Dr Alper Interviews Don Dudek, President and CEO of Savary Gold: Karankasso Gold Project in the Prolific Houndé Gold Belt in Burkina Faso, West Africa

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC

on 4/13/2016

Savary Gold Corp. (V.SCA) is focused on the exploration and development of its Karankasso gold Project located in Burkina Faso within an emerging gold camp in the prolific Houndé Gold Belt. The project's first resource estimate last November was just under 700,000 ounces, at 2.28 grams of gold per ton. According to Don Dudek, President and CEO of Savary Gold, Burkina has been a fairly good jurisdiction that has seen a lot of new investment, with quite competitive costs for exploration drilling services. The project has good upside potential with discovery of several new gold-bearing trends. Exploration drilling expected to resume in Q2/16.

Dr. Allen Alper: This is Dr. Allen Alper. I'm talking with Don Dudek, President and CEO of Savary Gold. A lot of exciting things are happening with your company in Africa. Could you tell me a little bit about what progress you have made with your gold exploration? What results you've had, your plans are for 2016?

Don Dudek:Okay. Over the last couple of years, with the drilling we've done, we put out our first resource estimate last November, which was just under 700,000 ounces, at 2.28 grams per ton gold. That's a pit constrained, open pit resource using a 0.5 gram per ton cutoff. All of the mineralized zones remain open in at least two directions, with modeled mineralized lenses extending beyond the pit constrained mineral resource at all zones. In addition, with the work we've done on the ground, we've added more than 60 new gold occurrences in the past two years, that are outside of the area that had been drilled. These, in part, are defined by five regional scale, greater than 15 kilometer long, gold, mineralized systems, along with numerous parallel, subsidiary, mineralized structures.

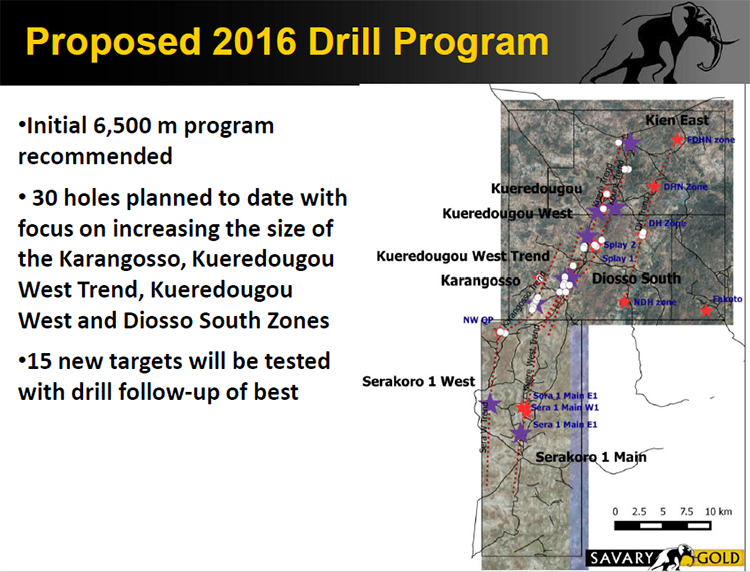

Our plan, starting in April, is to go back on the property and carry out a 6,500 meter drill program in 45 to 55 drill holes. This program is designed to both extend the known zones, especially those containing more than 2.5 grams per tonne, test what we think are the best of the best newly discovered gold zones and to test some conceptual targets that we developed through our mapping and field work. We hope that will lead to, I guess, quite a quantum change in who we are as a company. I would like to clearly demonstrate that we have potential for in excess of a million ounces of gold.

Dr. Allen Alper: That sounds great. Could you tell me how it is, operating in Burkina Faso, West Africa?

Don Dudek: For us it's been fairly simple so far. Our project area is about five hours drive to the south and west from the capital of Ouagadougou. I've been involved in this area since initial property exams in 2009, and was lucky enough to be part of a feasibility that I completed in Burkina Faso in 2012, for Endeavour Mining. We use local contractors, usually spearheaded by a single expat. Our costs are pretty low, and in-country services, they're quire competitive, cost wise, and we can get quite a bit of drilling done for quite a good cost.

Dr. Allen Alper: How is the political environment there?

Don Dudek: It's been a bit chunky over the last year and a bit, starting a little over a year ago, when there was a civilian-led coup when the leader, who had been in power for 26 years, wanted to extend his rule . Essentially 200,000 people marched on the Parliament and that was the end of his rule. Then we went through about a year of civilian-led transitional government. Burkina Faso had elections last fall. His Excellency Roch Marc Christian Kaboré is now President and won on the first ballot. President Kaboré appointed his new ministers in the beginning of this year. These new Ministers are finding their way around, but the mining code, as it is evolving, appears to be fair enough for now. We do not seem to have any political interference, and issues like bribery, fraud, et cetera, are quite low in Burkina Faso, compared to other countries.

Dr. Allen Alper: How about the geology of the region? I know you have some big neighbors, Endeavour Mining and SEMAFO.

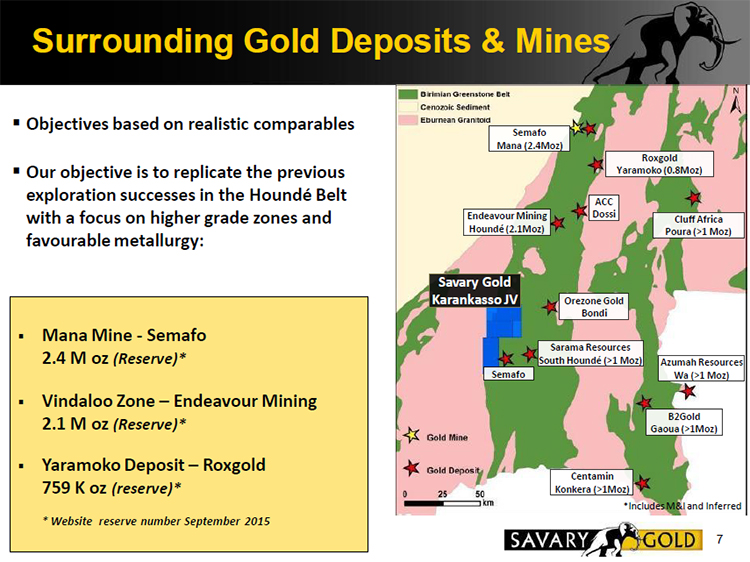

Don Dudek: Most of Burkina Faso is underlain by Proterozoic-age rocks that are around two billion years old. These rocks, which extend from Senegal, to the west, and Niger in the east, and south to Cote d'Ivoire and Ghana, are quite prolific for gold occurrences and discovery. What we have found on the project area is that almost all rock types are mineralized at some point. We have mineralization in felsic to intermediate volcanic rocks, felsic to mafic intrusions and in sediments. The Houndé Belt, which we're in, is well known in the country as having higher than average grade deposits. Starting about 100 kilometers north of us is SEMAFO's Mana complex, their initial open pit called Wona had about five million ounces at 2 to 2.5 grams per tonne. They discovered the Siou zone a couple years ago, and it's brought a million and a half ounces, open pit again, just over 4 grams per tonne. Immediately south of them is Roxgold's Yaramoko project. It's underground at around 12 grams per tonne. They should be commencing gold pour this year.

South of that is Endeavour, which is about 50 kilometers north of us. They have a little over 2 million ounces of reserves, at just over 2 grams. They will be making a decision on whether to proceed with that mine likely this year. Next one down the road is Orezone's Bomboré Project. There's a little over 400,000 ounces at just over 2 grams. Our resource is 2.28 grams, and our nearby neighbors, Sarama, have a resource of 2.1 million ounces, at about 1.6 grams, with about 500,000 ounces of that oxide. It's a prolific belt. Other deposits in the country tend to run closer to a gram, so for whatever reason, the Houndé Belt seems to be better than average.

Dr. Allen Alper: That sounds great. Could you tell me a little bit about your team and yourself?

Don Dudek: I was first involved in West Africa in 2008 with a junior exploration company called Avion Gold. We purchased the Tabakoto asset from Nevsun Resources for $20 million in May of '08. As probably everybody remembers, '08 was a bad year for almost everything, however, in February of '09, we re-started production at the Tabakoto Gold Mine, and started pouring gold shortly. From that base of discovery, we picked up the Kofi property to the north, and added about a million and a half ounces of resource to the Tabakoto Gold Mine’s 2 million ounce resource. Then in 2010, we closed a deal in Burkina Faso for the Houndé Project, which Endeavour now owns. We turned that from nothing to over 2 million ounces of resources and a feasibility in three years. In 2012, Endeavour bought Avion 100%. I worked the next year and a half for Endeavour, managing the feasibility study for the Houndé Project, and some of the environmental permitting in Burkina Faso. When I finished that work, the Savary asked if I could help them out, and so I've been doing that for a little over two years now.

Our CFO, Greg Duras was active with Avion in Africa when we picked up all of these projects, and so he's well familiar with the country. He's also worked with some other groups in Burkina Faso before Avion. The board is independent. Daniel Nocente, our chairman, used to be a vice chair of a National Bank. Craig Pearman, another geologist, he keeps me honest, as my background is geology. Third one, Paolo Lostritto, was a mining analyst in Toronto for Wellington West and the National Bank here on the street. He's now doing more banking related work with a group called Red Cloud here in Toronto. The fourth member of our board, Thomas Olesinski, used to be a certified fraud examiner, and he's the chair of our audit committee. We're well positioned to do the exploration part of the business. Once the project becomes more advanced, we would likely need to add some additional depth to our current team.

Dr. Allen Alper: It sounds like you have a well-balanced board. That sounds great. Well experienced, that's excellent. Could you tell me a little bit about your finances, your treasury and your capital structure?

Don Dudek: Okay. Right now we have approximately 1.3 million in the bank. We are financed to carry out the program that we're planning here starting this month. We have 140 million shares outstanding. We have a couple of major shareholders, Ross Beaty being the largest, with just under 20% at 19.99%. There's also a group here in Toronto called Altus Investments, who, together with their clients, have from 17% to 20%. Endeavour Mining has approximately 9.5% of us. Management has around 7%. Forbes & Manhattan, which is where this company was initially created, have in the order of 5%.

Dr. Allen Alper: That's very good. By the way, I did many articles on Forbes & Manhattan, and Ross Beaty too. You're in good company. Could you tell me four reasons why our investors and readers should invest in your company?

Don Dudek: Well okay. If you're interested in gold, and I'm assuming that would be the case with the investors, I think we're on the edge of advancing the project quite a bit. We believe that in this next drill program, we've selected the best of the best drill targets, and are anticipating quite early on that we will have good drill success. There's also an added proxy to our efforts. If you draw a circle around our land package, there's already 3 million ounces, within maybe a 30 kilometer circle. Even though I think we will reach a critical mass ourselves, there's still a back story to be made for combining the local area assets.

Third would be that the Houndé Belt traditionally has returned higher than average grade deposits. A 2 gram plus open pit is a fairly good open pit, even with today's gold prices. The fourth would be, let's say from a country risk perspective, Burkina has been a fairly good jurisdiction. We've seen a lot of new investment. You look at Endeavor's recent purchase of True Gold. Centamin is involved in the country with the purchase of Ampella in 2014. B2 Gold bought Volta, in late 2013. Also, recently, SEMAFO taking out Orbis in 2015. Four fairly major acquisitions in the last little demonstrates widespread support for Burkina Faso being a destination of choice.

Dr. Allen Alper: Sounds great. Is there anything that I didn't ask you that you'd like to mention?

Don Dudek: I guess the one thing from where we are, from a logistics point of view. The northern part of our property is cut by a highway, so blacktop. The central part of the property has a 47 kilometer long gold-soil-anomaly. Essentially we own an entire mining camp. We have a river that goes right through the middle of the property that's flowing for 10 out of 12 months, and then it turns into a series of lagoons or lakes. We aren't short of water. 50 kilometers to the west of us we have the major power line that comes into West Africa, so there's an opportunity to take power from that line to our project. The last element is that there is a rail line 50 kilometers to the west of us as well. We could bring supplies in by rail.

Dr. Allen Alper: That's very good. Good infrastructure. That's great.

Don Dudek: Not bad.

Dr. Allen Alper: Okay, well that sounds like in the right area, and you have the right people, and you're doing all the right things, exploring. With the neighbors you have around, my guess is, at some point, you'll have the decision of either mining it yourself or selling it to one of your buddies nearby.

Don Dudek: Yeah, because at the end of the day you get to know everybody.

http://www.savarygold.com/

Suite 2400 – 120 Adelaide Street West

Toronto, ON M5H 1T1

Canada

Investor Relations:

Email: info@savarygold.com

|

|