Compañia de Minas Buenaventura S.A.A. (NYSE: BVN; LM: BUE): Peru’s Largest, Publicly Traded, Precious and Base Metals Company, Interview with Víctor Gobitz, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/14/2018

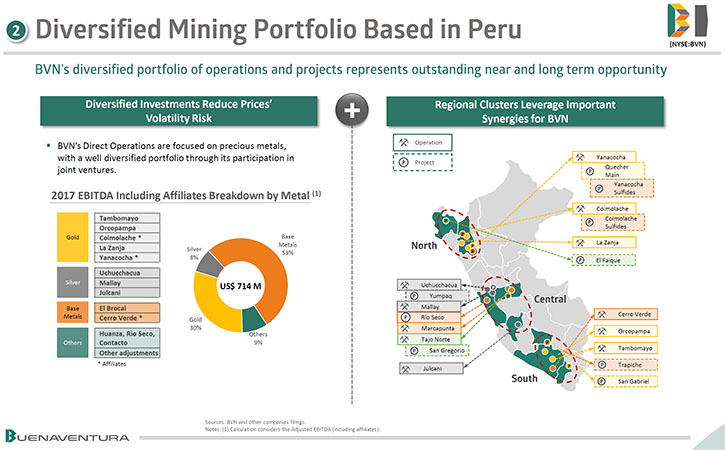

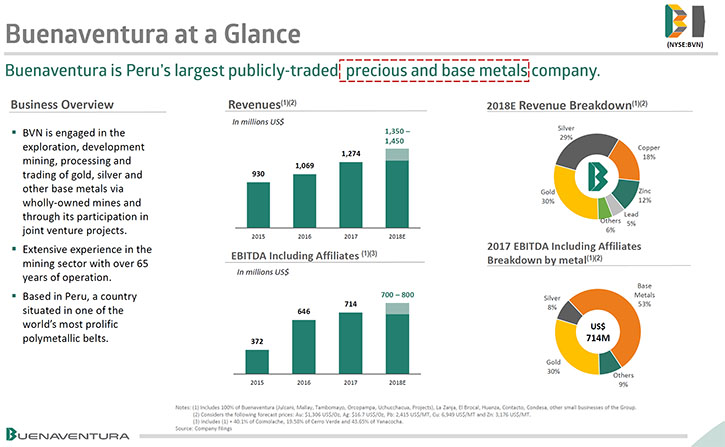

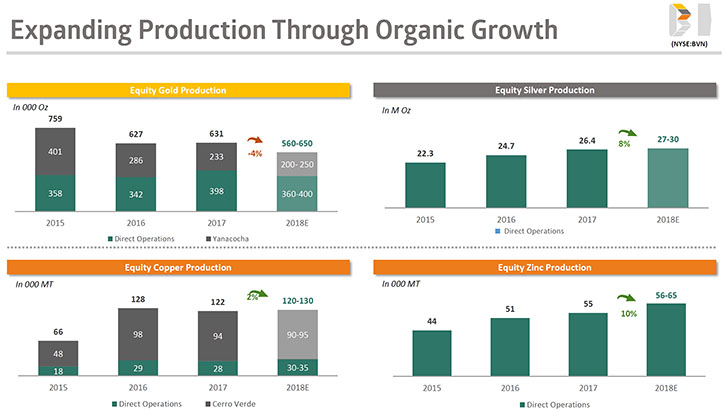

Compañia de Minas Buenaventura S.A.A. (NYSE: BVN; LM: BUE) is Peru’s largest, publicly traded, precious and base metals Company, and a major holder of mining rights in Peru. The Company currently operates several mines in Peru and is engaged in the exploration, mining development, processing and trade of gold, silver and other base metals, via wholly-owned mines and through its participation in joint venture projects. Buenaventura owns 43.65% of Minera Yanacocha S.R.L (a partnership with Newmont Mining Corporation), an important precious metals producer and 19.58% of Sociedad Minera Cerro Verde, an important Peruvian copper producer. We learned from Víctor Gobitz, CEO of Buenaventura, that they produce about 600,000 ounces of gold, and in addition, about 28 million ounces of silver a year, as well as about 125,000 meta tons of copper equivalent. We learned from Mr. Gobitz, that Buenaventura is currently in the middle of a De-bottlenecking program to improve the mining infrastructure of their underground mines: Tambomayo and Orcopampa, two gold mines, Uchucchacua, the silver mine, and Marcapunta, the copper mine. According to Mr. Gobitz, Peru has a long mining tradition and mining infrastructure of contractors, suppliers, accountants, and training entities, as well as a very robust legal framework.

Compañia de Minas Buenaventura S.A.A.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mr. Victor Gobitz, who is President and CEO of Compañia de Minas Buenaventura S.A.A. Could you give our readers/investors an overview of your Company, your focus and current activities? I know it is one of the largest base metals producers in Peru.

Víctor Gobitz: Yes. Buenaventura is by far the largest Peruvian public company in Peru. The Peruvian Mining Company started 65 years ago in Peru. We have eleven different assets as part of our portfolio, and ten different projects in our portfolio for growth.

In terms of our portfolio, we have precious metals, gold assets and silver assets. Also, as part of our portfolio, we have two different base metals assets. We participate in Cerro Verde, which is the biggest copper mine in Peru, and also in the Marcapunta, which is also a copper deposit. We are developing two different studies in the part of our portfolio of operations.

We are executing a program to improve the mining infrastructure of our biggest, full underground mines: Tambomayo and Orcopampa, two gold mines, Uchucchacua, our silver mine, and Marcapunta, our copper mine. Regarding our portfolio of projects, we are implementing a program to maximize outcomes and to reduce risks.

Víctor Gobitz: The Company was founded in 1953 by Mr. Alberto Benavides de la Quintana, a very well-known and knowledgeable Peruvian. In 1953, Mr. Alberto Benavides de la Quintana acquired a small silver mine, an underground mine called Julcani. The Company has used two different avenues for growth.

The first was through the development of its own portfolio of projects, such as Orcopampa, Uchucchacua, and also recently Tambomayo. The Company invests significant amounts of money in restoration programs. Throughout these 65 years it has developed some of its own underground mines.

The second avenue for growth has been through the development of key JVs, such as Yanacocha, with Newmont and Sumitomo, Cerro Verde, with Freeport-McMoRan and Sumitomo, Coimolache, with Southern Copper (Southern Peru). One of the most important attributes of the companies is the partner of choice in Peru.

100 percent of our assets, our portfolio of operations, and our portfolio projects, are located in Peru. Peru has a long mining tradition. Our mining industry consists of contractors, suppliers, accountants, and training entities, and also a very robust legal team. Mining is important in the lives of people in Peru. Peru also has robust financials, micro economically speaking. In comparison to other countries in the region, Peru is one of the countries with investment grade, according to Standard and Poor and other rating agencies, as well as Mexico, Columbia and Chile. All are significant attributes for doing mining business in Peru.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about your resources, and operations?

Víctor Gobitz: Our company is a precious metal mining company, but with significant base metals exposure. We produce about 600,000 ounces of gold, and about 28 million ounces of silver a year. We process about 1 million ounces of gold equivalent a year in terms of precious metals. Additionally, in terms of base metals, Buenaventura produces about 125,000 metric tons of copper equivalent.

Dr. Allen Alper: That's excellent.

Víctor Gobitz: In terms of our financials, the company has a significant ratio of Net Debt / EBITDA lower than 1 times. Our total net debt is about 700 million dollars, but we have in cash, about 360 million dollars.

Dr. Allen Alper: That's very good.

Víctor Gobitz: Yeah, we have a very robust financial position.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about your background, the Board and the Management Team?

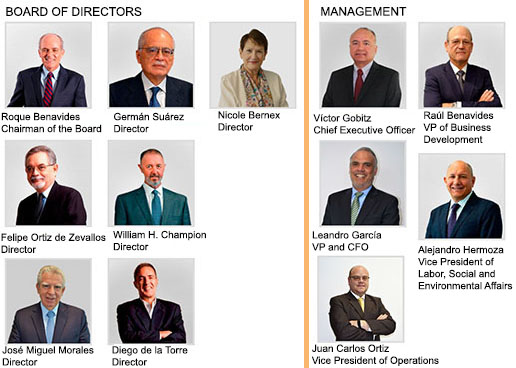

Víctor Gobitz: I became CEO in 2017. I am a mining engineer, with an MBA. Before Buenaventura, I was CEO of Compañia Minera Milpo, as well as General Manager and Director of Rio Alto Mining, which has changed its name, after a merge, to Tahoe Resources. In this role, I was in charge of the mining assets located in Peru, Chile, and also Brazil.

Regarding our board members, we have seven different members. Two of them represent the Benavides family because the founder of this company was Benavides de la Quintana. One of them is Roque Benavides, who is the Chairman of the company. When I arrived and took the role of CEO, the company had decided to split the roles of the Chairman and the CEO. Roque Benavides as the Chairman, and the second member of our board that represents the Benavides family, Jose Miguel Morales. The other five members are independent.

The Board members are Roque Benavides, German Suarez, Nicole Bernex, Felipe Ortiz de Zevallos, William Champion, Jose Miguel Morales and Diego de la Torre.

Victor Gobitz, Leandro Garcia, Juan Carlos Ortiz, Raul Benavides and Alejandro Hermoza are part of the management.

One of them is a metallurgical engineer, Bill Champion. He's from the United States. He worked for Rio Tinto previously. He has an excellent reputation in the mining industry. Dr. Nichole Bernex, a geographer, is on our Board. She was President of the Peruvian Forum for water and also the former President of the Central Bank of Peru, Mr. German Suarez is part of our Board

Dr. Allen Alper: It sounds like you have a very strong Board and Team. That's great.

Víctor Gobitz: Yes

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

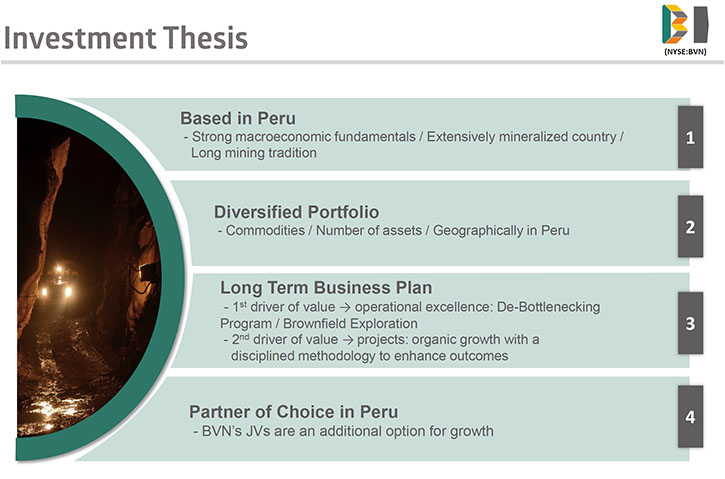

Víctor Gobitz: Good point. When you invest in Buenaventura, you are investing in Peruvian Mining Company. It's an entity located 100 percent in Peru. Peru is a mineralized country. Peru has a long mining tradition. It is excellent doing mining business in Peru. In comparison to other countries in the region, Peru has one of the best microeconomics figures in the last decade, in terms of GDP rate and growth and also the lowest inflation rate. That's by far the first attribute. The second one is a diversified portfolio. We have eleven different assets as part of our portfolio of operations. We have ten different assets as part of our portfolio of projects. We are diversified in terms of metals, in terms of commodities, in terms of number of assets. Also Buenaventura operates throughout our entire country. A further attribute is that Buenaventura has developed a long-term business plan. We are looking for investors with our same long term outlook. And finally, our fourth attribute is Buenaventura has a significant reputation in as a mining company here in Peru, the mining company of choice in Peru. A second option for growth is developing JVs in order to increase the value for our shareholders.

Dr. Allen Alper: That sounds excellent. Those are very compelling reasons for our high-net-worth readers/investors to consider investing in Buenaventura. Is there anything else you'd like to add Victor?

Víctor Gobitz: Just to say thank you for this opportunity to talk to Metals News about our Company. I'm very pleased to be a part of this mining company, which has, by far, the highest reputation here in my country.

Dr. Allen Alper: That's excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.buenaventura.com/en/

Corporate Communications

Diego Uceda Noguerol

Phone: (511) 419 2500

comunicacion.corporativa@buenaventura.pe

|

|