Black Rock Mining Ltd (ASX: BKT): POSCO of Korea, Approved Graphite Concentrate for Lithium-Ion Battery Anode Pre-Cursor; John de Vries, CEO & MD Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/19/2021

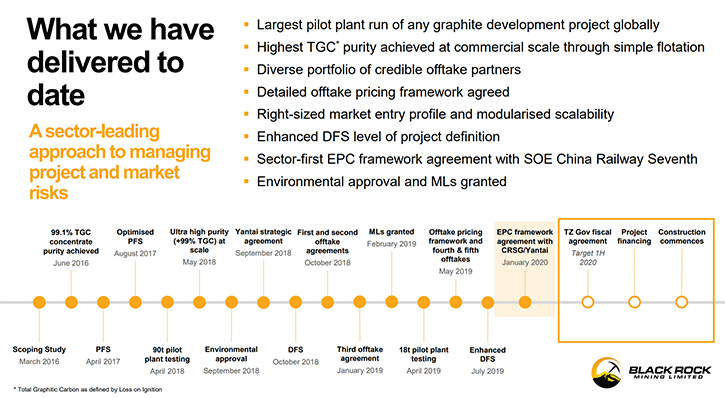

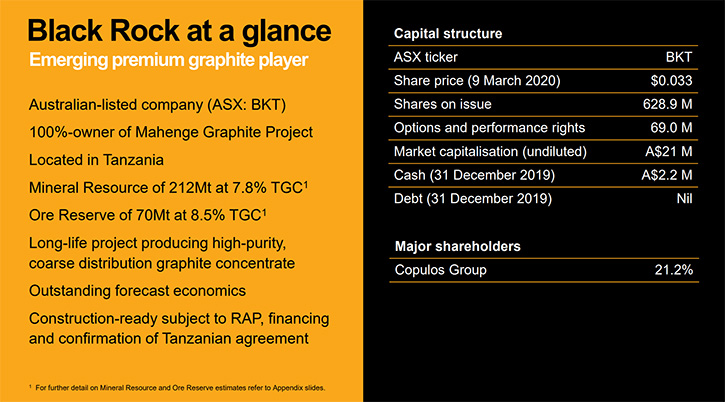

Black Rock Mining Ltd (ASX: BKT) has a 100% interest, in the Mahenge Graphite Mine, located in Tanzania. The Project has a JORC compliant Mineral Resource Estimate of 212m tonnes at 7.8% TGC. It also has Ore Reserves of 70m tonnes at 8.5% TGC. The Ore Reserves support a mine life of up to 350k tonnes of graphite per annum, for a reserve life of 16 years. The 2019 enhanced Definitive Feasibility Study for the project, which was based on strong customer demand, demonstrates exceptional financial metrics, including low CapEx, high margin, low technical risk, as well as superior economics targeting an annual EBITDA business of US$306M. We learned from John de Vries, Chief Executive Officer and Managing Director of Black Rock Mining, that due to its unique geology, Mahenge has a significant advantage, with high-grade and a larger distribution of premium large flake graphite. We learned from Mr. John de Vries that Black Rock collaborated with POSCO of Korea, one of the world's largest anode producers, on battery cell testing that confirmed Mahenge graphite concentrate meets battery grade requirements as Lithium-Ion Battery anode pre-cursor.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing John de Vries, Chief Executive Officer and Managing Director of ASX listed, Black Rock Mining. John, could you give our readers/investors an overview, and also what differentiates Black Rock Mining from others? Also, discuss your recent news about the qualification of your graphite for use in Lithium-Ion Batteries and what this means?

John de Vries: Thank you for talking with me today, Allen, I appreciate the opportunity to provide your readers/investors with an introduction to Black Rock’s Mahenge Graphite Mine. We’ve been working on our Graphite deposit and with the market, to fully understand the geology at Mahenge. This has been crucial in the context of how our Graphite product will perform and ultimately, the value we deliver when we integrate into our customers supply chain.

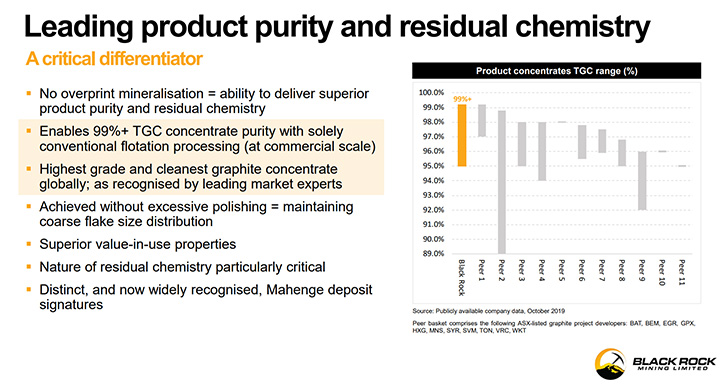

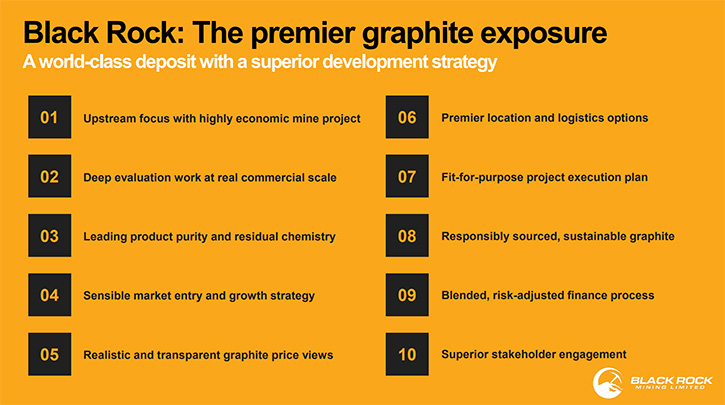

The Geology is a very important differentiator, in our business strategy, something that cannot be replicated. Typically, graphite deposits have a mineralogy, where they have had fluids go through the ore body as part of the metamorphic process. This creates inclusions or intercalations, in the flakes, which need to be removed before you can refine it to manufacture a Lithium-Ion Battery from it. Mahenge was a dry system, so we have very, very low levels of intercalation, which means we have a uniquely high-grade concentrate that has superior electrochemical properties.

Also, it means that the graphite doesn't need to be highly processed before it is useful as a commercial product. In a typical graphite plant, you might have 14 or 15 processes before you produce a commercial product. At Mahenge, we will have fewer processes, or stages where the graphite is polished, means we retain a greater portion of the large flake. This Geology advantage provides Black Rock with product optionality – 35% of our graphite is aimed at the battery anode market, while 65% of our larger flake product will enter under- supplied, higher price markets. This speaks to a higher margin business, and important yield value for our customers. Our approach to the battery anode market has been to collaborate with the existing globally established supply chain. And this is where the partnership with POSCO has come from. POSCO is one of the world's largest battery anode producers, with an ambition to grow to 20% share of the global market, and clearly targeting the significant demand coming from electric vehicles driving the Lithium-Ion Battery boom.

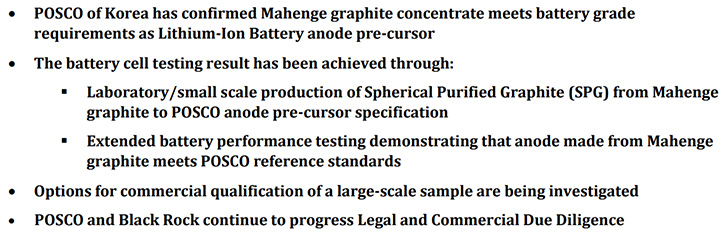

We have spent a long time working with POSCO, who has assessed our capability to supply high quality natural flake graphite, into their battery anode supply chain. This culminated in a recent announcement, where POSCO confirmed that Black Rock’s Mahenge Graphite met their specifications for battery anode, essentially confirming that we have saleable product in this highly competitive, battery anode market. A fantastic result, which confirms our upstream business model - we're a miner and that's where our skill set is and POSCO is a battery anode maker.

It's much better to work with a globally established business like POSCO and leverage their channels to market. It is simply far too risky for us to setup a downstream manufacturing business to take on our customers, and other globally established battery makers. Because our Geology is so good, it means that we can stay upstream and focus on mining the best Graphite on the planet.

Dr. Allen Alper: Oh, that's excellent. That's a great position to be in. Could you tell our readers/ investors a little bit more about some of the financial data that your project has?

John de Vries: Yes. The financials of Mahenge are interesting. I think we're at the cusp of a sustained uplift in raw material pricing. When we talk about Graphite, we talk about a thing called a basket. You imagine, when you look at a graphite project, you have some fines, you have some very large flake and you mix this together, it produces a basket as a product. The mix of products in the basket drives the overall sale price, and larger high purity flake, as we have at Mahenge, ultimately delivers Black Rock a high margin operation.

In Mahenge's case, when we completed the DFS, back in 2018, we had a basket estimate of about US$1,300. The size of the plant was somewhere between 80,000 to 85,000 tonnes. That produced a stunning NPV, of around US$1.2 billion. It was a very significant operation. It's all based on the fact that two-thirds of our product is premium large flake rather than fines.

The fines portion is the one that gets attention in the press, as it is linked to the highly competitive battery feedstock market. China dominates this market as the leading producer, which means they are also the price setter.

Dr. Allen Alper: You have some very interesting returns projected and also a little CapEx. Could you talk about that aspect of the project?

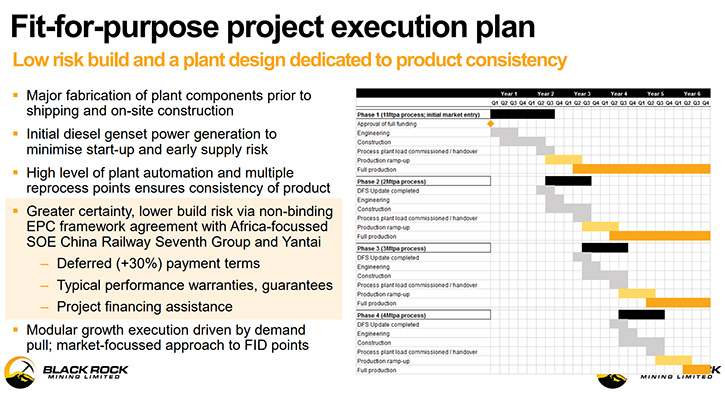

John de Vries: Capital has been an interesting exercise for us, because again, if we go back to our business model, we prefer to collaborate. In our approach, we have used Chinese EPC and Chinese equipment supplies. Why? Because effectively the people we're dealing with in China have built four graphite plants in China that work, so we'll use them and gain experience and reduce technical risk in the process.

The Chinese EPCM alliance is also delivering a deferred payment arrangement. So effectively, out of a US$75 million equipment supply and construction contract, about US$35 million of that will be deferred, until after the plant is commissioned and running successfully. But what this really represents for us, is a performance warranty and soft finance option combined into one.

Because we are working in Tanzania, we have collaborated with the local financial institutions, including a relationship with a parastatal bank, the Tanzania Investment Bank, or TIB. We are working with TIB to assess the depth of local financial markets. This is all about aligning our interests. Module one will cost US$116 million, which includes most of the ongoing infrastructure, required for subsequent modules. Then, when we build out modules two, three, and four, driven by customer demand, we can cash flow and debt fund them, as they will attract significantly lower capex. The modular strategy gives us the flexibility to respond to customers and market signals quickly, so we only grow when the market allows it.

In other words, if you are going to build an airline, most people start off with Boeing 737 or A320, even though one A380 may work. The reality is the A380 makes a lot of money when it's full. It loses a lot of money when it's not full. Having lots of smaller modules gives us much better control, when we bring capacity and product into the market. This strategy which we call, “Crawl, Walk, Run, Sprint” is all about maximizing effectiveness at the right time.

Dr. Allen Alper: Well, that sounds like a very excellent approach. It sounds too that you have a very high IRR projected, is that correct?

John de Vries: Yes. The IRR is about 45%, that's an ungeared IRR, with an NPV of US $1.2 billion. And again, that comes back to the discipline of the approach about bringing in one module at a time, and effectively taking cashflow from that first module to fund modules two, three, and four. It's planting the seed and growing a tree, I think, rather than trying to plant the whole tree in day one.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors your primary goals for the remainder of 2021?

John de Vries: Well, we have two critical goals that we're working on at the moment. Goal number one is executing on our partnership with POSCO. We entered into a strategic alliance with them, in June last year, and recently completed the due diligence and commercial processes, where POSCO has agreed to a 15% equity stake in Black Rock. Now we want to finish the second part of the alliance, an offtake prepayment of up to US$20M, which we expect to be completed by April. I think POSCO, coming on board sends a clear message to the market about the quality and commercial value of our Mahenge Graphite, especially when you consider that POSCO could have partnered with any one of a number of existing Graphite producers in the market today.

The second key piece of work is to complete the process, with the Tanzanian Government, on the structure and nature of their 16% Free Carried Interest (FCI) in Black Rock’s Mahenge Graphite Mine. We have had positive discussions, working through the draft framework agreement to date, and importantly, believe we have an alignment of mutual interests, which will ultimately deliver an outcome.

If we can deliver on these two activities, in the coming months, the Company will be in a very good position, heading into a financing process. In the meantime, funds from the POSCO investment will be substantially used on the design and engineering processes, to be ready for construction.

Dr. Allen Alper: Well, that sounds like a very exciting time for Black Rock Mining. Sounds excellent!

John de Vries: It's good to see it all come together. We've been working on this now for four years, and pleasingly timed our run into the market perfectly, at the right time, as the electrification of transport megatrend drives demand for graphite in battery anode, as well as large flake, expandable graphite applications in fire retardant building cladding, foils, and new nano-technologies such as graphene.

Dr. Allen Alper: Sounds great. John, could you tell our readers/investors a little bit about your background, the Board, the Team?

John de Vries: For a junior mining company, we have an unusually well-experienced Board. Our Chairman is Richard Crookes, previously with EMR Capital and Macquarie Bank. He is a geologist by profession. But, he has spent the last 30 years in resources finance. We have an independent non-executive Director, Ian Murray, the former CEO of Gold Road Resources, where he grew Gold Road from a junior gold explorer right through to well over a billion-dollar market capitalization. Our Company Secretary, and Non-executive Director, is Gabriel Chiappini, a chartered accountant with over 20 years experience in the commercial sector. And lastly myself, I've been in the resources sector now, nearly 40 years.

The only continent I've not worked on is Antarctica. I bring a background of technical discipline and operating efficiency, and having built a number of mines along the way. We have a strong Board with the right staff to deliver a graphite mine.

On the ground in Tanzania, is Raymond Hekima. Raymond's an absolute machine. He just gets stuff done, and properly. Raymond is an environmental scientist, by profession, and has been instrumental in leading our whole Government approach and community engagement.

Dr. Allen Alper: Well, you have an excellent Board and Team, so that's very good! Could you tell our readers/investors a little bit about your capital and share structure?

John de Vries: We've just completed two capital initiatives in the last year. Black Rock Mining has ~700 million shares on issue, listed on the Australian Securities Exchange (ASX) under BKT.

As of December 30, 2020, the Company had cash reserves of A$2.6M, which has provided enough operating capital, leading into the US$7.5M investment from POSCO this quarter.

Dr. Allen Alper: Sounds very good. Could you tell our readers/investors the primary reasons they should consider investing in your Company?

John de Vries: Effectively, three reasons:

The first is that we've done the study work in depth and at commercial scale. Our Definitive Feasibility Study and pilot plant operations were designed to be pressure tested against bank grade due diligence. The fact that our work has passed a robust due diligence process, with POSCO, a US$20 billion company, speaks to this. Remember, most mine projects fail for technical reasons, and this is not one of them.

Secondly, we believe we have the best Graphite on the planet, with a world first 99% purity Graphite. The geology at Mahenge has high-grade and high purity, delivering not only product optionality for small and large flake markets, but because it is so good and easy to work with, we have a much lower operating cost, which when combined, drives our exceptional financial metrics of NPV10 of US$1.2 billion, IRR 45%, from a 26 year mine life.

Lastly, package this up with our modular build approach and upstream focus, we have a very sensible market entry model and growth strategy that is ultimately driven by customer demand and market pull. In other words, we have a right sized operation, with meaningful returns that will integrate seamlessly into the market.

Dr. Allen Alper: Sounds like very strong reasons for our readers/investors to consider investing in Black Rock Mining, John. Is there anything else you'd like to add?

John de Vries: Well, Allen, I think the big thing is we have been lucky with our timing. The Electrification of Transport megatrend is now real and is beginning to impact graphite market dynamics, both for demand and pricing. We are already seeing interest more broadly in the Electric Vehicle raw material supply sector and this will simply get stronger in the months ahead. As I said earlier, our journey has taken us 4 years to this point, so the barrier to entry being time is a significant one. Market demand is now turning in our favour, so I am pleased for our shareholders that the decisions we made years ago, forming our technical and commercial work, have led us to now enter the market at the right time.

Dr. Allen Alper: Well, that sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

www.blackrockmining.com.au

John de Vries

Chief Executive Officer

Black Rock Mining

+61 438 356 590

jdv@blackrockmining.com.au

|

|