Interview with Phillip Walford, President and CEO, Marathon Gold Corporation (TSX: MOZ): Developing the Largest Gold Project in Atlantic Canada

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/22/2018

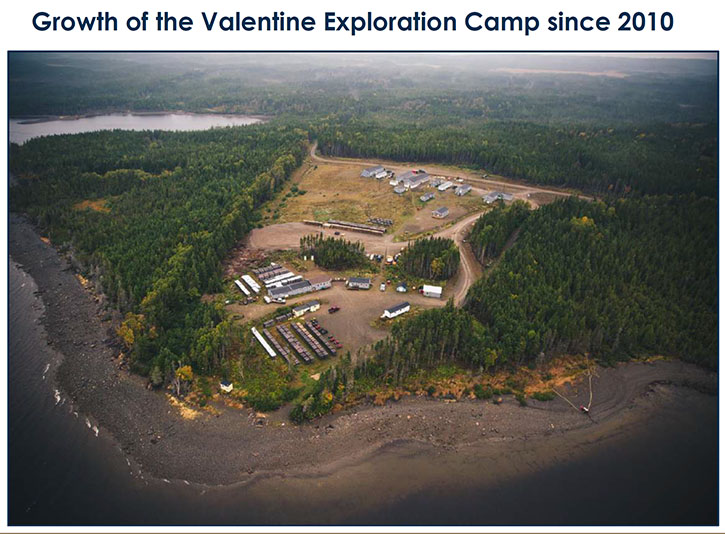

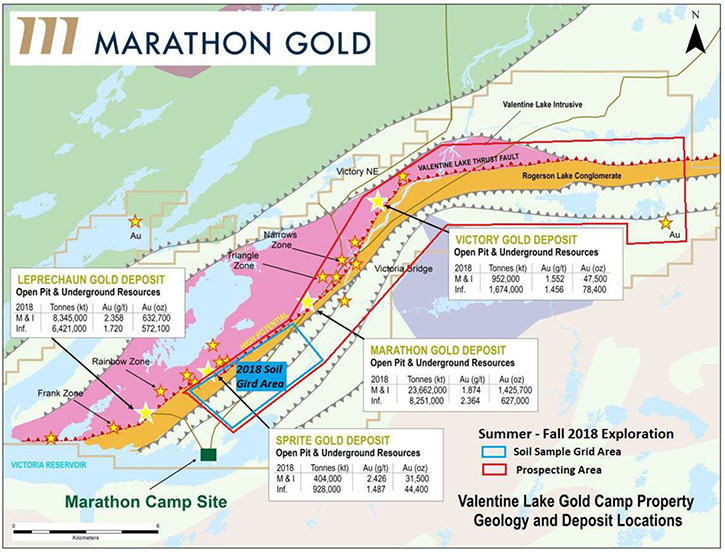

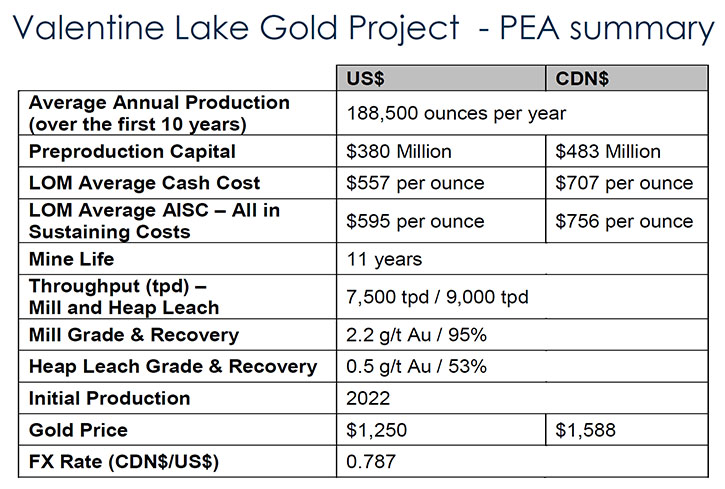

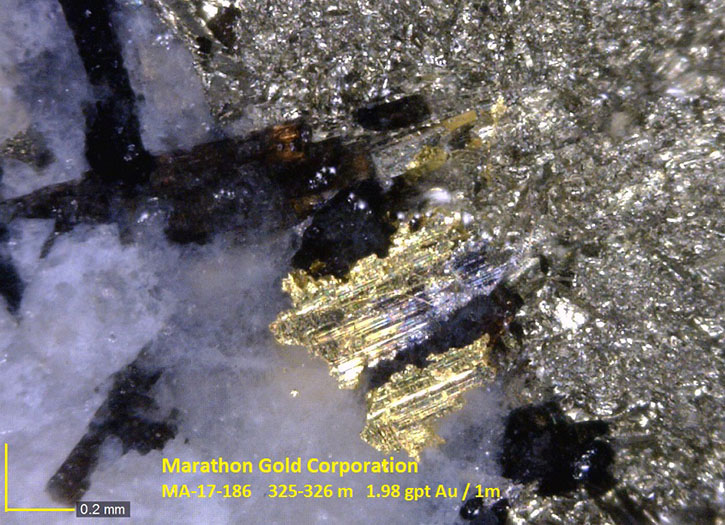

Marathon Gold Corporation (TSX: MOZ) is focused on their long-term goal of moving the 100% owned Valentine Lake Gold Camp through to production, in central Newfoundland. The Valentine Lake Gold Camp currently hosts four near-surface, mainly pit-shell constrained, deposits with measured and indicated resources, totaling 2,137,400 oz. of gold at 1.99 g/t and inferred resources totaling 1,104,700 oz. of gold at 1.99 g/t. Marathon recently completed a positive PEA that shows an average annual production of 188,500 ounces per year over the first 10 years, with an after-tax payback of 2.8 years, an after-tax NPV (5%) of $466 million and an after-tax IRR of 25%. We learned from Phillip Walford, President and CEO of Marathon Gold, that the conservative PEA demonstrated a very robust low-cost operation, with the cash cost roughly less than half the present gold price per ounce. Marathon’s 240 sq. km sized Valentine Lake property has multiple exploration targets to be explored in 2018.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Phillip Walford, President and CEO of Marathon Gold. Phillip, could you give our readers/investors an overview of your company?

Phillip Walford: Certainly. Our company owns the Valentine Lake Gold Camp in Central Newfoundland. This is something a little different. It's not different geologically from a lot of the gold deposits in Canada and the United States, but its location is a little different. I would call us fairly early explorers on a greenstone belt that received attention in the past for base metal deposits, but didn't receive a lot of attention for gold.

We now have over 3.3 million ounces of gold that have a grade of 2 grams. Most of that's open pit. Since last year, we've added a million ounces. We've also completed a very robust PEA that relies on open-pit material only, although we have almost a million ounces of potential underground material as well, on which we have to do more work.

This camp is 100% owned by us. Last fall there was a royalty on Precious Metal and Base, and we bought that royalty. We started out with 50% of this property, and now we have 100%. We also have the royalty taken care of, so we're moving right along. We don't have any strategic partners yet, although some people have made overtures to us and we'll certainly consider them, but we wanted to get the PEA out first before we made any of those considerations.

Dr. Allen Alper: Well, I looked over the PEA and it looks like it's a very robust, a very exciting PEA. Could you highlight the results of the PEA?

Phillip Walford: Certainly. Most of our resource is measured and indicated, but 30% of the open-pit resource is inferred, so we have a little bit of cleaning up to do on the inferred end. But the PEA demonstrates that we have a very robust margin here. Our cash cost is roughly, less than half the present gold price per ounce. We did everything at 1250 gold, and right now it's at 1300. One of our sensitivities is gold price, and we're very sensitive to increased gold price. So the numbers in our PEA are actually pretty conservative. What we see is a 10-year mine life, throwing off almost 200,000 ounces a year.

To me, as far as the resource goes, it's very similar to the Haile mine that OceanaGold has now in grade and in size.

Dr. Allen Alper: Excellent. Really fantastic results you're getting, and data and projection! Great! It's great to have such a large resource and such good projected costs for producing the gold, so that's really excellent.

Phillip Walford: In the year that's gone by, we've added a million ounces of gold, completed a robust PEA and our stock price is actually less than it was a year ago. That's largely because of the market. We have a total resource of 3.3 million ounces and our net present value, after tax, is about a half a billion Canadian. All of those indicate we should have a much larger share price. Also, we're probably one of the top projects in Canada, possibly even in the States right now, for open pit and with lots of blue skies.

It's going to be an exciting year. We truly are undervalued by any metrics, and I think it's a great opportunity to take advantage of that and buy some stock. I know I am.

Dr. Allen Alper: I think you're right. I think you've shown that you have a great property to-date and a huge resource, a low-cost open pit, so I think it sounds like a great opportunity. A lot of the experts are saying that it just might be the time now for gold to keep increasing and for things to be improving in the Junior market. What are your thoughts about that?

Phillip Walford: Well, I think we're into a growing metals market, where the resources; copper, zinc, and of course lithium, which is one of the flavors of the year, and cobalt are going up. I think we're going to see more attention being paid to the gold stocks because they're relatively undervalued, and in particular, the Junior stocks are very undervalued.

Dr. Allen Alper: That's true. That's true.

Phillip Walford: It's a bizarre situation that we're in, when the gold price is very good, but the Juniors in particular, are treating it like it's lower than it is. There's a huge gap and sooner or later it's going to be filled in, and I think that's an opportunity.

Dr. Allen Alper: I agree. There's a disconnect in the marketplace right now. A lot of the other metals like nickel, cobalt, lithium and zinc, etc. have seen increases and I think gold's turn is coming.

Phillip Walford: I'm certainly not going to disagree with you.

Dr. Allen Alper: Could you refresh the memories of our readers/investors on your background and experience and that of your management team?

Phillip Walford: Certainly. I'm a mining geologist. I have almost 50 years of experience. I started working as an underground mind geologist and eventually becoming Vice President of Geology for Lac Minerals and holding other senior positions in other companies, before going on to the Junior space, where I had a lot more fun. In my past, I've helped to construct some major gold mines and bring them into production, as part of the team. I've found, through the efforts of my mining team, a gold zinc deposit in Chile. We've also done a lot of resource expansion.

When I was with Lac Minerals, my mining team and I were adding a million ounces a year to the minerals reserves of that company. We were basically replacing and sometimes even growing the reserves with on-site explorations, so I've taken those skills and I've gone on. When I was at Geomaque, we put into production the San Francisco mine, which Alio Gold has now. When we got the property it was only a quarter of a million ounces, and then I brought that up to well over a million.

That's our skill. Another very important person, Sherry Dunsworth, our Senior VP Exploration, lives in Newfoundland and she's really connected to the Newfoundland people. We both work as a team, we both look at every drill hole, we plan every drill hole together, and that's why, as a team, our finding cost per new ounce is $10 Canadian. That also includes upgrading from inferred to measured indicated.

Dr. Allen Alper: That's excellent!

Phillip Walford: It is. We are constantly continuing to do it. Our total resource right now, 3.3 million ounces, is based on slightly less than 200,000 meters of drilling. So the more we drill, the more we find and the faster we find it. So it's really good. The other part of the team, too, like Sherry lives in Newfoundland. We also have Jim Kirk, who's our CFO. And Robert Borst is a mining engineer that's on contract right now, but will be joining us on a full-time basis to go forward with the preliminary feasibility. He managed the PEA and he did an excellent job of it. We're looking to job-size, to add more people to the team because we are pretty lean. We'll do that as we need to and not before.

Dr. Allen Alper: That sounds excellent. Could you say a few words about your board of directors?

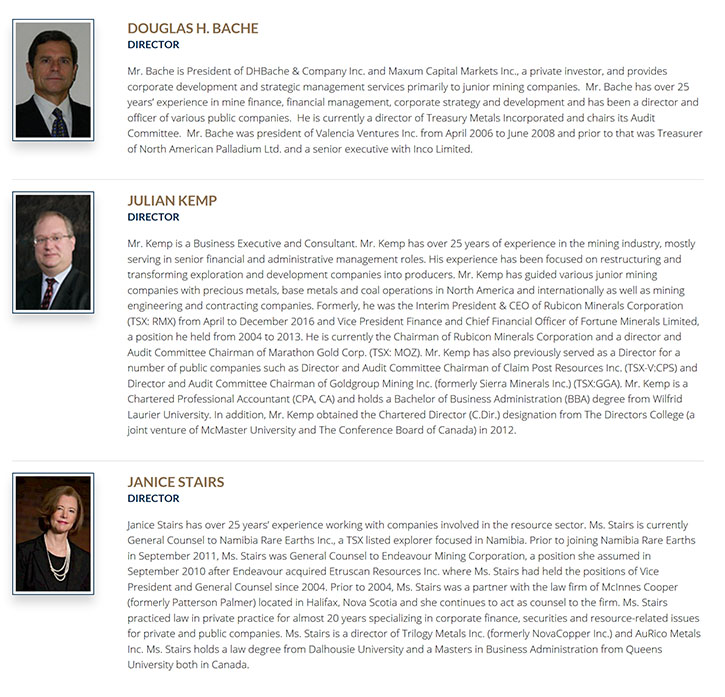

Phillip Walford: The Board of Directors is very experienced. They've all been involved in mining in one way or another. George Faught, the Chairman, a Chartered Professional Accountant (CPA, CA) with over 30 years of senior management experience, has worked for various mining companies, like I have, in one case, the same company: Hudson Bay Mining and Smelting. Mr. Faught is the Vice-Chairman of Aberdeen International Ltd., and previously the chief executive officer of Aberdeen International. Before that he was Vice President, Finance and Chief Financial Officer of North American Palladium Ltd. He has been Chief Financial Officer of publicly traded companies in the natural resource industry and has broad financial management, corporate development and operating experience and was a director of Marathon PGM Corporation.

Julian Kemp is a Business Executive and Consultant. Mr. Kemp has over 25 years of experience in the mining industry, mostly serving in senior financial and administrative management roles. His experience has been focused on restructuring and transforming exploration and development companies into producers. Mr. Kemp has guided various junior mining companies with precious metals, base metals and coal operations in North America and internationally as well as mining engineering and contracting companies. He's the chairman of Rubicon, and he's really done a great job, keeping that company alive, when it got into trouble.

We also have Mr. Joseph Spiteri, an independent mining consultant focused on advanced-stage exploration, feasibility, construction, operations management and acquisitions. Prior to that, Joe held executive positions with Placer Dome Incorporated, Northgate Explorations Limited, Lac Minerals Limited, and Campbell Resources Incorporated.

We have Doug Bache, who provides corporate development and strategic management services primarily to junior mining companies. Mr. Bache has over 25 years’ experience in mine finance, financial management, corporate strategy and development and has been a director and officer of various public companies. He is currently a director of Treasury Metals Incorporated and chairs its Audit Committee.

Janice Stairs has over 25 years’ experience working with companies involved in the resource sector. She is currently General Counsel to Namibia Rare Earths Inc., a TSX listed explorer. Previously, she was General Counsel to Endeavour Mining Corporation, after Endeavour acquired Etruscan Resources Inc. where Ms. Stairs had held the positions of Vice President and General Counsel since 2004. Prior to 2004, Ms. Stairs was a partner with the law firm of McInnes Cooper, in Halifax, Nova Scotia and she continues to act as counsel to the firm. She specializes in corporate finance, securities and resource-related issues for private and public companies and is a director of Trilogy Metals Inc. and AuRico Metals Inc. So that's our team, and certainly we're working well to move this project forward.

The chart of our Board below provides an account of our Board Members’ prestigious affiliations, important offices, extensive experience and reflects the esteem with which they are held in the industry.

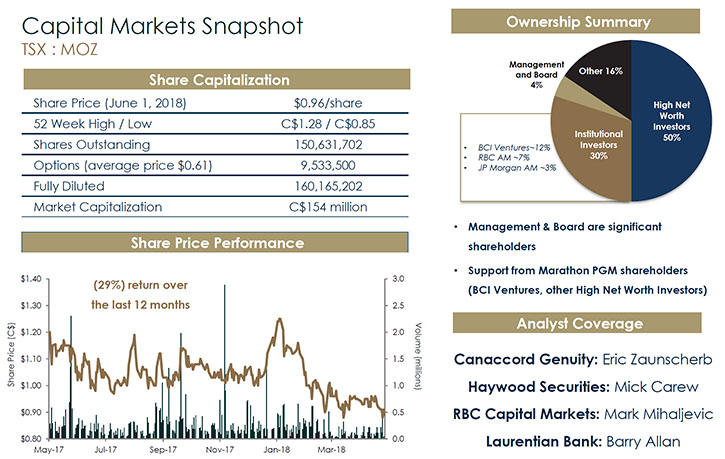

Dr. Allen Alper: Well, you have a great, experienced management team and Board. Well done! Could you tell our readers/investors a bit about your capital structure? Give us a capital market snapshot, your share, capitalization, etc.

Phillip Walford: We're trading around a dollar right now, which is, to me, much lower than it should be. But, the market's the market. We have a Canadian value of about 150 million. We have 160 million shares out full. What we're seeing is increasing analyst coverage. We have Canaccord, RBC, Haywood and now Laurentian, all covering us. We're really pleased that we have another group that's also interested in covering us as well, so it's really starting to click. As we go forward, I think we'll start seeing the benefits of the interest from these other people.

And there's another group, with a research report underway, for qualifying. A lot of these are reasonably large companies. RBC is very large. This is very good now. We're coming out of the pure exploration play and into pre-development and that's being recognized by larger institutions. We are becoming attractive.

Dr. Allen Alper: That sounds excellent. Who are your main shareholders?

Phillip Walford: Board and management has about 4%. I probably have half of that. I have slightly more than 4 million shares, most of which I've bought over the years, and I'm continuing to buy. We have one large shareholder, he has about 12% in his fund. We have other funds, all under 10%, so they're very difficult to identify. But we know roughly who they are. I'd say it's about probably 60% institution and the rest is retail.

Dr. Allen Alper: Well that sounds very good. What are the primary reasons our high-net-worth readers/investors should consider investing in Marathon Gold?

Phillip Walford: Well, I think there's our track record. We sold the previous company, Marathon PGM, for 100 million, to Stillwater Mines several years ago, and we're basically building up a new deposit. We have some high-net-worth individuals that are major shareholders, and they have a long-term view. They have faith in our team, and they know that we're going to do it. And we are doing it. We are finding lots of gold. We have a study showing us clearly that we have a high-profit margin operation potentially, so we plan to grow it.

But it is de-risked a lot and as we go forward even more so. If you go through any metrics you want for the PEA and resource and all of that, you'll see that we are very much underpriced. There's lots of room in there to profit in the next year or so, depending on the gold market etc. because there aren't a whole lot of deposits around like ours in Canada or the US that are attractive and in a very good mining jurisdiction. So anything can happen from now on, and I think it will be profitable for our shareholders.

Dr. Allen Alper: Sounds like excellent, compelling reasons for our high-net-worth investors to consider investing in Marathon Gold. Is there anything else you'd like to add, Phillip?

Phillip Walford: I think, like most of our shareholders, taking a year-long view of the stock, it's going to appreciate, and it's going to appreciate significantly, with the right gold market maybe even earlier. I think we'll start seeing our value as this metal market continues into the fall.

Dr. Allen Alper: Sounds excellent.

https://www.marathon-gold.com/

Phillip Walford

President and Chief Executive Officer

Tel: 1-416-987-0711

E-mail: pwalford@marathon-gold.com

|

|