David Garofalo, Chairman and CEO of Gold Royalty Corp. (NYSE American: GROY) Discusses Their Rapidly Growing Royalty Streams and the Gold Market Outlook

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/1/2022

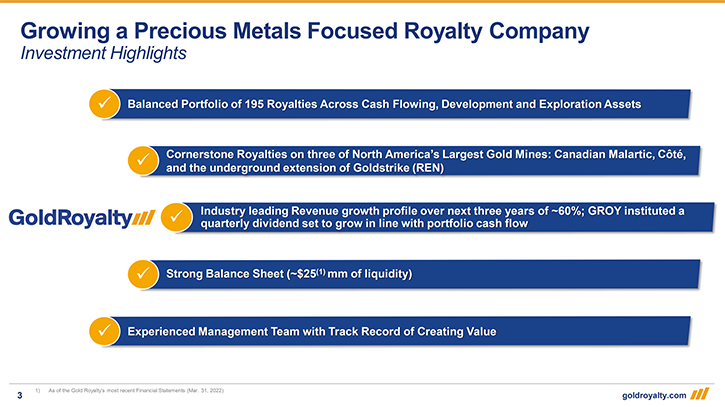

We spoke with David Garofalo, Chairman and CEO of Gold Royalty Corp. (NYSE American: GROY). Gold Royalty Corp. is a gold-focused royalty company, offering creative financing solutions to the metals and mining industry. Its mission is to acquire royalties, streams, and similar interests, at varying stages, of the mine life cycle, to build a balanced portfolio, offering near, medium, and longer-term attractive returns, for its investors. Gold Royalty's diversified portfolio currently consists of over 190 net smelter return royalties, on gold properties, located in mining friendly jurisdictions, throughout the Americas. This provides investors, with lower risk exposure to gold, with free exploration upside, on the underlying projects.

The REN Project – Goldstrike Underground

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with David Garofalo, Chairman and CEO of Gold Royalty. David, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

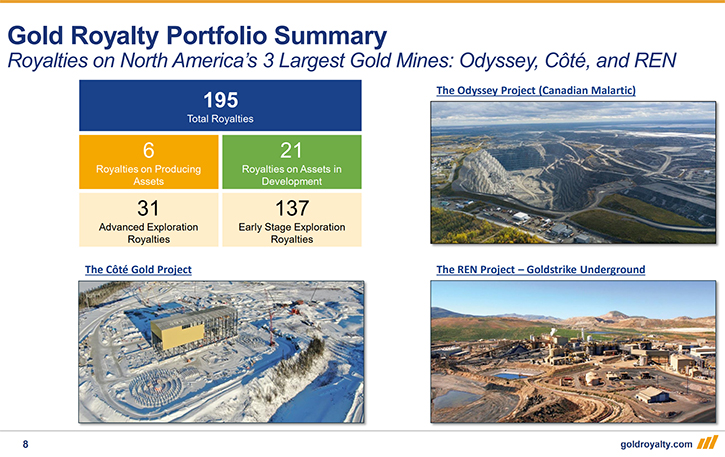

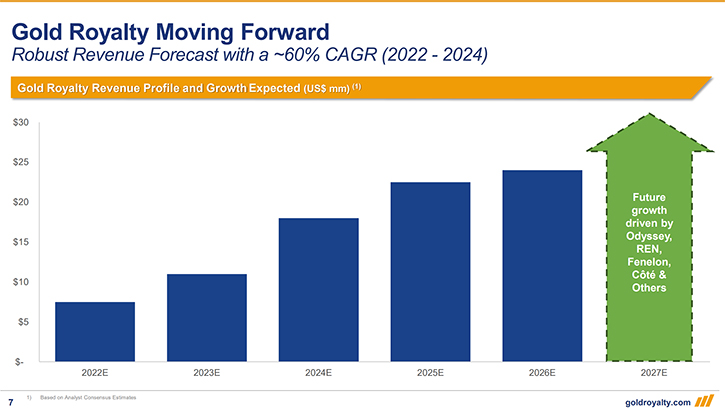

David Garofalo: Sure. Gold Royalty Corp is one of the newest entries in the precious metal royalty space. Having IPOed in March 2020, we raised 90 million U.S., on the NYSE American. And since then, we've pursued a strategy of consolidation, in what's a highly fragmented sector. And over the course of the last year, we've merged with Ely Gold, Golden Valley Royalties and Abitibi Royalties to grow our royalty portfolio from 14 royalties, at the IPO, to today, almost 200 royalties spread across the world, with a heavy concentration in Quebec, Ontario and Nevada, the three best mining jurisdictions in the world, both for precious metal prospectivity and also with low political risk and low regulatory risk. And we've gone from no cash flowing royalties, to having six of our 195 currently producing assets, with another 21 in various stages of development. That underpins the highest growth rate in revenue, in the entire precious metal royalty universe, with 60% compounded average growth in revenue, over the course of the next three years.

Dr. Allen Alper: That's fantastic. That's amazing, the growth you've seen and the rapid development of your portfolio! Could you tell me more about your portfolio and assets?

David Garofalo: Sure, the foundational elements of our portfolio are made up, principally of royalties, on the three biggest gold mines, in North America. We have a royalty over Canada’s largest gold mine: Canadian Malartic. Our royalty covers a significant portion of the Odyssey Underground project, at Canadian Malartic, in which Yamana Gold Inc. and Agnico Eagle Mines Limited are investing 1.6 billion dollars. We also have a royalty on Cote, which is IAMGOLD's newest gold mine, which will be producing late next year. It'll be Canada's second biggest gold mine, after Canadian Malartic, and it will represent a significant portion of our cash flow growth, starting in 2024. We also have a royalty on Ren, which is the underground extension, of the prolific Goldstrike mine, operated by Barrick and Newmont. Those three represent the foundational elements of our portfolio. But beyond that, we have another 192 plus royalties, many of them cash flowing, or in development, that underpin that significant upward trajectory of revenues that I talked about, a bit earlier on.

Dr. Allen Alper: That sounds excellent! Could you tell us a little bit, about some of your operating results and a little bit more about the growth you're having?

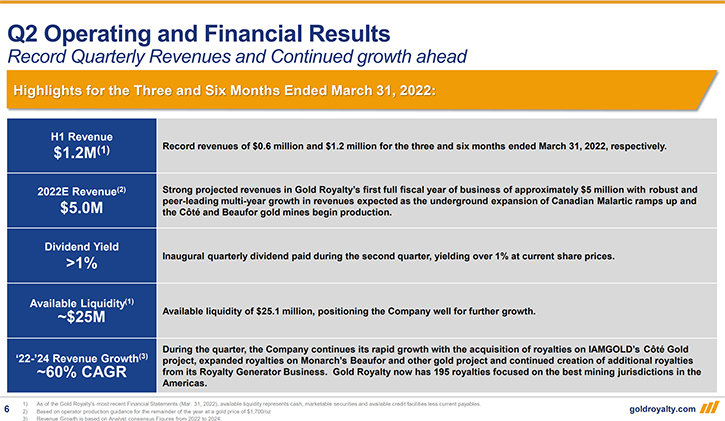

David Garofalo: Certainly. We just reported our second quarter results, and reported record revenues, for both the three and six month - periods. And that will continue to grow, in the second half of the year. Our cashflow growth has been so quick and the trajectory is so strong upwardly, 10 months after our IPO, we introduced the dividend, just over a 1% yield, at the current share price. I have a high degree of confidence that we'll be able to grow, over the next several years, as we crystallize that revenue growth that I talked about a little earlier on.

Dr. Allen Alper: Oh, that's fantastic. That's really outstanding performance. Could you tell our readers and investors a little bit about your background, your Management Team and your Board and advisories?

David Garofalo: Excellent question! So, I come with 32 years of mine building and mine operating experience, having run Gold Royalty and Gold Corp. I was one of the authors of the merger, to create the world's biggest gold company in Newmont, to that merger in 2019. Before that, I ran Hudbay Minerals and before that I was the CFO at Agnico Eagle for 12 years, during its formative stages. And before that, spent about eight years in IMAX. So, I bring, quite a bit of depth of experience, in mine development and operation, which I think has served us well, as we've looked at opportunities and have a good fundamental understanding of how operators think and how to price risk appropriately. Given that many of us, on our Board of Management, have been operators and mine developers, in our own right. Collectively, our Board of Management has over 400 years of mine industry experience, principally on development and operations.

Included among them, is Ian Telfer, the Chair of our Advisory Board, who created Wheaton Precious Metal, the first streaming company, 15 years ago, when he spun it out of my former Company, Gold Corp. But also, within my Board, we have Warren Gillman, who runs Queens Road Capital, and manages natural resource investments, on behalf of Li Ka-shing, among other significant billionaire investors. He was a cornerstone investor, in our IPO. Alan Hair, with 40 years of mineral processing experience, most recently the CEO of Hudbay. He was my successor at Hudbay. He was my chief operating officer. He brings a wealth of mine building and operating experience to the table. John Griffith is our chief development officer. Before he joined us, he had over 30 years of experience in investment banking. Most recently, he was the Head of Merrill Lynch's North American mining business. So, he brings a wealth of deal experience. as well as mining experience, to the table.

And as I said, collectively, over 400 years of industry experience gives us a couple of distinct advantages. It gives us the ability to understand the risk, inherent in the royalty opportunities we're investing in, and pricing things appropriately as a result, but also given the depth and breadth of experience of our Board of Management, it gives us unparalleled access to virtually anybody in the industry, as we look to generate new deal opportunities, to continue to grow our business.

Dr. Allen Alper: Well, that's an outstanding Management Team, Board, and group of Advisors. That's really fantastic. David, could you tell us a little bit about your capital structure?

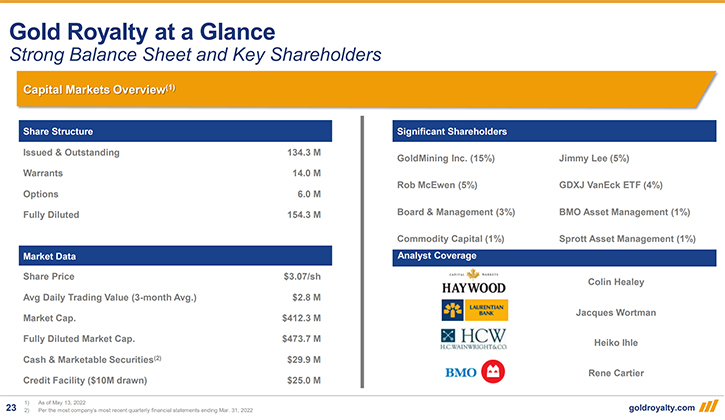

David Garofalo: Certainly. We have about 134 million shares outstanding. We have no debts. We have about 25 million dollars, of available cash and marketable securities. So, we have quite a bit of liquidity that we can put to work and new royalty opportunities. As I said, we pay a dividend, just over a 1% yield, but a one and a quarter percent yield, is the current share price, with the ability to grow that dividend over time. So, it's a very clean and simple capital structure. Very little dilutive elements, within the structure. We have some warrants outstanding. They're well out of the money currently, and we have very few stock options outstanding. We've been very judicious and careful about issuing stock-based compensation, to all of our Management and our shareholders.

Dr. Allen Alper: That sounds excellent. Could you tell our readers and investors a little bit about your thoughts on the outlook for precious metals?

David Garofalo: Certainly. I think we're in an inflationary cycle, unlike anything we've seen since the 1970s. I would argue that this has the potential to be far worse, from an inflationary perspective, than back then. I think the monetary expansion we've experienced, since the credit crisis almost 15 years ago, far exceeds what we saw in the 1970s, as gold was decoupled from the U.S. dollar by Richard Nixon.

We saw a vast expansion of money supply back then that led to hyperinflation. We saw an oil embargo in the 1970s imposed upon us by the Arab world. I would say the oil embargo, we're experiencing now, was self-imposed as we're being quite judicious about where we're importing oil from and namely avoiding doing so from Russia, so that's driven up oil prices dramatically. We’ve also seen supply chain disruptions, like we saw in the 1970s. Many of the things that we're seeing in terms of lineups at fuel stations, empty shelves in grocery stores, we experienced in the 1970s. And like the 1970s, we had a Federal Reserve that was starting to tighten nominal interest rates. And gold, in the face of that, continued to do extremely well, back in the 1970s, because even as nominal rates went up, inflation continued to accelerate, for a good decade, well into the 1980s.

Gold has always been a very accurate barometer of inflation. And I think, if inflation adjusted the gold price, we saw back in the early 1980s, the peak, to today's dollars, we would see gold at $3,000 an ounce. That's the kind of runway, I see for gold, in what I think is a hyperinflationary environment. The one difference, though, that we have from the 1970s is the ability of the Federal Reserve to actually raise interest rates. Back then we didn't have nearly as much debt at the sovereign level, at the personal level, and at the corporate level as we do today. I think that will handcuff the Federal Reserve from raising interest rates significantly, like they did in the seventies and eighties. Therefore, I do believe that this inflationary cycle, will be much more pronounced than it was in the seventies and eighties. And that will fuel a hard asset price inflation, including gold.

Dr. Allen Alper: Wow, that's a frightening picture for the economy, but well, very optimistic outlook for gold and precious medals. Wouldn't you say?

David Garofalo: I would say that! And if you buy into that thesis, and clearly, I do, the question you have to ask yourself, as an investor, is where do you best place your dollars to get optimum leverage to a rising gold price? And my view is it's in the royalty space. That's why I've switched allegiances from developing and operating mines, to working on the royalty and streaming side of the business. Because of the inflation and supply chain impacts, we're experiencing in the general economy, we will inevitably see impacts on the mining industry as well. We’ve already seen significant cost escalation in the few projects that are being built, but I think it's going to continue to be very pronounced and I think that will squeeze margins, even as the gold price goes up, for established operators.

And it's not unlike what we saw, coming out of the credit crisis a dozen years ago, when gold did exceedingly well, but the mine producers did very poorly, certainly relative to the gold price, because of inflation and input costs. And we didn't have inflation, in the general economy, a dozen years ago. We had the Chinese Supercycle that drove producers, in both the base and precious metal universe, to build new mines, which inflated input costs. And I think they're going to do that again, because of the lack of investment in exploration and mine development, since that time. Inevitably, that'll drive-up input costs, but we're also going to see it amplified, by the inflation that we're experiencing in the general economy.

Dr. Allen Alper: Well, I really appreciate you sharing your insights, with our readers and investors. I think that's very important, for them to know and to think about. David, could you tell our readers and investors the primary reasons we should consider investing in Gold Royalty Corp?

David Garofalo: Well, there are several reasons. One is we do pay a dividend, one that we think will grow over time, and it's a significant dividend, over 1% yield. We have the highest compounded average growth rate revenue, over the next five years, in the entire royalty universe. We have 195 royalties in the Americas, with 75% of our royalties, in the three best mining jurisdictions in the world; Nevada, Quebec, and Ontario, so we have low geopolitical risk. We have high revenue growth. We have a strong dividend, that's likely to grow over time. And we have an experienced Management Board, with over 400 years of experience, in the industry that will serve us well, as we look to continue to perpetuate and grow our business, beyond the 195 royalties we currently have in the portfolio.

Dr. Allen Alper: That sounds excellent! Those are very compelling reasons for our readers and investors to consider investing in Gold Royalty. David, is there anything else you'd like to add?

David Garofalo: Just that anybody that would like more information on our story, please visit our website, goldroyalty.com, sign up for our newsletter, and reach out to our 800 number, our general delivery email, if you're looking for more specific questions to be answered and please follow us on the NYSE American, under the stock trading symbol, GROY.

Dr. Allen Alper: Excellent! We’ll publish your press releases, as they come out, so our readers/investors can follow your progress.

https://goldroyalty.com/

For additional information, please contact:

Gold Royalty Corp.

Telephone: (833) 396-3066

Email: info@goldroyalty.com

|

|