Aben Resources Ltd. (TSX-V: ABN, OTCQB: ABNAF, Frankfurt: E2L2): Flagship Gold Project 23,397 Hectors in the World-Class B.C. Golden Triangle; Interview with Jim Pettit, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/1/2019

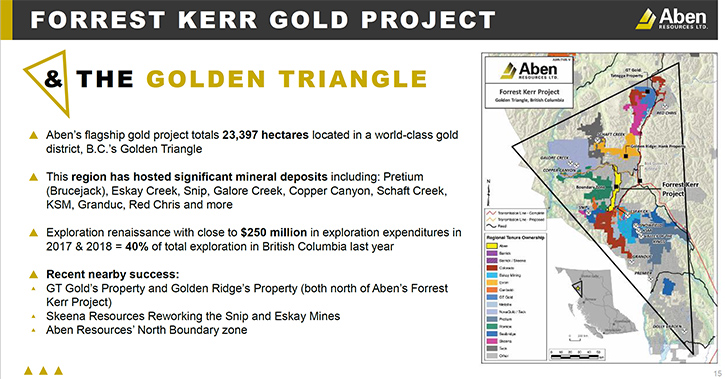

Aben Resources Ltd. (TSX-V: ABN, OTCQB: ABNAF, Frankfurt: E2L2) is a Canadian gold exploration company, developing gold-focused projects in British Columbia and the Yukon Territory. We learned from Jim Pettit, President and CEO of Aben Resource, that they are focused on the high-grade North Boundary Zone, discovered in 2018 at the Forrest Kerr Gold Project, in the Golden Triangle region of British Columbia. Plans for 2020 include compiling and analyzing data from the two years of exploration drilling of 20,000 meters and surveys. Aben is a well-funded junior exploration company, with over $1.5 million in the Company’s treasury.

Aben Resources Ltd.

Dr. Allen Alper: Dr. Allen Alper, Editor in Chief of Metals News, talking with Jim Pettit, who is President and CEO of Aben Resources LTD. Could you give our readers/investors an overview of Aben Resources and also tell them what differentiates Aben Resources from others?

Jim Pettit: I can do that. First of all, it's good to be back with you and bringing you up to date on what Aben has done in the last while. We haven't talked for a while. Aben is very involved in the Golden Triangle, which is Northwestern British Columbia. We're looking for gold, principally high-grade gold, but up in that neck of the woods, Mother Nature will give you what she feels like and this year was a classic example of that.

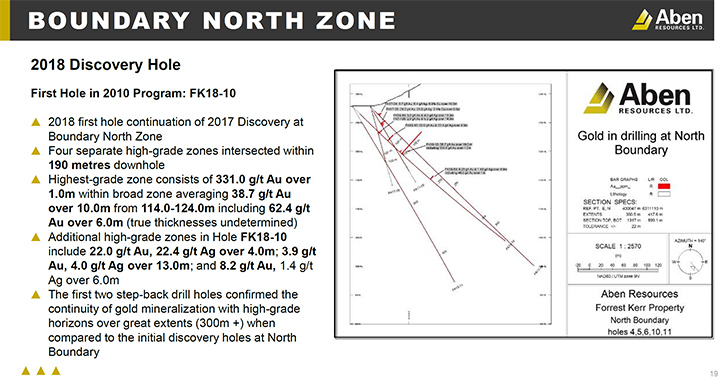

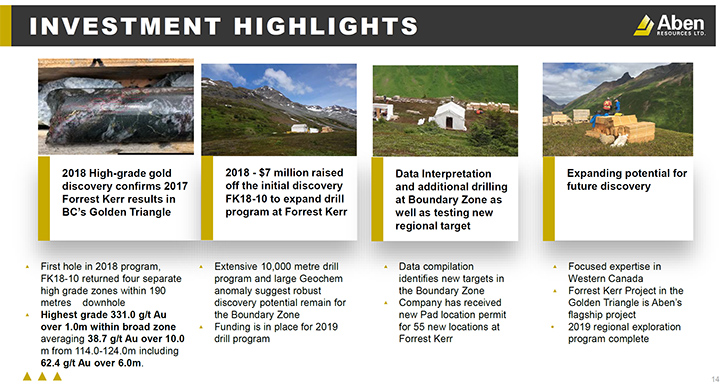

For the first couple of years, say 2017-2018 we encountered a zone, which we called the North Boundary Zone. Very high grade. We encountered intersections like 10 meters of plus 30 gram gold, more than once. That really got the attention of the market and the financial community and we raised a lot of money last year on our first hole. That allowed us to raise 5 million, plus took down a million and a half dollars in warrants and I already had over a million in the till. So we're pretty set for increasing our drilling last year to 10,000 meters and then also cover the costs of this year's drilling, which was almost another 10,000 meters.

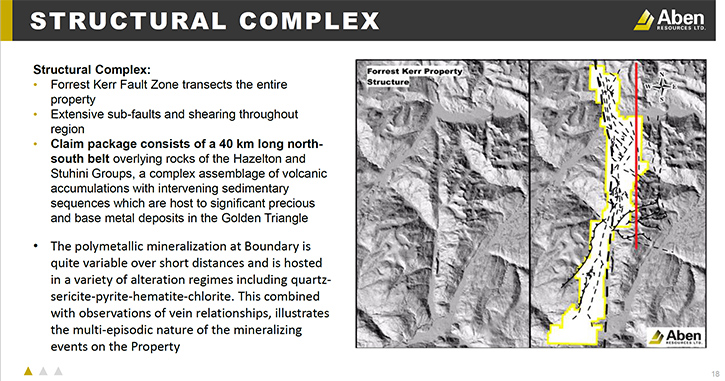

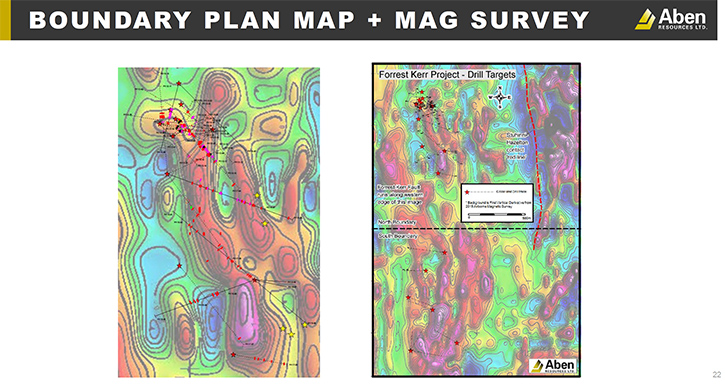

We concentrated our time and efforts in that North Boundary Zone. The overall boundary zone is a very large valley. It's about six kilometers by two kilometers wide and it has a huge geochem anomaly on it. We've done that survey plus a big geophysical survey now, and we utilize those two surveys to start stepping away from the high-grade zone because we had spent a lot of time and effort and drilled over 30 holes trying to define that high-grade zone. It gave us an area about 200 meters North, South and maybe 50 meters East, West and it is open at depth. We utilize the geophysics as well, we can see a lot of structure a lot anomalies.

And what you want to do is test them because we're looking for a feeder system, a heat source. We can see it in the alteration that we have in that North Boundary Zone, where you know you have really good-looking alteration which gives us an indication of a heat source somewhere in the vicinity. So, we started moving South and as we move South, away from that North Boundary Zone’s high-grade, we actually started encountering a slightly different mineralization where we had more polymetallic. Where we would have gold, copper, lead, zinc, silver.

So things have changed. There's a tremendous amount of activity in this Valley. As a matter of fact, we drilled a zone at the southern margins of South Boundary that displays characteristics of VMS-style mineralization, a mineralization style not previously observed in the Boundary Valley. That's a primary target because everybody would like to duplicate the Eskay Creek discovery from way back. We have now encountered at least 3 different styles of mineralization.

The market definitely wants high grade. You can tell that by the price. You know what happened to the price this year. It fell from a high on the year of 25, 26 cents down to seven and a half to ten cents now. And that's simply because it very much wanted high-grade. What we're getting now as we move South are large, much broader based intersections and of lower grade. Anywhere from trace to one and a half to two grams. But we get broad intersections of it. So it's not like the mineralization is going away, it's just changing. And we now have a broad corridor about 700 meters, where all the holes are mineralized and we're going to keep going. Then right on the Southern edge of where we were going past the South Boundary Zone is where we encountered this new Eskay Formation, which has the geologists scratching their heads because we didn't expect to see that there, not at all. And if it is what we think it is, boy that could be something fantastic for us to look at for next year.

Dr. Allen Alper: That sounds exciting! Sounds like this coming year will be a very important time for your exploration. Could you tell our readers/investors more about your plans going into 2020?

Jim Pettit: There's going to be a tremendous amount of data compilation because we have a lot. In two years we've drilled 20,000 meters. We're modeling, we have the 3D models working and we have so much more to work with because we did a big mag survey and we've filled in the gaps, in this large, but older geochem survey that was done 20 odd years ago. It's just putting it all together. They really want to figure out where that Eskay Formation came from, how it's tied in, right? Because this whole area, the Golden Triangle, is known for its extreme geology. You cannot travel very far, without going from one style of mineralization to a distinctly different style of mineralization. That's why you have such big copper deposits up there and some incredibly rich gold mines, historically and presently, up there.

For next year I think we're going to be concentrating our efforts on figuring out what this Eskay Formation is because we encountered it at the bottom of hole, I think it was 63. It's the bottom 35 meters of it. It's what they call the mud stones up there. That's going to be a primary target. But then we also think that the heat source can be just to the West of the high-grade North Boundary Zone. It was the one target we couldn't get to because we could not do the geochem on top of it to confirm anything because it's covered in scree, which is the debris off the mountain side. It's a blind target for us, but it's still sticks out and it's within a thousand meters of the North Boundary Zone, which is indicative to us that it's something we want to go test right away next year.

Dr. Allen Alper: It sounds like next year will be a very exciting year for you and your geologists, as you drill and discuss and outline the project and define it more greatly.

Jim Pettit: Well it is. There has been a lot of time and effort put into this and we have the backing of some pretty respectable people too. Eric Sprott's still the largest shareholder. He likes investing in these things for the long term and he sees the potential up there.

Dr. Allen Alper: Sounds great. Could you tell our readers/investors a little bit about what you're doing in the Yukon? On what you have there?

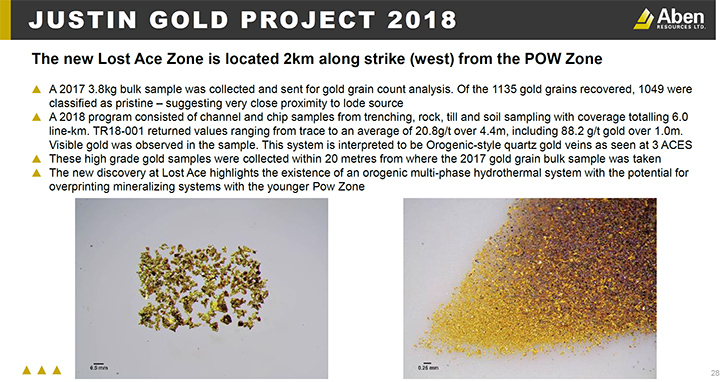

Jim Pettit: We thought we could stretch our exploration season out, by spending a month in the Yukon prior to getting started in the Golden Triangle. We have a property that's we discovered back in 2012, it's an intrusion related gold system. We wanted to test it further because right beside it we've discovered a different type of gold system; it's orogenic in nature. The big intrusive system that we found earlier came up. It's a younger occurrence and we thought maybe there'd be over printing between the two because the orogenic system was very high- grade and we were finding it on surface, so we thought we'd bring in a Rab drill, which is a rotary air blast type of drill and do a bunch of 35 meter holes because we figured whatever we're looking at, they're close to surface.

Then we used a diamond drill to do about four holes that we've completed around the intrusive. The Rab drill was not very successful because we encountered water, artesian water, groundwater just below the surface and it doesn't work for that. It was a bit of a disappointment for us. The diamond drilling went well. We hit the formations exactly where we wanted to hit them, on the fault structures. But we actually only encountered mineralization, good mineralization, in one of those holes. And so that was less than stellar. But part of exploration is what you don't find. You get a lot of information out of it and we have all that ground up there intact, in good standing for another 10 years and Newmont's in the area, looking at potential opportunities just across the border in the Northwest Territories from where that Justin Property is. There's always something possible on the horizon.

Dr. Allen Alper: That sounds promising. Could you tell our readers/investors about your successful team? Yourself and the others on your team?

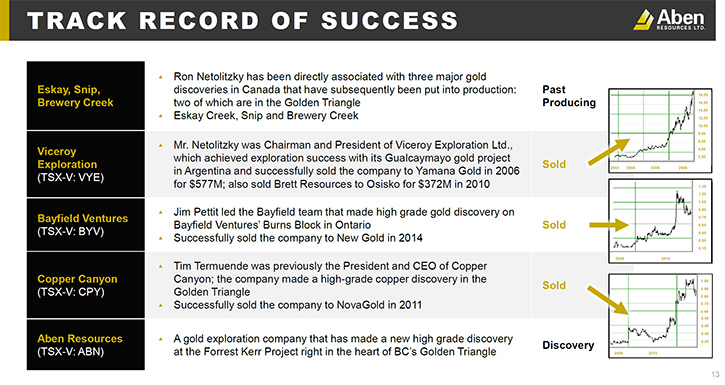

Jim Pettit: Our Chairman is Ron Netolitzky, who has a certain amount of fame up in the Golden Triangle areas because he discovered the Snip mine and was in on the discovery of Eskay Creek, which were back then the two big gold mines that were discovered 30-35 years ago. He has a pretty stellar track record for M and A, that sort of thing. There are probably, in his past, seven deals that he's spun off to bigger companies. Tim Termuende, who's very active on the Board with me, he actually put together Copper Canyon with Ron that's just to the North of us in the Golden Triangle and they sold that to NovaGold, which became Galore Creek. NovaGold's been bought out now by Newmont. They're partners with Tech and they're going to develop the Galore Creek copper and gold mine. And then the last project I worked on, Company that I was running, I sold to New Gold in Northwestern Ontario. It turned out to be right in the middle of their deposit, so it was a fairly straightforward deal.

Dr. Allen Alper: Excellent. Very impressive track record that you and your team have. That's excellent, gives investors confidence.

Jim Pettit: We also have really good geologists too. Cornell McDowell runs the program. I've never seen anybody run such an efficient job. It's expensive to work in the Golden Triangle. If you're not careful, it can cost you up to $500 a meter. Every year Cornell seems to pull it in at $250, all in costs, a meter, which is spectacular. So we do 10,000 meters of drilling. That's two and a half million dollars and it's right to the penny.

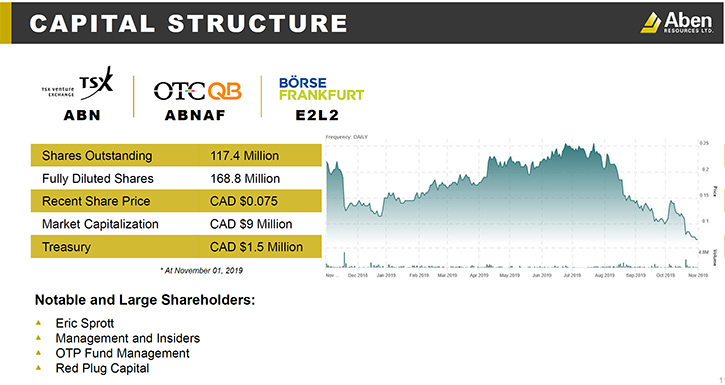

Dr. Allen Alper: That's excellent. Could you tell our readers/investors more about your capital and share structure?

Jim Pettit: It's about 117 million shares issued and outstanding. There're a couple of million dollars still of warrants. We haven't had to do a financing this past year. We did it last June-July. We don't really have to do anything right away until we get a budget, probably come March. We're in good shape. We have a million and a half dollars in the till. We paid for last year and this year already, all the bills are in. A significant shareholders is Eric Sprott and I have a fund out of Budapest, actually, of all places. They work with the country's biggest bank there and they have a resource desk. They've been quite successful with us in a couple of the deals we've been involved in, and a fair institutional presence from Europe. I just got back, as a matter of fact, from Europe.

Dr. Allen Alper: That's excellent. I understand the Management Team has quite a bit of holdings.

Jim Pettit: Yeah, we have about 12% among us, insiders and Management and that's pretty good.

Dr. Allen Alper: That's excellent. Shows the investors that Management has confidence, and has skin in the game. That's excellent.

Jim Pettit: Absolutely.

Dr. Allen Alper: Could you tell our readers/investors the primary reasons they should consider investing in Aben Resources?

Jim Pettit: Well, we just talked about one of the primary reasons, the people involved. We have the people. We have the project. The project is in a prime location. As a matter of fact, we have more projects that we're reviewing right now because we're getting a lot of interest from other groups that have projects that haven't been worked for a long time. They're bringing them to us, but we're not in a rush to look at anything else. But if something good comes along, we certainly are going to look at it. The Golden Triangle area is a place where the sky's the limit. It's elephant country. And we're in the gold business, we're in the gold exploration business. I don't have to sit around and wait for the rest of the commodity markets to catch up because people are interested in gold right now.

Dr. Allen Alper: Sounds very good. Is there anything else you'd like to add, Jim?

Jim Pettit: Just to thank you for interviewing Aben Resources for Metals News

Dr. Allen Alper: Well, Aben Resources sounds great. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.abenresources.com/

JAMES G. PETTIT

President & CEO

For further information contact myself or:

Don Myers

Aben Resources Ltd.

Director, Corporate Communications

Telephone: 604-687-3376

Toll Free: 800-567-8181

Facsimile: 604-687-3119

Email: info@abenresources.com

|

|