Compañia de Minas Buenaventura S.A.A. (NYSE: BVN; Lima Stock Exchange: BUE.LM): Peru’s Largest, Publicly Traded, Precious Metals Company; Interview with Victor Gobitz, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/4/2019

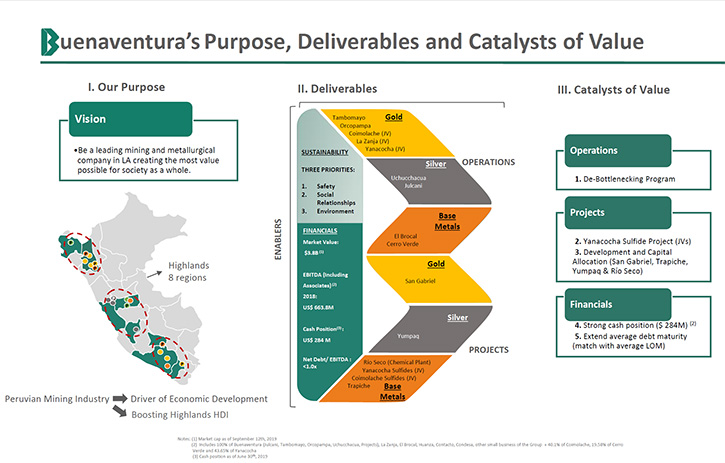

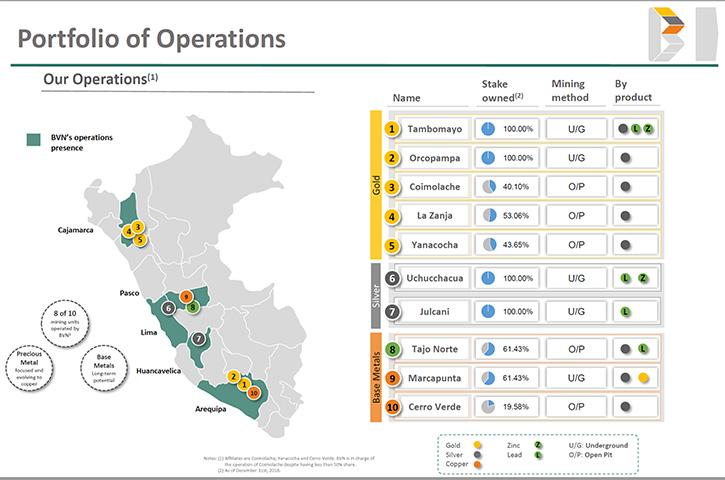

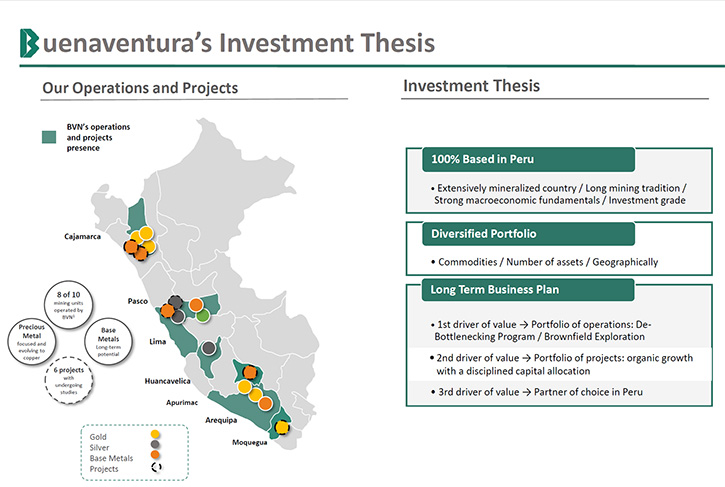

Compañia de Minas Buenaventura S.A.A. (NYSE: BVN; Lima Stock Exchange: BUE.LM) is Peru’s largest, publicly traded, precious metals company and a major holder of mining rights in Peru. Buenaventura currently operates several mines in Peru: Tambomayo, Orcopampa, Uchucchacua, Julcani - all wholly owned, as well as joint ventures: El Brocal, La Zanja and Coimolache. Buenaventura owns 43.65% of Minera Yanacocha S.R.L (a partnership with Newmont Mining Corporation), an important precious metals producer, and 19.58% of Sociedad Minera Cerro Verde, an important Peruvian copper producer. We learned from Victor Gobitz, CEO of Buenaventura Mines, that the Company's founders' philosophy, from the beginning, was organic growth and JV partnerships. 66 years later, Buenaventura has become the Company of choice to partner with in Peru. According to Mr. Gobitz, when you invest in Buenaventura you invest in Peru, the mining friendly country, with great mining infrastructure and long standing mining tradition, a leading mining territory in terms of production and reserves of gold and silver, as well as copper, zinc, and lead.

Compañia de Minas Buenaventura S.A.A

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Victor Gobitz, who is CEO of Buenaventura Mines. Victor, could you give our readers/investors an overview of your Company?

Victor Gobitz: 100% of our assets are located in Peru. Buenaventura is by far the biggest Peruvian mining company. It started in 1953. As part of our portfolio, we have gold mines, silver mines and also base metals mines. As part of our strategy, we are working to increase the efficiency of our existing assets. We are developing a program called the De-Bottlenecking Program in order to increase the efficiency of our existing assets.

Also we are developing our portfolio of projects from our organic growth. We have six different projects spread out over our country’s Highlands. Buenaventura, based on its reputation, is a partner of choice. One avenue for our growth has been our JVs. We have JVs with major players in the mining industry. It started as with Yanacocha with Newmont, Cerro Verde with Freeport and Sumitomo and also Coimolache with Sothern Copper.

Dr. Allen Alper: Wow! That sounds excellent. Could you tell us about your history and your Founding President?

Victor Gobitz: The Company was founded 66 years ago by a geologist, Mr. Alberto Benavides de la Quintana, who was a very young man. When he founded the Company he was just 33 years old. He started with a silver mine called Julcani, which is still a silver producer for us. Julcani is iconic in the history of Buenaventura. Through a significant effort in exploration, Julcani has been the first asset, and we continued to make the Company what it is today. After Julcani, we developed Uchucchacua, after that, Orcopampa as part of each organic growth. Also, early-on, Buenaventura developed some significant JVs. In 1979 Buenaventura was part of the development of El Brocal, which is a base metal company. At that time, our participation was just 11%, but right now we control more than 61% of El Brocal.

In the 1990s, when our country opened the market for foreign investment, the major mining companies of the world identified Buenaventura as a partner of choice, based on Don Alberto's experience, Don Alberto's reputation and clearly it was a significant attribute that allowed the company to be part of two different JVs, one with Newmont in order to develop Yanacocha. Yanacocha has been a world class gold deposit and part of the privatization process for El Cerro Verde.

At that time in 1994, Cerro Verde was a very small copper mine. But through many huge investments, right now Cerro Verde is a world class copper deposit and is by far the biggest copper producer in Peru. The experience, reputation, image and leadership of Don Alberto Benavides de la Quintana was clearly a key component of Buenaventura's history.

Dr. Allen Alper: Well that sounds excellent. Could you tell our readers/investors about the resources and reserves your Company has?

Victor Gobitz: In our portfolio of gold assets, we have Tambomayo and Orcopampa, two underground mines, 100% controlled by Buenaventura. And we have also in this gold portfolio, three other assets, Coimolache, which is a JV with Southern Copper, La Zanja, which is a JV with Newmont and also Yanacocha, which is a JV with Newmont and Sumitomo. That's our portfolio of gold assets.

And in terms of our silver assets, we have Uchucchacua, by far the biggest silver producer in Peru, which is also an underground mine and Julcani, an iconic mine. In terms of our base metal assets, we have participation, and we are the operator of El Brocal, which is a copper, but also zinc, lead and silver producer and Cerro Verde, where we control around 20%. There's a different JV with Freeport and also with Sumitomo.

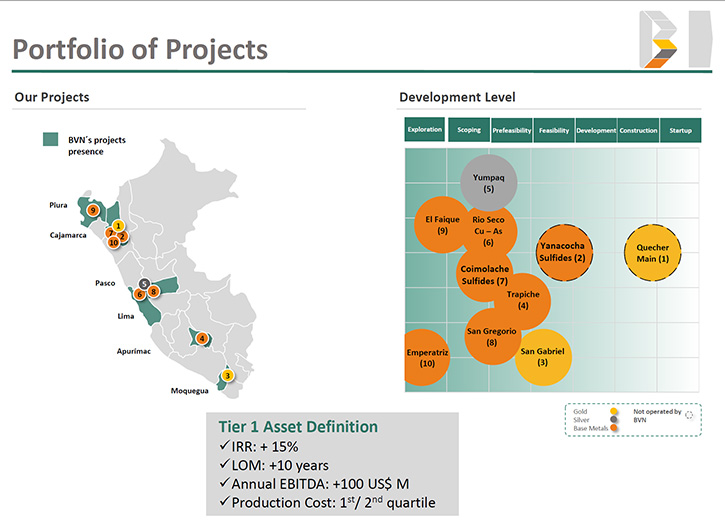

That's our portfolio of operations. Also, as part of our portfolio for growth, we are developing San Gabriel, another underground gold asset, located in Moquegua, Peru. We expect to submit for approval on this project next year, 2020. Also in these portfolio we have Yumpaq, a high grade silver deposit, located nearby Uchucchacua. We intend to develop Yumpaq as part of the expansion of the Uchucchacua mine.

In our portfolio of base metals, we have Trapiche, a copper project, located in the south part of Peru, Apurimac. We control 100% of these assets. During this year, we expect to achieve the pre-feasibility stage, and in 2020 the feasibility stage. It's a copper deposit, we are developing as an open pit mine.

Also in this base metal portfolio we are part of Yanacocha, which has been a world class gold producer and is becoming a copper producer, with some content of gold in the current footprint. We are working closely with Newmont in order to develop Yanacocha, which could also be part of our base metals assets. It has some similarities to the case of Coimolache. Coimolache right now it's a gold producer. It's a JV with Southern Copper. It has part of the same geology. Beneath the gold deposit there is a copper deposit. We are developing this business case in order also to become a copper producer in Coimolache.

As part of our base metals portfolio, we also have a chemical plant in Rio Seco, where we treat our lead concentrate, coming from Uchucchacua, with a high content of manganese. We reduce significantly the content of manganese and produce a sulfate of manganese, which is a commercial product. In that way, we reduce penalties and unlock the value of part of Uchuacchacua mine.

We are also developing technology in order to reduce and remove the arsenic content from our copper concentrate. That comes also from a copper mine called Marcapunta, which is an underground mine, part of El Brocal. As a pilot plant, we are very confident we could add value through this project.

We have 10 different assets, part of our portfolio of projects, and we have six different projects, part of our portfolio of projects. By far Buenaventura is the biggest Peruvian mining company.

Dr. Allen Alper: That sounds excellent. That's a great company. Could you tell our readers/investors about your background, Victor?

Victor Gobitz: I am a mining engineer, with an MBA, very proud to say that I studied mining engineering at the University of Católica del Perú - PUCP, a pilot school, founded by Mr. Alberto Benavides de la Quintana, a key person in the development of this private mining school.

My clinical background is based on mining activities. Before this role, I was a CEO of Buenaventura. I took this role in January, 2017.Prior to that, I was the CEO of Milpo Zinc Company, which changed its name to Nexa Resources. Of this company, as part of our portfolio, we have operations in Peru, but also in Brazil and Chile.

Before that I was the CEO of a gold project that was developed as part of a junior company, Rio Alto, and before that for more than 15 years, I was the COO of Volcan Company. Volcan, it's one of the biggest zinc producers in Peru. At that moment, the company belonged to a Peruvian family. Right now it's part of the Glencore group, so I have more than 25 years of experience and I have an extended experience in the region. As I said in Peru, also in Colombia, Brazil and Chile in the last 10 years. We do also management roles.

Dr. Allen Alper: Well, you have a fantastic background. That's very, very impressive. Could you tell our readers/investors a little bit about your share and capital structure where your stocks are listed, about how many shares are out and the price of your shares?

Victor Gobitz: We are listed on the New York Stock Exchange and also the Lima Stock Exchange. Our total number of shares is in the order of 275 million. The Benavides family controls around 25%. Also we have big institutional shareholders. One of them is Van Eck. They control more than 12%. Black Rock, controls more than 5%. Fidelity controls more than 5%. Templeton, which is another our shareholders, more around 4%, and Azvalor, a Spanish group more than 3% in general. In terms of intuitional shareholders, they control more than 60% of our product shares.

Dr. Allen Alper: Well, you have very strong support. Very impressive investors.

Victor Gobitz: In the New York Stock Exchange, our average daily value to date is around $20,000,000.

Dr. Allen Alper: Well, that's very good. Victor, could you tell us what are the primary reasons our investors and readers should consider investing in Buenaventura?

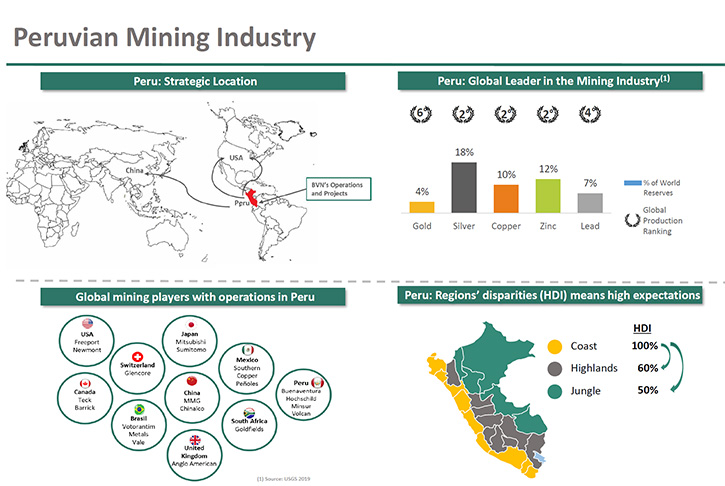

Victor Gobitz: When you invest in Buenaventura, you are investing in a mining company located 100% in Peru. Peru it's an emerging market. Peru, in the region, is a country with strong macroeconomic fundamentals. Peru is one of the few countries with investment grade in the region. Peru is by far a leading mining territory in terms of production and also in terms of reserves, in these five different metals; gold, silver, copper, zinc and lead, which is a significant attribute.

Also, Peru has a long mining tradition in doing mining activities. We have an ecosystem based on not only mining companies, based on our geology, but also in terms of suppliers, contractors, and our framework. So investing in Buenaventura, you are investing in a country with strong macroeconomic fields, with a lot of mining experience and tradition. Clearly Buenaventura is by far the biggest Peruvian company, with extensive experience, doing business in Peru.

Dr. Allen Alper: Those all sound like excellent reasons for our readers/investors to consider investing in Buenaventura. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

www.buenaventura.com

Investor Relations

Rodrigo Echecopar

Phone: (511) 419 2500

|

|