Stanmore Coal Limited (ASX:SMR) Prepares to Get Coking Coal to Asian Markets from Isaac Plains Project Located in Australia

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC

on 4/22/2016

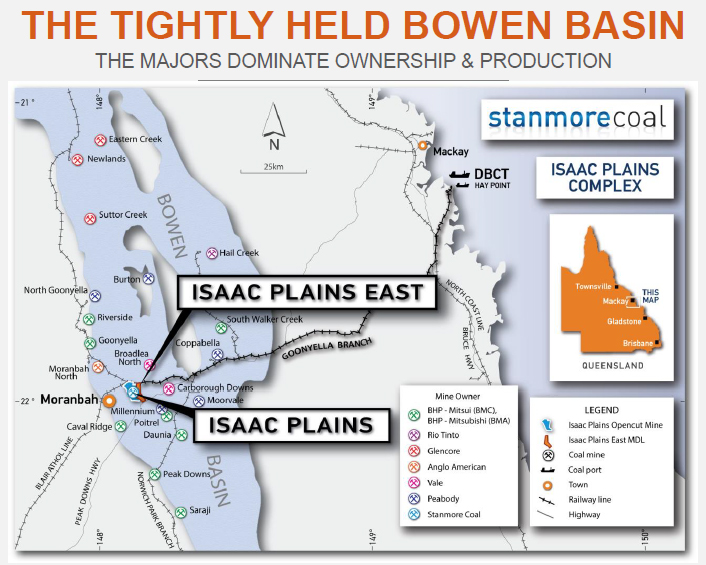

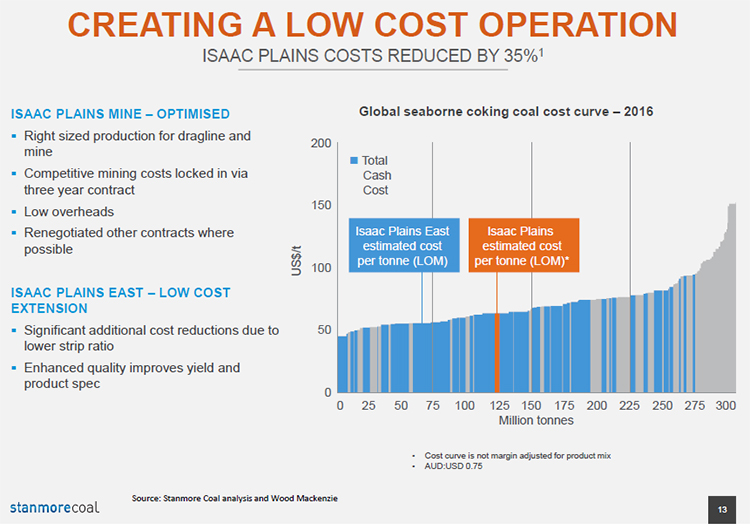

Stanmore Coal Limited (ASX:SMR)) is preparing to send their first shipment of coking coal out from the Isaac Plains project located in Australia’s Bowen Basin. Isaac Plains is an established mining asset with mining and transportation infrastructure in place and potential for future expansion via Isaac Plains East and underground mining at Isaac Plains. According to Nick Jorss, Managing Director of Stanmore Coal, in this coal market it is all about lowering the cost, and bringing Isaac back on line has decreased the costs by 35%.

Nick Jorss, Managing Director of Stanmore Coal (ASX: SMR), took a few moments to speak with Dr. Alper to update readers on the progress the company is making with their Isaac Plains coking coal operation based in Australia.

Mr. Jorss said, “It is an exciting time for us. We acquired a mine in the second half of last year in the Bowen Basin called Isaac Plains. At the same time, we acquired an adjacent property from Peabody, which we renamed Isaac Plains East. So we are now bringing back online the Isaac Plains Mine, a coal mine that originally commenced production in 2006. We are currently doing the final tweaks to the wash plant and are now moving the coal through the wash plant. The drag line is operating up there and we have a mining contractor who is running a truck shovel fleet for pre-strip. We just achieved our first coal milestone this month and we will be doing 1.1 million tons a year of coking coal selling into key north Asian steel producers.”

The company has also acquired another project nearby. Mr. Jorss said, “We recently completed an exploration program on our Isaac Plains East deposit to increase our resources which has increased the expected mine life from 3 years to 10 years with that acquisition as well.”

Stanmore Coal is working in an area that has historically been good for mining. Mr. Jorss said, “Isaac Plains is near the town of Moranbah, which is one of the three regional mining towns built by Utah, an American company operating in the 1960’s, to open up the Bowen Basin. We are right in the heart of coal country in the Bowen Basin which, as you know, dominates the seabourne market for coking coal into Asian steel mills and beyond. We are located 172 kilometers from the port of Dalrymple Bay down the Goonyella line in a part of the Basin that is surrounded by the major global coking coal producers. The rail line passes our front door and goes straight to Dalrymple Bay Coal Terminal, where we will export the product to Japan, Korea and other key steel producing customers.”

The company plans to send out their first product coal for shipment in the near term. Mr. Jorss said, “We are within a month or so. Our first production is happening now. We are mining and washing coal and certainly before the end of May we should have our first shipment going. There are a couple of things that make us different. Firstly, we are the only ASX listed junior coking coal company in the Bowen Basin. Outside of us it’s primarily the majors. We have a high quality goal. Initially, we are focused on producing semi-soft coal. The volatiles are quite low and lower than Hunter Valley coal so that is quite popular with the North Asian end users. We have been able to re-contract with some of the steel mills that have bought from the mine in the past. In this coal market, you have to watch your pennies. We have very capable people who have mined a lot of coal in their lives. It is all about bringing the costs down. Bringing Isaac back on line with a low cost focus has decreased the costs by around 35%.”

Lowering their costs has involved using a dragline as a more predominant method of excavation. Mr. Jorss said, “The mine came with an existing dragline in good condition. It is a high performance machine and a very cheap way to move dirt. We have re-optimized the mine plan to focus the open cut solely on the northern pits which have the lowest strip ratio. As a proportion we are shifting a lot more dirt with the dragline system, including some dozer dirt. We are doing a lot less with truck / shovel which is a much higher cost method. In addition, we have lowered our overheads and have renegotiated a number of the infrastructure contracts.”

The company will become profitable in the near term. Said Jorss, “We expect to wash over the next couple of years based on today’s coal price. Once we get into our Isaac Plains East, the costs drop dramatically. That is where we will make much better margins.”

Mr. Jorss and his team have a good deal of experience in the coal industry. He said, “I’m a civil engineer by training and have worked as a civil engineer in construction. I worked in finance for a similar amount of time and I started this business in 2008 with some colleagues. We have Mike McKee who has operated and built a number of low cost mines in the Bowen Basin. We run a small but experienced team, and we have over 150 years of combined coal mining experience within the team.”

Jorss is cautiously optimistic about the market. He said, “We think it is a bit early to call it a recovery but we are seeing some recent strength and tightening in the coking coal market. We are starting to see some recovery in benchmark pricing into Japan with hard coking coal rising to US$84 for the current quarter, an increase of $3. Coupled with continued strength in the spot market, with spot hard coking coal prices over US$90 there are some encouraging near term signs. But it is the longer term outlook we are focused on, and the fact is good coking coal remains a relatively scarce resource which is being depleted every year. In the meantime nobody is spending money on new projects. When the market does switch over from oversupply to undersupply, it will take quite a while to get additional coking coal to the market. So the seeds of the next upswing in the cycle are being sown today.

We have 222 million shares on issue with a market cap of $50 million. We have no corporate debt, and we have a project facility for Isaac Plains. We have $17 million in cash. We are well capitalized.”

http://stanmorecoal.com.au/

Phone +61 (7) 3238 1000

Fax +61 (7) 3238 1098

Email info@stanmorecoal.com.au

Level 8, 100 Edward Street,

Brisbane QLD 4000

|

|