GoviEx Uranium Inc. (TSX-V: GXU; OTCQB: GVXXF): Focused on the Exploration and Development of Uranium Properties in Africa, Interview with Daniel Major, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/22/2018

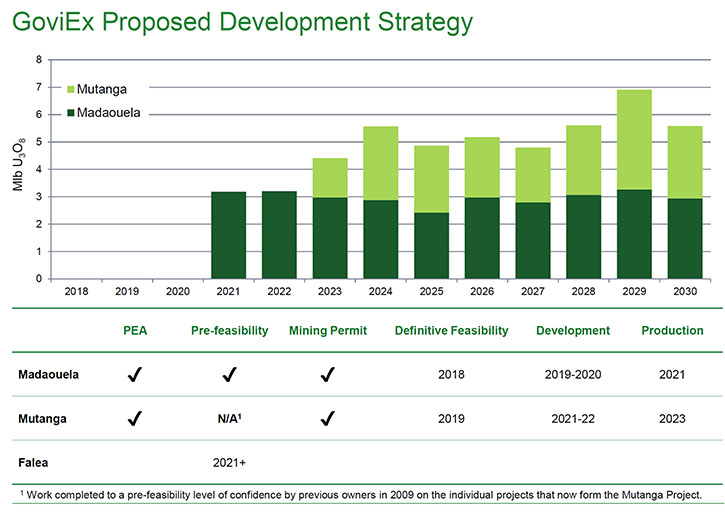

GoviEx Uranium Inc. (TSX-V: GXU; OTCQB: GVXXF) is a mineral resource company focused on the exploration and development of its uranium properties in Africa. The company's main assets are the mine-permitted Madaouela Project in Niger and the mine-permitted Mutanga Project in Zambia. We learned from Daniel Major, CEO of GoviEx Uranium, that with the two large, fully-permitted uranium projects and with the uranium market currently on the uptick, GoviEx has positioned itself to be able to make a transition from an exploration/development-stage company to being a producer-rated company, subject to a uranium price that supports the development of new mines. According to Mr. Major, there is currently a long-term trend of increasing demand for nuclear energy, with the construction of the new reactors in China and India, restarts in Japan, and steady retention in developed markets.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News talking with Daniel Major, who is CEO of GoviEx Uranium. Could you give our readers/investors an overview of your company, and tell them what differentiates GoviEx from other uranium companies?

Daniel Major: Certainly, Allen. GoviEx is an African-focused uranium exploration and development company. What differentiates us from our peers is the fact that we already have two of our projects fully permitted.

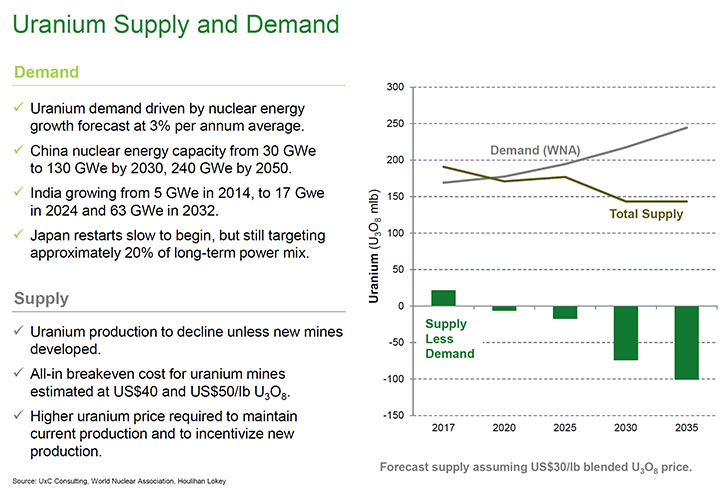

Looking at the overall uranium market, the long-term picture is one of increasing demand for nuclear energy and hence uranium, due to continued construction of reactors in China and India, reactor restarts in Japan, and steady retention of nuclear as a clean, cheap energy source in developed markets.

At the same time, we've seen a number of mine closures, particularly reductions in production from Kazakhstan, the closure of the Langer Heinrich mine, and more recently, the closure of the McArthur River mine. Cameco has committed to buying their contractual requirement in the spot market because it's cheaper to source it from the market than mine it themselves. Those factors are expected to have a very positive impact on the uranium market, in the short to medium term.

In the longer term, a number of large, historical, high-production mines are coming to the end of their reserve life and the expectation is that we will see further mine closures, thereby expanding the primary supply deficit. Current uranium prices do not support the development of new mines, and the uranium price is likely to increase.

Dr. Allen Alper: It's been a long, dry spell, but I'm glad to hear that the supply and demand for uranium has shifted.

Daniel Major: Yes – that's very important. We've seen a number of investment funds now committing to buying uranium as well, with Yellow Cake and Tribeca being two of the new entrants to the market.

Dr. Allen Alper: That's excellent.

Daniel Major: We have been preparing our projects so that we’re ready to take them into production when the market recovers.

This state of preparation is important from an investor point of view, because what you'll be seeing is a stock that benefits, not just because the uranium market is recovering, but also as we go into development of our projects. Expect to see a re-rate as we go from being an explorer/developer-rated company to being a producer-rated company.

Dr. Allen Alper: That sounds excellent. Do you have any idea on the timing of that?

Daniel Major: We're following a four-pronged strategy. The first step is to optimize the Madaouela project in Niger. We already have quotations from a number of consultancy companies, advising us on costing for the feasibility study. As soon as we have that costing secured, we'll announce who is going to finish the feasibility study on Madaouela.

At the same time, we've been working with the banks, and a number have expressed interest in helping with the debt financing of this project. We’ll be advancing those factors as the uranium market improves.

You're really going to see our changes going forward as the market improves. GoviEx will accelerate our project improvement and development.

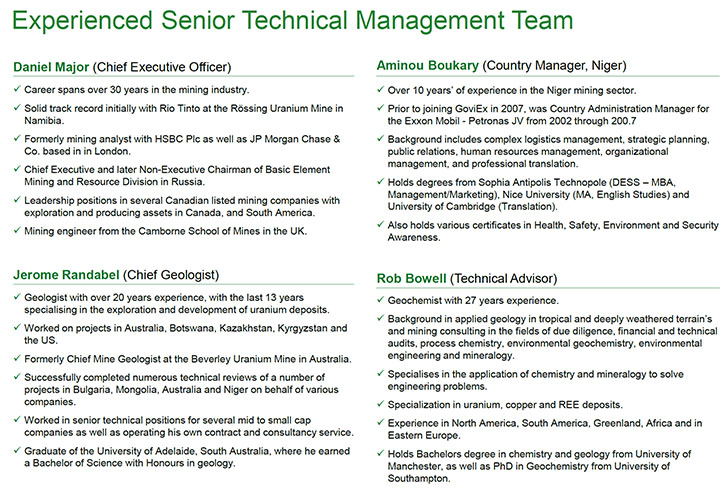

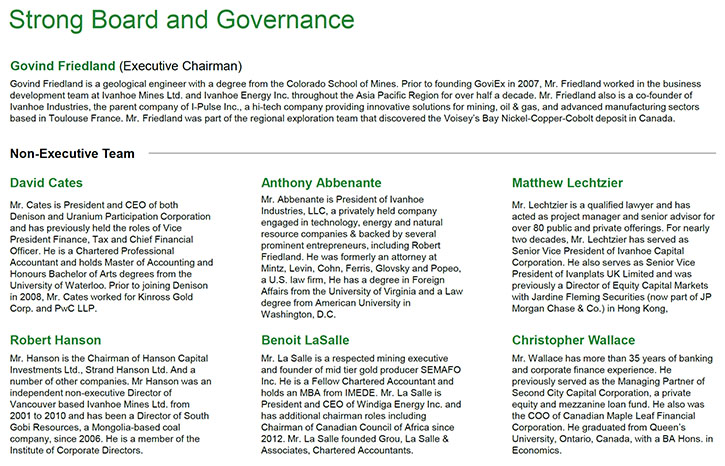

Dr. Allen Alper: That sounds excellent. Could you refresh the memory, for our readers/investors, on your background and your team and board?

Daniel Major: Yes, absolutely. My background is as a mining engineer. I've worked across Africa. I've also worked in South America, Canada, and Russia. I've worked in multiple commodities, and also have been in the capital markets, so I have experience in a whole range of different areas.

The GoviEx board has the required skills in capital markets, legal, debt, project development, and experience in West Africa. We have CEOs of major listed companies, both in mining and in the uranium sector, on our board.

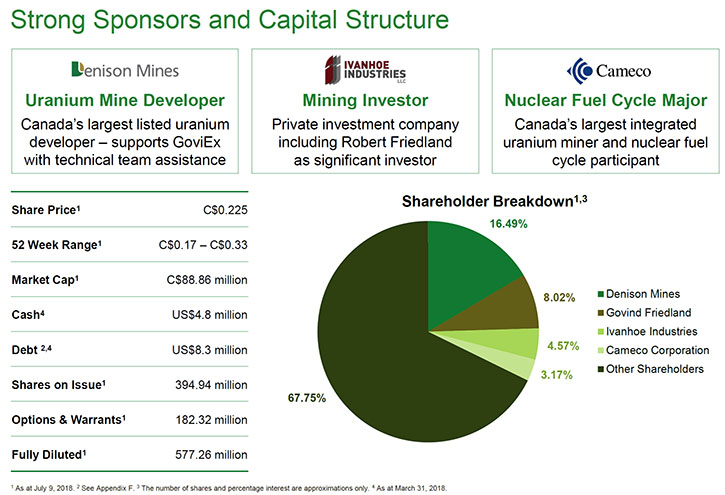

Dr. Allen Alper: That sounds excellent! Could you tell our readers/investors a little bit about your share structure?

Daniel Major: We have 394 million shares on issue. We removed the debt from our balance sheet recently when we bought out the debt that Toshiba had. We bought that debt at half face value, roughly, at the bottom of the uranium market.

At the same time, Toshiba sold their shares to a long-term investment fund supported by Medea. Medea is the group doing GoviEx’s debt financing.

We continue to have Cameco, Ivanhoe Industries, and Denison Mines as our key, strategic industry shareholders.

Dr. Allen Alper: Well, that's excellent. That's really good news for your investors.

Daniel Major: Yes, it is.

Dr. Allen Alper: Could you tell our readers/investors a little bit about operating in Africa?

Daniel Major: It's not that much different from operating anywhere else. No matter where you operate, many of the risks and skillsets required are very similar, and you have many of the same issues. One of the benefits of being in Africa is our ability to obtain project permits from pragmatic operating governments, which helps us move forward.

We are in countries that have long-standing mining histories and very sensible mining codes. That is one of the key positives that helps GoviEx now and into the future.

Dr. Allen Alper: That sounds excellent! What are the primary reasons our high-net-worth readers/investors should consider investing in GoviEx?

Daniel Major: We have a very large uranium resource of over 230 million pounds of uranium. We have a strong management team and board. We have a lot of exploration upside on our properties and we also have our permits. If you believe the uranium price is going to recover, then GoviEx is one of those companies that can not only see price appreciation with the rising uranium price, but that has the ability to go from being an explorer/developer to being a producer, which is very important. The difference in valuation potential between developers and producers is almost double – that is one of the big differences that sets GoviEx apart.

Dr. Allen Alper: That sounds excellent! Is there anything else you'd like to add, Daniel?

Daniel Major: Just thank you for your interest and the opportunity, Allen.

Dr. Allen Alper: Thank you. I always enjoy talking with you and hearing about all of your company’s successes.

http://www.GoviEx.com/

Govind Friedland, Executive Chairman

Daniel Major, Chief Executive Officer

+1-604-681-5529

info@GoviEx.com

|

|