Aztec Minerals Corp. (AZT: TSX-V, OTCQB: AZZTF): Completed a Very Successful Drilling Program, on District-Scale, Tombstone Gold-Silver Project, in Arizona and Formalized the JV, with Kootenay Silver on Prospective Gold-Copper Property in Sonora, Mexico; Simon Dyakowski, President and CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/12/2021

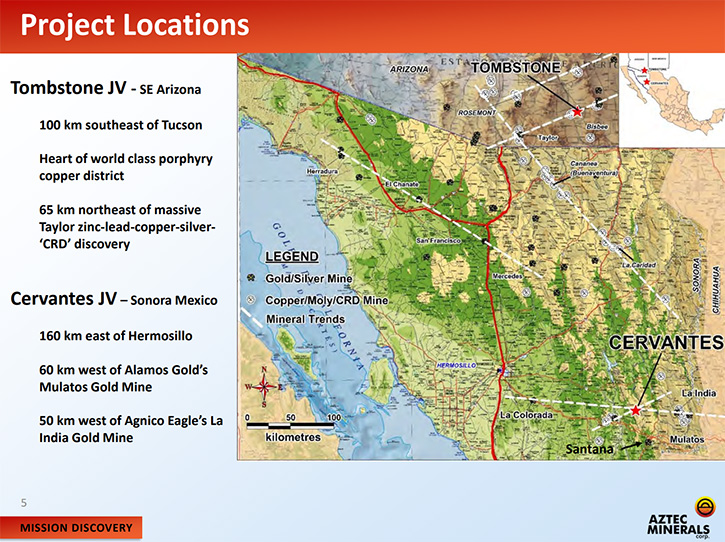

Aztec Minerals Corp. (AZT: TSX-V, OTCQB: AZZTF) is a mineral exploration company, focused on the discovery of large polymetallic mineral deposits, in the Americas. Aztec's core assets are the prospective Cervantes porphyry gold-copper property, in Sonora, Mexico, and the historic, district-scale Tombstone gold-silver project in Arizona. We learned from Simon Dyakowski, President and CEO of Aztec Minerals, that they have completed a very successful exploration drilling program, in Arizona. Plans for 2021 include sampling, mapping and drilling in Mexico, where they formalized the joint venture, with Kootenay Silver, in December.

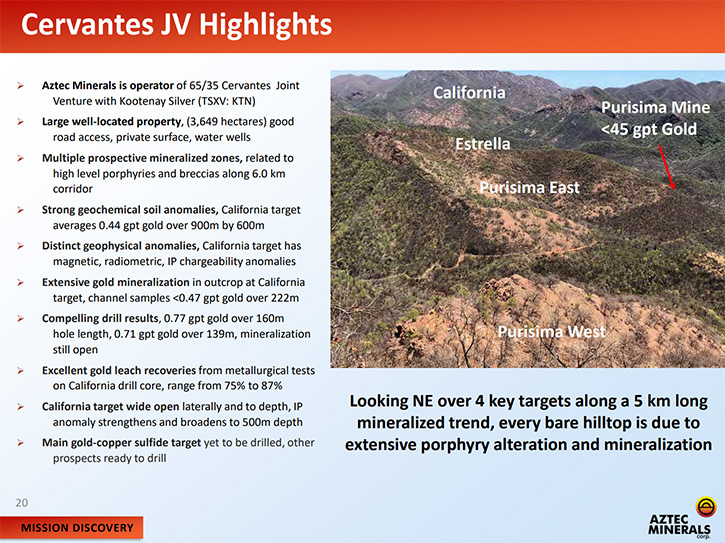

View of the California target.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Simon Dyakowski, who is President and CEO of Aztec Minerals. Simon, could you give our readers/investors an update of Aztec Minerals and information on some of the results you've had in 2020 and 2021 on drill results and data you've received? Also, what are your plans for 2021?

Simon Dyakowski:Aztec has been quite busy on advancing both of our projects, Tombstone, which is located in southeastern Arizona, as well as Cervantes, which is located in Sonora State, in northwestern Mexico. At Tombstone, we've completed a phase one drill program where we drilled just shy of 3,000 meters in 21 holes. It was a successful drill program in that it allowed us to spend sufficient funds to earn our 75% interest in the project.

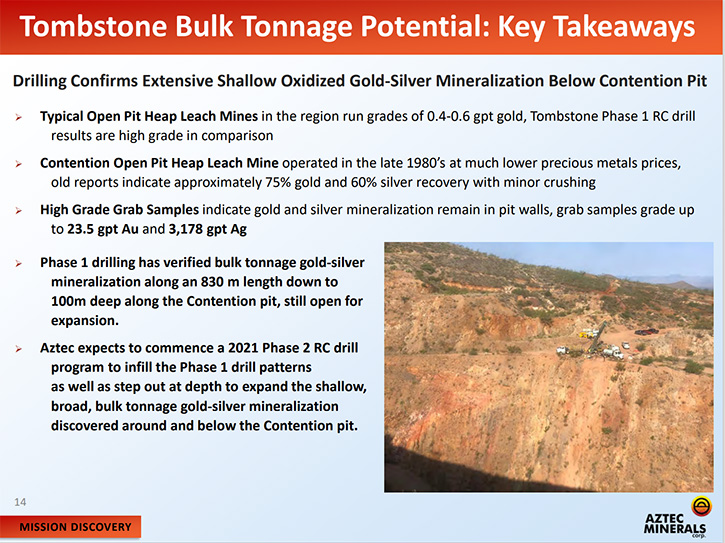

Technically, it was very successful, in that we discovered excellent gold and silver mineralization, with high-grade intervals up to and including a highlight hole in all nine of 7.15 grams per ton gold equivalent over 15.14 meters in all nine. In hole 18, we hit 6.36 grams per ton gold equivalent, over 7.6 meters. So, successful in finding high-grade gold and silver mineralization. We also drilled thicker mineralized intervals, including a 140-meter intersection that graded just over half a gram of gold equivalent.

In hole 20, we hit 82.3 meters, at 1.03 grams per ton, gold equivalent. We also conducted some surface sampling of historic mine dumps and found some high-grade mineralization in those, with the highlight sample of 47 grams of gold and over 2,800 grams of silver, on a new target that has had no historic drilling.

In Cervantes, we have also formed a joint venture on that project. We had previously spent our earn in obligations, but we hadn't yet formed the joint venture. In late December we formalized the joint venture with Kootenay Silver.

Since then, we have announced our exploration plans for 2021, which are broken into two phases. The first phase of exploration this year has occurred and we're analyzing the samples of it right now. Phase 1 consisted of approximately $60,000 worth of sampling and mapping and getting the project ready to drill. That Phase 1 mapping and sampling program is expected to support a larger Phase 2 drill program, later this year, once the rainy season has ceased in Sonora, Mexico.

We have announced that our plans to drill at Cervantes will be approximately 5,000 meters. 2800 meters are going to be infill drilling, on the California target. The California target is where Aztec had initially had drilling success in 2017 and 2018, where we drilled several holes of significant gold mineralization, oxide gold mineralization, near surface, with a highlight hole of 160 meters of .77 gold. This is our first opportunity to go back into our newly formed joint venture, to continue testing the California target.

Just over half of our drill budget this fall is expected to be at California, that 28,000 meters. Then we have 1,200 meters of drilling budgeted for other shallow gold oxide targets, particularly to the north of the California zone, as well as the zone called Purisima East. Then we have 1,000 meters of drilling, budgeted for two 500-meter-deep drill-holes into sulfide targets, around and below the initial oxide gold discovery in California.

Dr. Allen Alper:

It sounds very exciting. It sounds like you've been getting great results, both in Mexico and in Arizona. So that's fantastic. Sounds like 2021 will be an extremely exciting time for stakeholders and shareholders.

Simon Dyakowski:

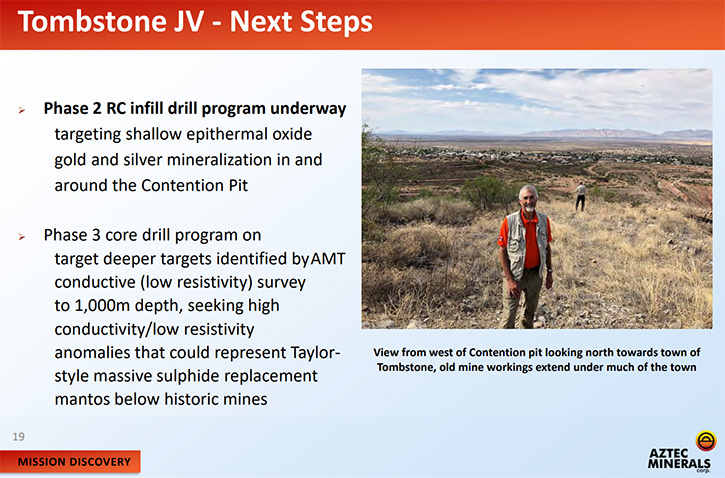

It will and last week we, in fact, started a second round of drilling at Tombstone. That's a 3,000-meter RC reverse circulation program that is designed to follow up and to step out and down dip of the intersections that we hit last year in our Phase 1 program at Tombstone. That's 20 holes along the contention open pit, which is the shallow gold, silver epithermal target that we're testing. That program is well underway now and we expect to have results from that Phase 2 drill program starting to come in at the end of May and into early June.

That program will take approximately three months and will take us into the summer, when we prepare for deeper drilling at Tombstone, to target CRD style mineralization, well below the open pit that we're drilling. It represents a unique target in itself. The Phase 2 drilling, we have planned to start in September. There is a lot of news flow for investors to look forward to and we look forward to advancing both projects, in our newly formed joint ventures, at both Tombstone and Cervantes.

Dr. Allen Alper:

Sounds like 2021 will be an exciting and great year for Aztec Minerals!

Simon Dyakowski:

We expect it to be! It's just starting right now, so it's a great opportunity to have an update, with you and your audience. There's plenty of news coming up. We spent the winter months preparing for our upcoming drill programs and now we are pressing the start button on those programs and expect to be exploring in an aggressive manner, over the next year.

Dr. Allen Alper:

Well, that sounds great, Simon! Could you tell our readers/investors a little bit about yourself, your Chairman and your Team?

Simon Dyakowski:

Absolutely! I'll start with our Chairman and largest shareholder. With any successful exploration company, the number one factor in success is the experience, knowledge and support of the Management and Board of Directors. We are very fortunate, in that our Company was founded and is Chaired by Bradford Cooke, the CEO and Founder of Endeavor Silver and as well as Canagold Resources. He has over 40 years of experience in the mining industry and has experience through the full cycle of discovery to building and operating mines, to selling assets and companies. We are led from the top by Brad Cooke.

On the Management Team, David Heyl has joined us. He is an exploration geologist, with more than 38 years of experience in the mining industry. He's had senior corporate technical roles, with both major companies and junior companies. He's worked mostly in the Andean countries of South America and in North America. He joined us last month, just ahead of our drilling program, very experienced. He has played key roles in the discovery and evaluation of more than 30 million ounces of gold and 25 million tons of copper and reserves and resources, with a number of very well-known deposits that he's worked on.

As for myself, I've been with Aztec now for about a year. I come from a capital markets background. My specific expertise, in the last few years, has been in financing and marketing, exploration companies, fundraising and helping to execute exploration and drilling programs. I'm a former stock research analyst and I worked in corporate and investment banking for several years before joining the issuer side of the exploration industry.

On our Board, we're supported by a number of very experienced Directors, including Mark Rebagliati, who is from the Hunter Dickinson Group of Companies. He is known to be a Porphyry expert and he has recently been inducted into the Mining Hall of Fame. We have Patricio Varas, a geologist with decades of experience in the junior mining industry, and he has been associated with a number of successful M&A transactions, including Far West Mining. And more recently, he was the founder and CEO of Western Potash Corp. I hope that gives us some good color and background to our Management and Board group, who obviously are the key factor in creating a successful exploration and mining company.

Dr. Allen Alper:

You have a very impressive Management Team and Board, and it gives investors confidence in what you're doing. People, who have done that before, have been extremely successful, well recognized, and to do it again with Aztec Minerals.

Simon Dyakowski:

Yes, absolutely. This is a good opportunity to discuss our capital structure.

Dr. Allen Alper:

That would be great.

Simon Dyakowski:

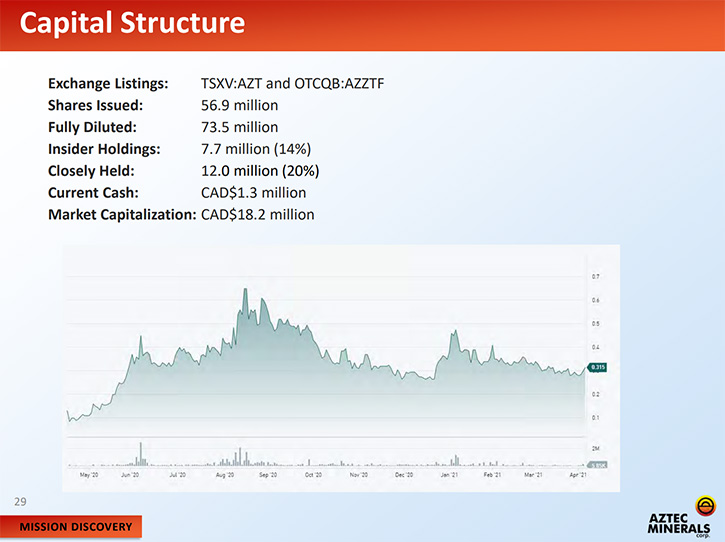

As with other mining companies, obviously share structure is important in valuation, when investors are considering the prospects of a company. Our Company is well structured, it has just under 57 million shares issued in outstanding. We have 73.5 million shares fully diluted, and in my opinion, that's a good structure for a company that has two drill ready projects. Our market cap today stands at about 18 million CAD. Insiders hold about 15% of the stock of the company of the basic shares outstanding. We have over a million dollars in cash so our current drill program at Tombstone is fully funded. We are not in in any need to raise money, while we're drilling.

Dr. Allen Alper:

That sounds excellent. It's great to see that Management has skin in the game and they have the same goals as investors.

Simon Dyakowski:

Absolutely, yes, we're all very interested in seeing the Company through to success and hopefully we all benefit financially from that success.

Dr. Allen Alper:

That sounds excellent. Simon, could you highlight and summarize the primary reasons our readers/investors should consider investing in Aztec Minerals?

Simon Dyakowski:

There are six points that I'd like to make. Number one, we have an experienced Management Group and experienced Directors, with a successful track records, discovering ore bodies, operating mines and selling companies. Number two, we have an attractive valuation, with the market cap of less than $20 million. It's well structured. Insiders own 15% and a closely held group holds another 20% so it's a tight share structure.

We have three prospective project joint ventures, Cervantes and Sonora, and Tombstone in Arizona. We've recently made epithermal bulk tonnage gold and silver discoveries on the Tombstone Property, around the contention pit, and it is wide open for expansion. Number five, we have a recent Porphyry bulk tonnage, gold copper discovery, on the Cervantes Project, at the California Target, and that is wide open for expansion, and we plan to be drilling there again soon.

Finally, we have prospective CRD polymetallic mineralization, at the Tombstone Project that could be similar to the Taylor Discovery, located just 60 kilometers southwest of Tombstone, which was purchased for $1.8 billion by South32 just three years ago. So good discovery potential on both of our projects could structure, attractive valuation, experienced Board and Management and the news flow kicks off right now.

Dr. Allen Alper:

Those are very compelling reasons for our readers/investors to consider investing in Aztec Minerals. Simon, is there anything else you'd like to add?

Simon Dyakowski:

I think that sums up my comments and an update on Aztek. Thank you for the opportunity and for your readers/investors to follow along.

Dr. Allen Alper:

Well, that's great! I think it'll be a very exciting time for our readers/investors, and they'll stay tuned to all the results you'll be announcing as the year progresses and as you get more and more data on your drilling results, both in Arizona and Sonora.

Simon Dyakowski:

Yes, indeed. Thank you very much for the opportunity.

Dr. Allen Alper:

I enjoyed hearing more about what you are doing. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://aztecminerals.com/

Simon Dyakowski, CEO

or

Bradford Cooke, Chairman

Tel: (604) 619-7469

Fax: (604) 685-9744

Email: simon@aztecminerals.com

|

|