Vimy Resources Limited (ASX: VMY, OTCQB: VMRSF): Exploring One of Australia’s Largest Undeveloped Uranium Resources, in Western Australia; Mike Young, Managing Director and CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/15/2021

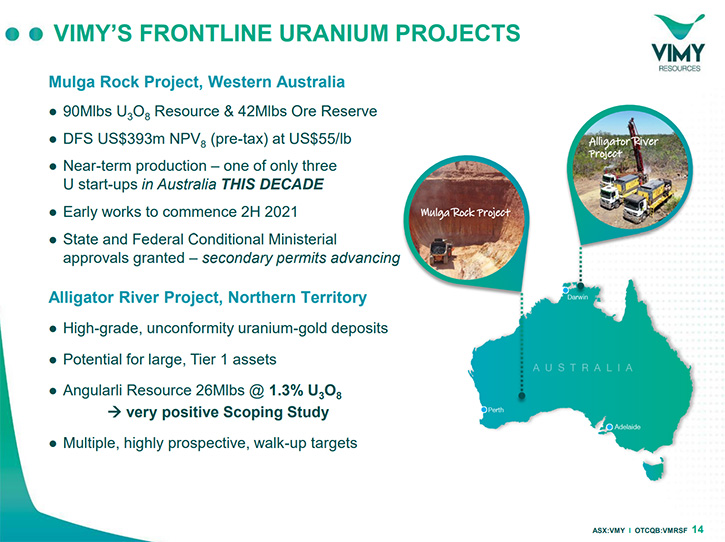

We spoke with Mike Young, Managing Director and CEO of Vimy Resources Limited (ASX: VMY, OTCQB: VMRSF), an Australian uranium development company, whose flagship project is the Mulga Rock Project, one of Australia’s largest undeveloped uranium resources, located in the Great Victoria Desert of Western Australia. Vimy is moving towards project readiness for Mulga Rock and is preparing for early works in the second half of 2021. Plans for 2021 also include flow sheet optimization to reduce Capex and Opex, project financing and offtake partnerships to develop Mulga Rock.

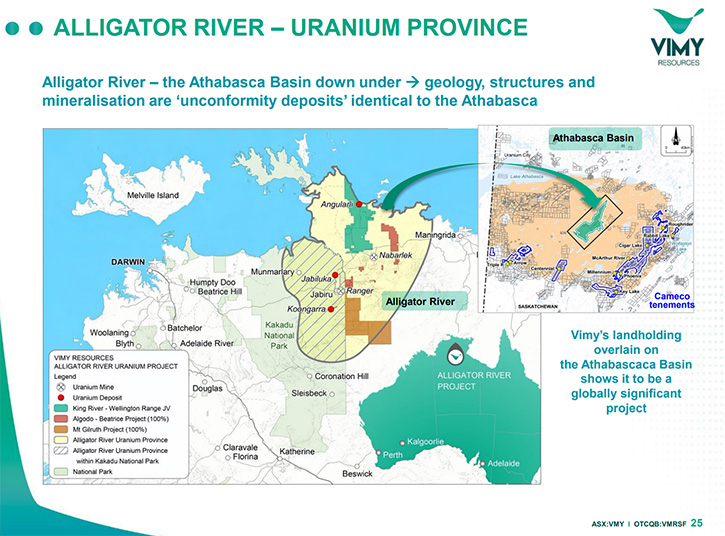

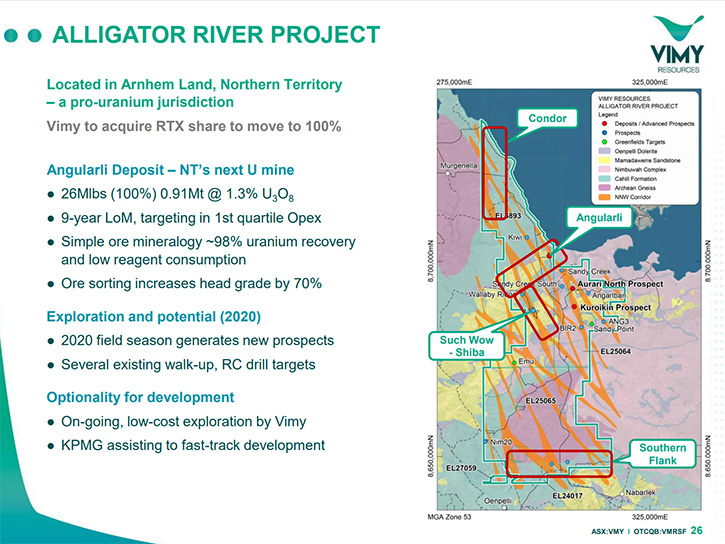

Vimy also owns and operates the Alligator River Project, which is the largest granted uranium exploration package in the world-class Alligator River uranium district, located in the Northern Territory. Vimy is exploring for large high-grade uranium deposits, identical to those found in the Athabasca Basin in Canada.

Vimy Resources Limited

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mike Young, Managing Director and CEO of Vimy Resources. Mike, could you give our readers/investors an overview of your Company and what differentiates your Company from others? Also, talk about the importance and outlook of uranium.

Mike Young:Vimy Resources is a uranium development company, based in Perth, Western Australia. We are developing two projects, one is the Mulga Rock Project in Western Australia, which is 240 kilometers east of the mining center of Kalgoorlie. We're also developing the Alligator River Project in the Northern Territory of Australia. That's a less advanced project, which has an inferred resource and multiple exploration targets.

Vimy has been around since about 2008, originally called Energy and Minerals Australia. I got involved in 2013. At the time the Company had significant convertible note debt, so we recapitalized and brought in $12 million of new money from Andrew Forrest, who is a significant mining entrepreneur, who lives in Perth, and someone whom I knew from a previous job.

Using that money, we were able to restart studies on the Mulga Rock Project, which had been discovered by the Japanese in the 70s and developed in the 80s and 90s. The Japanese left Australia during the Asian financial crisis and then EMA picked up the tenements and listed the Company in 2008. I became involved in 2013, we recapitalized and renamed the Company Vimy Resources.

We then started doing a significant amount of new work on the Mulga Rock Project. We discovered that the ore zone was actually very amenable to significant beneficiation; I'll talk a little bit more about that. That unlocked the economics of the project and then we moved from a scoping study to a pre-feasibility study to a definitive feasibility study, which we released in 2018. In 2020 we decided that we would have another look at the outcomes of the DFS and see if we could reduce some of the capital and operating costs, and we did. We made a significant announcement in August of 2020, which demonstrated that we could remove $100 million AUS, 20% of the capital of the project, without significantly affecting the operating costs. In fact, the operating costs came down slightly.

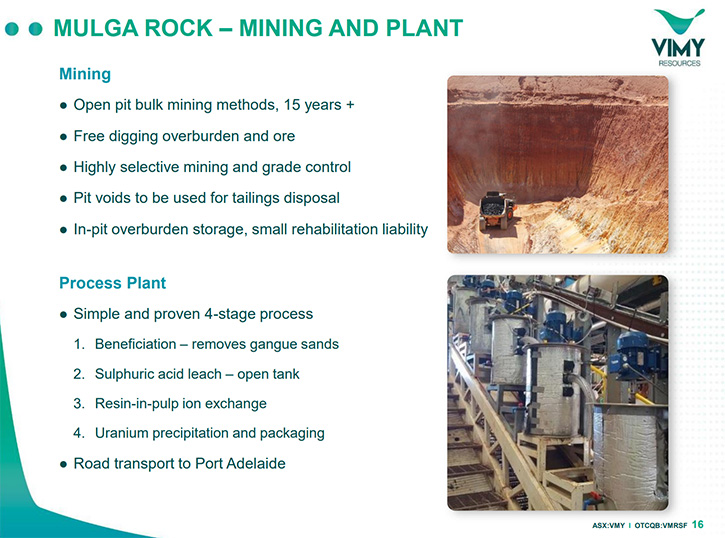

That was a really significant bit of work and that has set us up moving forward. Mulga Rock is a very large deposit. It is 90 million pounds and has a reserve of about 47, but there is more mineable material in the inferred classification, about a 15-year mine life at 3.5 million pounds a year with the potential to add another 5 years to the mine life. The NPV for the project is about $400 U.S. with an IRR of 31% and the capital costs are $255 million U.S., payback of about 2.4 years. Its C1 cost, which is just the pure cash cost, is $26 dollars per pound U3O8 and the all-in sustaining cost, in the first five years, is just under $30. On an all-in sustaining cost basis, it sits in the middle of the global cost curve. We will touch on that a bit, just in terms of where we think uranium is going. We are very keen to buy and hire local, out of Kalgoorlie.

The project ticks a lot of boxes with respect to ESG. The deposit itself is flat-lying; it's a sandy lignite. The uranium and other metals, base metals included, are trapped in the carbonaceous material and by washing out the sand, we are able to upgrade the ore, which is significant because this means the entire plant is a lot smaller. But what is really, enormously important about the way we are mining it, is that we are able to use the pit voids as a tailings dam, so we're not going to have any surface tailings facilities. Tailings management has obviously come into very sharp focus recently, with the failures of tailings dams in Brazil. We don't have that sort of topography, it's very flat where we are. The tailings management is a particularly important part of the environmental permitting.

Because we are able to put the tailings into pit voids, and bury them with clay and overburden material, they'll be entombed and basically the management of them becomes much simpler. That's a really important part of our project. Because we are strip mining, we'll be placing the overburden behind us as we go, so a lot of our overburden landforms will be inside the pit void. Overall, residual impact is extremely low for the size of the project, which is very important to us, and it also makes environmental and economic sense.

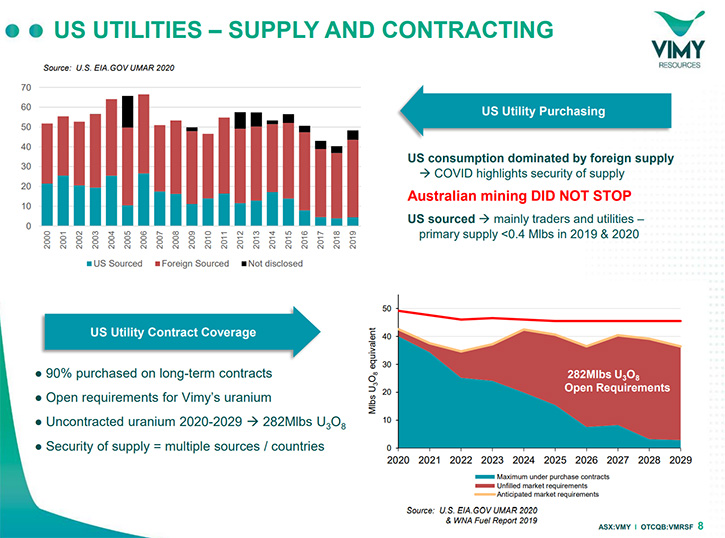

How do we get this project up and running? Well, uranium is a contract-led market. We often hear about the uranium spot price, but it is actually a very low volume traded price. There's no clearing house for the uranium spot price. There's no London Metal Exchange, there's nothing like the gold spot market. It is essentially a reported price and it is a guesstimate of what a consignment of uranium would trade hands for, on any given day. It is based on intel that two price reporters get from the market. They basically put out questionnaires and have relationships with traders, producers and utilities. They collect this intelligence every day and then they estimate what the price would be. It would be similar to a very thinly traded stock, where instead of reporting the transactional price, they guess what the price might be if shares were to trade today. Unfortunately, the spot price sort of drives sentiment. What we're after is contracts as contracts sustain about 90% of global mining and global production. That's because the utilities need to know how much uranium they're going to get and what they're going to pay for it a long time in advance for the planning, for the refueling.

We focus on contracting and the way to get the project up and running is to get enough contracts at the right price to support project debt as the contracts will have low counter party risk. We will necessarily leverage up and we would hope to see the debt at least 50% of the project, if not more. Obviously, that's going to depend on the financers. Our plan is to get sufficient contracts to get as much debt as the project will allow and that way, decrease the equity component and dilution on our shareholders.

Now, a lot of people mistakenly look at today's share price and say, "How are you going to raise that much money at your current share price?" Well, the point is we will not be at our current share price when we're raising money, because we will have announced contracts and debt, so you would expect to see some significant rerating on the stock before we go out to the market for the equity component. That's just something that a lot of people don't seem to get when they're looking at projects at this stage.

The contracts we are seeking are with the U.S. market; the United States is about 28% of the global market demand for uranium. Twenty percent of the U.S. electricity is nuclear. A lot of countries are coming around to looking at nuclear to achieve their greenhouse gas targets: instead of shutting it down, they are actually building. But going back to the U.S. it's 20% of their power, it's over 50% of their clean energy, followed by hydro and then wind. They are 28% of the global market. In terms of an accessible market, they're probably 80% of the market that we're concentrating on. After the U.S., you have France. France gets most of the uranium from companies that are already producing, dominated by Orano.

China gets most of its uranium from Asia and is not likely to pay the contract prices that we need, so we concentrate on the U.S. They have big utility, low counter-party risk, long life contracts. Scott Hyman, our Vice President of Sales and Marketing, is based in America. I like to refer to him as our secret weapon because not too many juniors or even larger uranium companies actually have a dedicated marketing person. Scott's been on board for about three years, he used to work for Dominion Energy, and then he worked for Cameco selling uranium, so he's been on both sides of the fence.

He has a very deep contact list in America. One thing about the nuclear industry in America is nobody moves out of it. Once you get into the nuclear industry, there's basically nowhere else to go. People that Scott worked with when he was a uranium buyer and seller, are still with the same companies, so he has very deep, long lasting relationships and that is important. When the utilities are looking at contracts from producers and all things being equal, it's more likely that we'll get a contract over a competitor because of a relationship that Scott has.

Plus, we've spent a long time with the utilities, through Scott and me, on many visits and at the nuclear industry’s international conferences, just bringing them up to speed about the project. We've been able to achieve a lot of the due diligence that they would ordinarily do after they've signed an agreement to move into long-term contracts. We have done a lot of the lead work that would ordinarily happen after you have secured a contract. In terms of the project itself, we would go through the contracting phase, debt phase, equity phase and then once the Board says, right, financial investment decision, let's go. It's a two-year build and then we would be producing uranium.

The other exciting project we have is the Alligator River Project in the Northern Territory. This is an area that has been under-explored for a long time, owing to historical uranium politics in Australia, which have now ceased. Because of the politics back in the 80s and 90s, there was very little exploration done in this part of the world. But the geology of the region hosts one of the biggest uranium deposits on earth, which is Jabiluka at 350 million pounds. That deposit is owned by ERA but surrounded by Kakadu National Park so is unlikely, sadly, to ever be developed.

The area in which we are working is east of the East Alligator River. It's in Arnhem Land, which is Aboriginal Land. We bought the projects from Cameco several years ago; they had worked very hard to put together the tenement package. It's a large package, it's about 80 kilometers long and with many significant targets. The whole area is under-explored, yet it has the exact same geology as the Athabasca Basin in Canada, so you have the unconformity uranium deposits, where sandstone is sitting above crystalline basement and you have high angle and low angle faults that go up through the basement into the sandstone. You had fluids pumping through full of uranium. They intersected the groundwater, sitting in the sandstone and through that fluid mixing, created these uranium deposits, same system as Saskatchewan.

One of the big differences is we do not have all the water and soupy overburden that the Canadians have. So, the Canadian deposits, while they are very high-grade, are very difficult and expensive to mine. Mining costs are high, but just because of the sheer high-grade nature of the deposits, on a per pound basis, they are low cost. We have a 26Mlb U3O8 deposit called Angularli. It is high-grade at 1.3% and so we could literally mine it out in 14 months. However, the current plan involves a nine-year mine life.

We have done a scoping study on Angularli; we want to do more drilling to find more pounds around that deposit, so it becomes a mining hub. Our intention is to spend money on Alligator River, either through a joint venture, a farm in, or indeed our own money, but to add pounds to the resource base up there and then start to advance.

Dr. Allen Alper:

Yes. You have a very impressive project, you have a great Team, with great backgrounds and a great location. Fantastic that you have someone who really understands the U.S. market, both a buyer and seller, that is fantastic. Could you tell us a little bit more about yourself, your Team and your Board?

Mike Young:

I was born in Canada and I studied Geology at Queen's University in Kingston, Ontario. I graduated in '85, and started working in Canada. I spent two winters in Northern Saskatchewan, doing geophysics for uranium. In 1981 my first summer job as a student, was working at the Eldorado Uranium Mine in Uranium City, where we were mining very deep, steeply dipping deposits. I remember at one point I was working at 5,200-foot level underground; that was very warm from the heat of the rocks, just from being so deep. So, I have long experience and interest in uranium.

I then came to Australia in '87. I was working for several small junior mining companies, mainly in mine development. I'm actually really colorblind, which isn't that good for an exploration geologist, so I gravitated towards resource development, drilling, structural geology, and then I got into 3D modelling. I was working during the 90s with some very high-end programs doing 3D modelling on different deposits all over the world. I got to go to Chile and do audits of Escondida work on deposits in Sumatra, Africa, a lot of deposits in Australia. I developed an innate sense of what it takes to be a commercial deposit, that's quite a high threshold. We saw a lot of data, a lot of deposits, and then brought many of them through definitive feasibility studies and into mining, we were involved in all facets of mining.

In the early 2000s, I left that consulting company and went into the junior mining sector again. In 2006, I was asked to run a company called BC Iron, I was essentially hired as a glorified exploration manager. But because I was the only employee, I was actually the CEO as well. We listed that company in December 2006. In January, I was up in the north of Western Australia, doing mapping and field work for a drilling program, at 9:00 o'clock at night, it was still 105 degrees Fahrenheit.

We started drilling in April of 2007 and by May 2007, we knew we had an economic deposit, and by February 2011, we were exporting iron ore. We went from our first drill hole in the ground to exporting iron ore, in under four years. Now, that's an impossibility today just because of the approvals process. We built a Company that became a $600 million Company by the time I left in 2013.

A couple of key takeaways from BC Iron, one was that we entered into a joint venture with Fortescue Metals Group, run by Andrew Forrest, whom I mentioned earlier. That was a 50/50 JV, where we allowed them to farm into the project for 50% and in exchange, we were able to access their infrastructure to export iron ore. At the time, we received a lot of criticism for giving away half the deposit, but in reality, we had no “deposit” without infrastructure, so I always had the view that 50% of something was better than 100% of nothing. We created a company that ultimately hit a market cap of $800 million before the iron price collapsed.

The other thing we did that is really important to me, is we paid dividends very early on. Also, we had a very transparent dividend policy where people could see the iron ore price and they could almost derive what their dividend would be for that year. That move put us on the radar of investment funds that follow yield plays, which really strengthened our capital structure.

I learned a lot of lessons from BC Iron, including that being in production is the way to provide sustainable growth for shareholders. You can have these little sugar hits, you can chase the metal of the month and get a share price rise, but it is very spiky, whereas getting into production and having cash flow, paying dividends, that gives you sustainable value that the shareholders respect and thank you for and certainly everyone loves the dividend. I left BC Iron in 2013 as the company had matured into a cash machine and I wanted a new challenge.

In 2013, I was approached by Dave Cornell, who is one of our Directors at Vimy. I looked at the Mulga Rock deposit, it was big, it was simple, and it had no competing land interests. That meant that it would have been, from an approval standpoint, easier to progress. And I've always loved uranium. I got on board and we've taken it through to where we are today.

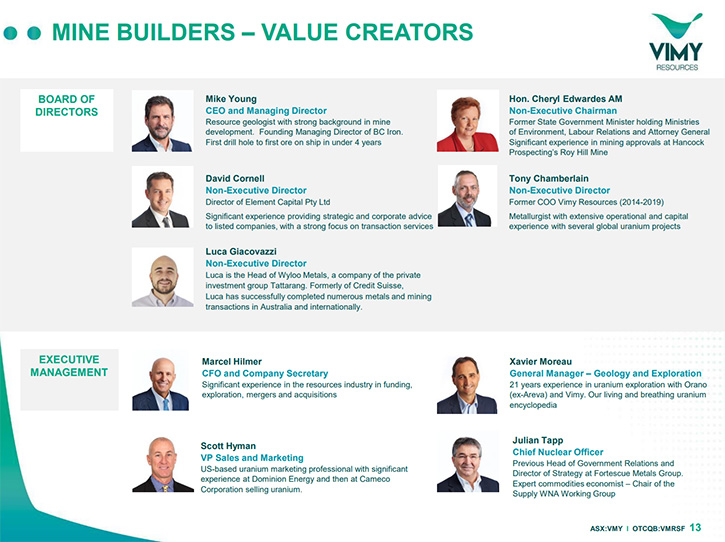

Our Chairman, the Hon. Cheryl Edwardes AM, is a previous Minister for the WA Liberal government; she was Minister for the Environment. She was Australia's first female Attorney General, a very impressive lady, very smart lawyer, very good Chairman. We also have on the Board, Luca Giacovazzi, who works for one of our biggest shareholders, Wyloo Metals, which is part of the Forrest group; Dave Cornell, who has been involved since the foundation of the Company, and then Tony Chamberlain, who was our COO until 2018, and led all the studies on the project. Because we were not advancing the project because of the market at the time, Tony decided to move on. But I asked him to stay on the Board, so we could keep the intellectual knowhow in the Company.

The other key executives are Julian Tapp, who worked at Fortescue Metals Group and was on the Fortescue side of the BC Iron JV. He is extremely good at everything, but he's particularly good at approvals and has a profound understanding of the uranium market. He's an economist by training and was convinced that there was an iron boom coming, well before anyone else picked up on it. And he's been doing similar work for the uranium space since he joined Vimy. He is the Chairman of the World Nuclear Association Supply Working Group, so he actually spends a lot of time looking at the uranium market, and that gives us insight that you just don't get from publicly available information.

Xavier Moreau is a French born geologist, a uranium expert, probably one of the best, certainly in Australia, if not the world. And Marcel Hilmer is our CFO, and he has previous uranium experience, having worked for Forsys Metals. He also worked for First Quantum, so he has good commercial experience. I have mentioned Scott Hyman previously, so a good well-rounded Team.

Dr. Allen Alper:

Well, it does seem like a very successful, very experienced and very well-balanced Team, so that's excellent. Mike, could you tell us the primary reasons our readers/investors should consider investing in Vimy Resources.

Mike Young:

There are a few narratives. The first one is clean energy. If you are looking at ticking the ESG boxes, then uranium is the cleanest energy there is. The CO2 emitted per kilowatt hour is lower than any other power source. From a clean energy standpoint, it is number one as a baseload. In terms of cost, once you look at the amortization of capital across the +60-year life of a nuclear power plant, it is actually the cheapest. There are a lot of fallacies out there and a lot of poor modelling regarding the cost of nuclear. But when you actually do the math properly, nuclear is actually very cheap. In 2020, the U.S. nuclear fleet had an average production cost of 2.9 cents a kilowatt hour.

In terms of the uranium market, there is solid growth in the nuclear power industry, dominantly in the non-OECD countries, so China, Middle East, Asia, Russia. China and Russia are very keen, as are the Koreans, to export their nuclear technology to developing nations and that is ongoing. There is growth in the nuclear industry, certainly in the last two years, with the advent of the global warming catastrophism, a lot of policymakers are looking to nuclear to achieve their 2050 zero emission greenhouse gas targets. A lot of people are realizing, you look at what Germany did, what California's done, they have shut down nuclear power and have had to replace them with fossil and their emissions just have not dropped anywhere near places like Ontario, Sweden and France who have very low emissions and cheap energy that are dominantly either hydro or hydro nuclear.

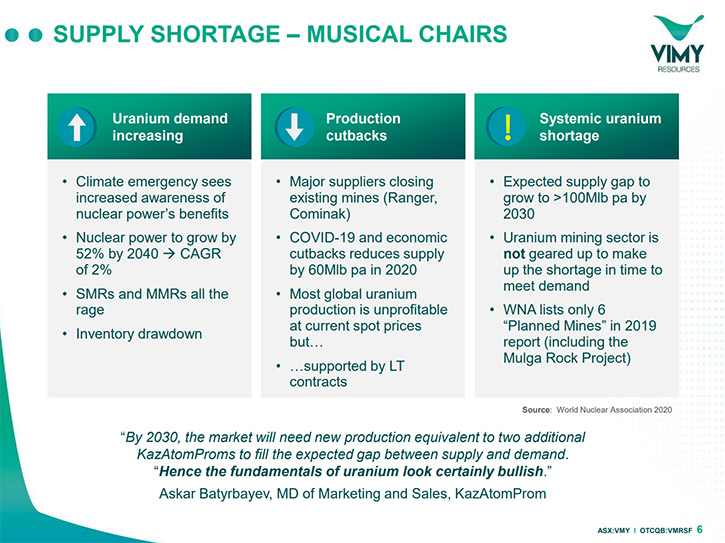

Global sentiment is moving back to nuclear, so now you have an industry that is growing. On the supply side, you have a systemic shortage. In 2020, the world mined about 121 million pounds of uranium and used 180 million pounds.

Coming back to supply, because of the sustained low prices, because Kazakhstan overproduced, they have cut back; Cameco shut down both their mines, one for economic reasons, one for COVID. Canada is now a net importer of uranium, which is amazing considering that it was one of the biggest exporters in the world previously. A lot of other mines just haven't been advanced. There are only six mines in the planning stage in the World Nuclear Association's report, Mulga Rock is one of them.

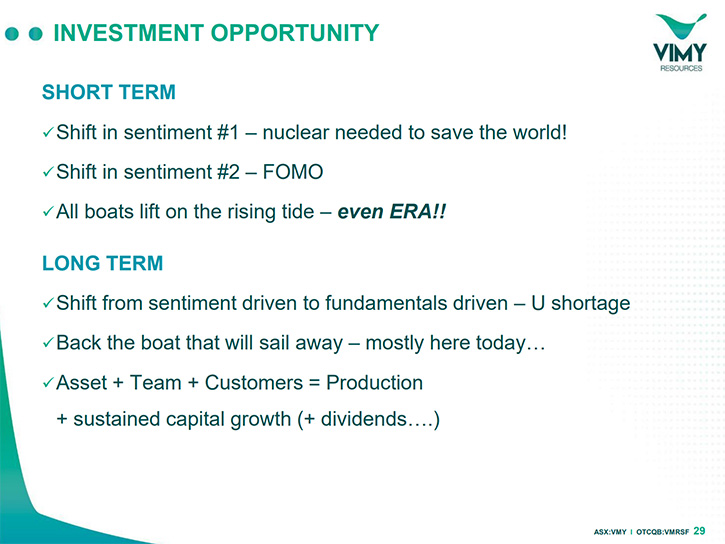

We are one of the world’s most advanced projects, so when we see the uranium price start to move in response to the shortage, that is inherent in the current system, Vimy is well placed to leverage off that.

What we are seeing recently is producers getting into the uranium market, becoming traders, which is the short-term fix, but what it does do is soak up more material out of the spot price and we are starting to see a spot price move.

The sustained price movement is going to come from the U.S. utilities getting back into the contract market. We know that they're running their inventories lower, and they will need to get back into the market. We know that because we've got Scott over there. So now you look around the world, you go, okay, who's the best uranium producer? If you are going to look at that, you want to look at leverage. What you want to do is look at a company's NPV, and then look at their NPV compared to the share price, and if you put in different uranium prices, how does that share price move? When you look at Vimy, compared to some of our peers, who are either sitting on mines that have shut down or waiting to reopen or companies that are a little bit more advanced like we are, if you look at our peer group, Vimy is one of the highest leverage players out there. You get short term leverage and then, with our plans to get into production, you have long-term growth and sustainable growth.

Dr. Allen Alper:

Sounds like very compelling reasons to consider investing in Vimy Resources! Anything else you would like to add?

Mike Young:

Not really. When you are looking at any deposit, you can look for the short-term stock hits, and that certainly provides some return. But if you're looking for a long-term return, you want to look at the team, the people who are running it. Do they have experience getting mines into production? Of course, you look at the deposit, is it viable? What's the grade? What are the technical issues around the deposit? What are the environmental social issues around the deposit, political issues? And then any you look at, how far is it along the study curve. Does it need to go to studies and approvals?

Just on approvals, where we are with approvals is that we have all our State and Federal approvals with conditions that we're going through and expect to have all those conditions satisfied by mid-June and later in the year. We also are working through the secondary approvals, which are things like mining approval, the works permits, management plans, that is all being done. Later in the calendar year we will be doing some site works up at Mulga Rock, early works on site. That is to satisfy one of the state government conditions that we have started the project, within five years. You look at all the boxes you need to check, and we check all the boxes.

Dr. Allen Alper:

That sounds excellent. We will publish your press releases as they come out so our readers/investors can follow your progress.

https://www.vimyresources.com.au/

Mike Young

Managing Director and CEO

Tel: +61 8 9389 2700

|

|