Denarius Silver Corp. (TSXV: DSLV): Spin-Off of Gran Colombia Gold’s, Large Silver Projects in Colombia, Acquiring the Past Producing, Lomero-Poyatos Massive Sulphide Project in Spain; Serafino Iacono, Executive Chairman Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/7/2021

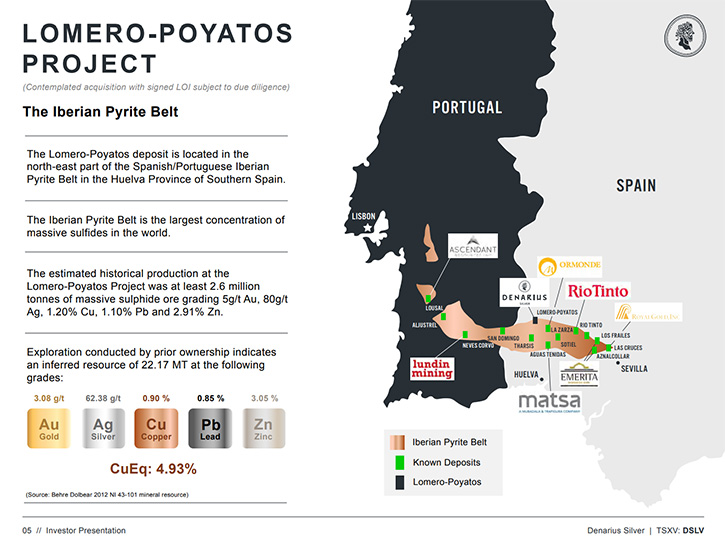

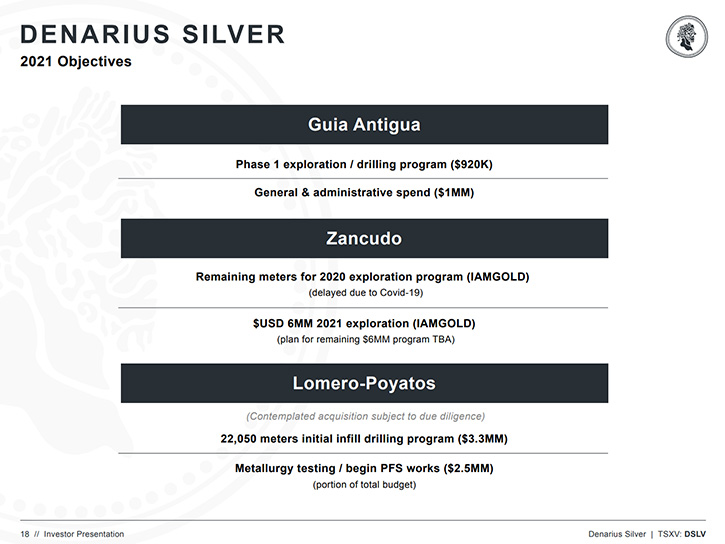

We spoke with Serafino Iacono, who is the Executive Chairman and Interim CEO of Denarius Silver Corp. (TSXV: DSLV), a Canadian junior silver and polymetallic exploration company and a spin-off of Gran Colombia Gold, to take advantage of its silver assets, like the Guia Antigua and Zancudo silver projects, located in historic mining districts in Colombia. Denarius Silver recently completed the acquisition of the past producing Lomero-Poyatos project in Spain, located in the Iberian Pyrite Belt, which has the largest concentration of massive sulfides in the world. The estimated historical production, at the Lomero-Poyatos Project, was at least 2.6 million tonnes of massive sulphide ore, grading 5g/t Au, 80g/t Ag, 1.20% Cu, 1.10% Pb and 2.91% Zn. The project site is well serviced by great infrastructure, multiple high-capacity processing facilities, proximity to a port, and potential sources of labour in nearby villages.

Denarius Silver Corp.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Serafino Iacono, who is the Executive Chairman of Denarius Silver. Serafino, could you give our readers/investors an overview of your Company and the vision you have for your Company?

Serafino Iacono:

The Company has been created, as a spin off, to take advantage of some silver assets that we had in Gran Colombia in particular, in the Zancudo Mine. We have a joint venture with IAMGOLD and the Guia Antigua Mine that is right next to our operating mine in Colombia, where we are on track to produce over 200,000 ounces of gold. We decided to take advantage of exposing these silver assets, because they had more silver than gold instead of more gold than silver, and we were getting no benefits from them. The most important thing we got out of this asset package was the acquisition of a mine in Spain called Lomero.

The Lomero Mine sits in Andalusia, in what they call the pyrite belt. It's an interesting area, where there are about seven or eight operating mines. The largest of the mines is the Matsa Mine that is owned by Mubadala and Trafigura. It produces 200,000 tons of copper concentrate, with zinc, lead, copper, concentrate with gold. We are six kilometers away, in a deposit that has outlined resources in a historic estimate that we're going to be upgrading soon, of approximately 21 million tons with 3.08 grams of gold average grade and 62.38 grams of silver. Based on the historic resource, it also has 0.90% copper, 0.85% lead and 3.05% zinc. A fantastic polymetallic, but mostly with lots of gold, lots of silver. Most important is the big quantity of copper that it has. It has historic resources with more than 180,000 tons of copper outlined.

Great Brownfield Area has been drilled in the past. It was a producing pyrite mine in the 1950s to the 70s, until they discovered this gold in the polymetallic bearing area. It's open pit for the first 250 meters and then it goes underground, that's going to be a tremendous upside on the underground. Just to give you an idea, the Matsa Mine operates 100% underground, not on an open pit, because their ore is a lot deeper.

It's an exciting Company, Gran Colombia owns 27%. It's well financed. We did an initial financing of C$8.4 million. We just did a second financing of C$33.75 million. Very successful financing! We're looking forward now to be the next area of development. We already did that with our project that is now Aris Gold, of which we own 44%. It's going to be a big producer in Colombia. By doing what we did with Denarius, we have now outlined our silver assets that before were undervalued inside Gran Colombia. In many ways they're going to get some more value. We see it with Denarius’ stock, which is now around 60 cents a share and it's going to be a project that's going to do very well.

Dr. Allen Alper:

Sounds exciting. It sounds like a great project, a huge project and rich in silver, copper and gold.

Serafino Iacono:

Absolutely. I will look at the gold as the hedge in new investing in this Company. It gives you a hedge against inflation, because gold is a hedge against currency, and the other ones are all green metals that are going to be used in the new electric world that we are trying to create. The copper is going to be a big element in it. The lead and the zinc are still going to be a big part of batteries. The copper is going to be a big element in the development of electricity.

Dr. Allen Alper:

That sounds great. Could you tell our readers/investors your primary plans for 2021?

Serafino Iacono:

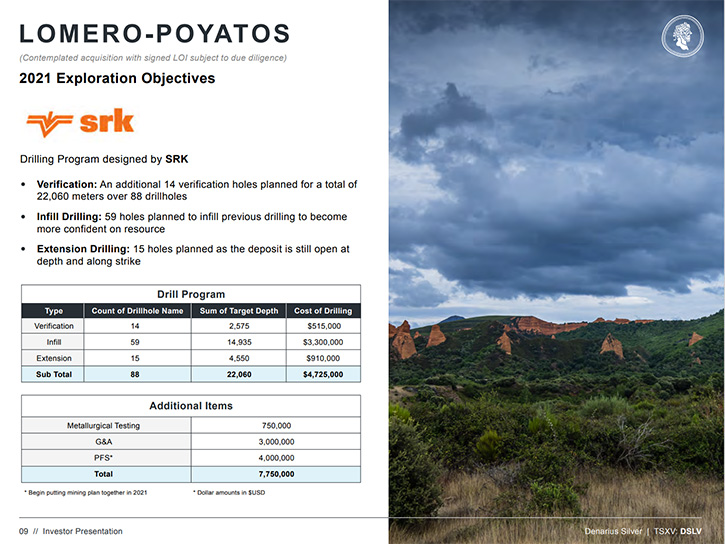

For 2021, we already have a 22,000-meter confirmation drill program. That's going to take the project, from where it is right now and upgrade the resources in a new 43-101 report. It's mostly confirmation to us, when we decide that we're going to wrap it around, within the next 18 months, into a feasibility. The nice part about this project is that we have right next to us, the Matsa Mine, and there is a possibility that we could be able to use part of their excess facilities for processing our material, which will make it very easy for us, as we wouldn't have to build a plant. But regardless, within 18 months, we're going to be putting resources to reserves, wrapping them around a mining plan and a PFS. Then we're going to decide when to start mining this material.

Dr. Allen Alper:

That sounds very exciting! It sounds like an area where the infrastructure is great and also the political environment is great for mining.

Serafino Iacono:

Yeah, absolutely. It's Spain. Huelva is a town that has been a mining town for 200 years, actually longer. It's been a mining town since Roman times. There are six mines over there, including the Atalaya Mine that is a publicly traded Company, producing copper. First Quantum is there. Lundin is there. We're in the right neighborhood, with lots of infrastructure, and it's very secure.

Dr. Allen Alper:

Well, that sounds excellent, Serafino! Could you highlight the primary reasons for our readers/ investors to consider investing in Denarius Silver?

Serafino Iacono:

The most important reason and why I invested in Denarius and put lots of money into it is, in Colombia, you're buying a potential extension and a huge silver/gold mine. We're hedged with gold and silver over there, in an area that is already producing. We're partners with IAMGOLD, where, in the worst case, if they decide to stay in and develop, the project will end up with 30% of the project carried to feasibility. We're going to own a percentage of a very, very profitable mine, which produced in the past six million ounces of gold in 100 years and it's still in its infancy.

But the most important thing is that right now, with less than $100 million market cap, you're buying yourself a Company that in Spain, will potentially have 180,000 tons of copper. It has 2 million ounces of gold to outline to open at 3.08 grams. It has more than 20 million ounces of silver and more than 500,000 tons of lead and zinc. You have $5 billion, $6 billion worth of ore, for the green industry that is being developed. We have a leg up on a lot of people in these metals, which are going to be sold out and they're only going to go up in price.

Dr. Allen Alper:

That sounds excellent. And Europe is moving, very aggressively, with electric vehicles and the green projects.

Serafino Iacono:

Copper, as Goldman Sachs says, it's going to be the new oil. That's what's going to drive the industry, it's going to be copper.

Dr. Allen Alper:

Excellent! It sounds like you and your Company will be in a great position to take advantage of the zinc, copper and the growth of demand.

Serafino Iacono:

With Gran Colombia owning 27% of this Company, Gran Colombia shareholders are very well-positioned. Also, for people that just want to play the area, the easiest thing is to buy shares. It's in the beginning, it's in its infancy of being created. It's a stock that is trading in the 60 cents range right now. It's held by institutional investors. There is a very small float. If I were an investor right now, I would be buying the stock because it's at its infancy.

Dr. Allen Alper:

It sounds great. It sounds like a great opportunity for our readers/investors to consider. Is there anything else you'd like to add?

Serafino Iacono:

Look at the Company, look at the assets. You're a very diligent writer, who knows his stuff! This is going to be the beginning of putting together a Company. There's going to be development more towards the polymetallic, the green metals, but with a little hedge against inflation by owning gold in this Company.

Dr. Allen Alper:

That sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://denariussilver.com/

investors@denariussilver.com

|

|