Gold Reach Resources (TSX: GRV) Releases Preliminary Economic Assessment for Ootsa Copper-Gold Project Located in British Colombia Adjacent to the Huckleberry Mine

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC

on 3/25/2016

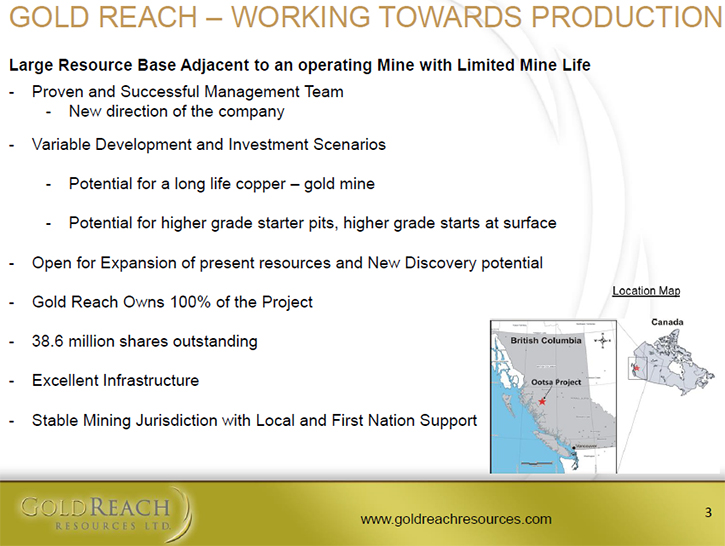

Gold Reach Resources (TSX: GRV) has just released a preliminary economic assessment for their Ootsa copper-gold project adjacent to the Huckleberry Mine, located in mining-friendly British Colombia. Dwayne Melrose, President and CEO, has expertise in taking mining companies from late stage exploration into development and through to mine construction. He is focused on doing just that with Gold Reach Resources. His approach will be a lower capex project, with higher grade, so Gold Reach Resources can get into production at lower gold prices and achieve a good cash flow. The mine also has long life copper /gold potential.

Dwayne Melrose, President and CEO of Gold Reach Resources (TSX: GRV), offered his perspective on the progress that his company has made over the last few months, with the release of their preliminary economic assessment on the Ootsa copper-gold project in British Colombia.

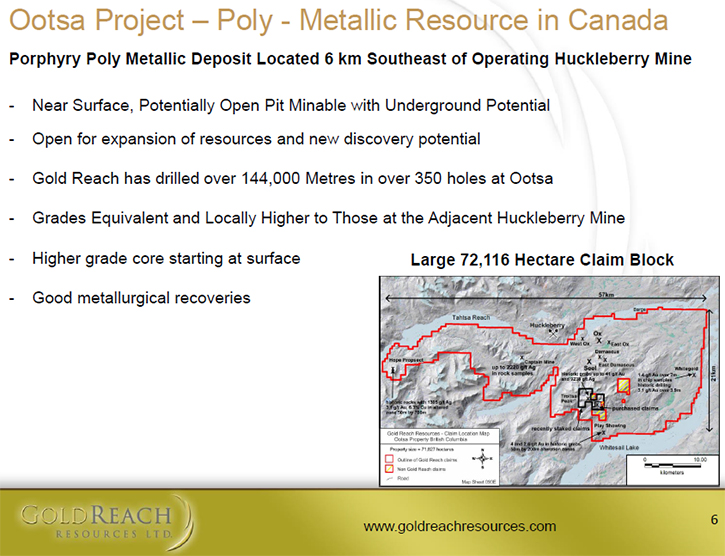

He said, “Gold Reach Resources (TSX: GRV) has been around since the early 2000s. It started off as an early stage exploration company that picked up the property next to the existing Huckleberry Mine. Over the years, they have completed over 144,000 meters of diamond drilling. Having achieved this advanced exploration stage, Gold Reach Resources is progressing into the development stage.”

Mr. Melrose has an ideal background for taking the company to the next level. He said, “With that large resource, one of the reasons that I joined the company was because my expertise is taking companies from late stage exploration into development and through to mine construction. That is what I have been doing for over 15 years. I was at the Kumtor Gold Mine in Kyrgyzstan for nine years and I was in China with Minco Silver, where we advanced the Fuwan silver deposit to feasibility stage”

Mr. Melrose brings with him a particular business philosophy that seems appropriate for Gold Reach. He said, “Before joining Gold Reach, I was the President and CEO of True Gold where I came up with the business philosophy that bigger is not always better. Instead of going ahead with a big CIL and large capex intensified project, I thought, let’s start with a lower capex project, heap leach mining scenario, so we can get into production and get a good cash flow. I’m using that same philosophy here with Gold Reach. They have a large, lower grade resource. So when I joined, I said that we should look at the resource. We know we have a high grade core that starts at surface and goes right down vertically. What can we make of that? Will it have some benefits? That was the premise for doing the PEA.”

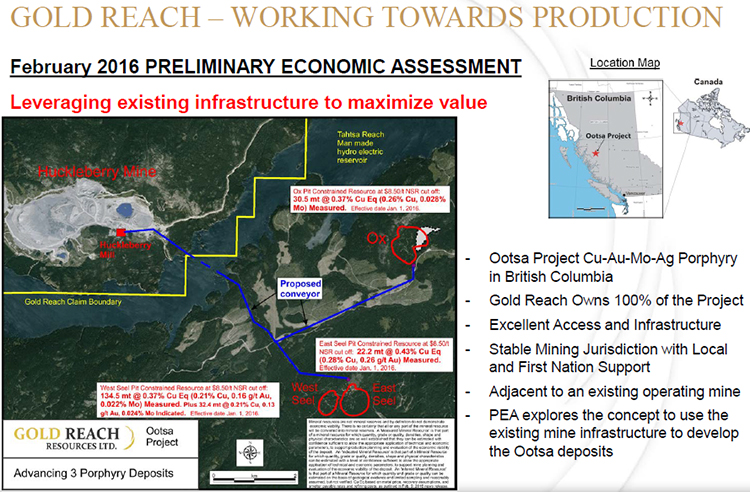

The PEA has certain features that are not common to most PEAs. Mr. Melrose said, “Now, I must say that the PEA conceptual study has been designed as an afterlife to the Huckleberry Mine that is currently in production. There are no agreements with the Huckleberry Mine or any of the partners in that company. So, this concept is envisioned as an add-on and we included contract mining and a toll mining cost in our economics. From the release that we have put out this week, we feel that it has come back rather unique in its results.”

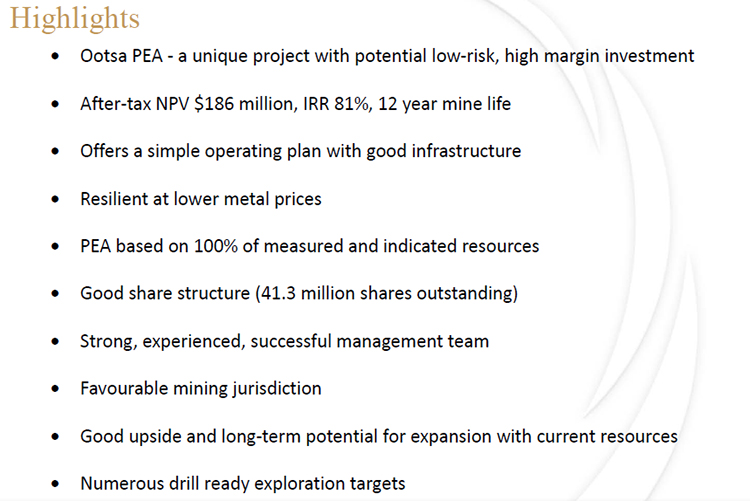

Mr. Melrose believes that mining in BC offers the company certain benefits. He said, “You know, one thing you have to look at with the Ootsa project is that it has identified a potential scenario in an area that is low risk because your infrastructure is there. Your road is there, the power is there, the mill is there next door – all those scenarios. So it is a nearly unique scenario that you don’t see in many places in the world. I believe that the best place to look for resources is around already producing mines. Most mining companies spend big dollars around their already producing mines. This is where Gold Reach has started and built a resource base and the PEA is a concept of what could potentially be achieved. It is a standard open pit, truck and shovel project. We are very fortunate that our high grade starts right at surface. You would start with the high grade core and start with the pushbacks. We came back with a capex of $64 million dollars and twelve years of mine life. We have a post-tax NPV of $186 M with an IRR of 81%. That is the philosophy on how this project could be developed. This is what I do and I’m fortunate to have access to great projects.”

One of the benefits of the project is that it works even at low priced copper. Said Melrose, “The operating scenarios, even if you wanted to go with $2.25 copper prices, would give you a positive NPV after taxes. The next step will be to continue to develop the deposit we have here. That could take it toward a production scenario. We will continue our environmental work where it could be taken to the permitting process, if the project advances to that stage. We will continue with our metallurgy testing. With my production experience background, knowing your metallurgy is key. You need to know what you are putting in your mill. We will check for variability along strike and down dip. We will also look for pit wall slope scenarios. If you have good geotechnical information that could steepen the pit walls, this could potentially lower the strip ratio and lowers your cost. That is just the concept from the PEA. I haven’t even approached the long term upside potential this project has. We have numerous targets that are drill ready that we could drill at any time. That is not our focus at this time. In this market, drill results don’t get much attention. But, with these results, this project has long term upside potential.”

Melrose believes his philosophy will make a long term difference to the company. He said, “We have a plan that we have been following since I joined and we are following on that path. We have a small team. I’m the President and CEO and I have been with them for 10 months. I was brought onto move the company forward in this matter. Dr. Shane Ebert is our head of exploration. I give him full credit for the advancement of the exploration and building the resource, with which the company is working today. Don Mosher works on corporate development scenarios and we have a CFO and a controller. The Board is very supportive of the direction we are going.”

Some of the reasons to consider investing in Gold Reach are: the Ootsa PEA project is potentially a low risk project, with high margins, after-tax NPV $186 million, IRR 81%, a 12 year mine life and a very experienced, successful and competent management team.

http://www.goldreachresources.com/

Gold Reach Resources Ltd.

PO Box 10351

888 - 700 West Georgia Street

Vancouver, BC V7Y 1G5

Phone: 604-718-5454 604-718-5454 604-718-5454

Fax: 604-662-3791

Toll Free: 1-888-500-4587 1-888-500-4587 FREE 1-888-500-4587 FREE

info@goldreachresources.com

|

|