Paramount Gold Nevada Corp. (NYSE American: PZG): The Grassy Mountain Gold Project Will be the First Gold Mine ever Permitted in Oregon, High-Grade and Quick Payback Underground Mine; Rachel Goldman, CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/10/2021

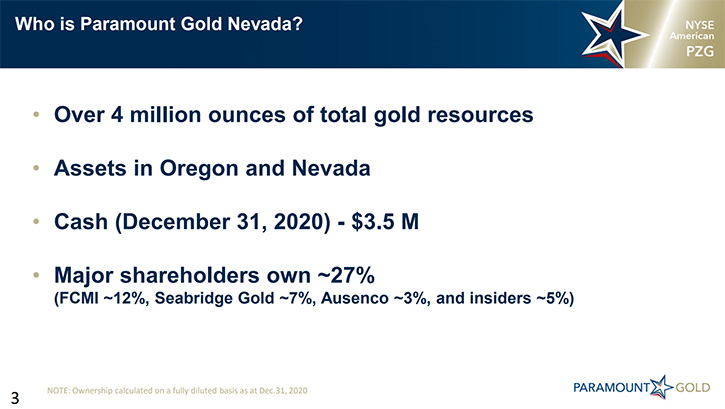

We spoke with Rachel Goldman, CEO of Paramount Gold Nevada Corp. (NYSE American: PZG). Paramount Gold Nevada owns 100% of the Grassy Mountain Gold Project in Oregon, and 100% of the Sleeper Gold Project in Nevada. The Grassy Mountain Gold Project will be the first gold mine ever permitted in Oregon, it will be a high-grade and quick payback underground mine, with a very small footprint. Once in production, Grassy Mountain will be generating about $35 million a year in free cash flow. The Sleeper gold project, which includes the former producing Sleeper mine, is host to a large, low-grade gold deposit (over 4 million ounces of mineralized material). A positive PEA was released in 2015. With higher gold prices, the Company has begun work to update and improve the economics of the Sleeper project. On April 20, 2021 – Paramount Gold Nevada Corp. announced it has completed the purchase of 152 unpatented lode claims (~3,100 acres) from South Sleeper Resources LLC. The claims are located only two miles south of Paramount’s wholly-owned, former high-grade, producing Sleeper Gold Mine. With the acquisition of the South Sleeper claims, Paramount has increased its total land position to over 40,000 acres in the prolific and highly prospective Sleeper district, situated at the intersection of two major Nevada mining trends - the Battle Mountain-Eureka and Western Nevada Rift.

Paramount Gold Nevada Corp.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Rachel Goldman, who is CEO and Director of Paramount Gold Nevada. Rachel, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

Rachel Goldman:Paramount is a US based, US listed Company, with US assets. I think that's probably a good starting point, there aren't that many US listed gold companies. Our assets are located in Oregon and in Nevada. Between the two properties, Grassy Mountain, which is in Oregon and the Sleeper Property in Nevada, we have about four million ounces of total resources right now.

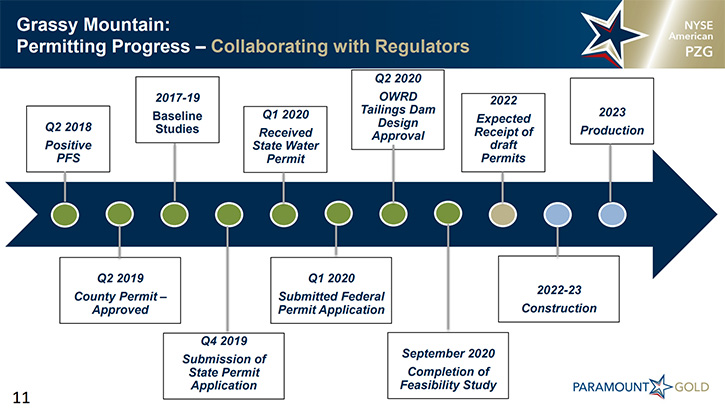

We have been working diligently to advance Grassy Mountain through different stages of studies through to a feasibility study that was released last fall, and we've been advancing it through permitting as well. What's different about our story is this will be the first gold mine ever permitted in the state of Oregon, so although their neighboring states all have thriving mining industries, this will really be somewhat of a breakthrough in the state of Oregon. We are working quite collaboratively, with the regulators there, to advance through their permitting regime.

We've seen some good success in terms of the traction that we've been making, in terms of knocking off some key items, with respect to that and we'll make our next big permitting submission this summer.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors a little bit about the highlights of your feasibility study on the Grassy Mountain project in Oregon?

Rachel Goldman:

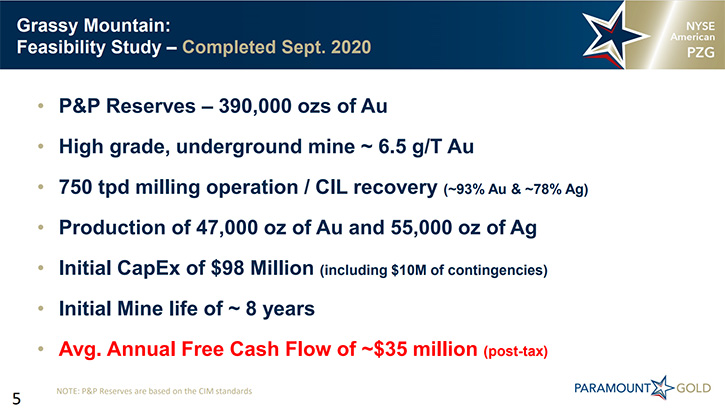

The highlights of the feasibility study were released on September 15th and the technical report would have been filed the following month. At the base case $1,470 gold price Grassy generates a 26% after tax IRR but that rises to about 40%, when you look at a $1,900 gold price. We also have some good downside protection because the project breaks even at $1,000 gold. That certainly gives us a lot of comfort, as we finish moving through the permit work and we start to look at construction financing. We have a lot of wiggle room over the next couple of years as we do that, in case we do see volatility in the gold price itself.

Grassy Mountain will have a very small footprint. It will be a high-grade and a quick payback underground mine. We'll be mining about 6.5 grams per ton. We'll be producing annually, on a gold equivalent basis, about 50,000 ounces of gold. The after-tax payback is about three years, at that base price. When we look through the details of the feasibility, what's exciting, as well, is that our all-in sustaining costs are going to be sub $700, which is great. Once in full production, we’ll be generating $35mm a year, in free cash flow, which is close to our current market cap.

Dr. Allen Alper:

That sound excellent. Could you tell our readers/investors about the highlights of the permitting status?

Rachel Goldman:

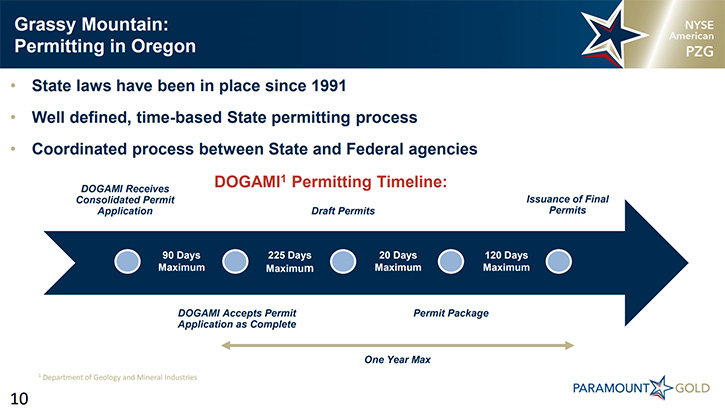

In Oregon, they have a very well laid out time-based approach to their permitting regime. Where we are in that process is we made an initial submission of what's called the consolidated permit application, or the CPA. That was initially made in November of 2019. The permitting regime in Oregon sets out a requirement for the regulators that they need to respond, with their comments and feedback within 90 days, so it's a pretty quick clip. Especially when you consider that they've never gone through this before and they're coordinating amongst several agencies.

The prevailing agency is called DOGAMI, which is the Department of Geology and Mineral Industries in Oregon. They coordinate with the wildlife people, the water people and all the different departments. They responded exactly in their 90 days, which brought us forward to last February when we got their feedback. Of course, everybody knows what happened after that, with COVID, the world hit the general pause button. We took some time to reassess the information that we'd gotten back, so we could figure out our next steps forward. It also gave us an opportunity to replenish our balance sheet, which we did last summer and make sure that we're in a position to be able to continue to advance, without running into any funding shortages.

It is important to point out that Oregon is what's called a pay-to-play state, which means that we reimburse the agencies for the work that they incur, in assessing our permits. That's why we always need to make sure the balance sheet is in good shape, as it is right now. With that information in hand, we will make the next submission for our CPA this summer. In the interim, we've had a number of positive permitting developments. Just a couple of weeks ago, we announced that they had approved our Wildlife Baseline Data Report. We’ve now had a total of 20 baseline data reports that have been approved.

These are the types of little incremental milestones, which are very important to the Company that the market maybe doesn't quite appreciate, but they're things that will help us streamline our next submission in the summer. When that submission goes in, after three months we should be told that our application has been deemed complete, then they'll move us to a 225-day review period, at the end of which we'll get draft permits and then 140 days after that we'll get our final permits. Based on that, we would expect to have our final permits and be able to start construction by 2023.

Dr. Allen Alper:

That sounds great. Could you tell our readers/investors about your Sleeper Gold project in Nevada?

Rachel Goldman:

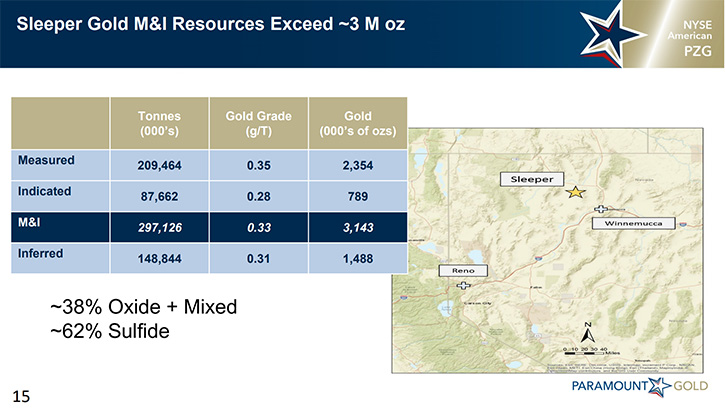

Sleeper is a past producing mine. From the mid-80s to the mid-90s, it produced close to 2 million ounces from one very high-grade Sleeper vein, through an open pit, heap leach operation. They were mining about 7 grams per ton of gold, so it was a very profitable mine even in a much lower gold price environment. I think the gold price then was averaging $400. What we have now is really in a sense the shadow of that old mine. It's a lot of ounces, north of 3 million ounces, but at materially lower grade, 0.33 grams per ton is the average right now. This is a property that really hasn't had a significant amount of development or exploration work done on it in probably a decade.

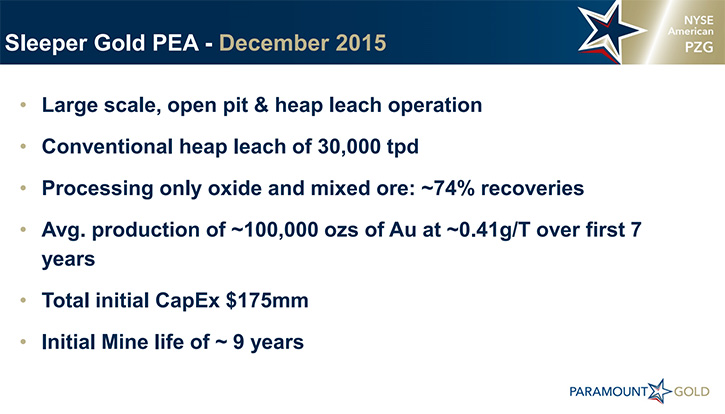

While there was a PEA that was done on the property in 2015, it was a different gold price environment, the gold price was about $1,200 on that PEA. Even at that, it generated some interesting returns for companies of any size. We could see 30% to 40% rates of return after-tax, on 100,000 ounces a year, from a 30,000 ton per day heap leach operation. It's not an optimized scenario, considering it's a dated report and there have been a lot of developments in the industry and the commodity prices since.

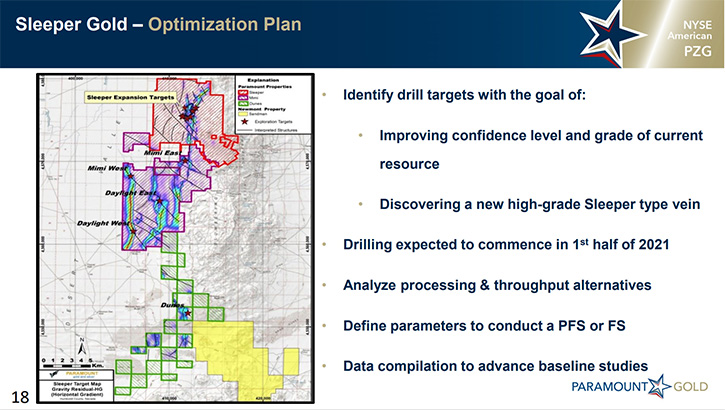

At Sleeper, in its entirety, we have a 38,000-acre land position. Pretty much all of it has been unexplored, but we've shot a number of different surveys over the property and there's a lot of historic data we have in hand. Just this past December we announced that we are, for the first time since 2015, putting in a development program at Sleeper, to start to assess what the property could look like in a production scenario. There's quite a bit of work that we can do that will bring fresh eyes and fresh interest to the property.

There is a sizeable sulfide component of the current resource. One avenue of work is going to be testing our sulfide material, with different processing alternatives, whether it's bio-oxidization or alkaline oxidization, to determine if or how it would be economic to bring those ounces into a new mine plan, because the sulfides were excluded from the 2015 PEA analysis. The second will be to work with our consultants in aggregating the historic data to determine what will be the most prospective drill targets, for increasing the grade and confidence level of the current resource.

We have portions of the current resource that have much higher grades than the 0.33 average, so we are following up on that and other areas that could yield better grades to increase the 0.33 average. Also, we are looking at where the prospective drill targets are, if we wanted to discover a new high-grade Sleeper vein, within this big property that we have. If we can find anything like that 7 gram per ton vein that AMEX was mining from the mid-80s to mid-90s, it would be a very profitable endeavor.

That will set us up for multiple years of work that we can do in determining the best approach to bring Sleeper back into production. Applying a bit more science to it, at this juncture, will pay off in the long-term, as we figure out the best approach to move forward.

Dr. Allen Alper:

That sounds very good. Rachel, could you tell our readers/investors about your background, your Team and the Board?

Rachel Goldman:

I joined the Company in February of last year, so it's a been a tumultuous start from the standpoint of the travel restrictions and everything else that COVID has delivered. We were very lucky because we were already well structured for a work-from-home environment. We're a small team. We're geographically spread out. We're used to working at home and collaborating over the phone, email and video calls.

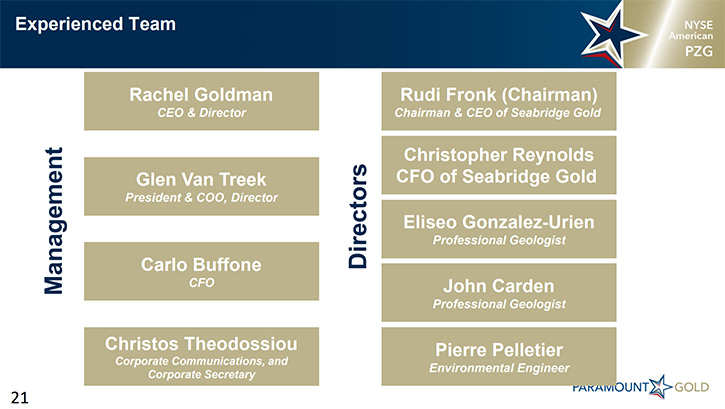

Before joining Paramount, I spent 20 years in capital markets in Canada, so I come to this equation through a finance and capital markets background. I don't have a technical background, but I worked for a number of different brokerage firms in Canada, mostly dealing with natural resource issuers and investors. Our team, outside of me, has all worked together for the last decade or so. You may recall that this current Paramount is version 2.0, the original Company was called Paramount Gold and Silver and had been acquired by Coeur Mining in 2015, when they spun out the Sleeper property into Paramount Gold Nevada.

The current team, between Carlo Buffone, who is our CFO, Glen Van Treek, who is our President and COO. Glen is our technical guru, he's a geologist who lives in Chile, who's had a lot of experience working with mining companies all over the world, in different sizes and stages of development. They've all been working together for a long time.

Our Board has strong representation in the geology camp. Importantly, to us, from Seabridge Gold, Rudi Fronk, is our Chairman. He's the Founder, CEO and Chairman of Seabridge and Seabridge is a significant shareholder of Paramount. He and Chris Reynolds, who is the CFO of Seabridge, sit on our Board and they have been invaluable members to us and very supportive of what we're doing in terms of advancing these projects.

Dr. Allen Alper:

Sounds like you have a very balanced and experienced team, with a very strong Board. Rachel, could you tell our readers/investors about your share and capital structure?

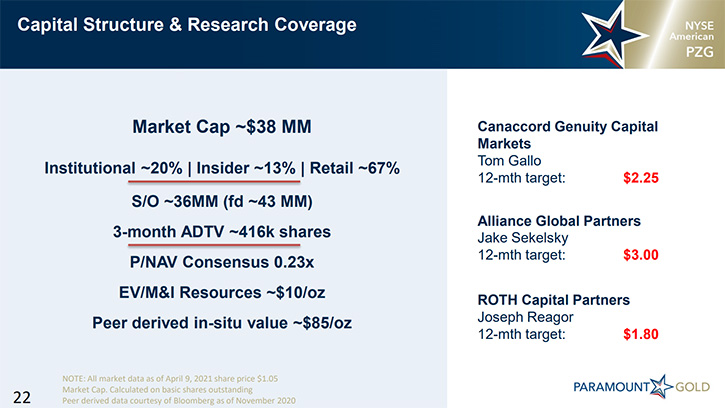

Rachel Goldman:Paramount had a philosophy of keeping the share structure quite tight. At this juncture, on a fully diluted basis, we have just under 43 million shares outstanding. That includes about a $5 million convert, which is in the money right now, so I include it in the fully diluted share count. We're probably about 36 million shares outstanding. In terms of the ownership, we have a significant retail component at about 65%. Our insiders would be about 13% and institutions, as we have picked up some new investors is about 20%. We're a microcap, so certainly it's a little bit harder for big institutions to become shareholders at this juncture. We have seen a nice increase in the average trading volume, which does help.

We are trying to broaden our reach to a bigger group of investors. We are trying to get in front of investors, who like a US focused Company, and don't really care that it's a microcap and who sees value here, like we see it. We see the stock right now trading at about $8 or $9 per ounce in the ground. We think there's a lot of opportunity to see an increase in the valuation by us continuing to deliver on the development work. We don't necessarily need a higher gold price or anything else. We think that the opportunities are certainly there, both as we advance Sleeper, and as we continue to move through the permitting process in Oregon.

We'll also be initiating an exploration program at a property called Frost, which is in Oregon, 12 miles away from Grassy Mountain. It's a property that we've optioned. It had historic drilling done on it back in the early 90s, with no follow up. They had very high intercepts at the time, up to 20 grams per ton. Certainly, something to follow up on. The timing is good for us now that we will be receiving all our permits to pursue an initial exploration program here, which could certainly add to the robustness of the Grassy Mountain Project, should we be successful in finding anything.

Dr. Allen Alper:

That sounds excellent. Rachel, could you tell our readers/investors the primary reasons they should consider investing in Paramount Gold?

Rachel Goldman:

I think the primary reason is the stock is very inexpensive. We're probably trading at about $8 or $9 per ounce in the ground. We have a lot of ounces already identified to our credit. We have potential to see those ounces grow and the grade and the confidence in those ounces improve through a number of different avenues. One is through the permitting work in Oregon. I think part of the reason why the stock is very inexpensive now is because Oregon has never permitted a mine before, so here is skepticism that they will permit Grassy Mountain.

I can tell you, and I think it's an important distinction, that Oregon hasn't permitted a mine yet because nobody has applied to have a mine permitted before. It's not because they have a history of rejecting them. I think this will be a significant value creation and opportunity for the Company as we receive those permits. In the meantime, we will be dusting off the old Sleeper property, which has an incredible history behind it. For the first time in decades, envisioning how this property can be brought back into production, in a profitable fashion. I think there are a lot of avenues for us to deliver value to shareholders as we go forward.

Dr. Allen Alper:

Those sound-like good reasons for our readers/investors to consider investing in Paramount Gold.

We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.paramountnevada.com/

Paramount Gold Nevada Corp.

Rachel Goldman, Chief Executive Officer

Christos Theodossiou, Director of Corporate Communications

866-481-2233

Facebook: https://www.facebook.com/ParamountNV/

Linkedin: https://www.linkedin.com/company/paramount-gold-and-silver-corp./

Twitter: https://twitter.com/ParamountNV

Youtube: https://www.youtube.com/channel/UCOq5wSfWzYXvgKf6eHF7Ugg

|

|