Lomiko Metals Inc. (TSX-V: LMR, OTC: LMRMF, FSE: DH8C): Developing Graphite to Supply a Future Market for Electric Vehicles; Interview with Paul Gill, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/18/2021

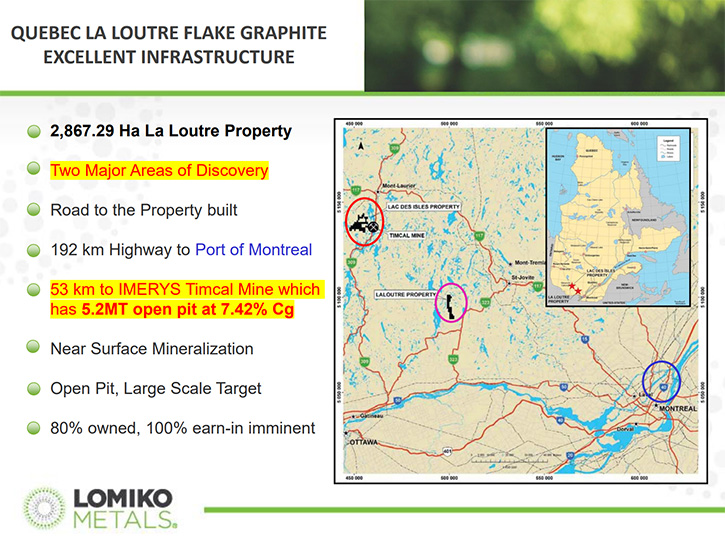

Lomiko Metals Inc. (TSX-V: LMR, OTC: LMRMF, FSE: DH8C) is an exploration-stage company focused on the La Loutre Project in Quebec, where they are developing graphite to supply a future market for Electric Vehicles and to help facilitate the transition to the new green economy. We learned from Paul Gill, who is CEO of Lomiko Metals, that in 2019 they had a discovery, and recently announced an upcoming PEA that should be completed in summer 2021. According to Mr. Gill it is important to have a supply of graphite that's very inexpensive, high quality and aimed at the North American market.

Lomiko Metals Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing A. Paul Gill, who is CEO of Lomiko Metals. Paul, could you give our readers/investors an overview of your Company and what differentiates your Company from others? Also what were some of your major highlights in 2020?

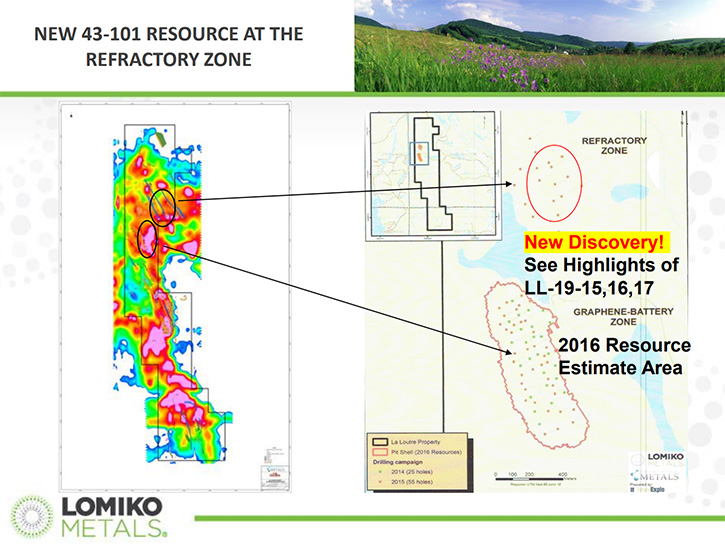

Paul Gill: Absolutely. Thanks for having me, Dr. Alper. What we do at Lomiko is look for materials that are going to be used in the new green economy. We have identified lithium, graphite and cobalt. We have identified, specifically, a strategic advantage on our project in Quebec, called La Loutre, which is a graphite project. So we're focusing in on that. Also we've had some great news in 2019 when we had a discovery. Since then, we've been working to develop the project and recently announced a preliminary economic assessment, which will give it a valuation much higher than where it is now.

Dr. Allen Alper: Great. Could you tell us a little bit about your preliminary evaluation?

Paul Gill: Yes. What goes into the PEA is essentially a number of factors. One, it examines the cost of extraction of the material and the processing of the material and the transportation of the material. Second, it'll also look at the infrastructure related to the project, whether it has power, water and proximity to facilities such as roads and ports, and also look at the community structure to check that the community is supportive of the project or able to contribute in any way. Also, it looks at First Nations and Indigenous rights anywhere near the project. Lastly, it would look at the market conditions for the material and the types of materials that could be produced.

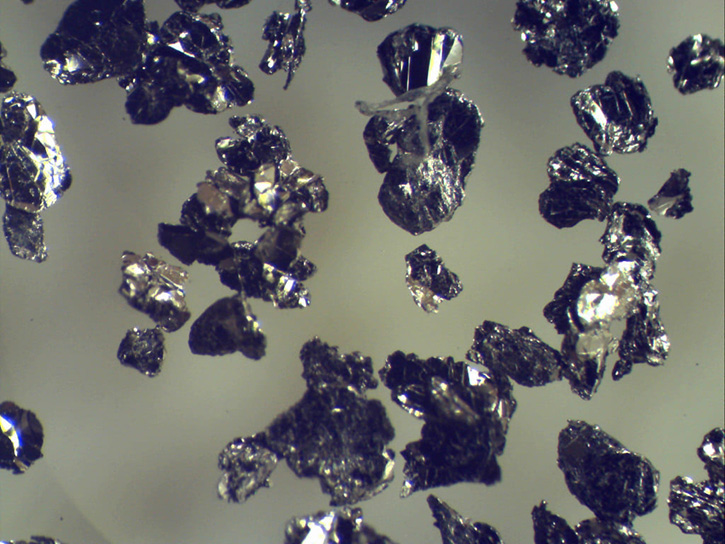

You could have particular types of graphite, such as spherical graphite for Li-ion battery anodes, which go into electric vehicles, or you could have electrodes that are used in steelmaking. Or there could be other types of graphite, such as expanded graphite and graphite used in nuclear facilities. Those are all end-products being researched. Also on the property, on the geology itself, they'll do a 43-101 on the project, which will look at the depth of each intercept and the proximity of the holes to each other, which will identify the contiguous nature of the ore body and the grades, estimate the grades and the tonnage of material that could be extracted, creating a block model and potentially a 3D model of the types of graphite, the types of grades, the carbon purity and the flake size. We have a really good body of information on the project, which will then propel the value of the project.

Dr. Allen Alper: That sounds excellent. So when are you planning to have that completed, Paul?

Paul Gill: Well, we've started the process of doing metallurgy and graphite characterization right now, which is the first step to identifying the value of the product. Then we will assign an engineering firm to do the full report and a geological firm to do the 43-101. So we're in the process of reviewing those right now and should have that decision within a month. Then we will have the delivery of the project report itself, within the summer of 2021.

Dr. Allen Alper: Well, that sounds very good. Could you tell our readers/investors a little bit more about your graphite project and also some of the downstream projects that you're working on?

Paul Gill: We've been working on this particular project since 2015, when we optioned it from Canada Strategic Metals. Now we have made the last payment and earned 100% interest. It is a project that specifically focuses on graphite. There is no other by-product involved, but there are various types of graphite that can be used in different industries. There are graphite anodes that are used in electric vehicles. There are electrodes that are used in steel-making. There is material that could be used for gaskets, material that could be used for lubricants, materials that can be converted into graphene. So there're a wonderful spectrum of products from that one type of mineral, graphite, which is essentially carbon.

We are really concerned about the purity of this material. That's why we looked long and hard to find a project that didn't have any sulfur or any other contaminants that would detract from the conversion of the material into the end form that is the most valuable, which is spherical graphite, which will be going into electric vehicles. That particular spherical graphite sells right now for about US$2,700 to US$3,000 per ton. And we want to make that product for less than $1,000 so we have a nice margin of profitability, which will drive the economic value of the entire project. So we're really excited at this point to get this report done and in the books, and show it to analysts and people, who would be buying the product around the world, so they could come and test the material.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors about the market for graphite and the forecast for electrical vehicles?

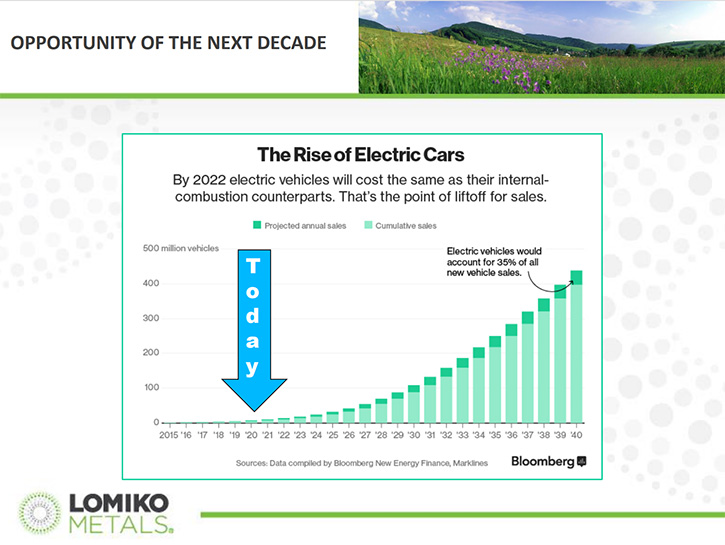

Paul Gill: Perfect. That's exactly the next thing I was going to talk about. We know right now that the market for electric vehicles is only just taking off. The penetration in different parts of the world are between 2% and 5%. Norway is the highest with 50% and California is probably in a good range as well, but most of the world hasn't adopted electric vehicles. When that adoption happens, look out. There's going to be a big demand for battery materials, such as lithium, graphite and cobalt. We want to have a supply of graphite that's very inexpensive, high quality and aimed at the North American market. We need to create a supply chain, within North America that will supply the new factories that are going to be built here to support the lithium ion battery industry. We feel we have at least 20 years of growth ahead of us and so we want to be able to start now and have a good product. By the time we get to market with it, we will have a number of things going on in the electric vehicle market that will be massive indicators.

We see that Tesla, right now, is already at almost $800 per share, after a five to one split. That is a forward-looking situation. Right now, if you examined Tesla, it would be worth $1.5 million per car on the road. That's not realistic today, but eventually the value of the Company will catch up with the value of the stock price. And we know that investors are looking forward. They are the canaries that will be looking at where the value chain is and get ahead of everyone. So we know that the rest of the market, the consumers will follow. We know that many people are making decisions right now about whether to go electric or not for their next vehicle. They're looking for price points that are going to be comparable to gas powered. So that's a big factor, but a lot of the luxury cars are going electric anyway.

You have the I-Jaguar, you have Rivian, and others that GM are going to produce. You have BMW coming out with their line, Volvo, Volkswagen. So there's going to be a competitive market. All those electric vehicles will need some type of graphite in their batteries. For instance, a Tesla uses 92 kilograms per car. For every million EVs on the road, you're going to need one mine to supply the graphitic material. That's where we are. We're looking at where the next big commodity boom is going to be, and it's going to be in electric vehicle battery materials. I think people getting in on Lomiko, will get in on the ground floor and grow with the Company. They'll definitely be happy, within the next five, six years as we go to production.

Dr. Allen Alper: Ah, that sounds excellent. Paul, could you tell our readers/investors about your background and the background of your team?

Paul Gill: Certainly. I've been involved in mining since 2003, when we formed Norsemont Mining, which was a copper exploration company that started out with a project in Peru. We developed that project over the next seven years and in 2011, the Company was bought out by Hudbay Minerals for $500 million. There was huge demand for copper. We're really learning about how commodity booms work. We know that when there is that kind of demand for products, there is a demand for the materials that go into those products. At that time, copper was in demand in the 2000s in China, due to the manufacturing boom. We know that same demand exists in battery materials today. We learned a lot and now we've attracted new Directors that are involved in business development, in engineering and mergers and acquisitions. We're prepared. We have a team prepared for what's to come.

Dr. Allen Alper: Oh, that's very good. I notice you're supporting the Roberts Bank Terminal 2 development. Maybe you could tell our readers/investors a little bit about that.

Paul Gill: Yes. We support the major infrastructure projects that are out there, simply because it's logical to be prepared to move the materials around the world that are required to build these batteries. There's going to be demand in various parts of the world at particular times. In order to get the best price for your product, you're going to have to be able to move it. And if we have infrastructure such as this particular terminal, we'll be able to move the product to where we'll be able to sell it for the highest price. That's why we support these infrastructure projects. If we're going to rebuild the economy, we have to have transportation as part of it. You can't always locally source these materials. They're not available everywhere. The high quality materials that are in Quebec are very specific and the government is very supportive of extracting and of the extraction industry, so we're in a good situation there.

Dr. Allen Alper: That sounds good. Could you tell our readers/investors about your share and capital structure?

Paul Gill: Yes. Currently there are 175 million shares out on Lomiko. It trades currently at C$0.23, so it has about a $21 to $22 million market cap. Right now we are going to be able to add to that by providing information on the preliminary economic assessment. That preliminary economic assessment will produce a report that is able to be added to our audited financials as a value statement. So it's a very key report because all of a sudden, we'll go from zero value for the project to X plus-plus-plus, and we're estimating $50 and $75 million as a value for the project. So it'll be a big change for the Company. Our competitors, Nouveau Monde, Mason Graphite, and others have already gone to feasibility and defined their projects and created huge valuation jumps. Nouveau Monde is trading at $2.50 and Mason Graphite's trading at $0.75. Those are the kinds of results we'd like to see for our shareholders.

Dr. Allen Alper: That sounds excellent. Paul, could you summarize the primary reasons why our readers/investors should consider investing in Lomiko Metals?

Paul Gill: Absolutely. Number one, Lomiko is at the right time in the markets. We're right at the beginning of a huge commodity boom in electric vehicles. Number two, Lomiko has a great project that is undervalued right now because it doesn't have a preliminary economic assessment report, which we will deliver this year. And number three, what we are looking at is the ability for this project to add considerable value to the stock price, considering the future market for these materials.

Dr. Allen Alper: Sounds like excellent reasons for our readers/investors to consider investing in Lomiko Metals. Paul, is there anything else you'd like to add?

Paul Gill: No, that's it. Thanks very much.

Dr. Allen Alper: Okay. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.lomiko.com/

A. Paul Gill

Director & Chief Executive Officer

info@lomiko.com

|

|