Interview with Dave Cole, President and CEO, EMX Royalty Corporation (TSX-V: EMX; NYSE: EMX): A Successful, Diversified Portfolio of Royalties, Mineral Properties, and Investment Interests

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/11/2018

EMX Royalty Corporation (TSX-V: EMX; NYSE American: EMX) is well-positioned for growth, with ongoing revenue streams from royalty and pre-production payments, as well as an industry network with global connections. EMX Royalty is constantly searching for new opportunities. EMX's portfolio of royalties, mineral properties and investment interests, spans five continents. The portfolio is focused on gold, copper, and polymetallic assets. We learned from Dave Cole, President and CEO of EMX Royalty Corporation, that the Company utilizes a very powerful kind of project generator model. (a) Whereby they sell prospective mineral rights, which they've acquired and added value to through cost effective, early stage geological work. (b) Then they receive pre-production payments and retain a royalty interest as their partners advance the projects. In addition to these organically generated royalties, EMX also buys royalties and makes strategic investment in unrecognized opportunities. According to Mr. Cole, the Company has a first rate team that is uniquely qualified to execute the Company's diversified business model and build shareholder value.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Dave Cole, President and CEO of EMX Royalty Corporation. Dave, could you give our readers/investors an overview of your Company?

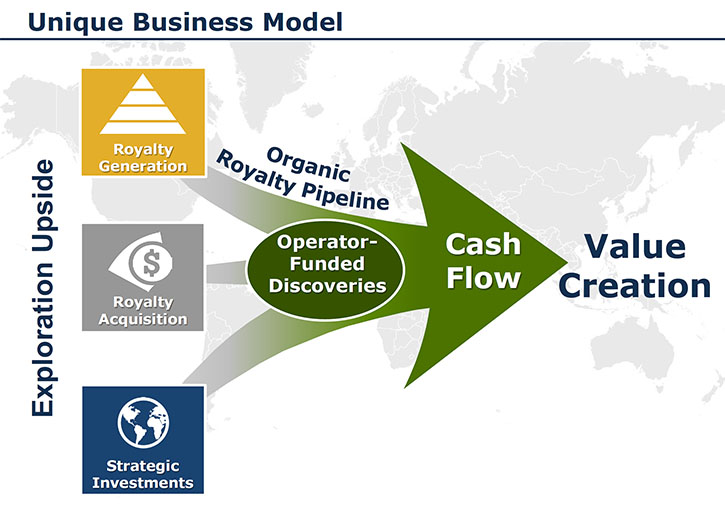

Dave Cole: Certainly Al, I would be happy to do so. It is always nice to have a chance to update you and your readers/investors on EMX Royalty Corporation. First, I want to describe our business model, which is key to understanding how we look at the mineral sector, and how we create value by leveraging our technical and business expertise. Specifically, I'm a huge fan of the prospect generation business model, where one acquires large tracts of prospective mineral rights and adds value by performing basic geological investigations, then seeks to sell and or joint venture those properties.

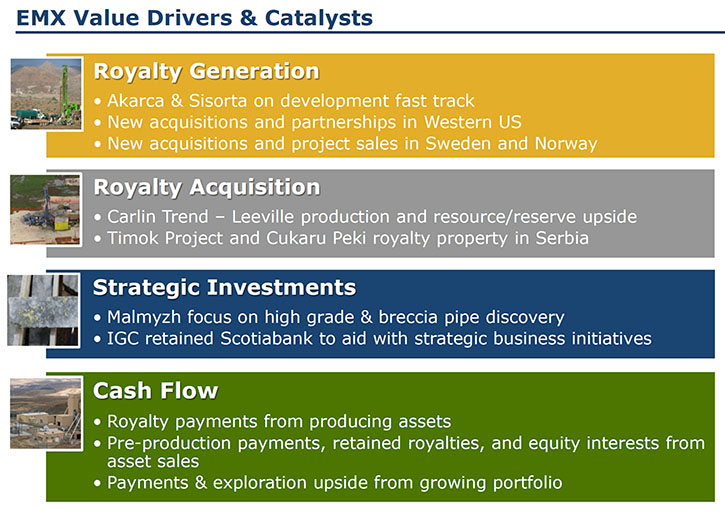

The unique way that EMX Royalty Corporation has chosen to execute this model is to sell the projects that we've acquired and maintain a royalty position in those properties. Typically we're selling our mineral projects for a combination of cash, shares, pre-production payments and work commitments over time, in addition to a production royalty. This is a very powerful aspect of our business model that we term 'royalty generation'.

To augment the royalties that we generate organically, through the prospect generation process, we also buy royalties. There are a couple of solid royalties in the portfolio that we've purchased, including the cash flowing Leeville royalty. The Leeville royalty property is operated by Newmont Mining Corporation, and covers portions of their underground mining operations in Nevada's northern Carlin Trend. I think the combination of organically generating royalties and buying royalties is very powerful.

The third aspect of our business model, Allen, is strategic investment. One of the more interesting and valuable assets we have in the portfolio is a strategic investment that we've made in a company that's advancing a very large copper and gold discovery in far south eastern Russia. The name of the project is Malmyzh, and the name of the company is IG Copper, also called IGC. EMX Royalty Corporation owns about 40 percent of the stock in that private company. We've announced that Scotia Bank is working with IGC to look at business endeavors to maximize the value of that project. Malmyzh is a key asset in the EMX portfolio.

However, I would be remiss if I did not emphasize that the most important assets that we have at EMX, are the people that have successfully executed the business model and generated value from our assets over the last 15 years. When we execute the three different aspects of the business model, the organic growth through royalty generation, the purchase of undervalued royalties, and strategic investments, that's all being done by the same team in a synergistic manner. So the team that's working around the world focusing on our bread and butter of prospect generation is also identifying, on occasion, the royalties that can be purchased, and on occasion, good strategic investments. I believe it's the combination of the three that's unique to EMX Royalty Corporation, and this provides our shareholders with some nice leverage and significant optionality from the portfolio as our assets are developed through our partners' investments.

Dr. Allen Alper: That sounds excellent. Could you tell us a little bit about the diversification you have of your assets?

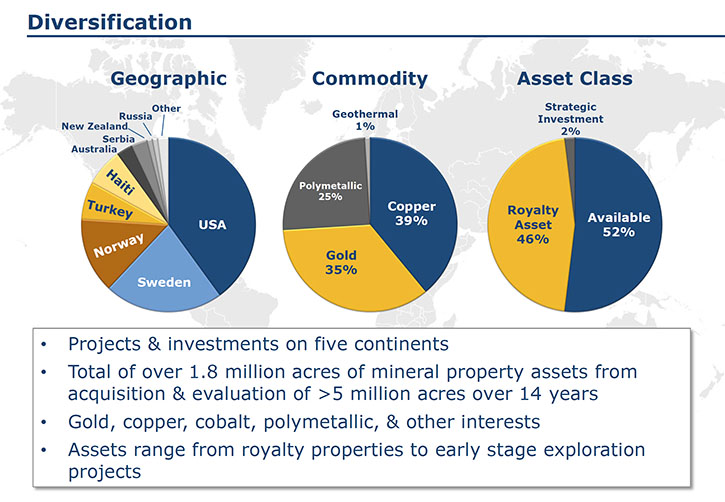

Dave Cole: I'd be happy to. Our business model lends itself to substantial diversification on a global scale, with assets throughout northern Europe, Serbia, Turkey, the western United States, and Russia, in addition to some projects in New Zealand and Australia. We have excellent geographic and commodity diversification. EMX continues to acquire prospective mineral rights, taking advantage of the cycles within the natural resource sector. We open up those opportunities in different regions of the world, where we can employ our geological talent to leverage into mineral real estate to control, and then sell the projects, where someone else is paying to advance those assets.

Our counterparties are putting the money in the ground, so this business model lends itself to diversification and it also lends itself to optionality for EMX shareholders. Much of the portfolio is being advanced by our partners, and it is to the partners' account that all the exploration work is being done. It is by design of the EMX business model paid by them, which leverages the opportunity for discovery across the portfolio. In regard to commodity interests, the portfolio is nicely allocated between copper and gold, as well as zinc, lead, silver, nickel, cobalt, etc.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about the executive leadership and advisors?

Dave Cole: Of course. As I mentioned, the most important resource that we have is our people. We seek to leverage that talent base to grow the portfolio and make astute business decisions on behalf of the shareholders. Michael Winn is the Chairman of the Board of Directors. He has a long history in the natural resources sector, and is someone who bridges the gap between knowledge of finance and knowledge of geology. He is a pleasure to work with. Michael has been involved with EMX since the very early stages of the Company's founding.

I am EMX's President and CEO. My educational background is a Bachelor’s degree in geology and a Master’s degree in economic geology. I worked for Newmont for 18 years before leaving to pursue my passion of value creation at the pointy end of the stick through the prospect generation process, which lead me to found the Company that ultimately became EMX Royalty Corporation.

I have had the pleasure of working with some phenomenal people. I have been fortunate in getting a number of them to join the EMX team, including Dr. Eric Jensen and Dr. David Johnson, both PhDs via the University of Arizona. We have some other PhDs out of the University of Arizona as well that create a fantastic tactical team. They have significant expertise in the structural geology of the western United States and an ever increasing knowledge of the geology of northern Europe. Those examples point out a couple of key regions where we have substantial geologic expertise. These gentlemen continue to develop their business acumen through executing our business model worldwide.

To augment our geological and business decision-making capabilities, we have Jan Steiert, our very, experienced and accomplished Chief Legal Officer. Jan was a previous President of the Rocky Mountain Mineral Law Foundation, and we're just delighted to have her as an in-house attorney. She helps us manage the multitude of different deals that we execute, and the commercial aspect of the projects that we have in the portfolio. We found it to be quite synergistic and efficient to have her as our Chief Legal Officer. That's worked out really well.

And then on the royalty purchase side, helping guide us to new royalty opportunities and understand the intricacies of building financial models to value assets, is Tom Mair. I worked with Tom for years at Newmont Mining Corporation, and he is the previous CEO of Golden Star Resources. We are pleased to have him as General Manager of Business Development. He augments the Company's team quite nicely.

Those are some of the key people in the Company. I'm humbled to have the opportunity to work with these folks.

Dr. Allen Alper: Very, very impressive group! Talented, experienced and accomplished! Could you highlight your partners and operators?

Dave Cole: Absolutely. We've been fortunate to be working with a whole host of quality companies in the last decade and a half. Right at the top of the list I would put Newmont Mining Corporation. They are operator of the Leeville Royalty property, and we are happy to get checks from them every month as they continue to produce gold from that property. We enjoy a one percent gross smelter return royalty on Leeville. Newmont is also a shareholder in the Company. They own more than five percent of outstanding shares in EMX Royalty Corporation. That goes back to three different placements they made into EMX, when we were involved in the joint venture with them in Haiti. We have a royalty on those properties, and it's great to have them as the counterparty on those. Haiti has been interesting, and hopefully, long term, it will turn out to be a productive investment for Newmont.

We've also had the pleasure of partnering with Kennecott, which is an exploration arm of the Rio Tinto Group. I believe we've executed six deals with them in the last three years, and it's great to have repeat business with a top tier company such as they are. We are building a rapport with them by being able to provide quality exploration projects, where they can earn 100 percent project equity, while in return we receive work commitments, pre-production payments, and a retained royalty interest. The projects that we've worked on with Kennecott are in Arizona's copper porphyry belts.

We just completed a deal with South32, which is a spin out group from BHP. They have earned in on our Riddarhyttan copper project in Sweden. We feel the project has some excellent geology, and we're very pleased to have the opportunity to work with South32 in advancing a potentially big, big system. South32 has been a very good company to work with. I hope we have the opportunity to work with them on additional properties.

We've been quite active in Scandinavia by acquiring exploration licenses covering a number of different commodities including; gold, copper, cobalt, nickel, lead, and zinc. Some of these assets have received quite a bit of industry interest. We sold a number of projects to new, start-up public companies where we receive shares, as well as cash and royalty interests. A great example is Boreal Metals. We're quite pleased with our share ownership in the Company and the projects that we've sold them. They've produced some nice lead-zinc-silver results from drilling at the Gumsberg royalty property. I believe there'll be more good results to come as the asset is advanced.

Selling projects for shares and a royalty interest is an aspect of our business model that we like a lot. We think it's a good way to have exposure to partner funded drilling and the exciting stages of discovery as well as a royalty in the eventual case of production. So EMX has a chance to win twice, and there are always a few incremental payments along the way built into our deals. I encourage folks to read our press releases and see the structure of the deals we've executed to understand how that's creating value for the EMX shareholder.

I should also mention that we have a substantial portfolio in Turkey and most of those assets have been sold. The companies that we've worked with in most cases have been local Turkish miners who continue to build their expertise and their financial wherewithal. We're pleased with the results from our Turkish partners as they advance the projects. Or course we are exposed to the upside via royalty interests.

There are a myriad of examples with other operating companies, Allen, but that gives you a feel of how we've executed the business model in building our royalty portfolio with quality partners.

Dr. Allen Alper: That sounds excellent. A fantastic job that you and your team are doing throughout the world and with many different commodities. That's excellent. Very incredible knowledge base that you all have and ability to negotiate, so that's really fantastic!

Dave Cole: I appreciate your support.

Dr. Allen Alper: You're welcome. Could you tell me a little bit about the committed ownership of your top shareholders and your capital structure?

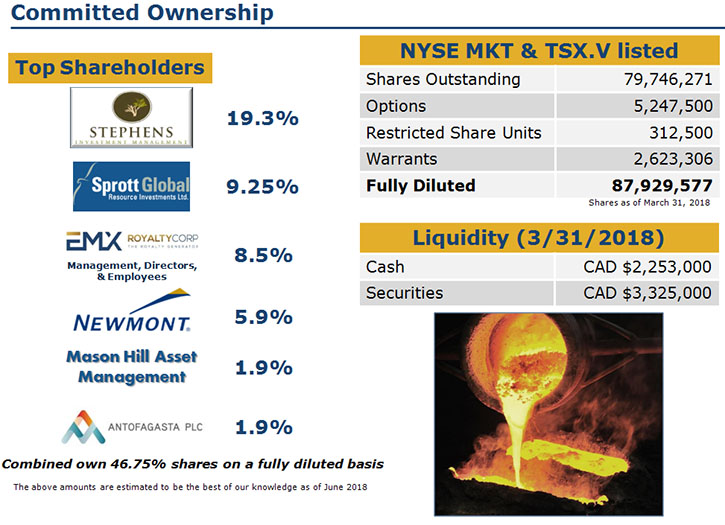

Dave Cole: Yes, I'd be happy to. The largest shareholder we have is an interesting story. That's Paul Stephens, who was part of the Robertson Stephens group of mutual funds. He's a friend and advocate from way back. He’s also a huge believer in the royalty and prospect generation business models. He became interested with what we were doing and started accumulating shares, mostly in the open market. Paul now owns approximately 19 percent of EMX Royalty Corporation. I speak with him regularly. He's also on our advisory board, and he's a nice spokesman for the Company. He is a good person to consult with about what's going on in the capital markets. He understands the long term potential of royalties, and what that means to shareholder value. We're very pleased to have him as a long term supporter.

Another long, term champion of the Company is Rick Rule and his client base. Rick has been with us from the very beginning and continues to be a strong backer. Rick is now with Sprott of course, and he's one of the top guys on the finance side of the mineral sector. We're always glad to have his endorsement.

As previously stated, Newmont Mining owns almost six percent. The large Chilean copper producer, Antofagasta is also a shareholder .Then the management and directors have around 8-9 percent combined. These shareholders give us a nice foundation of committed owners of the Company.

Dr. Allen Alper: That sounds excellent. That's really a great team of supporters and shows that management has skin in the game and confidence in the Company. So that's great. Could you tell us about your share structure?

Dave Cole: Certainly. Everyone can go to our website and look at the latest share structure at EMXRoyalty.com. On an outstanding basis, we have about 80 million shares issued. This is after having been in business for almost 15 years as a public company. On a fully diluted basis, we have approximately 88 million shares outstanding.

One of the ways we're able to keep our share count low, while raising the monies to build the Company, is of course through the execution of the prospect generation business model. The lion's share of the money that is spent on our properties comes from our counterparties. That's what creates the leverage that I mentioned. We are traded as a Tier 1 issuer on the TSX Venture exchange under the ticker symbol EMX, just like our name, EMX Royalty Corporation. We also have a listing on the NYSE American exchange, also under the ticker symbol EMX. We trade a modest amount in Germany also.

Dr. Allen Alper: Sounds excellent! What are the primary reasons our high-net-worth readers/investors should consider investing in EMX Royalty?

Dave Cole: I believe the primary reason why people invest in EMX Royalty Corporation is our unique, diversified business model and our top notch team. A number of different companies claim to be prospect generators, and are good at acquiring assets, but getting assets sold and building those into a royalty portfolio is the real measure.

We have a strong track record of executing the business model over the long term. If you look at the cumulative value across the portfolio, the cash flowing royalties, the projects that are under development, the share ownership in other companies, I think that you’ll see that we are indeed undervalued. I'll specifically highlight the Malmyzh copper-gold project that we have, through our share ownership in IGC, as a key asset within the portfolio that's not properly valued in our share price. In a world where commodities continue to come under pressure from increased demand, as economic activity across the globe continues to increase and people are looking for hard asset exposure, I think we look like an excellent candidate for investment.

Dr. Allen Alper: Well I definitely agree. You have a strong team, great knowledge of the world, where to explore, and what to purchase. You and your team have a network of backers and people who are excited about your projects. Well done!

Dave Cole: Thank you for your support, Allen. I appreciate that very much. I know you're an astute observer of the industry.

Dr. Allen Alper: You're very welcome. I have great respect for you and what you’ve created.

https://www.emxroyalty.com

David M. Cole

President and Chief Executive Officer

Phone: (303) 979-6666

Email: Dave@EMXRoyalty.com

|

|