Niël Pretorius, CEO, DRDGOLD Ltd (DRDGOLD; JSE, NYSE: DRD). DRDGOLD Discusses Being a World Leader in the Recovery of Gold from the Retreatment of Surface Tailings in South Africa

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/13/2021

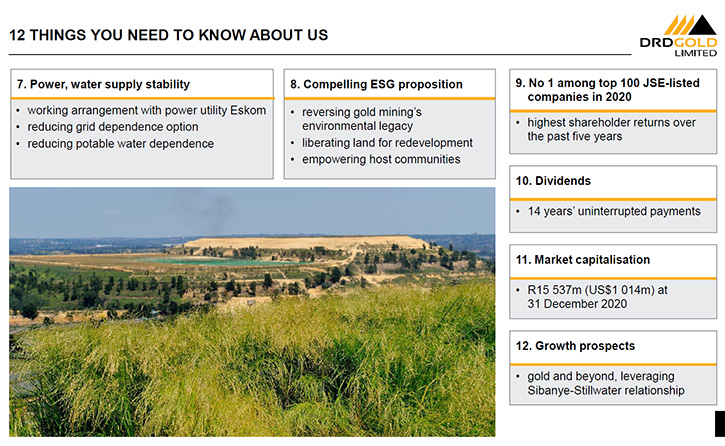

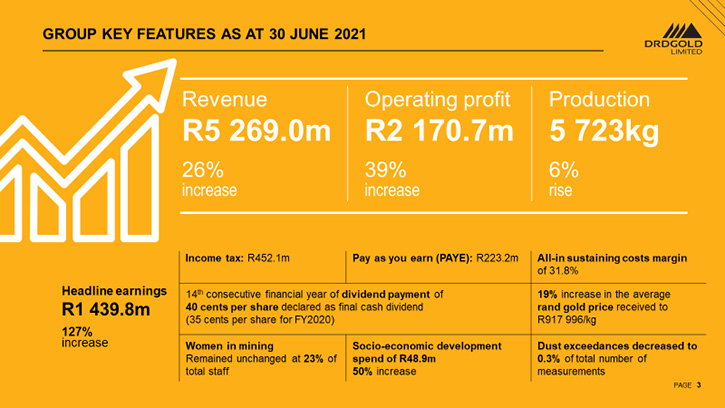

We spoke with Niel Pretorius, who is the CEO of DRDGOLD Limited (DRDGOLD; JSE, NYSE: DRD). DRDGOLD is a South African gold producer and a world leader in the recovery of gold from the retreatment of surface tailings. The Company extracts gold from the tailings and cleans the site for future sustainable land use. According to Niël Pretorius, the Company's sustaining costs are quite competitive. Last year, they saw a 26% increase in revenue, which added up to $363 million, giving them a cash inflow of $108 million. DRDGOLD has no debt. The Company's network of assets is unrivalled in South Africa and, with its consolidated businesses, operating as a single entity, it is focused on optimizing these assets in order to increase gold production.

DRDGOLD Limited

Tim Cummings

Dr. Allen Alper:

This is Dr Allen Alper, Editor-in-Chief of Metals News talking with Niel Pretorius, who is the CEO of DRDGOLD. Niel, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

Niel Pretorius:

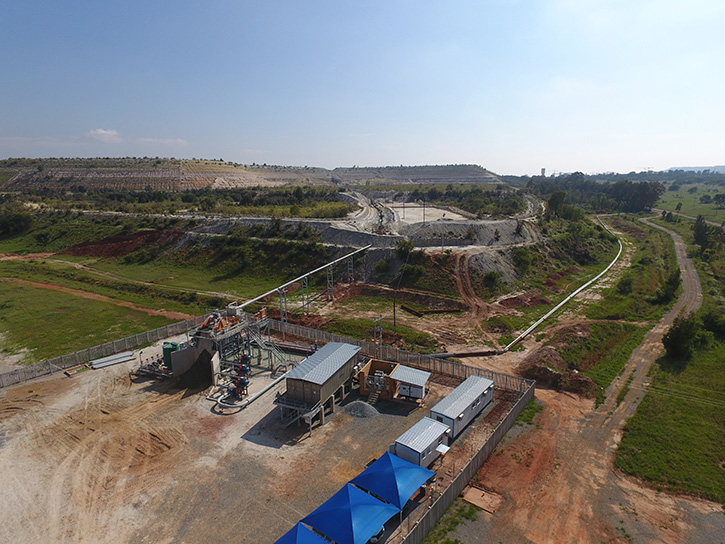

We’re a gold producer, but we do not dig any hard rock out of the earth. We produce all of our gold by retreating tailings. In a country where most of the gold is produced from deep-level underground mining, the one thing that differentiates us the most is the fact that we’re actually a surface operator, retrieving gold from what I prefer to refer to as a stockpiled resource, in the form of old mine waste, mostly through a mechanised process, which is not labour-intensive. While grades are on the low side, because it is mine waste, through the requisite volume throughput - we treat close to 28 million tonnes per year - we actually achieve economies of scale and as a consequence, the business is doing quite well, in the current gold price climates.

Dr. Allen Alper:

That sounds excellent. Could you tell us a little bit about how your cost compares to others?

Niel Pretorius:

Yes, we're on the high side with cash operating costs at around $1,000 per ounce. But our sustaining CapEx is only about 5% of cash cost because we are long CapEx. We put up plant infrastructure and pipelines up front and we don’t have the ongoing opening-up and development you find in underground mines. So, if you add the two together, then it actually becomes quite competitive. The higher gold price allows us to spend quite a bit more now also on strategic development or on investment capital. The whole idea is to move incrementally towards solar power, on the one hand, and also to increase size and capacity of the deposition facilities that we have, for the storage of the waste that we treat, since we do not backfill to the sites from which we retreat waste. We actually clean these sites up for future sustainable land use. But our waste then goes on to a new facility, a far more modern facility, which in terms of environmental governance, is managed at a different level. So, we’re spending quite a bit of CapEx this year, on that as well. On the whole, comparing apples to apples, while our cash operating cost is on the high side, holding or sustaining cost is actually quite competitive because we are long CapEx.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors a little bit more about the process you use?

Niel Pretorius:

It’s a semi-automated process of remote hydraulic mining. The tailings are retreated by way of high-pressure water jets. It's a remote-controlled water gun, which washes the tailings material into a sump. From there, it’s pumped into a network of columns that connect the various reclamation sites with the reduction-works or met-plant. The slurry is pumped to the reduction-works and there, in certain instances, it is milled, depending on fraction size or coarseness of the material and post milling, it goes through a thickener to take it to the right density and then into a series of carbon-in-leach tanks.

The gold is dissolved by introducing cyanide and then settles onto carbon. The carbon is eluted, and the gold then goes into a zinc precipitation circuit, it gets smelted and the waste then goes back onto a waste facility. It’s stock standard carbon-in-leach, but because of the scale and volume throughput, it makes good economic sense for us. The key drivers are kept in sync by way of automated adjustments in terms of oxygen, in terms of cyanide, in terms of carbon to ensure that the plant remains in range. At this stage we do not recover anything other than gold – we’re a pure gold play.

We saw a 26% increase in revenue for the year, assuming a Dollar exchange rate of US$0.069 per Rand, we had $363 million in revenue. Our operating profit was up by 59% year-on-year - the financial year was at the end of June - and we achieved an operating profit of $150 million for the year. Our headline earnings were up 127% year-on-year and headline ratings were basically $100 million. As for production, we guided 185,000 ounces for the year. So those were the key results and the key trends for the year.

I’ll give you one or two other key numbers that we use. We saw a net cash inflow of $108 million and we currently have, available in cash and equivalents, $150 million in cash, and we don't have any bank debt. This year we paid a dividend for the 14th year in a row, without interruption, and this year the yield was about 5%.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors a little bit about your background as well as the team and the Board?

Niel Pretorius:

Our Chairman is Geoffrey Campbell. He is British, and lives in Scotland. He became Chairman of DRDGOLD in 2005, if I'm not mistaken. He's basically guided us, over the last decade and a half, from being an underground producer, into the surface environment at this moment.

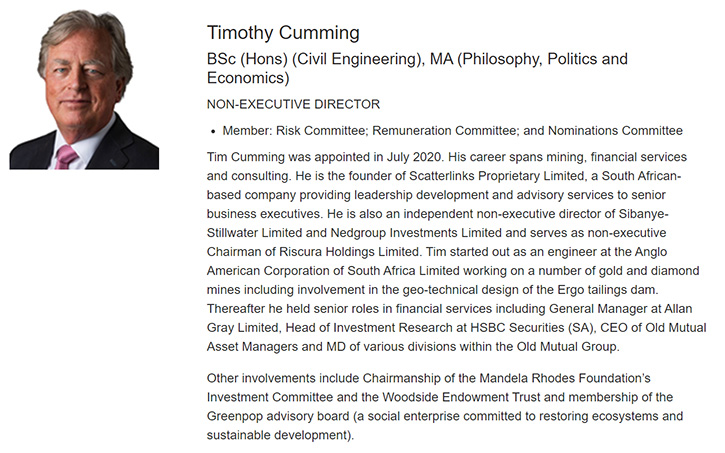

His term is coming to an end now, in November. He's being replaced as Chairman by Timothy Cumming. He has been nominated onto our Board by our main shareholder, Sibanye-Stillwater.

Timothy has a long history in mining and also in finance. He started off in mining in Anglo American and went on to hold various senior executive and non-executive roles in financial services - Alan Gray, Old Mutual and HSBC to name but a few - and in consulting. He is also a non-executive Director on the Board of Sibanye-Stillwater. He's a seasoned campaigner, and I think it's going to be an exciting new era, with him coming on the Board, as our new Chairman. In terms of shareholding, the Company is listed, both in Johannesburg and also on the New York Stock Exchange.

Our main shareholder, Sibanye-Stillwater, became our primary shareholder about two years ago. They have 50.1% of the shares issued and being developed, which effectively makes DRDGOLD a subsidiary of Sibanye-Stillwater. It is no different from what we find in Anglo American, for example, who also owns several listed subsidiaries. Our strategy is to align ourselves increasingly, with the strategy of Sibanye-Stillwater, because we believe that's where the opportunity lies for our Company. And we have good support from them.

Dr. Allen Alper:

That sounds very good. Could you tell our readers/investors the primary reasons they should consider investing in DRDGOLD?

Niel Pretorius:

I think we are a gold mine, with a difference. We do not have the operational risks, associated with deep-level, underground mining, but we give the same kind of exposure to movements in the gold price. It's a share that is very, very liquid and it's also very volatile, in response to the movements in the gold price. So, even our longer-term shareholders actively trade the stock because it provides the level of liquidity that it does.

Having said that, we also are a dividend-paying Company. So, yeah! I consider this to be the best of both worlds. On the one hand, you have the dividend flow, which is income, and roughly about 5%. We don't take it at 5%, but it just so happens to be around that region. We distribute free cash, but it matches an earnings return of 5%. On the one hand, you have this income, in terms of dividends. But on the other hand, you also have good exposure to the movements in the gold price, because we are not hedged, we take full exposure to the gold price.

In addition to that, I think we have very good growth prospects, by aligning ourselves with the strategy of Sibanye-Stillwater and entering an interesting new era or play that might extend beyond just gold production to include the metals that are used in the generation and storage of clean power.

Dr. Allen Alper:

Oh, that sounds very good, Niel! Is there anything else you'd like to add?

Niel Pretorius:

I think you've covered it very well, with your questions. Thank you very much for the opportunity to have this conversation, with you, for Metals News. If you would like additional information, I’ll be pleased to fill you in.

Dr. Allen Alper:

Sounds great. I think you have a great Company, making money and also doing a service to the community, so I think that's great.

https://www.drdgold.com/

Tel: +27 11 470 2600

Fax: +27 86 524 3061

|

|