said Fitch, “The property is in an old mining district from the 1880’s. The gold was first discovered by a Mr. Pike who found big slabs of loose rock on the surface that ran as high as 5 ounces of gold per ton. Mr. Pike never found the source, but he put the high grade slabs in his cart and took them off to the mill. We have found some high grade veins that come right up to the surface and we have found some of the high grade slabs. We have approximately a million ounces at .6 grams/tonne gold equivalent now, but if we can build even a small 3 gram resource from the high grade vein zones, which we think is possible, it will make a dramatic difference in the already strong economics of the heap leach operation described in the PEA.”

Mr. Fitch believes that TriMetals is a stock for investors to look at closely. He said, “ The PEA, shows US$669 cash costs and US$863 all in costs. We have 135 million shares on the market and $2.3 million in cash. We aren’t flush with cash, but we are in good shape. We continue with modest exploration programs to demonstrate that we are continuing to expand our resource base. Last year’s drilling hasn’t been added into the resource totals yet. I would say that in talking to investors in the last month or so the sentiment toward metals has changed. The prices are going up and there is more interest in the stock.”

http://www.trimetalsmining.com/

580 Hornby Street, Suite 880

Vancouver, BC V6C 3B6

Telephone: (604) 684-0693 Fax: (604) 684-0642

Denver: (303) 584-0606

|

|