Hecla Mining Company (NYSE: HL): Produces a third of All Silver Produced in USA, Silver Production Increasing, Widening Gap between Supply and Demand; Phillips Baker Jr., President and CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/22/2021

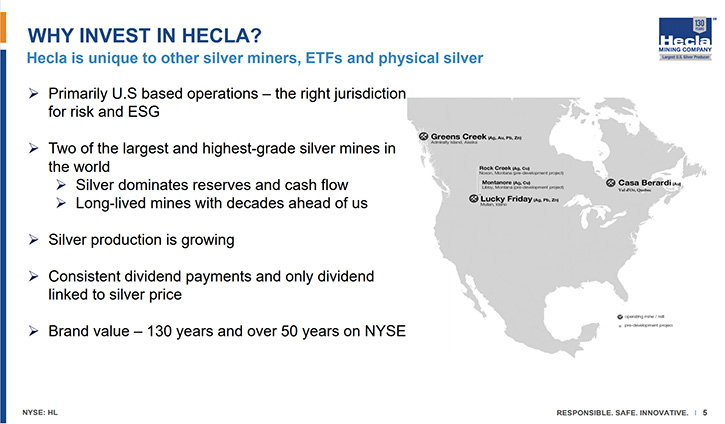

Hecla Mining Company (NYSE: HL) is the largest primary U.S. silver Company, with operating silver mines in Alaska and Idaho and with a gold operating mine in Quebec, Canada. The Company also has exploration and pre-development properties in eight world-class silver and gold mining Districts, in the U.S., Canada and Mexico, also an exploration office and investments, in early-stage silver exploration projects, in Canada. We learned from Phillips Baker Jr., who has been President and CEO of Hecla Mining for the past 18 years, that their assets have long lives. Currently the Company has by far the largest reserves in history. The prices of gold and silver continue to gain traction. Hecla is in a unique position to take advantage of precious metal prices, as a Company that has significant reserves and resources, in the right jurisdictions.

Hecla Mining Company

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Phil Baker, who is President and CEO of Hecla Mining. Phil, could you give us an overview and what differentiates Hecla? I know you have a very interesting dividend policy.

Phil Baker:

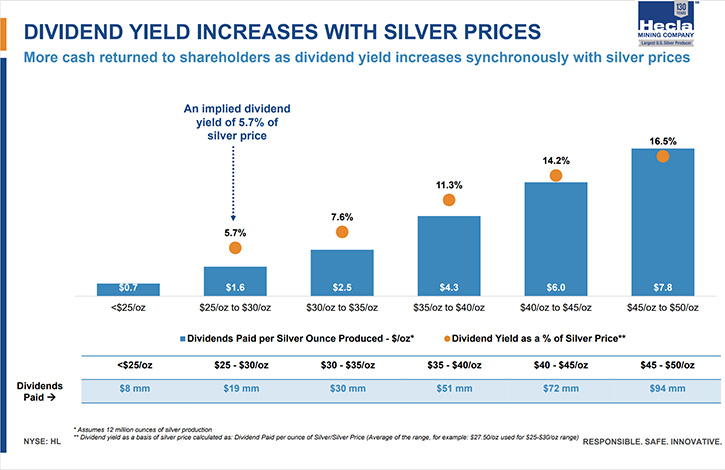

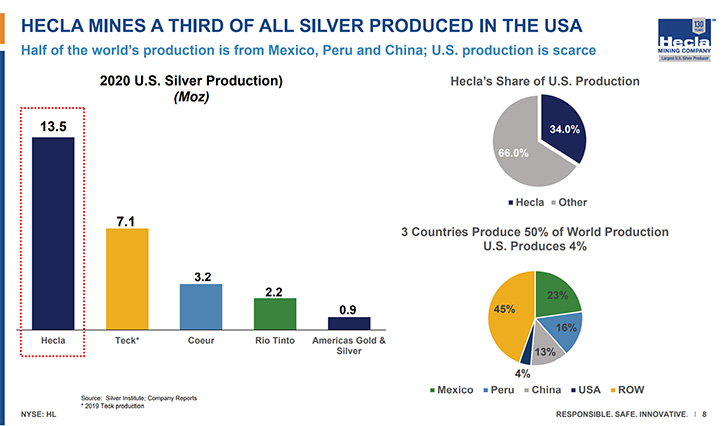

We have a dividend policy that's tied to the price of silver. It's a policy that we've had in place for over a decade now. We put that in place because of the fact that we are a primary silver producer. While we also produce other metals, silver is really what we're known for, where our reserves are, and where the largest portion of our free cash flow comes from. That's a function of the fact that Hecla produces a third of all the silver that's produced in the United States. There is no other significant U.S. silver producer that is a silver company. Our Greens Creek Mine, Lucky Friday Mine, will produce this year in excess of 13 million ounces. As the Lucky Friday grows that will go from a third of the U.S.'s silver production to close to 40%.

Dr. Allen Alper:

That's excellent. The timing is great too, as Silver is playing such an important role in the electrification of vehicles, as well as regaining status as a precious metal, with its value increasing.

Phil Baker:

If you look at the history of silver, and I've been in the silver business now for the last 20 years. I had a quite well-known investor, who said, "Unless Hecla sells its silver assets, I'm not going to invest in the Company. I think you should sell your silver assets and be a gold company." And I said to him, "Well, you're not going to be an investor in Hecla because we are a silver company, we believe that the price of silver will rise."

This was in 2001, when I had this conversation with him. What he was concerned with, was the photographic demand declining. Because at that time, 1999 was the all-time high for consumption of silver and photography. Roughly 236 million ounces of silver was consumed for photography. He was absolutely right. Silver lost, in this past year, probably about 30 million ounces. It lost over 200 million ounces of demand for photography.

One would think that his thesis would have been right. But what he didn't appreciate was the fact that the demand for silver was going to rise in what is known as industrial demand. It's not a particularly artful description of what that demand is because it is the demand for electronics. It's a demand for, now photovoltaics, demand for energy. And that started to grow and the other thing that started to grow was investment demand for silver. Since that time, those two categories have grown about 60%.

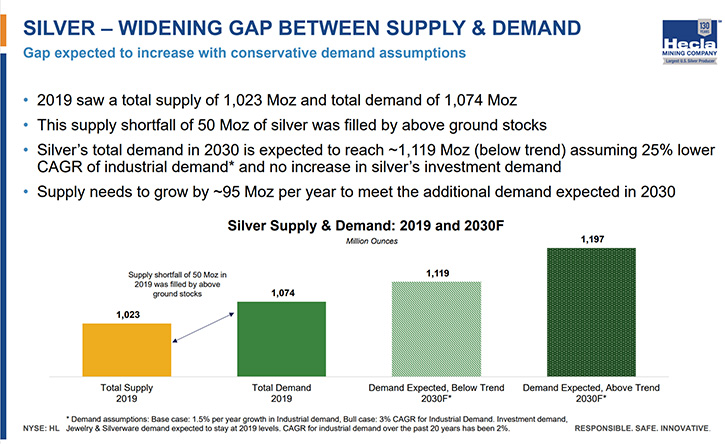

We now have a billion-ounce silver market, photographic demand is almost nonexistent. But these other categories, not only replaced the photographic demand, but far exceeded it. We're in an environment today, where we're having this decarbonization of the economy and that's going to require even more silver. The outlook for silver could not be better because it's done in the context of declining mine supply. Over the last five years, that supply of silver has declined, oh, about 50 million ounces, not including the decline that we had in 2020 for COVID. We'll make up some of that over the next few years, but it's a hard task to make up what's been lost and produce more.

Dr. Allen Alper:

That sounds excellent for a silver mining company! Such a great position! You have safe mining jurisdictions. Maybe you could say a little bit about that.

Phil Baker:

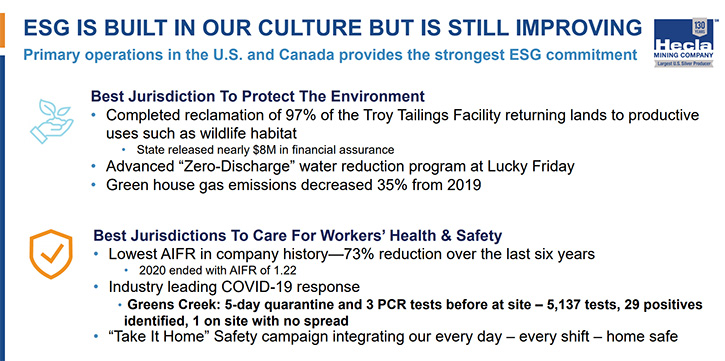

Yes, we do. Our silver mines are all in the U.S. We do have properties that are in Mexico. We have a property in Quebec. But the property in Mexico is now just an exploration property. The property in Quebec is a gold property. We don't have exposure to difficult places in the world. We don't have exposure to places that have had a huge volatility in the rules of the game and in some cases effective expropriations. Everything is in the U.S. We have the three operating properties, and we have about seven or eight exploration and development properties. All seven or eight have the potential to go into production, within the next decade.

One of them is in Montana and it's very, very large; it's 330 million ounces of silver, so more silver than the rest of Hecla has combined. It has a mine life that will last in excess of 3 years and it's in the United States. It's also three billion pounds of copper. We have existing assets, we have development assets, we have growth that's happening and it's all happening in the U.S.

Dr. Allen Alper:

That's fantastic! It's great to have great reserves and also the potential to totally increase exploration. So that's fantastic!

Phil Baker:

When you say we have great reserves, I think one thing I should mention is that our mines, Greens Creek and Lucky Friday are two of the 10 largest primary silver mines in the world, in terms of endowment of metal. Surprisingly, the Greens Creek Mine is actually larger than the Fresnillo Mine, which produces more silver, but it doesn't have as big a reserve. The other thing that's interesting about those two mines is they're twice the grade of any of the other large silver mines. So, the quality of these two assets is unparalleled in the space.

Dr. Allen Alper:

Excellent, could you tell our readers/investors a little bit more about the use of silver in electric vehicles and how much we need to use?

Phil Baker:

Silver is used in vehicles, whether they're electrical or internal combustion. Their use currently, in internal combustion engines, is somewhere around 25 grams per vehicle. Electric vehicles do use more silver. Silver requirements for electric vehicles are probably around 35 to 40 grams, so a significant increase, with vehicles currently using about 50 million ounces of silver per year. You can expect to see that grow quite dramatically as the production of these electric vehicles grows. To the extent that you have vehicles that have autonomous features, that requires even more silver. You have a category in electric vehicles that really wasn't even on the map five years ago, and now it's going to dominate the automobile sector and it's going to require a lot of silver.

Dr. Allen Alper:

Sounds excellent! Could you tell our readers/investors about your operating results?

Phil Baker:

We had a very strong year, notwithstanding that we had COVID. Why is that? Well, the primary reason is the determination by the governments that we were an essential industry. We had that determination in the U.S. immediately and we were able to continue to operate, without having to shut down at all. Same thing eventually happened in Quebec and then in Mexico, so we only missed a little bit of production from those operations, and we were able to produce in a year, where the metals prices strengthened, particularly silver.

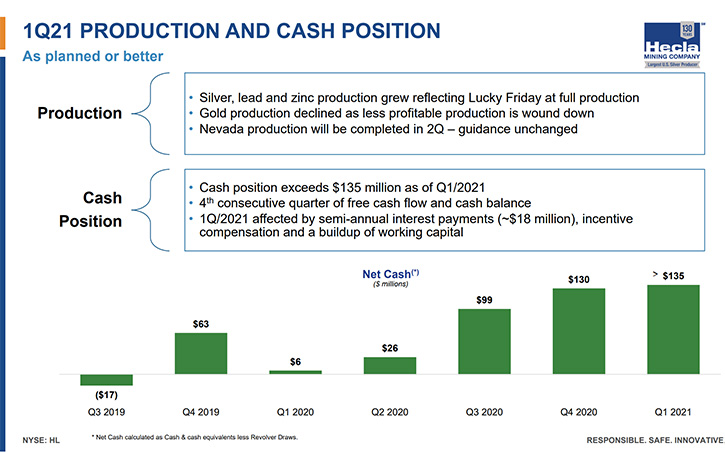

There's this recognition of the importance of silver in the market. We had very strong cash flow for the year, one of our three or four strongest cash flows in our 130-year history. A cash flow generation that really allowed us to improve our balance sheet. The amount of cash that we had on the balance sheet increased from about $60 million to over $125 million. It more than doubled! This just reflects how strong the year was, and that was the year where prices strengthened over the second half of the year. I think in 2021, you're going to see even stronger prices, particularly for silver, you should have even a better year because we'll have more production.

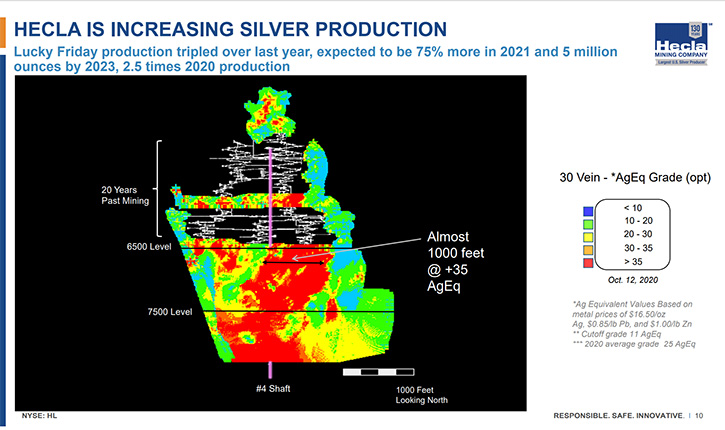

Our Lucky Friday Mine just started to ramp up to full production, during the course of the year. We went from 600,000 ounces of production in 2019 to two million ounces of production in 2020. This year will be over three million ounces, and by 2023 will be around five million ounces. We have not only higher prices, but we have more production of the metal.

Dr. Allen Alper:

Well, that's an excellent position to be in, increasing your production, and the price of silver increasing, and demand increasing. Everything seems to be pulling together for Hecla Mining!

Phil Baker:

It really is! We're in this environment that we've not seen for silver before. One of the things that I would suggest to investors, is that if they look over a period of time of about a decade, they can expect the increased demand for silver to probably be at least 10% more, that's 100 million ounces. Ten percent and 100 million ounces might not sound like very much, I mentioned earlier that Greens Creek was, in terms of metal endowment, the largest silver mine in the world. Not in terms of production, but in terms of endowment, in terms of production it's about a 10-million-ounce producer.

If the demand for silver increases to 100 million ounces, you need 10 Greens Creeks, but there are not 10 Greens Creeks to develop and to grow the production to meet the demand. What's going to happen? You're going to have to have higher prices to encourage more production and encourage the thrifting of silver. Hecla's right in the midst of being able to take advantage of those higher prices, with both the dividend policy that we have and the growth that you'll see us have in our exploration, as we expand, with the seven or eight properties that we have that we could take into production over the course of the next decade.

Dr. Allen Alper:

That sounds exciting for your shareholders and stakeholders. Could you tell our readers/investors about your capital structure?

Phil Baker:

We have a capital structure that is a combination of both debt and equity. I think we're one of the few companies that has their assets in a safe jurisdiction, assets with a long enough mine life and with a cost structure that makes debt appropriate to have on the balance sheet, debt that's long term. Our debt, which is about 475 million dollars is due in 2028. I would anticipate that during the course of the coming years, given the amount of free cash flow generation that we have, that we'll probably buy some of those bonds back, once we can call them at a reasonable rate, in order to reduce the debt that we have outstanding. But we think that having that debt and having that access to the debt market is a competitive advantage for us because it allows us to use that debt market to grow the Company rather than having to issue equity. You look at the Company’s peers and what do they have to do when they need capital? They have to raise equity. We don't have to do that in the same way.

Dr. Allen Alper:

That sounds very good. Could you tell our readers/investors the primary reasons they should consider investing in Hecla Mining?

Phil Baker:

The jurisdiction that we're in, the fact that we're in the United States. This is by far the best place in the world to be a miner. You have the best infrastructure, you have the best rule of law, you have the best geology in the world. Number two, we have the best silver mines in the space. These are large silver mines, with very long mine lines, very low costs, and they're growing. Particularly at the Lucky Friday, you have that growth. So those are the existing assets.

But we also have a whole suite of new assets. I've mentioned the one in Montana. We also have assets in Nevada, where we are exploring and having multi-ounce gold results that indicate that our rationale for acquiring those properties is going to come to fruition. We also have assets that are in Colorado and Washington State that could be developed, as well as assets in Quebec and in British Columbia. We're in the best places, with the best quality assets for what we're going to develop.

Dr. Allen Alper:

Those are very compelling reasons to consider investing in Hecla Mining, Phil. Is there anything else you'd like to add?

Phil Baker:

I would be happy to answer questions that your readers/investors have about Hecla. Please feel free to go to our website and see the information that we have on the website, as well as a variety of presentations that we're making that are available on the Internet. Then reach out to us with any questions you might have.

Dr. Allen Alper:

Sounds great. It's great to make the Company available for investors to learn more about what's happening. So that's a great opportunity! I enjoyed talking with you Phil. I am very impressed with what you're doing and with your Company, your properties, your locations and also the outlook of the market. It looks fantastic!

Phil Baker:

Yeah, I've not seen it quite like this in the 30 years I've been doing it.

Dr. Allen Alper:

That's excellent. You have to have determination and confidence and be willing to stick with it and work hard. It looks like you and your Team are doing that.

Phil Baker:

We are and we have a base to work from where we can do it without taking on too much risk.

Dr. Allen Alper:

That sounds excellent! We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

https://www.hecla-mining.com/

Russell Lawlar

Sr. Vice President – CFO and Treasurer

Jeanne DuPont

Senior Communications Coordinator

800-HECLA91 (800-432-5291)

Investor Relations

Email: hmc-info@hecla-mining.com

|

|