Geopacific Resources Ltd. (ASX: GPR): Developing the 1.6 Moz, High-Margin, Woodlark Gold Project, in Papua New Guinea., Pouring Gold in Q4 Next Year; Tim Richards, CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/30/2021

Geopacific Resources (ASX: GPR) is a gold development company, focused on developing the 1.6 Moz Woodlark Gold Project, in Papua New Guinea. Woodlark is a high-margin gold project, with significant exploration upside. We learned from Tim Richards, who is CEO of Geopacific Resources, that they will begin construction in Q2 of 2021 and will be pouring gold in Q4 next year.

Geopacific Resources

Dr. Allen Alper:

This is Dr. Allen Alper, Editor in Chief of Metals News, talking with Tim Richards, who is CEO of Geopacific Resources, Limited. Tim, could you give our readers/investors an overview of your Company, what differentiates your Company and your path towards production.

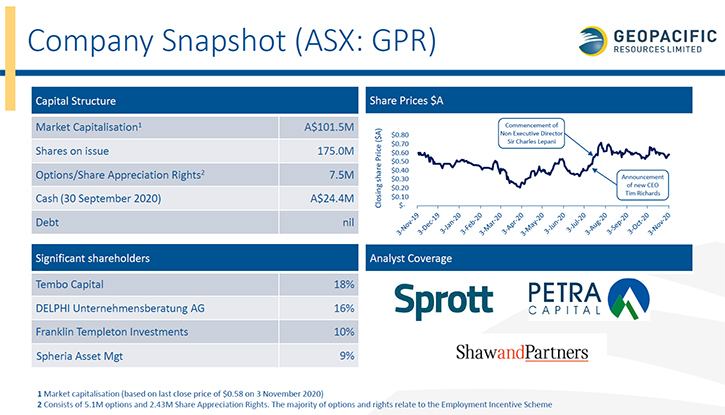

Tim Richards:Geopacific is an ASX listed company. In the most recent ASX rebalancing, we joined the All Ordinaries, an index comprised of shares from the 500 largest companies listed on the ASX. We have approximately 512M shares outstanding in the current market, and a market capital of circa $170M Australian. Geopacific took over the Woodlark Project, from Kula Gold, back in 2016 and since then a substantial amount of work has been undertaken to progress it towards development. The Project itself is in Milne Bay Province, in Papua New Guinea and is fully permitted.

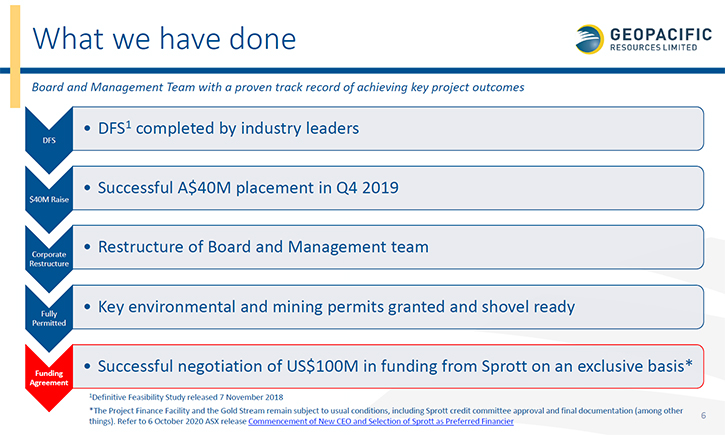

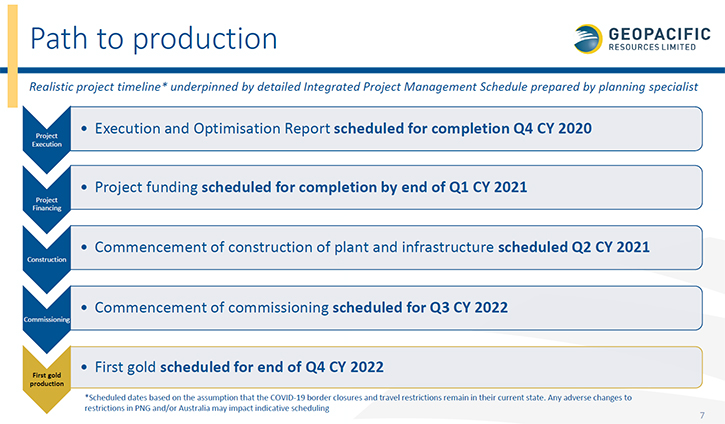

Over the last two years the 2018 feasibility study was revisited, with a view to refining capital and operating costs, as well as the project delivery strategy. This culminated in the November 2020 release to the market of the detailed project Execution Update. The financial modelling that underpinned the update defined the final capital requirements, while simultaneously, in October 2020, Sprott Lending out of the USA was announced as the preferred debt provider for the project. Key terms were agreed with Sprott for the provision of $100 M US in debt and then post the release of the Execution Update, the remaining funding was raised on market, in an oversubscribed placement ultimately raising 140M Australian Dollars.

As the project currently stands, the equity raise has been completed successfully and the final process of resolving the debt with Sprott is well advanced. Previous indications to the market were that that this would be done end of Q1 this year and while that will slip into April, the project is still on track and looking to formally commence construction of the project during Q2.

Dr. Allen Alper:

That sounds excellent, a very exciting project! Could you tell our readers/investors a little more about the details, your reserves, your plan to take it to production and your timing?

Tim Richards:

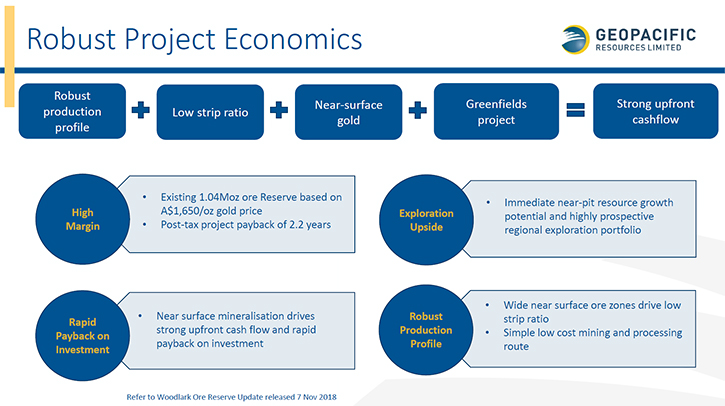

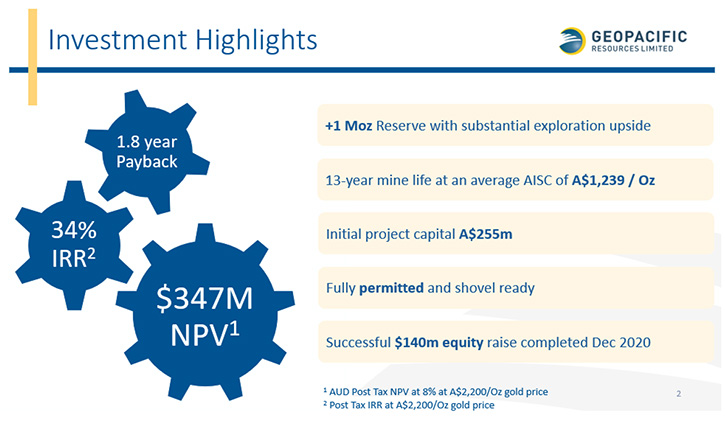

The project is a multi-pit open cut mine containing over 1.0 million-ounces in reserves and approximately 1.6-million-ounces in resources. Processing is via a standard 2.4 million ton per annum CIL plant, treating oxidized material and producing doré. The plant layout is conventional and not dissimilar to a standard gold plant in Western Australia or Africa. Metallurgically, the ore has solid recoveries, with an average life of mine recovery of 92%. The timeline for construction is relatively short, with construction starting in Q2 this year and culminating in first production in Q4 next year. Total capital is expected to be $255M Australian dollars and from start to finish it's expected to be a 21-month construction window.

Dr. Allen Alper:

Well, that sound exciting! That is really great! It must be fun to be running a project like that.

Tim Richards:

It's a great time to be involved in the Company. Geopacific has enjoyed a lot of strong support from the institutional shareholders over the years and they are very focused on seeing the project progress into production. While progressing construction is the primary focus of the Company, one of the key attractions of the Woodlark Project is it's still very much a phenomenal exploration prospect.

To date only a small portion of the mining lease has been drilled out and a substantial number of targets still exist on the mining lease. Incredibly, the three main pits are still open along strike and at depth, so that pit shells are limited by drilling not by geology. The next two years, during construction, will also be quite exciting from an exploration perspective. In particular, growing the reserve through infill and step-out drilling, adjacent to our existing pits, up until we start mining. Once production commences, exploration focus is likely to broaden a little more to testing targets, identified on the broader mining lease. Then ultimately, once a level of confidence has been achieved around the definition of resources on the mining lease, there are still a number of exploration tenements, adjacent to the mining lease that are highly prospective and remain largely underexplored.

Dr. Allen Alper:

That sounds great. Could you tell our readers, investors, engineers and geologists little bit about your background, the Management Team and the Board?

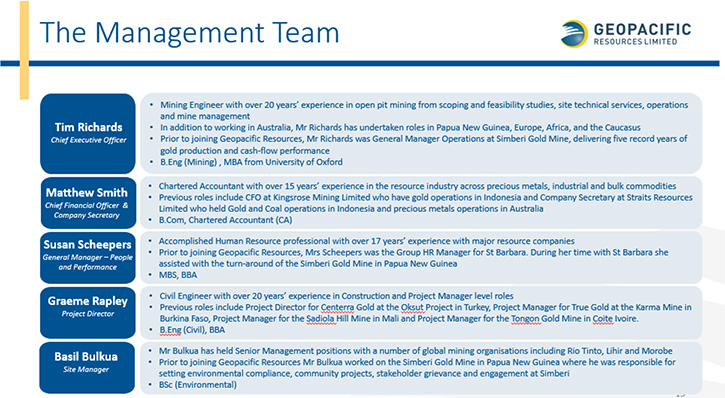

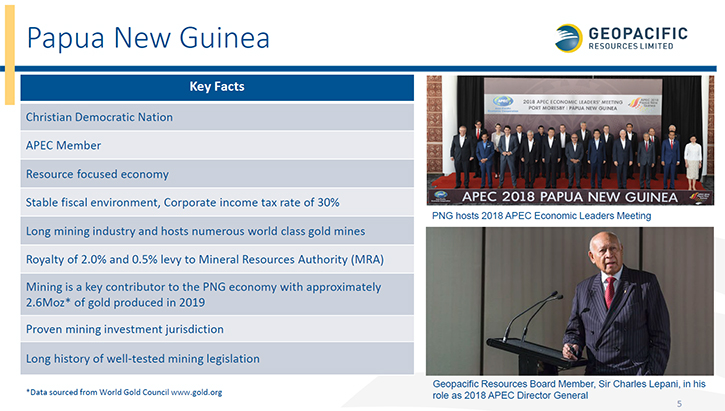

Tim Richards:Geopacific has a lean Board, albeit with a broad range of skills and experience. The Chairman, Ian Clyne was the Managing Director of Bank of South Pacific, which has been the main bank in Papua New Guinea, for six years. Sir Charles Lepani was the High Commissioner to Australia for 12 years, which ended when he returned to Papua New Guinea and was appointed as the Secretary General for the APEC conference, which was held in PNG in 2018. He is from Milne Bay Province, where we are building the project and is highly regarded within PNG.

The third Board Member is Ian Murray a chartered accountant. He was the former CEO and Managing Director of Gold Road, so he brings with him a substantial amount of experience in equity markets and project development. While Colin Gilligan is a mining engineer, with over 25 years' experience culminating in senior roles with Anglo and Downer EDI.

From the Management Team perspective, I joined the Company in October of last year. Prior to that, I spent six years as a General Manager for St. Barbara at Simberi, so significant experience running a very comparable operation in PNG. The Project Director, Graeme Rapley, is a 30+ year Civil Engineer, with substantial experience, delivering projects all over the world. He has prior PNG experience and specializes in delivering projects for junior and mid-tier companies with medium sized capital budgets. Our Management Team, on site, is largely in place and all the team have Papua New Guinean experience as well as other offshore experience. It is a strong Management Team, with a lot of in-country experience, supported by a Board, with a broad skillset and substantial experience operating in Papua New Guinea.

Dr. Allen Alper:

Well, that's excellent. It's great to have such an experienced Board and experienced Team, and so knowledgeable about the area and able to take the project forward. That is great! Tim, could you tell our readers/investors a little bit more about your share and capital structure?

Tim Richards:Geopacific is Australian listed, with 512M shares outstanding. The share price, is about 35 cents, giving the company a market capitalization of just over 180M Australian dollars. That market cap is materially different from what it would be had Woodlark been a similar scale project in terms of output and exploration upside in North America or Australia. When consideration is given to the current cash balance of 145M Australian dollars, it’s clear the value ascribed to the underlying asset is exceedingly low. While currently massively undervalued, the project is fully permitted and ready to go, with the expectation that a substantial rerating will occur as construction progresses into production over the next 2 years.

Dr. Allen Alper:

Sounds like you're very well fixed for funds and have great support. Now it's the Sprott Lending debt proposal that will really put you in good shape to go forward.

Tim Richards:

The Company is in a great position, with a very clear path from our current developer status to Papua New Guinea’s next gold producer. All the challenges associated with permits and the like have been addressed, equity is in place and the debt funding with Sprott is in the final stages. It's just a matter of working through and finalizing all the loan documentation, which is not overly difficult, but it takes time to work through the process. Geopacific is very comfortable with the progress on the debt front, it's just a matter of finishing up the process and at that point the project is fully funded. The site Team is well established in Papua New Guinea and there's already a substantial amount of construction work underway on the island. Engineering on the processing plant is being undertaken by GR Engineering Services (GRES) and is 30% complete, while all key contracts are largely agreed and ready for signoff. A substantial amount of work has been undertaken in parallel, with raising the equity and appointing the preferred debt provider, over the last couple of quarters and now it's simply a matter of just finalizing the debt and formally starting the build.

Dr. Allen Alper:

That's excellent. Could you tell our readers/investors how it is operating in Papua New Guinea?

Tim Richards:

Papua New Guinea is a jurisdiction that gets a bit unfairly represented in the press. It has a stable political environment, in terms of the legislation, the Mining Act in its current form, has been in place since 1992 and administration of resources in the country is managed effectively by the Mineral Resources Authority, which is funded by a levy on producing mines. It is undeniably a country with a phenomenal mineral endowment. For a relatively small landmass to have deposits like Lihir, Porgera, Ok Tedi and Wafi-Golpu, which are all world class, is a testament to the quality of the underlying geology. A number of these projects, along with a number of smaller operations have been running successfully in the country for decades, so the skillset of the national workforce is high. Socially and politically, there is a keen understanding of the value of the resources industry to the broader economy. Woodlark being located on an island, provides a number of benefits, in particular the simplicity of the logistics solution. International shipping clears customs in Lae or Port Moresby before being transferred to a domestic shipping line and transported directly to the mine site, with our wharf less than 7km from the processing plant. A far simpler solution than the mainland or Australia for that matter where supplies need to be loaded onto truck and navigate, at times, challenging access roads

In terms of the workforce, its largely English speaking, receptive to expatriates providing training and mentoring. Access to Australia is straight forward, with daily flights between Port Moresby and the east coast of Australia. For a project of this scale, it is certainly one of the easier jurisdictions, world-wide, in which to operate.

Dr. Allen Alper:

That's good to hear! It's nice to have a Team, with experience in the area and working in the area. So that's excellent! Tim, could you give our readers/investors the primary reasons they should consider investing in Geopacific Resources?

Tim Richards:

Presently it is a massively undervalued stock. For a project with a million-ounce reserve, fully permitted, shovel ready, with life of mine, all in sustaining costs of Australian dollar $1,239 an ounce, it is difficult to reconcile the value being ascribed by the market. Current project post tax NPV is $347M Australian dollars, while the post-tax IRR is 34%, which are compelling numbers in isolation, but they don’t account for the potentially massive upside, associated with the exploration potential on the island. Once the plant's built and the project is producing gold, the incremental value add for every ounce discovered thereafter is enormous. In the context of broader PNG, Woodlark is still a small resource, not because of the underlying geology, but simply because of the lack of drilling that's historically been completed. The current resource of 1.6Moz, while substantial, is open ended and the extents of the orebody are yet to be defined, the exploration is yet to touch the sides of the mineralization.

In essence it is a robust project that is fully permitted, equity raised, shovel ready, with a massive amount of exploration upside. Debt will be finalized imminently and within 2 years the project will be producing over 100,000oz per annum of gold.

Dr. Allen Alper:

Sounds like very compelling reasons for our readers/investors to consider investing in Geopacific Resources! Tim is there anything else you would like to add?

Tim Richards:

No, thanks for your time. I look forward to speaking with you in the future, as construction on the project proceeds.

Dr. Allen Alper:

Excellent! We will publish your press releases as they come out, so our readers/investors can follow your progress.

https://geopacific.com.au/

Tim Richards, CEO

info@geopacific.com.au

|

|