Mario Stifano, CEO, Galantas Gold Corp. (TSX-V & AIM: GAL; OTCQX: GALKF) Discusses Exploring and Mining Irish Gold with District Scale Potential

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/6/2022

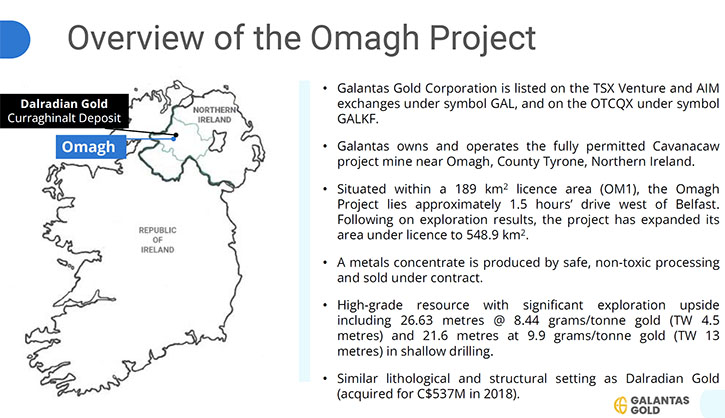

We spoke with Mario Stifano, CEO and Executive Director of Galantas Gold Corporation (TSX-V & AIM: GAL; OTCQX: GALKF). Galantas Gold owns a producing, open pit gold mine, near Omagh, County Tyrone, Northern Ireland. The mine also produces by-product silver and lead. A metals concentrate is produced, by safe, non-toxic processing, and sold under contract. Galantas believes they have a district scale potential, to not only expand the current resource, but also identify new resources, in their sizable land package, of about 550 square kilometers. Early results, from the current drilling program, are encouraging, with vein targets planned, to extend and upgrade the resource. According to Mr. Stifano, what really distinguishes Galantas, from all the other junior exploration companies, is Galantas is also entering production. The cash flow from production will fund exploration and will keep the Company's capital structure tight, as it creates value for shareholders.

Galantas Gold Corporation

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Mario Stifano, who is CEO and Executive Director of Galantas Gold. Mario, could you give our readers/investors an overview of your Company and what differentiates it from others?

Mario Stifano: Galantas Gold is a high-grade gold project in Northern Ireland. We think we have a district scale potential, to not only expand what we currently identified, but also to identify new resources in our sizable, about 550 square kilometers, land package. What I think really distinguishes Galantas, from all the other junior exploration companies, is Galantas is also entering production, and the cash flow from production could then be reinvested to explore our known veins and also discover this building. I think that’s going to be the biggest difference here, because we can keep our capital structure tight as we create value for shareholders. It's not just going to be a market cap expansion, through the raising of equity, but it's going to be a market cap expansion, through the rising gold price and a rising share price.

Dr. Allen Alper:

That sounds excellent. Could you tell me a little bit more about your project?

Mario Stifano: Galantas was a former producer of 20,000 ounces of gold through open pit. Now we're focused on developing the mine underground and getting into production, in the coming weeks. It's about 20 miles away from Dalradian, which was taken out by Orion in 2018, for about $550 million Canadian. I think gold at the time was about $1,100 an ounce, so a much higher gold price environment.

When they were taken out, the resources where about six million ounces at close to 12 to 13 grams, so obviously a real high-grade deposit. The difference with Galantas of course, is that we just never had the capital to invest in drilling, to really build up our resources. We have about half a million ounces now, at over 7 grams. The focus will be to get those ounces into the mill and at the same time, really grow those ounces and vein structures on strike and to depth and also identify additional veins.

If you look at our last real results, that we issued at the Joshua Vein, it's fairly shallow, less than 200-meter depth. But we did drill 13 meters of 17 grams and almost 9 meters of 25 grams. The grade distribution is not variable, because our high sample was 75 grams. When you get those kinds of grades, you can get 300-400 grade samples. It's telling us that our grade distribution here is going to be a little bit more predictable.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors what your plans are for 2022?

Mario Stifano:

For 2022, we're focused on getting the asset into production. We have a goal of 9,000 ounces of production this year and approximately 18,000 ounces next year. We're basically utilizing a 200 ton per day mill that's at site. As we grow our resources, which is going to be a key priority for us, drilling Joshua and Kearney from underground, later in the year we’ll try and drill some new targets on strike from both Joshua and Kearney. Our goal will be to increase the resources greatly, while at the same time trying to show the market that this has district scale potential, which we truly believe it has.

Dr. Allen Alper:

Well, that sounds excellent, Mario. Could you update our readers/investors on your background, your Team and your Board?

Mario Stifano:

I'm a CPA by trade. I was CFO of Lake Shore Gold and then I moved on to become CEO of Cordoba Minerals, which was taken over effectively by HPS, a Robert Friedland Company. From there, I also started another high-grade copper project, in Quebec, called Doré Copper and I'm still the Chairman. We have a fairly quickly growing deposit, at Corner Bay. It is high-grade copper.

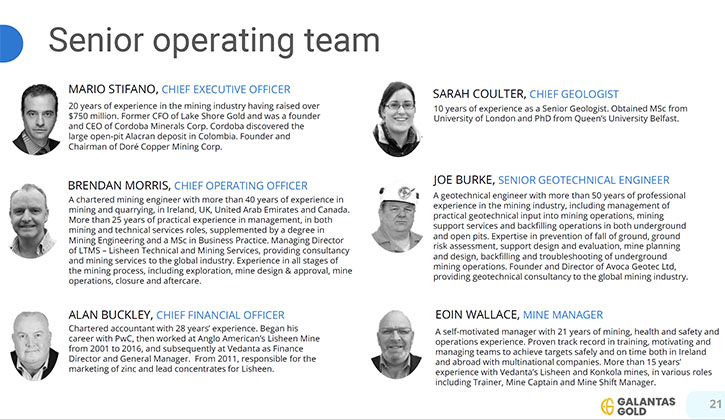

In terms of the Board and our Management Team and Advisory Board background, we brought in a new Management Team, led by Brendan Morris. He brought in a lot of experienced miners that worked in Northern Ireland and/or the Republic of Ireland. We now have a Team that knows how to mine underground, knows how to mine in Ireland in the ground conditions. Our mine is really no different than any other deposit in Ireland, but they are unique deposits. So having that knowledge base is, I think, going to bode well for our shareholders and our production profile.

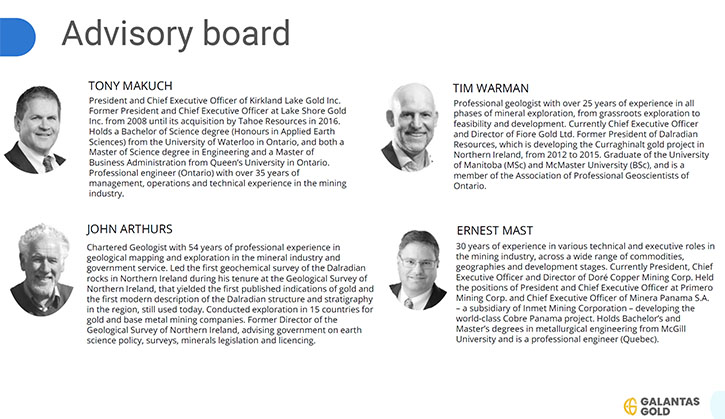

In terms of our Advisory Board, we have Tony Makuch, who was the CEO of Kirkland Lake and Lake Shore Gold, where I worked. We have Ernie Mast, the CEO of Doré Copper. We have John Arthurs, who many would recognize as the foremost expert on Dalradian rocks. Tim Warman is on our Advisory Board as well. He was the President of Dalradian. We have a strong Board. They do have quite a bit of experience in the European market. David Cather is an Engineer and has worked for various European listed Companies.

Dr. Allen Alper:

You have a very impressive Board, Advisory Board and Management Team and you have this very successful and diversified career, in the mining industry. It's great to not only have the right property, but the right Team, a Team that has experience in mining development and exploration and in finance. So that's fantastic!

Mario Stifano:

Thank you. I think we have a pretty special project here. If people want exposure to high grade gold, that's expanding resources, while at the same time producing gold, to take advantage of the rising gold price. I think that that's really going to benefit investors.

Dr. Allen Alper:

Well, that sounds excellent. Mario, could you tell our readers/investors a little bit more about your share and capital structure and your listings?

Mario Stifano:

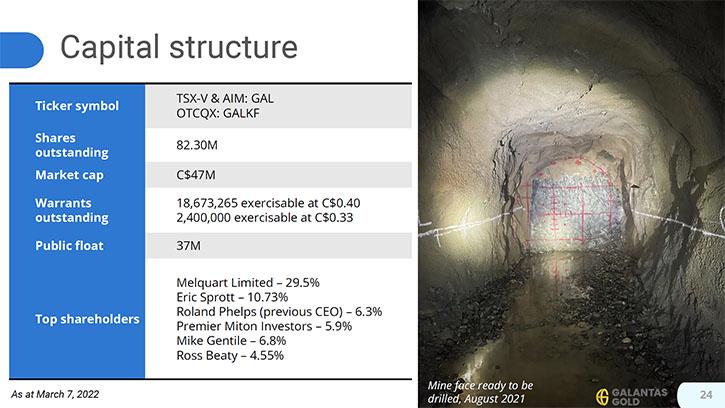

We have a really strong shareholder base. If you look at our significant shareholders, we have a U.K. fund, called Melquart. They own about 30% of the Company. Ross Beaty is a significant shareholder, and we brought in two new shareholders, Eric Sprott and Mike Gentile, in addition to Premier Miton, which is another UK based fund.

We have a Tier 1 shareholder base that's going to be very supportive and see that the warrants are exercised 15 months early. We’re fully diluted, including all the existing warrants outstanding, which will bring about another $7.5 million into the Treasury. We would only have 100 million shares outstanding. For a Company of our size, and where we are, and having that type of capital structure, while we enter production, I think is going to be quite significant for investors. Again, investors are going to be leveraged to the gold price and production, without having to worry about $50 million or $100 million equity financings, to get their asset into production.

Dr. Allen Alper:

That's excellent. Mario, could you highlight the primary reasons for our readers/investors to consider investing in Galantas Gold?

Mario Stifano:

From readers’ and investors’ perspective, I think Galantas provides exposure to high-grade gold. There are not many deposits out there, north of 6 grams, and we're north of 7 grams. We have real opportunity to expand, not only the resources to a multimillion-ounce deposit. That is our goal. And hopefully, as we drill deeper, we can also find some higher-grade zones as well. But at the same time, we are going into production, so investors are not just exposed to exploration success, they're also going to be exposed to a rising gold price environment, and their ability to reinvest cash flow back into the ground.

Dr. Allen Alper:

Those sound like very compelling reasons for our readers/investors, to consider investing in Galantas Gold. It’s great to invest in a project that has such high grade, that has potential to be district scale and that has a proven Management Team, Board, and investors. That sounds excellent to me.

Mario Stifano:

We're trying to get this stabilized, so we can get into production. But at the same time, also invest in exploration. That's the new strategy we have here, exploration, development, and production.

Dr. Allen Alper:

Oh, that's excellent! We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

https://galantas.com/

Galantas Gold Corporation

Mario Stifano, Chief Executive Officer

Email: info@galantas.com

Telephone: +44(0)28 8224 1100

|

|