Aurania Resources Ltd. (TSXV: ARU): Potential for World Class Gold Discoveries with a Proven Team, Interview with Richard Spencer, President

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/28/2018

Aurania Resources Ltd. (TSXV: ARU) is a junior exploration mining company engaged in the identification, evaluation, acquisition and exploration of mineral property interests, with a focus on precious metals and copper. Its flagship asset, The Lost Cities – Cutucu Project, is located in the Jurassic Metallogenic Belt in the eastern foothills of the Andes mountain range of southeastern Ecuador. We learned from Dr. Richard Spencer, President and Director of Aurania, that the Cordillera de Cutucu is the northern extension of a very prolific gold-copper belt and possibly the location of two ancient "gold cities" mentioned in Spanish records in the Vatican and other libraries. According to Dr. Spencer, Aurania is looking for the lost cities from the historical records, while at the same time, doing standard exploration, which is very likely to identify, not only the lost cities, but also new areas that actually weren't found by the Spanish, potentially new deposits.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Dr. Richard Spencer, President and Director of Aurania. Could you give our readers/investors an overview of your company, your focus and current activities?

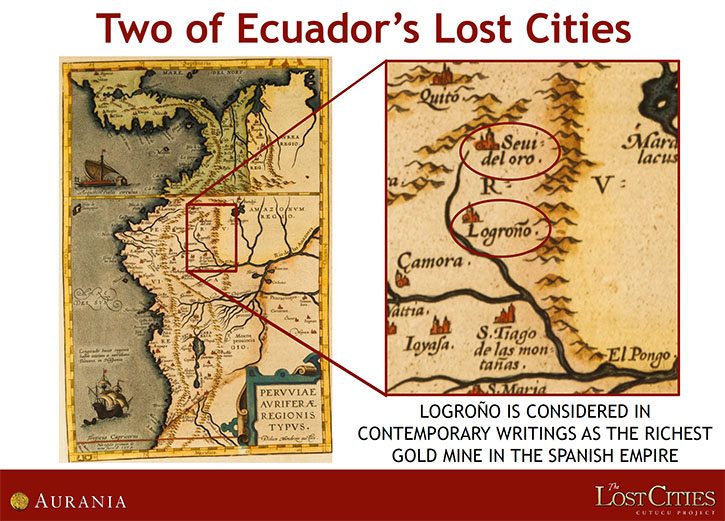

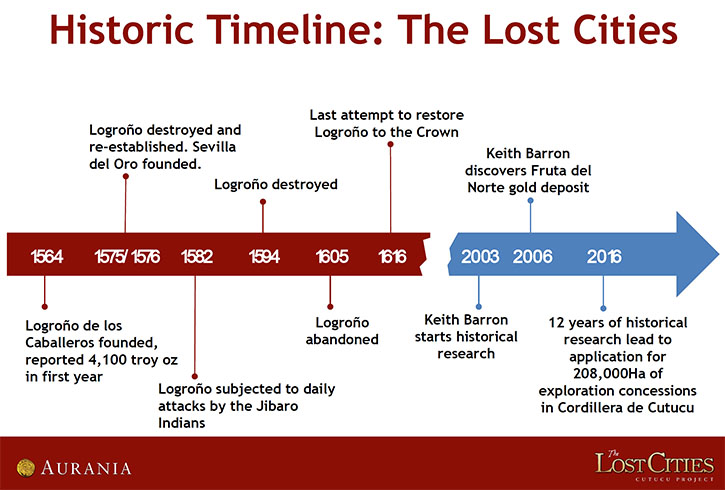

Dr. Richard Spencer: Certainly, Dr. Alper. The main project is in Ecuador. It's a grassroots project that's based on very extensive historical research that Dr. Keith Barron carried out over about 10 years, that followed up on Spanish records in the Vatican and throughout South America and in Spain. Records of gold cities, or gold-producing so-called cities, were probably just palisade forts, in fact. Two of them, we believe, are located in a mountainous area, called the Cutucu in southeastern Ecuador. One of the lost cities that was referred to in the Spanish literature, was found again in the early '80s. It was discovered by a couple of kids that were hunting, and it turned out to be a very rich gold deposit. That might indicate that the descriptions of the historic so-called cities were correct. That particular one was quite well located on the old maps that Keith Barron unearthed in the Vatican and other libraries.

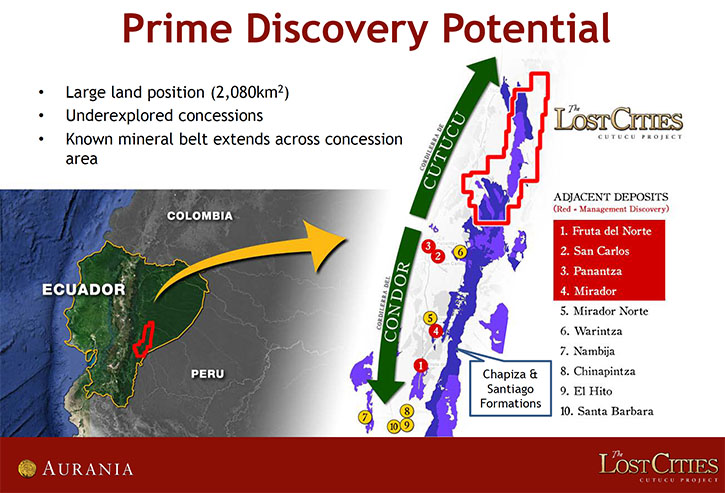

We believe that two of these lost cities, Logroño and Sevilla, are located in the Cordillera de Cutucu in southeastern Ecuador. Keith Barron took out an exploration license that covers an area of about 200,000 hectares, which is almost 500,000 acres. The concession covers the area where he believes these two locations are. In fact, it turns out that the concession area lies along trend of an area that both Keith and I explored in the '90s. Keith's team found the Fruta del Norte gold deposit, which is extremely rich, and the teams that I was involved with found some very big porphyry copper deposits in that same general area which is contiguous with Aurania's new concession application in the north.

So when Keith approached me about being involved with Aurania, I looked at the opportunity for a nanosecond before saying, "Yes, I would love to be involved," because I'm an exploration geologist and I approached it from a completely technical and exploration point of view, that we would be exploring an area that is the extension to an area that was explored in the '90s, and in which these very big discoveries were made. That area to the south of Aurania's concession package contains about 24 million ounces of gold and just over 30 billion pounds of copper, so it's an incredibly rich and well-endowed mineral province, and from a technical and geological point of view, I certainly believe that the Cordillera de Cutucu is simply an extension of that belt.

So we are looking for the lost cities from the historical records, but at the same time, we're doing standard exploration, which is very likely to identify not only the lost cities, or the mines that they were operating, but also new areas that actually weren't found by the Spanish, potentially new deposits. Basically that's a snapshot of what the company is doing. Aurania has been involved in that area for about a year now, and the exploration is proceeding extremely well.

Dr. Allen Alper: That sounds like an exciting, interesting, fascinating area to discover and work and explore. It must be a very enjoyable experience for you and your team. That sounds great.

Dr. Richard Spencer: It is. I'm privileged to be involved in it, I must say.

Dr. Allen Alper: That's excellent! Could you tell us a bit more about your plans for 2018?

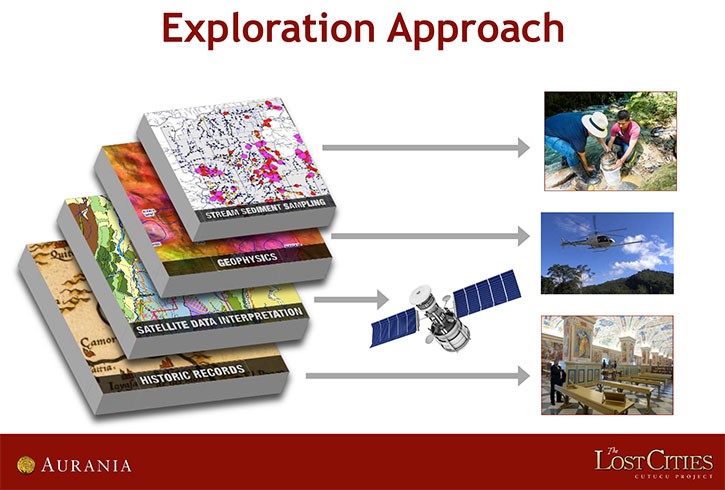

Dr. Richard Spencer: Yes. We flew a geophysics survey over the whole area, and the geophysics measures the magnetism of the rock. We did that based on the experience that both Keith and I had in the adjacent area to the south, where we realized that geophysics is a very effective method for identifying copper porphyry targets. It's very quick and relatively inexpensive to find those kinds of targets. The geophysics is less efficient in identifying epithermal gold targets. In that case, the geophysics would play a support role, with other methods being used to locate the first footprint of an epithermal gold area. In this case, the geophysics would come in later as a support method to refine that type of target.

So, we flew the geophysics and we've identified several targets. That was our first fundamental exploration step in the area. We have also implemented a stream sediment sampling program, which will eventually cover the entire 200,000 hectares. What that is, is a group of young, strong, motivated, fit geologists, who are working with a team of four people each. They basically walk up the streams and take sediment samples, silt samples, at regular intervals, and those silt samples are sent away for analysis.

The concept behind this very, very basic exploration is that the clay particles that are being washed down the streams are like little charged batteries. They have positive and negative charges on them, and any metals that are being washed into a stream from anywhere within the catchment of that stream would be captured by the little clay flakes. We collect those clay flakes and have them analyzed, and basically those results indicate what metals are enriched in that catchment. We then prioritize the streams for further exploration based on its concentration of gold, copper and/or pathfinder metals.

So, we're busy with that program and are currently working systematically through the whole area. Then once those reconnaissance geologists, the Rambo-types, have identified the streams that have an anomalous or higher than normal metal content, we send more experienced exploration teams into those areas to look for signs of gold, silver, and copper. After these teams have been in, we would typically do a soil sampling program, because the tropical soils are extremely efficient, they have a lot of clay in them, and they're very efficient at capturing those metal ions that are flowing through the soils in the water. By soil sampling, we can identify more or less where those metals are coming from and then, with a little bit of additional exploration work and geological work, we can normally define a drill target based on those soil results.

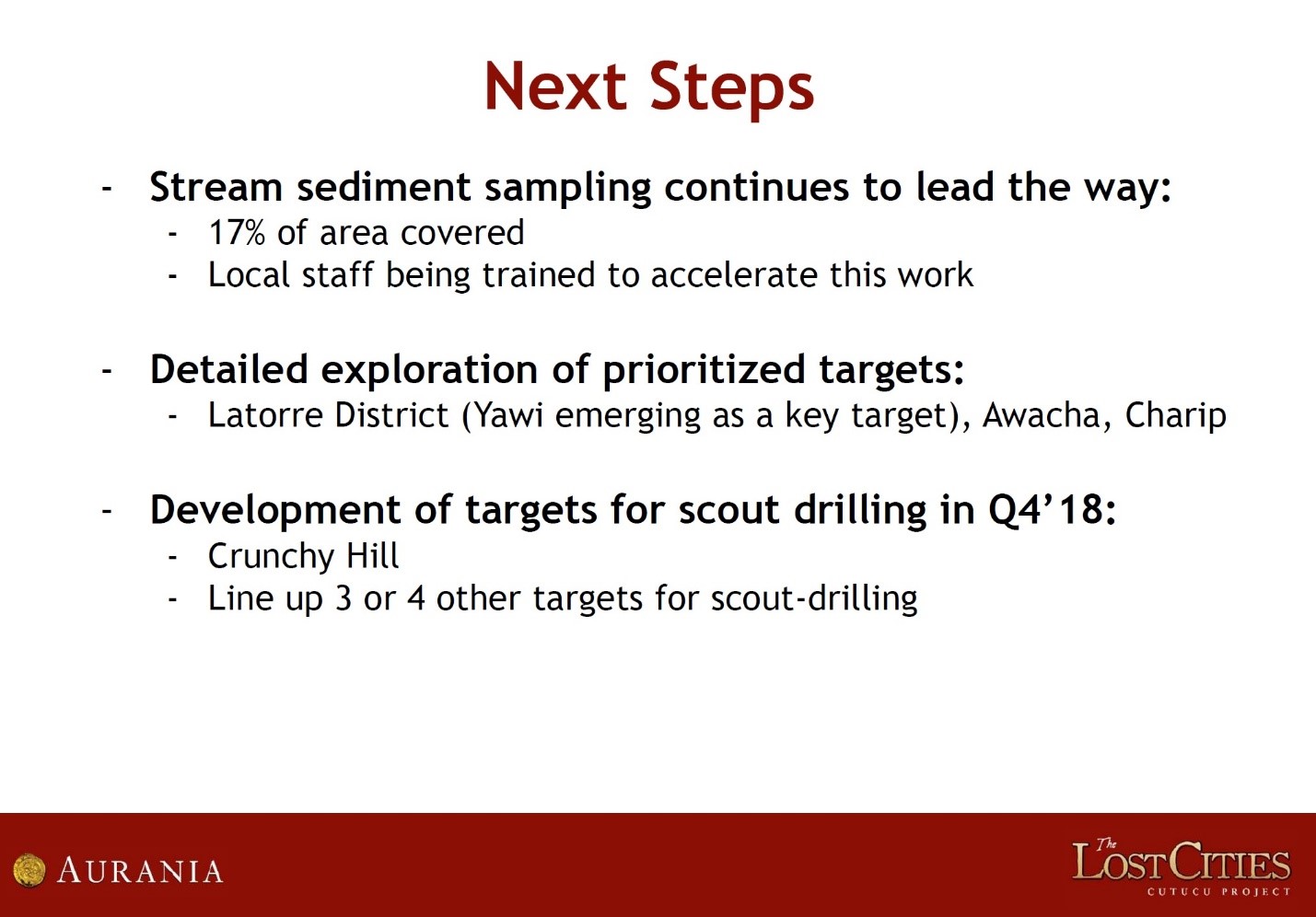

So, our plan is to have one group of people moving ahead doing the reconnaissance work with the stream sediment sampling, a second group of more experienced people doing the follow-up work that includes the soil sampling and the definition of the target, and then, ultimately, the drill rig would come in and we would do scout drilling, which basically just means that we would drill somewhere between three and seven holes of maybe 300 meters, 1,000 feet or so per hole, to identify where that source of metal in the soils is coming from. That would give us a very good idea as to whether we're dealing with a potential deposit or not.

We would plan to have the drill rig moving behind the advanced exploration, which is following the stream sediment sampling, so it's all a progression. We certainly plan to be drilling in the second half of the year in Q4, and ideally that drill rig would never leave the project. It would basically just move from one target that's been identified to the next, to the next, behind those other exploration teams. So that's the plan.

Dr. Allen Alper: That sounds like a very thoughtful and smart execution plan for exploration. Could you give our readers/investors an idea of your background, and your management team and board of directors? I can see they're all experienced and accomplished people, but could you tell us about yourself and Keith and the other members of the team and board?

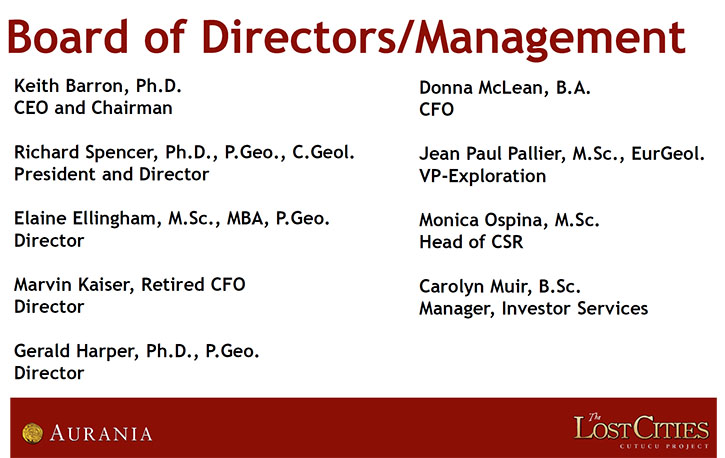

Dr. Richard Spencer: Absolutely. Keith Barron is the CEO and Chairman. He has a huge amount of experience and has a very big investor following because of having made the Fruta del Norte discovery, a very significant discovery of gold, in a similar area in Ecuador. He has a very strong board around him.

Elaine Ellingham is an exploration geologist, who has been involved in many companies, and very significantly involved in developing those companies into entities that eventually have been amalgamated with other companies. Her most recent foray, in that kind of situation, was with Richmont Mines, which late last year was acquired for a billion dollars by Alamos Gold. That's Elaine.

Then Gerald Harper is a very, very seasoned explorationist, with 50 years’ worth of experience in exploration, and has run numerous companies. At the moment he's involved in running a new zinc company.

Marvin Kaiser, who is US-based, has an enormous amount of experience in general. He's more on the financial side. He was involved with one of the big smelting companies in the US, and has just a huge amount of experience, particularly on the financial side.

Then I was involved in Ecuador, I lived there for 10 years, went there on a one year contract in 1994, and ended up staying until 2004. Our two sons were actually born in Ecuador. In the early days, I was involved with a South African company called Gencor that was doing gold exploration in the same area in the same sort of region where Keith was doing his exploration. We were actually looking for gold, and ended up identifying these very significant copper deposits, two of them are about 8 billion pounds each. We identified a whole chain of these copper deposits.

I left that company to join a Canadian-based gold company called IAMGOLD in '97. We made the discovery of the Quimsacocha epithermal gold deposit, also in Ecuador. That project's name has changed to Loma Larga. Then I was involved in Venezuela with Crystallex on the Las Cristinas deposit, which is an enormous gold deposit. We were able to increase the resources and reserves very significantly during that time.

Subsequently, I've been involved with a uranium and battery metals, exploration company, and then became involved with Aurania about a year ago. My whole life I've been an exploration geologist, as Keith has been as well, and we've both been very lucky in being able to be involved in the discovery of very significant deposits.

Dr. Allen Alper: Well, you definitely have an outstanding background. Keith has an outstanding background, and I see he was awarded the Thayer Lindsley Award, and all of you are well accomplished, and well recognized for what you have done in the past. So I could see why investors have great confidence in your team.

Dr. Richard Spencer: Thank you.

Dr. Allen Alper: Could you tell our readers/investors a little bit about your share structure?

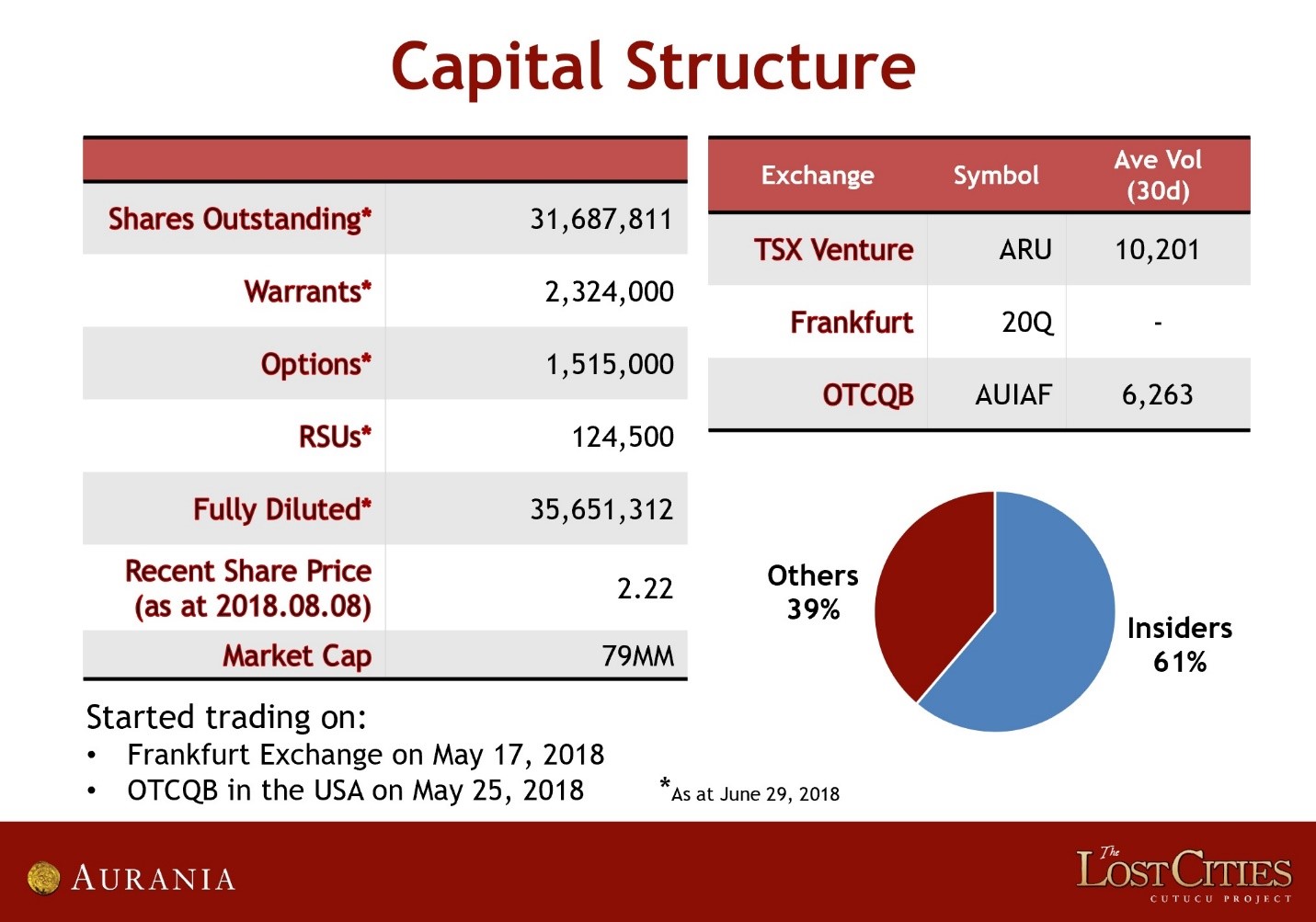

Dr. Richard Spencer: Yeah, the share structure is pretty tight. It's a nice, tight structure. We have a total of just over 31 million shares outstanding, and about 2.3 million warrants. We have about 1.5 million options, so fully diluted we're at about 36 million in total. The market cap of the company is sitting around 79 million at the moment.

That valuation can be seen as being a little high relative to some of our peers. However, there is very little question in my mind that this is not going to be a company that finds only a single deposit. I think we're looking at multiple deposits. I think our exploration has already shown the potential of the area for multiple targets, and I think the valuation is where it is because of people realizing that the potential of the company to make multiple discoveries is very strong.

Another significant factor is that Keith is very outspoken about the fact that Kinross not only acquired the Fruta del Norte deposit, but also acquired a land package of about 60,000 hectares, effectively rolled into the price of the deposit. The exploration that Keith's team had already done on that area had shown that it contained multiple targets apart from Fruta del Norte deposit. Lundin Gold bought the deposit and land package from Kinross – and Lundin Gold is developing the mine at Fruta del Norte. Lundin is doing what we believe is successful exploration on that land package, which they effectively got for free. Keith believes that the best value for our shareholders would be if we are in a situation of finding multiple projects, which I think we will be, rather than the company being taken over or sold in the future for one asset, we would try to make sure that we leverage the various assets, keeping some for advancement by Aurania, while others are joint ventured with other companies, while other targets are potentially spun off into other companies, a copper company for example, if we find significant copper targets.

So I think the valuation is where it is because people recognize the multi-target potential of this land package, and the fact that the company's attitude certainly is to maximize shareholder value by packaging up the individual properties and doing different business deals on each one or each cluster.

Dr. Allen Alper: That sounds excellent. That sounds like those are very excellent reasons for our high-net-worth readers/investors to consider investing in your company.

Dr. Richard Spencer: I think the other very significant factor in the share structure is that the insiders, board and management, actually own 60% of the company. Keith owns 51% himself. So there is absolutely no question that we have skin in the game, and we're absolutely aligned with our shareholders. Another significant point is that Keith does not draw a salary, so he is even more aligned, absolutely aligned, with the other shareholders.

Now, as we go forward and we do additional financings, equity-based financings to give us the cash to advance this enormous land package and do the drilling to establish these targets, and to establish the real value of the land package, the insider ownership will be diluted, and Keith's ownership will be diluted. But it still means that the insiders will have a very strong position in the company, and it means that no one is going to be able to come in and give us a low-ball offer. Any offer that comes in, in the future for any project, or for the company itself, is going to have to be a reasonable offer. Otherwise, it's just going to be turned away. That insider ownership is a huge factor that should be an attractive point for your high-net-worth readers/investors.

Dr. Allen Alper: That sounds excellent. I've interviewed Rob McEwen many, many times, and that's one thing that he stresses, that he doesn't draw a salary, and he has skin in the game, and he makes his money the way the investors make their money, by stock increasing. It sounds like Keith is positioned the same way, which will give our high-net-worth readers/investors confidence in your company.

Dr. Richard Spencer: Yes, exactly. Keith and Mr. McEwen have a similar point of view. He is a shareholder of the company.

Dr. Allen Alper: That's excellent. Is there anything else you'd like to add, Richard?

Dr. Richard Spencer: The exploration teams are very motivated, and they have stock options as well, so they are aligned with the shareholders too. It’s a very motivated team being led by Mr. J.P. Pallier, a French geologist, an outstanding geologist with good exploration history. Those guys are on the leading edge, and we're all dependent on them making the discoveries, and certainly they're doing an absolutely phenomenal job.

Dr. Allen Alper: That sounds excellent. Sounds like you have a very exciting company, exploring at the tip of the iceberg. You'll be a company that our readers and investors will want to watch every month and see how you're doing.

Dr. Richard Spencer: Great.

Dr. Allen Alper: It'll be an exciting journey.

http://www.aurania.com/

36 Toronto Street, Suite 1050

Toronto, Canada

M5C 2C5

Phone: (416) 367-3200

Fax: (416) 981-7811

Email: info@aurania.com

|

|