Kenorland Minerals Ltd. (TSXV: KLD, FSE:3WQ0): Aggressively Exploring First Class Gold and Copper Projects in Canada and Alaska, with Support of Strong Partners; Zach Flood, President, CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/15/2021

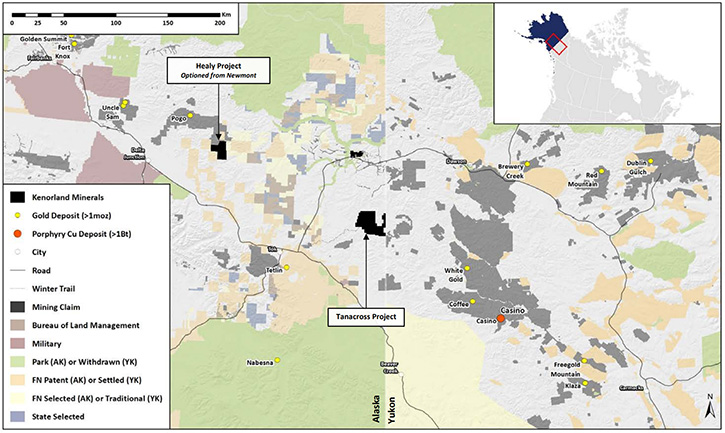

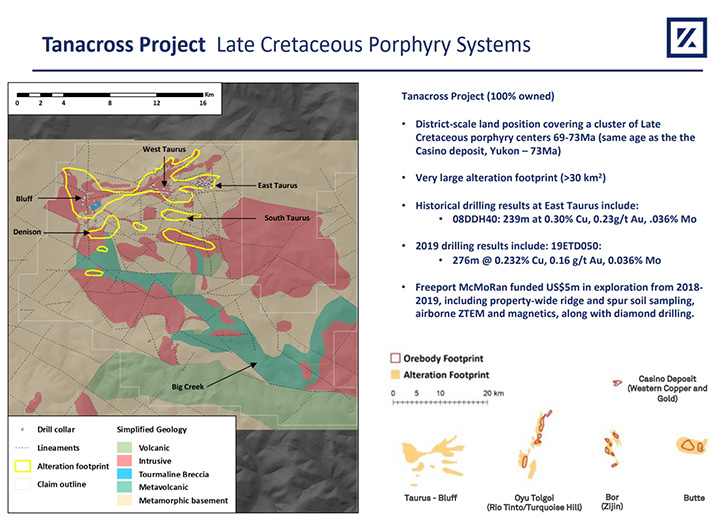

Kenorland Minerals Ltd. (TSXV: KLD, FSE:3WQ0) has just acquires a district-scale land package, in Ontario’s Birch-Uchi Greenstone Belt, in the Red Lake District of Northwestern Ontario. We learned from Zach Flood, President, CEO and Director of Kenorland Minerals, that they are about to wrap up the 9,000-meter drill program, at their Frotet gold JV, with Sumitomo Metal Mining in Northern Quebec that started in early March of this year. The results are expected in mid-May through mid-June. The Company will also commence a 4000-meter exploration drilling campaign at their Healy Project, in the Goodpaster District, of Alaska, in early June. In addition, Kenorland has scheduled surface exploration and a 2,000m drill program on their porphyry copper project, called Tanacross, in Eastern Alaska

Kenorland Minerals Ltd.

Dr. Allen Alper:

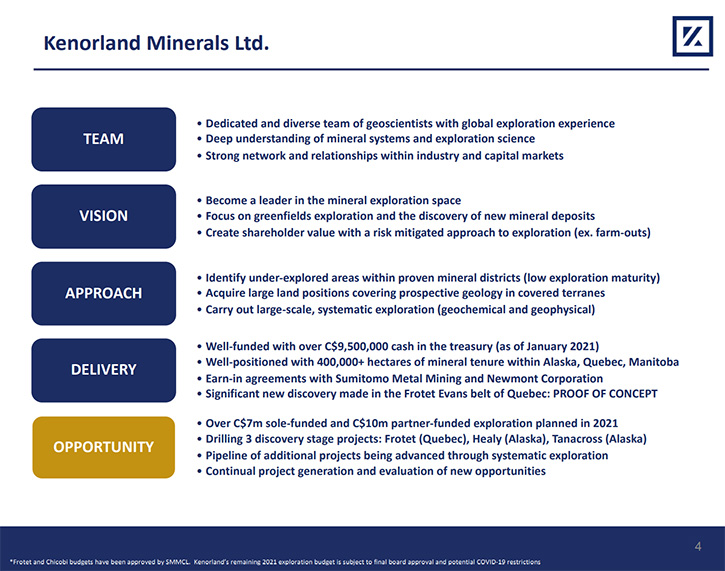

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Zach Flood, who is President, CEO and Director of Kenorland Minerals. It's been an exciting year for Kenorland Minerals, and I wonder if you could give our readers/investors a vision of the Company, an overview, and some of the primary goals for 2021.

Zach Flood:

The Company’s current trajectory and planned exploration activities make 2021 an exceptionally exciting time for our team and valued shareholders. We recently brought the Company public in January of 2021. Prior to that, we were a private company since 2016, mostly focused on early-stage exploration in the Americas. Our projects are located in Quebec and Alaska, looking mainly at gold, in terms of commodity focus. Additionally, the Company holds 100% of a significant copper asset in eastern Alaska. At the end of 2020 the Company raised $10 million during the reverse takeover transaction, which resulted in Kenorland being listed on the Toronto Venture Exchange under the symbol KLD, so we are fully funded for the planned exploration in 2021.

We immediately kicked off the year on one of our flagship projects, Frotet, currently partnered with Sumitomo Metal Mining, in Northern Quebec. We carried out a large-scale 3D IP survey, over the initial gold discovery made in 2020, which we're calling Regnault. That 3D IP survey was followed by a 9,000-meter drill program that started in early March, of this year. This program was successfully concluded a few weeks ago.

We're expecting the initial results will be released around mid-May and all results should be reported by mid-June. Recently, we announced an additional $6.6 million dollar exploration budget for the summer exploration program, which will include an additional 20,000 meters of drilling on the Regnault Discovery.

The project will be in joint venture with Sumitomo Metal Mining, and Kenorland will participate pro-rata on its 20% interest in the project, while Sumitomo funds 80%. Kenorland is the operator throughout this next phase of drilling as well.

In less than a month from now, we will also kick off our drill program on the Healy Project in the Goodpaster District of Alaska, starting early June, which included 4,000 meters of diamond drilling. We will be testing a few large-scale gold and soil anomalies in the Goodpaster District, which have never seen any diamond drilling. This is an excellent opportunity for us to make another significant gold discovery.

Goodpaster is well known for the Pogo Gold Mine, which has produced about four million ounces of gold and has a total endowment of over 10 million ounces. We're very excited to test the targets out there. The gold system appears to have a very large geochemical footprint and excellent geology. As we’re drilling at Healy, we will commence surface exploration on our porphyry copper project, called Tanacross in eastern Alaska. This will include grid mapping, drone magnetics and a large-scale Titan IP survey, over top of the south Taurus Target area.

Following the surface work, we will be drill testing South Taurus, starting mid-August. This target has never been drill-tested, has very little geologic information over it, but it does present an excellent exploration target and potential for the discovery of a new porphyry center, in this cluster of porphyry occurrences.

Dr. Allen Alper:

It's going to be a very exciting year for Kenorland Minerals. You have such an extensive drilling program planned and very exciting locations in Alaska and Quebec, and you have the funds and partners to do it. So that's really fantastic.

Zach Flood:

Yes, it’s a very exciting time for the Company! These projects are fairly early stage, but that's where immense value creation can occur, during the discovery phase of exploration. We have been very successful making one bona fide discovery already in Quebec, at Regnault. We hope to repeat this success at Healy and potentially at Tanacross. We also have a large portfolio of greenfields Projects, we call ‘the pipeline projects’. This includes an additional 300,000 hectares of ground in the Abitibi and another 70,000 hectares of ground in the Red Lake district of Ontario.

The Chebistuan project, which is being funded by Newmont Corporation, will see another $500,000 of partner-funded dollars in exploration this year, following up on our regional geochemical survey, we completed last fall. Another project in the central Abitibi, Chicobi, which is also being funded by Sumitomo Metal Mining, is now nearing that initial drill stage, after roughly two years of systematic regional exploration. We have two other pipeline projects, within the Abitibi, Hunter and O’Sullivan. Both are 100% owned and are being advanced, in a similar systematic fashion as the rest of the portfolio.

Dr. Allen Alper:

Excellent. It's a great place to be exploring, a lot of gold there, so that should be very interesting as it proceeds. You and your team have great backgrounds and great records of success. I wonder if you could tell our readers/investors a little bit about yourself and your Team and your Board.

Zach Flood:

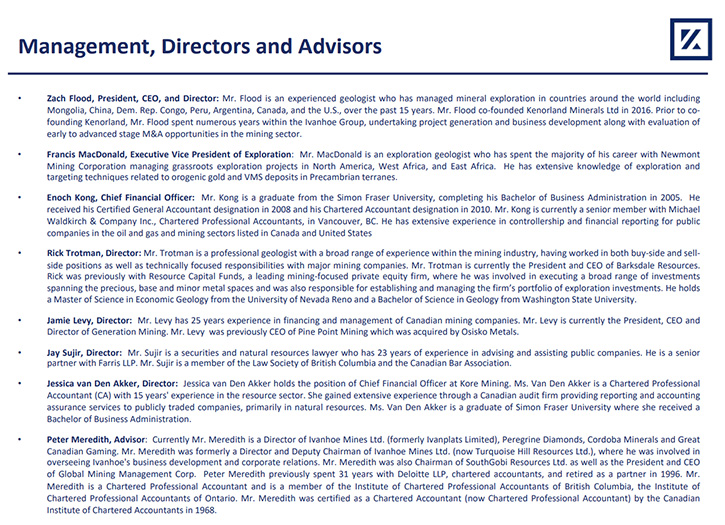

The four co-founders of this Company, including myself and three other colleagues, are all geologists by trade. We all worked together on the Hope Bay Project, in Nunavut, around 2007, 2008. Two of the co-founders stayed on and worked with Newmont from that point up until we started Kenorland in 2016. I spent a large amount of time in the Ivanhoe Group undertaking business development and project generation during the downturn. Our fourth co-founder and colleague, Dave Stevenson was working on his Ph.D. at the University of Western Australia at the Center of Exploration targeting in structural geophysics.

All of us have very diverse backgrounds in mineral exploration, with global experience focusing on, anywhere from Green-Field exploration, all the way up until resource definition and resource evaluation. I think we're pretty sorted on the technical side. On our Board, we have some great experience, with Rick Trotman, the President, CEO of Barksdale Resources.

On the Board, we have Jamie Levy, President and CEO of Generation Mining. They have a marathon PGE deposit in Ontario. Jay Sujir is a well-known natural resource lawyer, with over 30 years of experience in Canada. Jessica van Den Akker is the CFO of Kore Mining. Rick Trotman is the CEO of Barksdale Resources. We also have Peter Meredith, who has been a long-time Director of Kenorland, now he serves as an Advisor to the Board. He is currently a Director of Ivanhoe Mines and has spent the last 25 years working with Robert Friedland, building those companies.

Dr. Allen Alper:

Well, you have a great exploration team. An experienced and knowledgeable Board, very diversified and very strong. It's nice to see a Company, with such strong backing and such great, extensive experience, and a group that has worked well together and has been successful together.

Zach Flood:

It's been a great experience, growing this Company from the ground up. In 2016 when we started the Kenorland, we didn't have a single project. We went to our largest shareholder, John Tognetti, for initial financing and he’s supported every round of financing since then. We've grown Kenorland organically, from one project up to today, where we have over a million acres of mineral tenor between Quebec and Alaska. We've had multiple partnerships, with industry leading companies, like Sumitomo, Newmont and Freeport. I think now we have a stable of assets that have extreme potential for new discoveries and an entire pipeline of greenfield projects, which we're exploring, systematically on a large scale.

Dr. Allen Alper:

It's great to be in a position where you have great properties to explore, and you have the financial backing to pay for all of the drilling and exploration. Could you say a few more words about your capital and share structure?

Zach Flood:

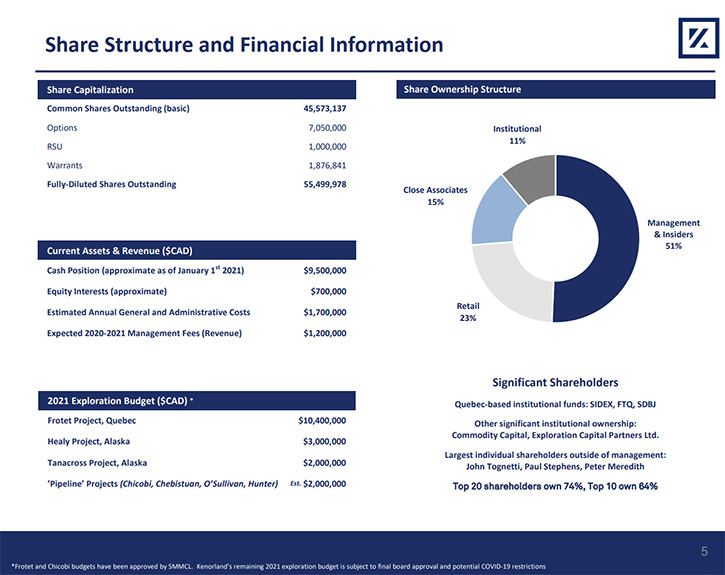

Today there are 45.5 million shares out, we're trading at about $1 per share today, which is where the last financing was done. In terms of ownership, Management insiders own 51% of the Company, including John Tognetti. We do have significant institutional ownership as well, including the Quebec based funds like SIDEX, F.T.Q. and SDBJ as well as Commodity Capital and another fund, under the Sprott umbrella, called Exploration Capital Partners Ltd.

Some other individual shareholders, outside of those groups, include Paul Stephens, with Stephens Investment Management, a legendary investor, in the resource space, based in San Francisco. He was a big shareholder at Diamond Fields. Peter Meredith also has significant ownership in the Company. Outside of that, we have retail ownership of around 23%. The stock is very tightly held. The top 20 shareholders own about 74% and the top 10 own 64%. A very tight share structure. We have a lot of long-term, supportive shareholders and I think that's really important for us, to set up a Company for success, when it comes to the exploration game.

Dr. Allen Alper:

Well, it's great to see that you have the stable, supportive backing that's in there for the long term. That's great!

Zach Flood:

Indeed, we’re very happy with where the Company is today. This year we have a lot to look forward to. We have around $17 million going in the ground. $7 million of sole-funded exploration, most of that is planned for Alaska drilling on Healy and Tanacross, as well as advancing some of our own projects in Quebec. On top of that, we have the $10 million partner funded exploration plan in 2021, which is focused in Quebec. $17 million dollars going in the ground, three discovery stage projects being drilled, an entire pipeline of additional projects which are being advanced through large-scale, systematic exploration. We have a technical team that can continually generate new ideas and evaluate new opportunities. It's a real exploration business, you'd be hard pressed to find a Company out there, with more ground being explored than Kenorland.

Dr. Allen Alper:

Excellent! 2021 will be a banner year for Kenorland Minerals and shareholders and stakeholders. It's great to see all that drilling in great locations. Is there anything else you'd like to add about why our readers/investors should invest in Kenorland?

Zach Flood:

I think we covered most of it. Keep an eye out for drill results from our 9,000-meter program that just wrapped up at Regnault, on the Frotet Project. Those should be coming out mid-May and throughout June. Beyond that, we have a lot more drilling to look forward to as well.

Dr. Allen Alper:

We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://kenorlandminerals.com

Kenorland Minerals Ltd.

Zach Flood

President and CEO

Tel: +1 604 363 1779

zach@kenorlandminerals.com

|

|