GoviEx Uranium Inc. (TSX-V: GXU; OTCQB: GVXXF): Two Projects, Fully Mine Permitted and Ready to Go, in Niger PFS Completed and in Zambia; Daniel Major, CEO and Director, Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/19/2021

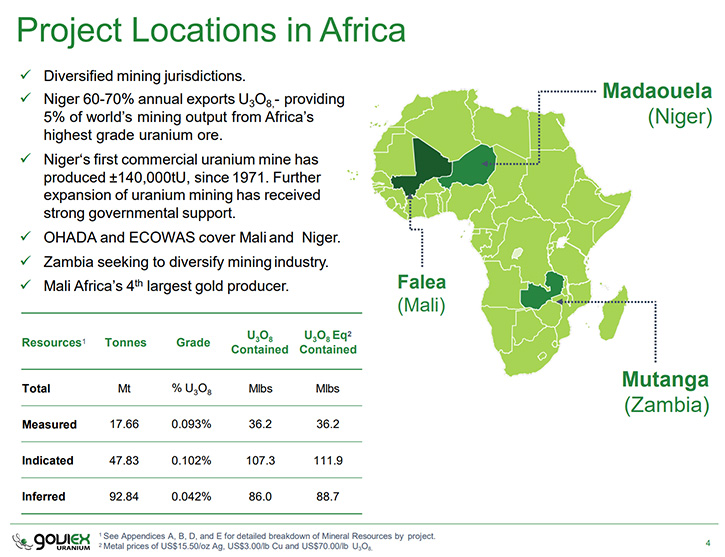

GoviEx Uranium Inc. (TSX-V: GXU; OTCQB: GVXXF) is focused on becoming a significant uranium producer through the continued exploration and development of its flagship, mine-permitted Madaouela Project, in Niger, its mine-permitted Mutanga Project, in Zambia, and its multielement Falea Project, in Mali. We learned from Daniel Major, CEO and Director of GoviEx Uranium that the uranium outlook is extremely favorable, with growing demand and declining supply. Plans for the next 12 months include completing the feasibility study for the Madaouela Project.

GoviEx Uranium Inc.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News interviewing Daniel Major, who is CEO and Director of GoviEx Uranium. Daniel, could you give our readers/investors an overview of your Company, what differentiates it from others, and tell us about your three main projects in Africa.

Daniel Major:

We have three Africa-centric projects. The key differentiation between us and our peers is that two of our projects are fully mine-permitted and ready to go. The Madaouela Project, situated in Niger, has its’ infrastructure in place and a prefeasibility study has just been completed. Similarly, the Mutanga Project, in Zambia, is also fully mine-permitted and all set to go. Falea, in Mali is predominately a Uranium project, but it is polymetallic, with the presence of copper, silver and gold, within the mineralization.

Dr. Allen Alper:

Could you give us a little more detail about the size and grade and the resources of your projects?

Daniel Major:

We have 230 million pounds of Uranium over the three projects, with substantial exploration potential on each of the properties. Madaouela, has 139 million pounds, at an average grade of 0.14%. We have 60 million pounds in Mutanga, at about an average grade of 0.3%. The Falea Project has 30 million pounds of Uranium and comes with those byproduct credits of Copper at 0.2% and Silver at 70 grams a ton.

Dr. Allen Alper:

Those are very impressive projects. Could you tell our readers/investors about the strong support GoviEx has, strategic and financial?

Daniel Major:

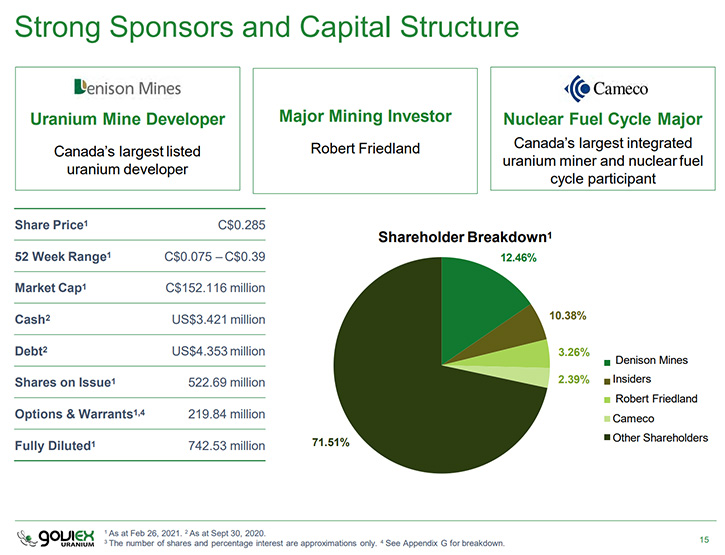

At the beginning of the year, we successfully raised money and we had a number of warrants exercised. Currently, we sit at over $10 million U.S. on our balance sheet, which is more than enough to get us through the next 12 months and get the feasibility study done, for the Madaouela Project.

Denison Mines has about 13%. Cameco is a shareholder, with just under 3%. Both Robert Friedland, father of our founder, Govind Friedland, are shareholders. We are fortunate to have some very interesting shareholders in the Company.

The Madaouela Project, has the government of Niger as a partner, and we have a strong collaboration with them.

Dr. Allen Alper:

That's excellent, it's great to have such great partnerships and backing. That also shows that Friedland and others have great confidence in your Company and also in the Uranium market. Maybe you could tell our readers/investors a little bit about the situation in the Uranium market and the outlook going forward.

Daniel Major:

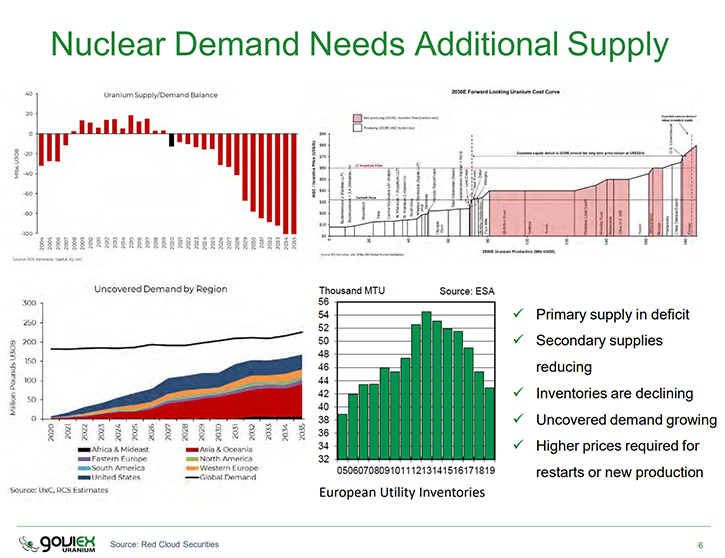

We are certainly encouraged by our position at the moment, as the uranium market outlook is very positive. Strong uranium demand growth is anticipated, driven heavily by the construction of new reactors in the Asian market. We have solid stability, within further developed reactor markets, such as Europe and the U.S. and have seen a number of other countries, including Russia, announce plans to increase their position from 20% to 25% of nuclear power in their power grid. Despite evidence that nuclear power has to be part of any green energy solution going forward, we have witnessed decline in supply. This year, so far, the Ranger Mine in Australia and Cominak Mine in Niger have closed.

Overall, we have seen a sharp downturn in available inventories and producers have curtailed operations. We have experienced a reduction in inventory in each part of the pipeline, with reduced inventories at the producers, at the utilities and in the secondary markets. More recently, increasing purchases by investment groups and/or producers further reduce available inventory. We are still anticipating a substantial deficit in primary supply and expect that to continue. In order to justify restarts or new projects being built, we will need to see a much higher Uranium price.

Dr. Allen Alper:

Looks like an extremely favorable outlook for GoviEx Uranium. Could you tell us a little bit about your background, your Team and the Board?

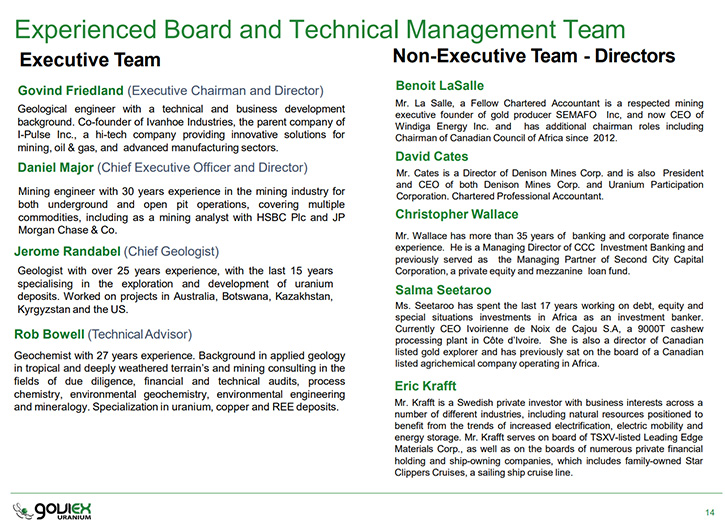

Daniel Major:

My background is as a mining engineer and I have been in the industry for over 25 years. I have worked in multi-commodities, throughout multiple jurisdictions and spent time as an equity analyst, on the finance side in this industry. I am fortunate to work with a strong team, including our Chairman, whose background is as a geologist and our Chief Geologist, who has extensive and diverse experience across the Uranium industry. We have a strong, and recently revised Board, whose extensive experience in mining, West Africa and project financing, enables us to focus on how best to position GoviEx financially and structure projects so that we continue to drive the Company forward. We are confident that we will progress to a feasibility study on both of our permitted projects and we certainly have the team to see that happen.

Dr. Allen Alper:

It is excellent to have such an experienced team to run your Company. Could you tell us how it is operating in Niger and Zambia?

Daniel Major:

We have been operating in Niger, since 2007, with no issues. Clearly, Niger and Mali make headlines, but the terrorism activity reported is localized to limited areas, within the countries. We appreciate our partnership with Niger and are comfortable working there. Having 100% local employment, across all our jurisdictions, is not only strategic for GoviEx, but has also been good for the people of Niger. All our projects are in mining jurisdictions therefore, there are well qualified people throughout those regions, to work there. Local employment is so important because we are viewed as a local company, to the people of those countries.

Dr. Allen Alper:

Could you tell us the primary reasons they should consider investing in GoviEx Uranium?

Daniel Major:

First, is the Uranium market itself. We are coming out of a long bear market and are at the beginning of a strong bull market. Second, we already have two, fully permitted mining projects, in a position to be developed. They are well within the scope of the $50 to $55 range to get them going. Third, we have the technical team to achieve that.

Dr. Allen Alper:

Those are strong reasons to consider investing in GoviEx Uranium, Daniel. Is there anything else you would like to add?

Daniel Major:

No, I think we have covered all the key points.

Dr. Allen Alper:

We will publish your press releases as they come out so our readers/investors can follow your progress.

https://goviex.com/

Govind Friedland, Executive Chairman

Daniel Major, Chief Executive Officer

Tel: +1-604-681-5529

Email: info@goviex.com

|

|