NovaCopper Inc. (NYSE-MKT, TSX: NCQ) Works toward Prefeasibility Study on Very High Grade Copper and Polymetallic Arctic Deposit Located in Alaska

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC

on 3/24/2016

NovaCopper Inc. (NYSE-MKT, TSX: NCQ) is focused on exploring and developing the Ambler mining district in Northwestern Alaska. NovaCopper is currently working toward a prefeasibility study on its most advanced project – the very high-grade polymetallic Arctic deposit. Rick Van Nieuwenhuyse, President and CEO of NovaCopper and Founder, President, and CEO of NOVAGOLD from1997 to 2012, and his team have an amazing high grade property, well financed and with excellent corporate values. NovaCopper enjoys a very good relationship and cooperation with local communities through its agreement with NANA Regional Corporation, Inc., a Regional Alaska Native Corporation.

Rick Van Nieuwenhuyse, President and CEO and Elaine Sanders, CFO, of NovaCopper (NYSE-MKT, TSX: NCQ), spoke with Dr. Alper at PDAC to update readers on the progress being made at their Arctic polymetallic deposit in Alaska.

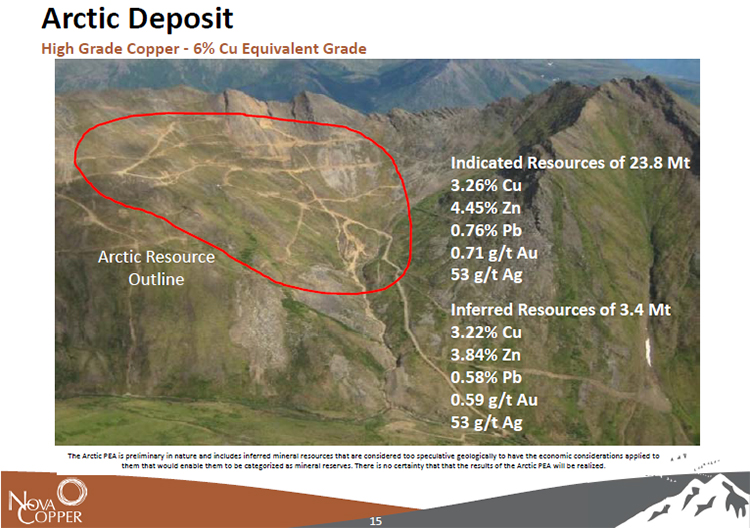

Mr. Nieuwenhuyse said, “Right now we are working toward a prefeasibility study on our Arctic deposit which is a polymetallic copper, zinc, lead, gold and silver deposit in northern Alaska and part of our Upper Kobuk Mineral Projects. Last year we completed a $5.5 million dollar program. We predominantly did the infill drilling on the deposit - moving our inferred resources to the measured and indicated category.”

Overall the team was happy with the results from their drill program. Said Van Nieuwenhuyse, “That program was pretty successful and we are seeing anticipated high grades. What is unique about Arctic is that we have a very high grade. We are talking about a 30 million tonne deposit with 3% copper and 4% zinc, plus significant precious metal credits. So, on a copper equivalent basis it is about 6% copper in an open pit scenario. The PEA study that we did a few years ago in 2013, using $2.90 copper, demonstrated an NPV8% present value of about a half a billion dollars, so we have very robust economics.”

Like many other companies working in the mining sector, pricing has brought some challenges to the company. Mr. Van Nieuwenhuyse said, “Obviously copper prices are lower today, but we actually see most of the analysts long term using copper prices at about three dollars. So, we think our $2.90 copper price is probably not a bad estimate. Crude prices have come down significantly. So we will be working on a new set of numbers to incorporate into our prefeasibility study. Right now we are just collecting all the background information, the engineering and environmental studies, our metallurgical studies, updating our geologic model - all of the components that go into producing a proper prefeasibility study. That is essentially our plan for this year, to collect all the information necessary to complete the pre-feasibility study.”

Mr. Van Nieuwenhuyse is working with a team that he is confident can take the project to the next level. He said, “We have a team that really understands how to do business in Alaska. I grew up in Alaska and a few years ago we started a company called NovaGold. We developed the Donlin gold project, which is now one of the largest open pit gold deposits in the world with 40 million ounces of gold at over 2 grams per tonne. That project is now partnered with Barrick as a 50-50 partnership and in the middle of permitting.”

Mr. Van Nieuwenhuyse’s own personal interest helped define the focus of the company. He said, “Being more interested in the exploration side of the business, we split the company in two – NovaCopper and NovaGold – a few years ago. Elaine and I worked together for a long time. Elaine’s background is on the finance side and she knows pretty much everything there is to know about running a public company. In today’s world, you want to make sure that you do things by the book and do things right. Elaine’s job is to make sure we, number one, have money and we properly account for what we have.”

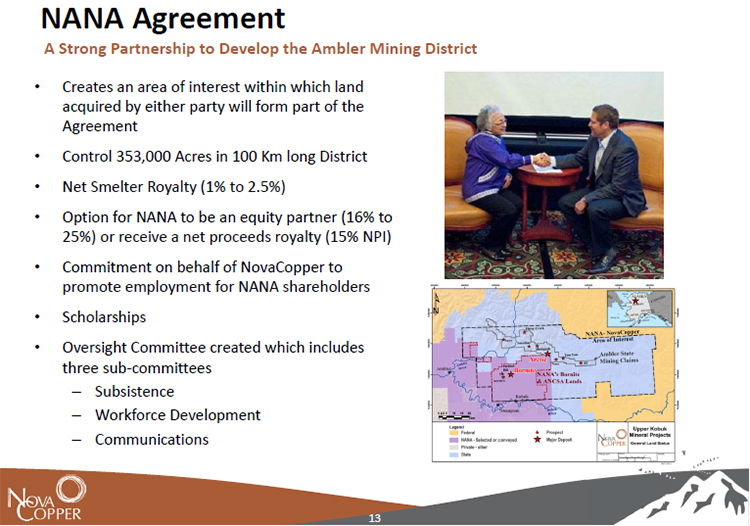

The company has focused on ensuring that they not only have great technical expertise, but that they work on the softer side of the business as well. Mr. Van Nieuwenhuyse said, “The technical side of the operation is where a lot of our expertise comes from. It is equally important to develop the relationship side of the business. This is an area where we excel. We don’t hear a lot of concern from the local population because they have been working on the project for the last 10 years. It is a little different, the way we do business. Specifically, we have partnered with a regional native corporation - NANA. It costs money to live in Alaska and they want to work. It is a perfect fit for native Alaskans to practice their culture and earn a paycheck. We bring that component to the day to day way we do business.”

Sanders addressed the financial side of the business. She said, “So we all know it has been challenging to finance juniors. We did something out of the box and ended up buying a company for shares of NovaCopper and we got $20 million dollars in cash. That money has been directed to our project in Alaska, which will give us money to run the operation for the next two years.”

Mr. Van Nieuwenhuyse is happy with the innovative way the company has handled the financial challenges. He said, “It was a smart piece of business in a market that was pretty much shut down. It consisted of looking at where the opportunities are and alternative ways of financing. The last few years have been pretty grim in the mining space and there has been basically no market in the last few years. Juniors have sold royalties which are the only type of financing that is available, but they are really expensive. There are not a lot of opportunities out there. We communicated with our shareholders and Elaine got us through the hoops and all the financing. We have 105 million shares outstanding and a series of warrants and options that total 118 million shares fully diluted. We have a $40 million dollar market cap with $20 million in the bank. Our approach in this market is to slow down, but not stop. We want to protect our treasury and we have taken a paced approach to doing the prefeasibility. We want to pace ourselves and wait for the market to come back in the copper space. Recently we have indeed seen a little bit of that with a 10% bump in the copper price.”

http://www.novacopper.com/

Head Office

1950 - 777 Dunsmuir Street

Vancouver, BC

V7Y 1K4

Telephone: 604-638-8088

Fax: 604-638-0644

Toll free: 1.855.638.8088

Email: info@novacopper.com

|

|