Element 25 Ltd (ASX: E25): Developing Australia’s Largest World-Class Manganese Resource for Producing High-Purity Manganese for the Battery Revolution; Interview with Justin Brown, Executive Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/11/2018

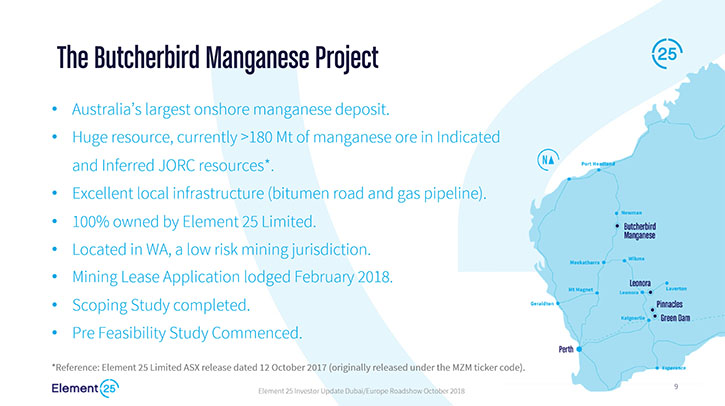

Element 25 Limited (ASX: E25) is developing Australia’s largest onshore manganese resource at the Company’s 100% owned world-class Butcherbird Project to produce high-purity manganese products for the battery revolution. We learned from Justin Brown, who is Executive Director of Element 25, that they have developed a flow sheet, which allows them to process their manganese ore into high-purity manganese products, including electrolytic manganese metal, electro-manganese dioxide and high-purity manganese sulfate for lithium ion batteries. Earlier this year, the company completed a scoping study, which highlighted the robust economics of development of the project, and it is currently about six months into a pre-feasibility study that is due in the third quarter of 2019. Element 25 has hit important permitting milestones, and is making good progress in the metallurgical test work and process optimization. We learned from Mr. Brown that traditionally manganese is used in steel making, but now there's a growing demand for high-purity manganese for use in lithium ion batteries. According to Mr. Brown, the company is looking to attract off-take partners and cornerstone investors.

Element 25 Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Justin Brown, Executive Director of Element 25. Could you give our readers/investors an overview of your Company, your focus and current activities?

Justin Brown: Yeah, sure, Allen. Element 25, formerly Montezuma Mining Company Limited, is about nine months into the commercial evaluation of our world-class Butcherbird Manganese Project. We have developed a flow sheet, which allows us to process our manganese ore into high-purity manganese products, including electrolytic manganese metal, electro-manganese dioxide and high-purity manganese sulfate for lithium ion batteries.

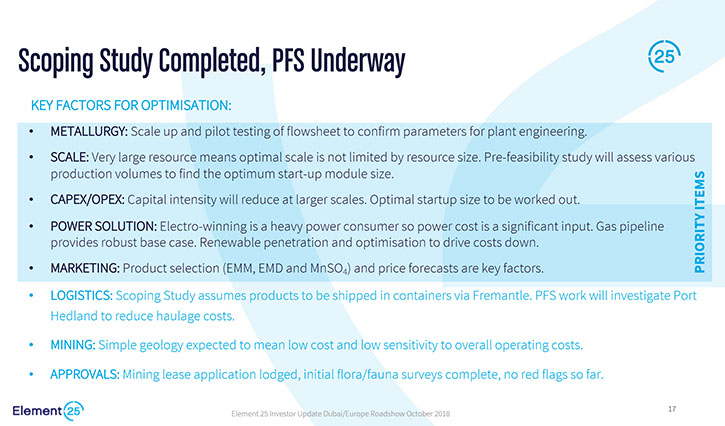

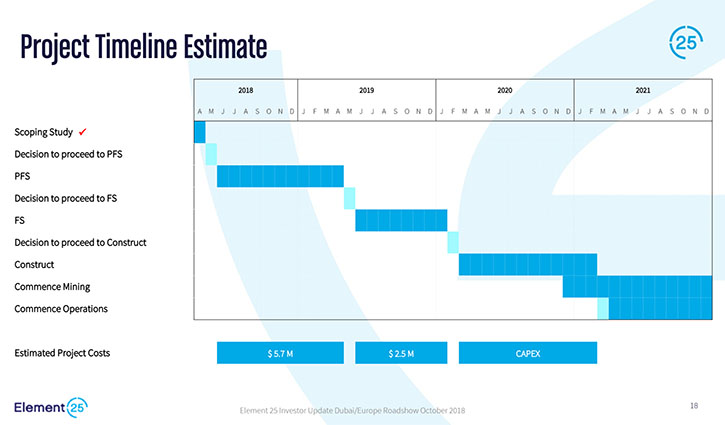

Earlier in the year, we completed a scoping study, which highlighted the robust economics of development of the project along those lines, and we're currently about six months into a pre-feasibility study into that project development strategy.

So I guess since we last spoke, we've moved forward on a number of fronts. We have hit some milestones in terms of permitting. Mining lease applications are in place, native title negotiations are well advanced. In addition to that, we've been progressing the metallurgical test work that is obviously pivotal to the success of the project. We've continued to work with CSIRO which underpinned the original flow sheet design and we're optimizing that. We expect shortly to receive our first samples from a bulk leach phase of metallurgical work that will be available for potential off-take partners to analyze and test, to see if it's suitable for their needs, which should then lead to off-take negotiations, which is important from a project financing point of view.

I guess another key thread is power. Because of the power requirement for making electrolytic manganese metal, we've been working very hard on optimizing the power solution for the project, which, in the scoping study, was based around gas-fired power. We have a gas pipeline, which runs through the project, providing competitive base load power from gas only, but we've also been working with a high-level consultancy here in Perth, to look at the integration of renewable energy. It's now looking likely that we will have substantial wind and solar energy to supplement the gas, and that will do two things. It will bring down the overall cost of power for the project further, but it will also add to the environmental credentials of and decarbonize our products. We believe this translate into important marketing advantages for us going forward as battery makers seek more sustainably produced products in their supply chains.

We've been very busy, and we continue to be so, and the project's advancing nicely towards a completion of pre-feasibility in the third quarter of calendar 2019, which will lead into a full feasibility study after that.

Dr. Allen Alper: That sounds excellent. Could you explain to our readers/investors why your manganese project and deposit is so important and so enabled to serve the lithium ion battery market?

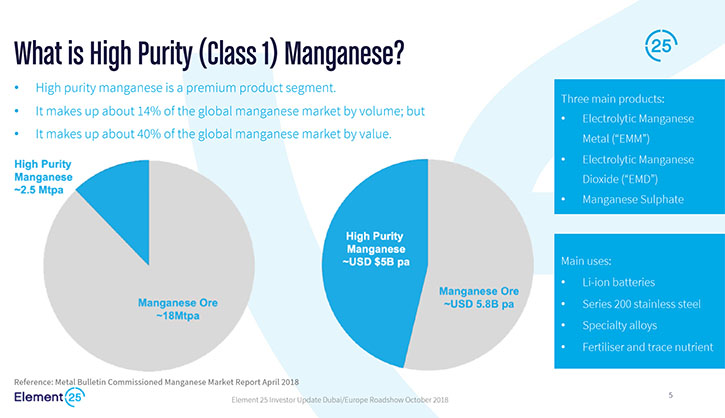

Justin Brown: Yeah, sure. So it's a really interesting time in terms of high-purity manganese. Traditionally manganese is a commodity that goes into steel, but as you point out, there's a growing demand for manganese for use in lithium ion batteries. So the chemistry of choice at the moment is the NMC cathode lithium ion battery, which N is for nickel, M is for manganese and C is for cobalt. And because this is the chemistry that's being used in most electric vehicles, the boom in electric vehicles forecast over the next decade or so is going to have a material impact on the demand for high-purity manganese, particularly manganese sulfate. Obviously one of the reasons that this is happening is because the world wants to reduce dependence on fossil fuels and to tap into more renewable energy, and if you're going to do that, it's important that the metals that you acquire to build your batteries for these cars are sustainable in themselves, and so at Butcherbird, we've developed a process flow sheet that uses much lower energy than the traditional methods of producing these high-purity manganese products, which are mainly produced in China at the moment.

In China, where they typically heat the manganese to 1000 degrees Celsius with coal, to reduce the manganese and allow it to be brought into solution, our revolutionary technology uses an ambient temperature and atmospheric pressure process and requires no energy input, so it's really key, because our process is much cleaner, much more efficient, and it allows us to produce manganese sulfate for lithium ion batteries that has a much lower carbon footprint, which is important for the world's ambitions to decarbonize our energy supply.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors your goals for 2019?

Justin Brown: Absolutely. We continue to refine the process and process-prove it. We'll do a pretty detailed metallurgical test program in the early part of 2019. Alongside that we'll work to finalize the power solution for the project and significantly advance the permitting and other work streams. Those should all come together in a pre-feasibility study release, which is scheduled for early in the third quarter of 2019. That will advance through to a full feasibility study after that. So the goal is to get us ever closer towards construction and production. There are a number of work streams happening to achieve that. We plan to talk to off-take partners, get those conversations going and move towards binding off-take agreements. All of those should underpin project financing. Discussions will commence as we approach the completion of the pre-feasibility study.

We're also looking to attract cornerstone investors, like-minded investors, who can add horsepower to our story in terms of heading towards full-scale construction and development of the project, so we're going to be pretty busy.

Dr. Allen Alper: That sounds excellent. Do you have an approximate capital cost for your investment?

Justin Brown: Yeah it's an interesting project because typically, with a mining project, you optimize the plant size over a mine life of, say, 7-10 years, to exploit the resource. This resource is so large that we are not constrained by resource, and therefore we can develop the project at a smaller scale, or we can do it at a much larger scale and take advantage of economies of scale that are associated with that. So it's a bit of a sliding scale at the moment. We've looked at scenarios between about $100 million and about $600 million. Where we land in terms of the optimal base cost is still to be determined, and it'll be somewhat dependent on the availability of capital and not, as is traditional for resource projects, the size of the resource. So we have a luxury in that regard.

Dr. Allen Alper: That sounds very good. Would it be okay to mention where you're looking for off-take partners, what part of the world or is it too early to talk about that?

Justin Brown: No, no, we're very happy to talk with off-take partners. Very shortly we'll have samples available for potential off-take partners to examine and analyze, and we would welcome approaches from anyone who is interested in talking about building a relationship in terms of off-take.

Dr. Allen Alper: That sounds great! Could you update our readers/investors on your background, your team, and your board?

Justin Brown: We're still a relatively small team. We're trying to keep costs low as we work our way through the process. I'm a geologist by trade, but I've been working in the corporate space for about 12 years. We have Seamus Cornelius, our Chairman, who's a lawyer, who's spent 20 years living in China. He is fluent in Mandarin, so he's very well-versed in introducing the opportunity to potential Chinese investors. He's also Executive Chairman of Danakali Limited, who are building a world-class project in Eritrea, a potash project. He has lots of experience in the kinds of things that we need in terms of project development and financing.

John Ribbons is our third director, who's an experienced financial professional. He's a CPA, a career miner, who has worked in operating mines in Australia and around the world, so he adds important skills to our skill set as well.

We have a very experienced mining engineer on board, an exploration manager who's a 20-year veteran. We also have a number of key consultancy groups to provide specialist skills in terms of metallurgy, environmental approvals, power solutions, et cetera.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about your share and capital structure?

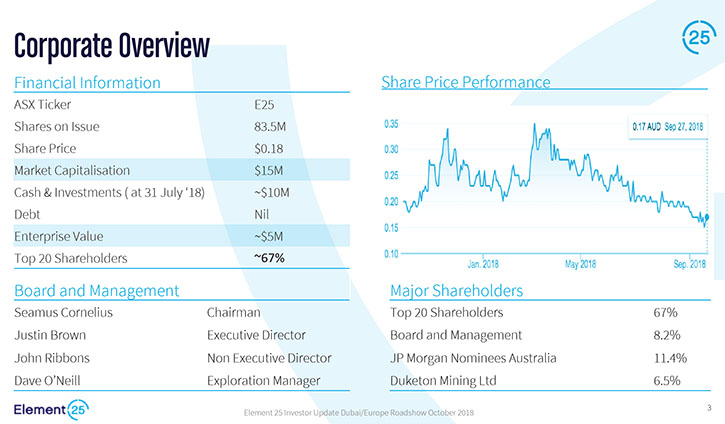

Justin Brown: We've worked pretty hard to keep the number of shares down in contrast to our peers here in Australia. We have 83 million shares on issue having listed in 2006, so that's quite important in terms of maintaining leverage for investors. We have a balance sheet that comprises approximately $10 million in cash and liquid investments, so we're well-funded. If you look at the current share price, we're not getting a lot of value for the project, which we think's a really world-class opportunity, so in terms of an investment opportunity, it's very cheap in my view. And the downside risk is protected by the balance sheet and the tight share register. I think if you were to invest now, I'd be surprised if it were not at or near the bottom.

Dr. Allen Alper: That sounds excellent! What are the primary reasons our high-net-worth readers/investors should consider investing in Element 25 Limited?

Justin Brown: I think the key points are that we have a world-class resource. We have a breakthrough technology in terms of processing, which is more efficient, cleaner, more cost effective than the traditional methods. We have effectively unconstrained mine life. We have fantastic infrastructure assets in terms of a bitumen highway and a gas pipeline going through the project. The integration of renewables will decarbonize our product, which should provide a competitive advantage against others. And if you look at the valuations the market's giving us, they're very low. We have market capitalization of something like $15 million and net tangible assets of something around $10 million. So the enterprise value is at about $5 million, very low for what we have. I think that those that recognize that opportunity will stand to do well.

Dr. Allen Alper: Sounds like excellent reasons our high-net-worth readers/investors to consider investing in Element 25. Justin, is there anything else you'd like to add?

Justin Brown: I'd like to add, the management are shareholders alongside other investors, and that's a reflection of the fact that we believe in the project, so we're going to work pretty hard to crystallize the value that we see. I’ve been happy to update you and your Metals News readers/investors. Thank you.

Dr. Allen Alper: It is exciting to hear about your developments! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.element25.com.au/

Justin Brown

Executive Director

P +61 8 6315 1400

E admin@e25.com.au

|

|