Nevada Copper Corp. (TSX: NCU): Near-Term, Mid-Tier Copper Production near Reno, Nevada, Interview with Matthew Gili, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/11/2018

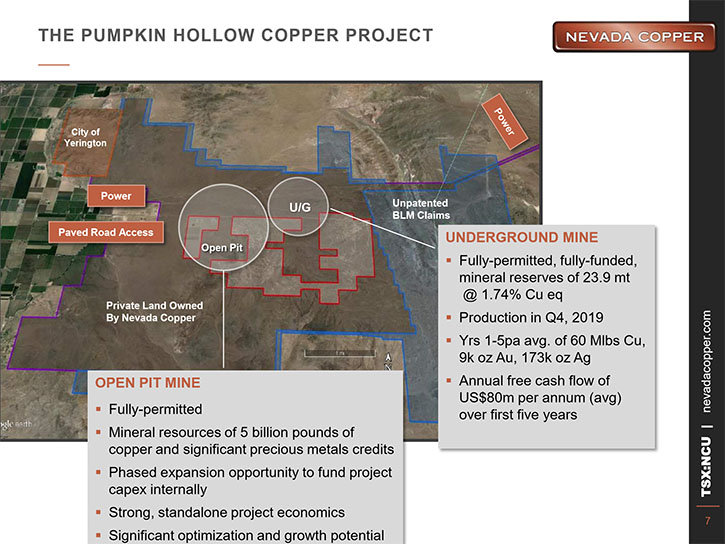

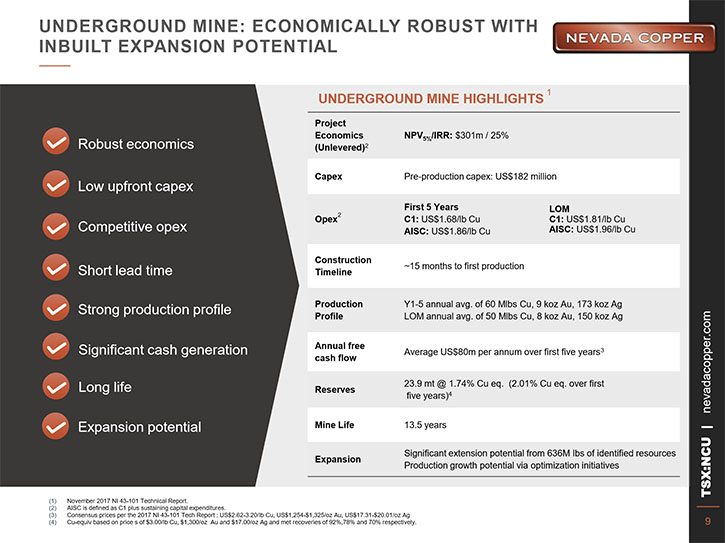

Nevada Copper Corp. (TSX: NCU) is focused on the near-term commencement of copper production at the Pumpkin Hollow copper project near Reno, Nevada in the Yerington District. There are two fully-permitted adjacent projects at Pumpkin Hollow: the high-grade underground project, which is in construction. Initial production is planned by the end of 2019, and the open pit project, a large-scale copper deposit with substantial mineral reserves, which has recently undergone an optimization program to target a reduced-capex, increased margin operation, as outlined in its new PEA.

We learned from Matthew Gili, President and CEO of Nevada Copper that the Pumpkin Hollow project contains over five billion pounds of copper in resource. According to Mr. Gili, the Yerington District holds about 33 billion pounds of copper in resource and, as first-mover in region, Nevada Copper aims to be the partner of choice in this district. The company's vision is to be the next mid-tier copper producer based in North America. According to Mr. Gili, the company anticipates an increase in copper prices, based on analysis of industry supply and demand factors, and with its experienced team, Nevada Copper is well positioned for the upturn in the copper market.

Pumpkin Hollow

Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Matthew Gili, who is President and CEO of Nevada Copper Corp. Matthew, could you give our readers/investors an overview of Nevada Copper and the highlights of the PEA that was announced on September, 10th.

Matthew Gili: Certainly Dr. Alper. Nevada Copper is currently a copper mine developer, and soon to be a producer. Our assets are centered in Northwestern Nevada, in the vicinity of Reno, Nevada. Our asset is referred to as the Pumpkin Hollow project, which contains over five billion pounds of copper in resource. It is really two deposits that are adjacent to each other.

On the east side you have the underground deposit. On the west side you have the open pit deposit. But they are separate. The underground is not the bottom portion of the open pit. Our headquarters have been historically in Vancouver, we are in the process of moving our headquarters, at least from the operational standpoint, to Reno. For example, I am currently based in Reno. I have moved my family from Toronto to Reno. The majority of the senior management team is based in Reno, so we can be close to the operations.

In terms of our timeline for advancement, as a corporation. There are three tiers to our strategy.

The first is to bring the underground mine into production by Q4, 2019. Right now we have commenced construction. We're busy sinking shafts, and preparing the groundwork in the earthworks for the construction of the plant facilities. Both of those contracts have been signed with the construction teams, the underground being done with Cementation and the plant facilities being done with Segman. Segman is a part of the Civic Group. They're very well known in Australia and Asia, and this is their entry into the North American construction market. They're an EPC contractor, which means that they provide us with a turnkey project at a fixed price. So that's where we're sitting.

Allen Alper: That sounds excellent.

Matthew Gili: Yes. This is really about our risk mitigation now. What are the risks to Nevada Copper? As a mine developer , nothing more critical to us right now than ensuring our underground project is executed on time and on budget. Part of our risk mitigation is that the plant facilities are going to be a turnkey project.

Allen Alper: That's excellent.

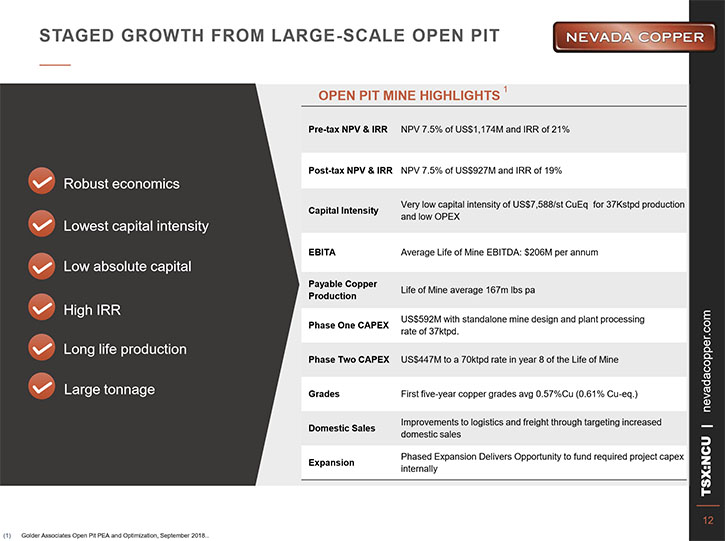

Matthew Gili: So that's the underground. The second tier to our three tiered strategy is advancing the open pit. The open pit already had a mine design by we have re-looked at it, and we've redesigned it. The previous design was a very good design at the time. It was 2012 when the feasibility study was done. The real market initiative back then was how big can you make it? Times and focus have now changed. We've re-looked at it, not in terms of how big you can make it, but how efficient can you be with capital expenditure and how much free cash flow can you generate from the operation. We’re excited by the results of that redesign and have released a PEA report that will soon be followed by a PFS report, planned for Q1, 2019.

And then the third phase to our three phase strategy is with regards to the region itself. We're in the Yerington District. Yerington was historically a major copper producer. Anaconda previously had a very large operation here. We are the next new movers in this district with Pumpkin Hollow. There's a lot of resource in the district so far. There're about 33 billion pounds of copper in mineral inventory in the district, held by different entities. We see ourselves as the leader in that district, the first mover and therefore the partner of choice in this district.

Allen Alper: That sounds very good. Could you tell me more about the highlights of the PEA.

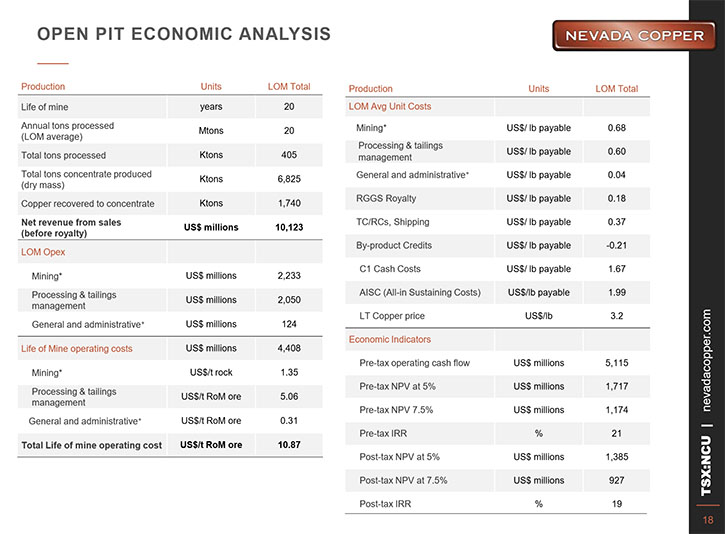

Matthew Gili: Absolutely. When we talk about the open pit, the previous feasibility study showed an extraction of approximately 3.6 billion pounds of copper. It would have been a very large operation at around 70 thousand tons a day. In order to get that large operation, you would have needed to invest a lot of money. The pre-construction investment was going to be in the region of $1 to 1.2 billion.

We took that same deposit. We incorporated some drilling that was completed in 2015. and we redesigned it to have low capital intensity and be free cash flow generating. The methodology we used was, what would a pit look like at $2.50 copper? When we did that, we came up with a smaller pit, with less of a throughput. So we've dropped the throughput down to 37 thousand tons per day of ore, but because we focused on the high grade portion of the ore body initially, that gives us an increase in grade. So by cutting the production rate in half, we still get over 60% of the copper generation because of the higher grade. That increases the economics and increases the value proposition for investment in this open pit.

When you look at phase one by itself, you're looking at the investment of less than $600 million. The concept is, we mine that phase one. We mine out the high-grade portion, primarily the northern pit. As we complete phase one, then we can look at phase two, which is the rest of the ore body, which is primarily the southern pit. It's a slightly lower grade pit.

When you mine in two phases, instead of mining it all concurrently as in the original feasibility study, it is very similar to what they do in gold mining. It allows us to self-fund phase two, the expansion. The best case right now, would be that we would expand between year six and eight and we would expand the plant, and that would allow us to process larger amounts of ore. This shows value both in the NPV and in the IRR. Those are all detailed in the press release that we put out.

Allen Alper: That sounds excellent.

Matthew Gili: This is our whole strategy. Nevada Copper’s vision is to become the next mid-tier copper producer based in North America. And so we have a funding path ahead of us that would allow us to build that phase one of the open pit and then self-fund the expansion in years six through eight. It's important to know that phase one is not dependent on phase two to be economically viable. Phase one by itself is absolutely a viable investment. Phase two would just enhance that investment, we'll make that decision when the time is right. But we're not obligated to do phase two.

Allen Alper: Sounds like an excellent approach.

Matthew Gili: Well, I learned that in my years in the gold mining industry. If you look at the big gold mines across the world, if you look at even some of the bigger copper mines across the world, they started off modestly and then they grew over time. That's the same approach that we're applying to Pumpkin Hollow.

Allen Alper: That sounds excellent. Matthew, could you tell our readers/investors a little more about yourself and your team?

Matthew Gili: I came into the organization in May, earlier this year. The Board of Directors and the management team really changed. The purpose was for the Board of Directors to be a broad group of industry experts. So Ernie Nutter came onto our Board of Directors. Ernie Nutter hardly needs an introduction. He is incredibly skilled and gifted in the financial markets. Tom Albanese joined the organization, unparalleled in his operation of major copper and metal producers all across the world. So the board was reformed to focus on being a mine developer.

In that same spirit, the leadership team here at Pumpkin Hollow, has been reformed as a mixture of people with immense experience and skill in building and operating mines, combined with retaining that institutional knowledge of the key players in Pumpkin Hollow. We talk about the mix here. I’m the new President and CEO. I am a mine developer and operator. I have over 25 years of experience. I had senior executive roles at Barrick and Rio Tinto. During my 15-year career with Rio Tinto, my appointments included Chief Operating Officer and Vice President of Resource Strategy for the Oyu Tolgoi project in Mongolia, Managing Director of Palabora Mining Company in South Africa, and Mine Manager at Greens Creek, Alaska. I spent three years as the Executive General Manager of the Cortez Operations in Central Nevada and then spent a year and a half in the Toronto office for Barrick, both as their Chief Technical Officer and their Senior Vice President of operational projects.

Allen Alper: You have a great background.

Matthew Gili: Well, I've been extremely blessed to work in a diverse range of countries and commodities. And I've had a very blessed career.

Allen Alper: That's excellent. A very accomplished career! And you are ready now to make Nevada Copper the next copper producer in North America.

Matthew Gili: Absolutely! That is our strategy.

Allen Alper: That's excellent. Could you tell me anything else about your players?

Matthew Gili: The Vice President of Operations is David Swisher. David Swisher has a great background in multiple different aspects of North American mining. One thing that I really like about David is, he spent part of his career working in industrial minerals and industrial minerals require a low margin. Low margin operations require a great deal of operational discipline. David really brings that to the team. He is used to operating in a low margin environment and we really benefit from that. Discipline is very important. David is very detailed. He executes brilliantly and really concentrates on efficiencies.

Allen Alper: That sounds very good.

Matthew Gili: Of course we also have team members who go back a very long way with the company. Bob McKnight, Gregg French and Tim Dyer - three people that have a lot of experience in Nevada Copper. They’ve all worked on the Pumpkin Hollow project for a long time and we benefit from their historical knowledge and their expertise.

Allen Alper: That sounds excellent. Could you tell a bit about your capital structure?

Matthew Gili: The balance sheet for Nevada Copper has over $170 million worth of cash and that cash came from a variety of sources. We did a restructuring in the very beginning of this year, where we cleaned up our balance sheet. We also did an equity raise, just a few months ago, that netted us that cash. We do have $80 million dollars of debt. We are fully funded for construction of the underground. It's just something that the Board was absolutely dedicated to, to ensure that today we have the funds available for complete construction and taking into operation the underground project.

Allen Alper: That's great. Nice to have the funds right at the top.

Matthew Gili: Yeah. The board of directors was very passionate about this and they led us brilliantly towards this outcome. The timing is also right. One question I get a lot is, why build up Nevada Copper, when copper prices are low, lower than they were several months ago. The answer is that we believe in the market fundamentals and we see the demand for copper increasing. We see the move to electrification driving that increase in copper demand at the same time. We see that the global supply of copper is struggling, new projects aren't coming online.

A lot of the new projects that are coming online are underground projects that require more capital and have lower production rates. We see this as the opportune time to be developing a compromise. We will be positioned and placed to be a copper producer when the prices rebound, not competing with everyone else still trying to build a copper mine, when copper prices are improving.

Allen Alper: That sounds like a very good strategy and an excellent analysis of the market on how you should move forward. What are the primary reasons our high-net-worth readers/investors should consider investing in Nevada Copper?

Matthew Gili: Nevada Copper has the right project at the right time. Nevada is an excellent jurisdiction to build a mine. It ranks in the top three of the Frasier Institute’s Most Mining Friendly Jurisdictions. It's a region of the world where I'm very familiar from my time with a Barrick in Central Nevada. We have great infrastructure, we have a very supportive community, a supportive government, and we have a large pool of very skilled labor.

We're really pleased with Nevada. It is the place to be. All that together gives us a lower-risk environment for the construction and operation of a large mine. Now is the right time to build the Nevada Copper. The market fundamentals are pointing towards an increase in copper price and we are going to be ready to reap the benefits of that increasing copper price. We have the right team. We brought together a team of mine builders, mine operators, with market knowledge.

Allen Alper: That's excellent. Those are compelling reasons to consider investing in Nevada Copper.

Matthew Gili: The other thing I really want to stress with Pumpkin Hollow is that, while there has been an incredible amount of drilling to date, there is a whole lot of potential for expansion, within the underground. We have large sections in the underground that have not been completely drilled out. We will drill those out when we go underground. For efficiency, we'll drill those holes from underground, there'll be shorter hauls, so they'll be more efficient holes. There is also a lot of potential upside within and around the open pit. So you've seen the press release earlier this year on our holes for the open pit. We drilled 26 holes this year. It was a very successful campaign and if you visit our website, you’ll see the recent news releases that outline the results.

Allen Alper: That's great. Sounds like this is a good time to pay careful attention to what's happening in Nevada Copper.

Matthew Gili: Yeah, I think it is. This is a very exciting time to be with Nevada Copper.

Allen Alper: Sounds excellent! Well, I'm very impressed with what you and your team are doing; your company, your location and the ability to fund and move forward. I think right now and next year are going to be extremely exciting times.

Matthew Gili: Thanks Allen. I share your enthusiasm.

Allen Alper: I enjoyed talking with you once again, Matt. Metals News will publish your press releases as they come out so our readers/investors can follow your progress.

https://www.nevadacopper.com/

Rich Matthews,

VP Marketing and Investor Relations

Phone: 604-355-7179

Toll free: 1-877-648-8266

Email: rmatthews@nevadacopper.com

|

|