Isabel Vilela, Head of IR and Corp. Comm., GoviEx Uranium Inc. Discusses Becoming a Significant Uranium Producer, with its Permitted, Madaouela Project in Niger, Mine-Permitted Mutanga Project in Zambia, and Multi-Element Falea Project, in Mali

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/28/2021

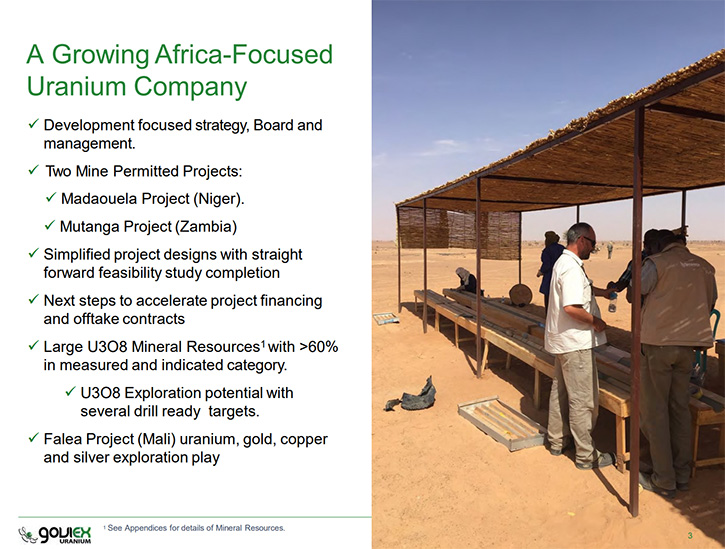

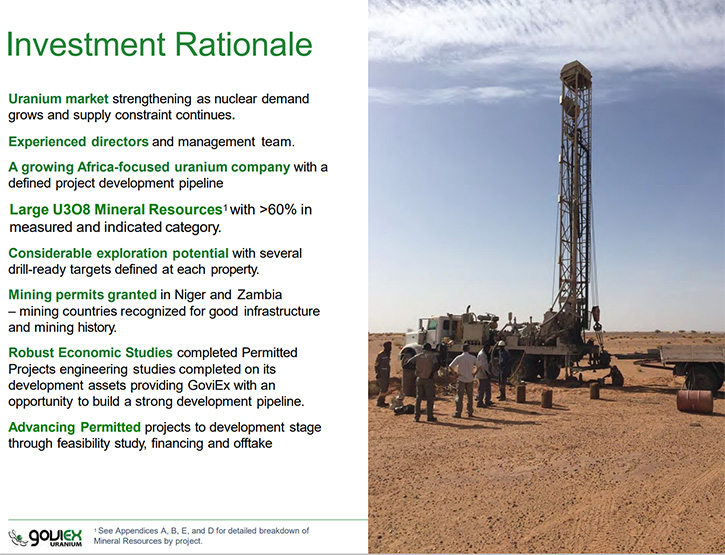

We spoke with Isabel Vilela, Head of Investor Relations and Corporate Communications for GoviEx Uranium Inc. (TSX-V: GXU; OTCQX: GVXXF), a mineral resource Company, focused on the exploration and development of uranium properties in Africa. GoviEx’s principal objective is to become a significant uranium producer, through the continued exploration and development of its flagship, mine-permitted, Madaouela Project in Niger, its mine-permitted Mutanga Project in Zambia, and its multi-element Falea Project, in Mali. In 2021, the Company upgraded to the OTCQX from the OTCQB. According to Isabel Vilela, the feasibility study on the Madaouela Project is expected in mid-2022, and the mine is expected to be operating by 2025.

GoviEx Uranium Inc.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Isabel Vilela, who is Head of Investor Relations for GoviEx. Isabel, could you start by giving our readers/investors an overview of GoviEx and what differentiates it from others.

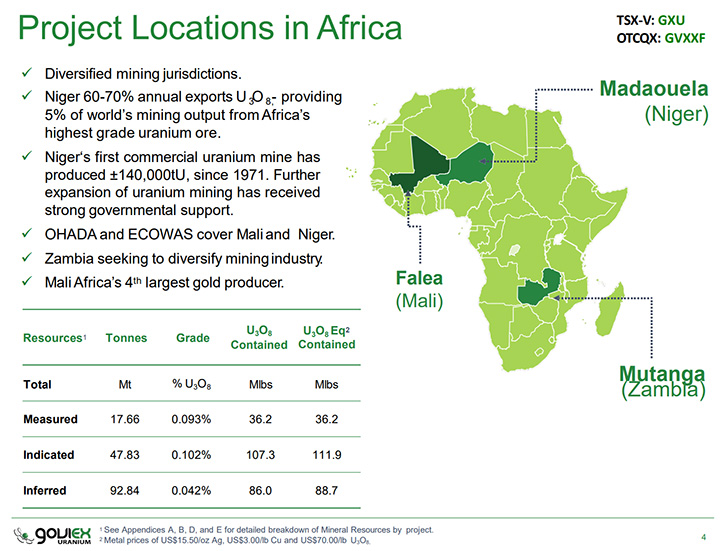

Isabel Vilela:GoviEx is an African-focused development Company, listed in Canada. Unlike most of our competitors, we have a portfolio of assets. Two of our projects are already mine-permitted; the Madaouela Project in Niger and the Mutanga Project in Zambia. We also have a third project in Mali, called the Falea Project, which is more of an exploration play. We already have a very large mineral resource, but our properties contain considerable exploration upside.

I could also tell you a little bit about Africa because I think that's relevant. All of our projects are in Africa, Niger is a well-recognized uranium producing country, being the fourth or fifth largest producer since the 70s. It has a very good standard mining code which hasn't changed since 2006. We have operated in Niger since 2007 and we have had a really good experience there. I think it's a very stable country, with a perception of risk that's not always what we experience. Zambia is a typically copper mining country, which has been looking at diversifying its commodity mix. The new government seems very keen on mining and seems to be creating the right environment to attract mining companies. Mali is now the fourth largest gold producer in Africa and is advancing through as a mining jurisdiction.

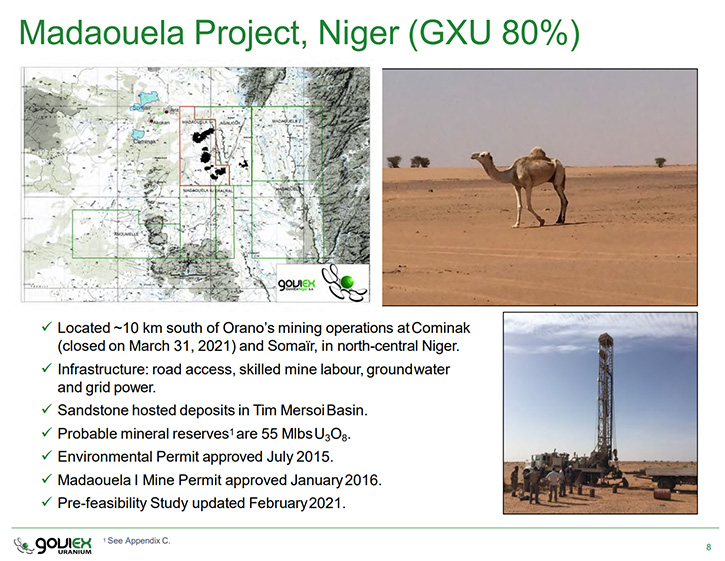

The most interesting project we have now is the Madaouela Project, or at least it's the one that is closest to development. We own 80% of it, and the Niger government owns about 20% of it. It's right next to the Orano’s mining operations at Cominak, which closed in 2021. It is very close to Somaïr, as well, so we benefit from the infrastructure that has already been put in there. We also have considerable water in Madaouela, so we're lucky in that respect.

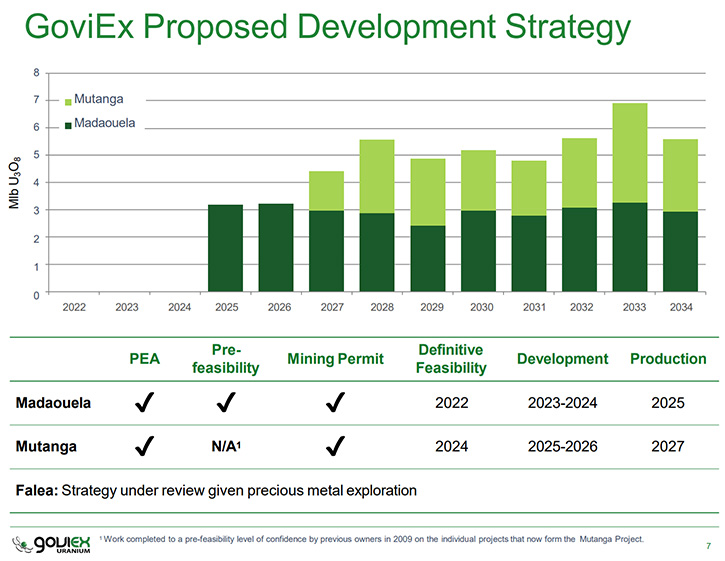

We have access to power. But we are also looking at our own power systems and with a solar hybrid option. We have been looking at ways to design the plant to try and reduce our water consumption, even more to maintain a more sensible environmental approach. We've updated our PFS in April, so it's very up to date. We are producing a feasibility study by the end of first half of next year, with a view to get the mine funded by the end of 2022 and operating by 2025.

Dr. Allen Alper:

That sounds excellent. You're in a great position, you have great resources and in the area that's familiar with mining. That sounds excellent! Could you tell our readers/investors a little bit about the resources?

Isabel Vilela:

Madaouela has about 79 million pounds of uranium, in the indicated category and 31 in measured, so about 110 million in measured and indicated. We are fast tracking our feasibility study in 2021, to target rapid development there. We have mining permits and environmental certificates that are already secured, and we do have a very good infrastructure there.

Dr. Allen Alper:

It sounds excellent! Isabel, could you tell our readers/investors the primary accomplishments that were made by GoviEx in 2021 and what your plans are in 2022?

Isabel Vilela:

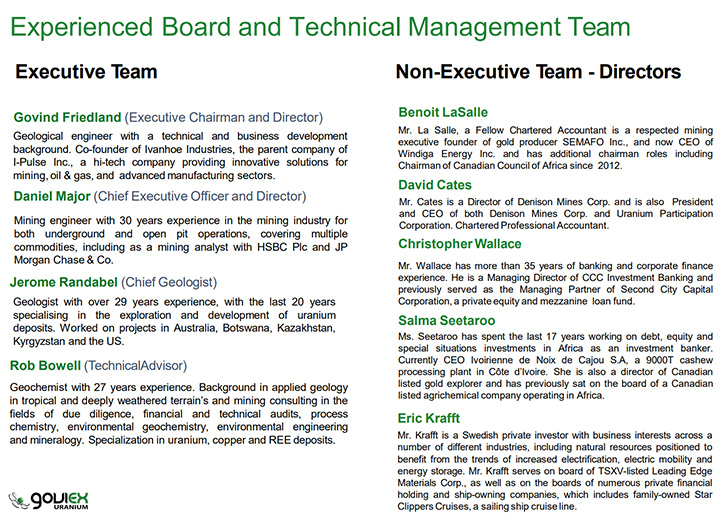

2021 has been a really great year for us and we have strengthened our Board. We brought in Salma Seetaroo, who is the CEO of a cashew processing plant in the Ivory Coast. Her background is in banking, she used to be part of the Team that did the Paladin financings. We also brought in Eric Krafft, who is a large shareholder and bringing lots of skills in the financing market. He's an experienced businessman. Also of note, is that we've hired Chris Lewis, very well known in the uranium industry. He’s our Chief Uranium Marketing. He has a wealth of experience in the field. He has 30 years’ experience and he's putting us in front of several utilities. So that's really great, because you can't really score a goal unless you're playing the game.

One of the big accomplishments we did in 2021 was to update our PFS. We've reduced CapEx, OPEX and water consumption. The next steps are to finish our feasibility study, by mid-next year, to be in a position to produce in 2025. We brought in Endeavor Financing to help us on the debt side. We're working really closely with them. They are specialized in the type of jurisdiction that we are in, and I think they will be bringing quite a lot to the table.

We were upgraded to the OTCQX, from the OTCQB. I think that's also important. It shows how we're maturing as a Company. Lastly, we're really focusing on ESG at the moment. I don't think that you will find an employee at GoviEx that is not involved with ESG in some form. We have our management framework plans developed and we're starting to develop structures, so that we can be compliant with different metrics. That is great because this is the time to do this - before you get your mine and so you can develop your ESG as your mine grows and develops.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors a little bit about the outlook for the uranium industry?

Isabel Vilela:

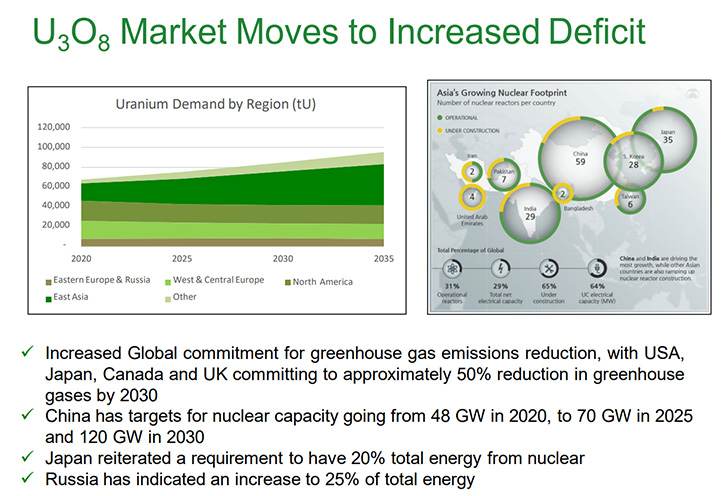

I think that the real factor, in the uranium industry, is really the fundamentals on the supply side. No matter what you hear, 190 million pounds is being consumed per year and about 128 million pounds being produced. The difference historically had been felt by the secondary market, but that's been tightened a bit, particularly because of Sprott, which is pulling down volumes quite quickly. I think that they've already bought 25 million pounds of uranium this year. Independently of Sprott, which sort of accelerated that supply gap, if you look at the fundamentals, especially with China being heavily investing in nuclear and with everything going on in terms of clean energy.

Without new supply, you are looking at probably around 60 million gap that needs to be filled by 2030. I think that utilities are expecting to see a tightening market. We have a lot of utilities that are not covered from 2024 onwards. I think what's interesting is that we've been seeing several U.S. and European utilities putting out long term RFPs. We've also been seeing an increasing number of RFPs coming out. This is also because the power market shifted a bit and I think utilities are getting a little bit more worried now, because diversity of supply is also a big issue, particularly with the big utilities. They're probably willing to support new production, and that's why our proposal is good. I think that we are well positioned to benefit from that tightening of the market.

Dr. Allen Alper:

Well, that sounds great! Could you tell our readers/investors a little bit about your CEO and Chairman?

Isabel Vilela:

I think that you've probably met Daniel a few times.

Dr. Allen Alper:

Well, I've met and interviewed Daniel Major oh, eight or nine times, so I know him well, he's a fine, wonderful fellow. And of course, your Chairman is well known throughout the industry and the family.

Isabel Vilela:

Daniel is a mining engineer. He's had a successful career that spans over 30 years, in the mining industry. He was initially with Rossing Uranium Mine in Namibia, but he also was a very successful mining analyst, with HSBC and JP Morgan. Govind is a Geological Engineer, and he founded the Company in 2007. He's also a co-founder of Ivanhoe Industries.

Dr. Allen Alper:

Well, that sounds great. You have a great Team and great background. That's excellent! You have great investors and people, who know the industry, so that’s excellent! Could you say a few words about your capital structure?

Isabel Vilela:

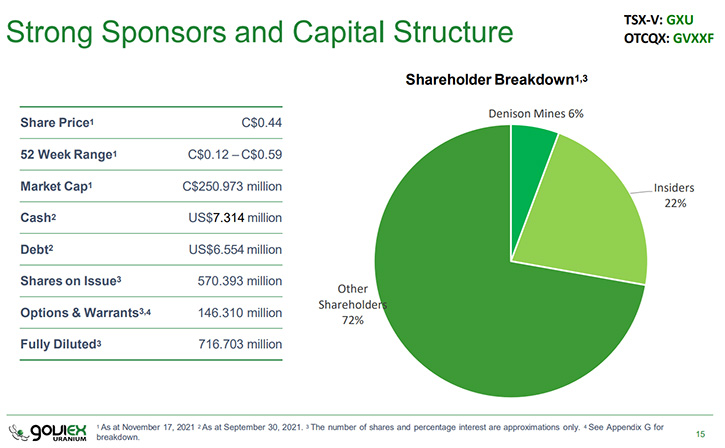

We've just published numbers actually in Q3. We are really well financed at the moment. We had about $7 million of cash in November, so we are well positioned to go into the next year. I think that we will be looking into raising capital, after we published the results of our feasibility study. But now, we are really well-financed and well positioned to continue the development of our projects and I guess more exciting things will happen once we do publish.

Dr. Allen Alper:

That sounds excellent. Isabel, could you tell our readers/investors the primary reasons they should invest in GoviEx?

Isabel Vilela:

Apart from having two very good projects that are mine-permitted and are in the process of getting developed, from a market point of view in the previous cycles, Africa has been a good prospect, either for development or take out. We are on the development side, but we recognize there is also a transactional side to our operations. We are in a strong position to benefit from a strong uranium market. The fundamentals are there. On top of that, there is still upside on the exploration side, even though the focus is on developing Madaouela, at the moment. We also have a strong Management Team and a strong Board. So, I'd say that we are a very good proposition at the moment.

Dr. Allen Alper:

Those sound like very compelling reasons to consider investing in GoviEx. It looks like uranium will be one of the key factors in providing energy, as the electrification of the world takes place, and they need an alternate to fossil fuel.

Isabel Vilela:

Absolutely!

Dr. Allen Alper:

Well, that's great! Isabel, is there anything else you’d like to add?

Isabel Vilela:

No, I don't think so. I think that we covered pretty much everything. It's great to chat with you.

Dr. Allen Alper:

We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://goviex.com/

Isabel Vilela

Head of Investor Relations and Corporate Communications

Tel: +1-604-681-5529

Email: info@goviex.com

|

|