Avesoro Resources Inc. (TSX: ASO, AIM: ASO): A Growing Low Cost West African Gold Producer, Interview with Nick Smith, Corporate Communications and Investor Relations

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/10/2018

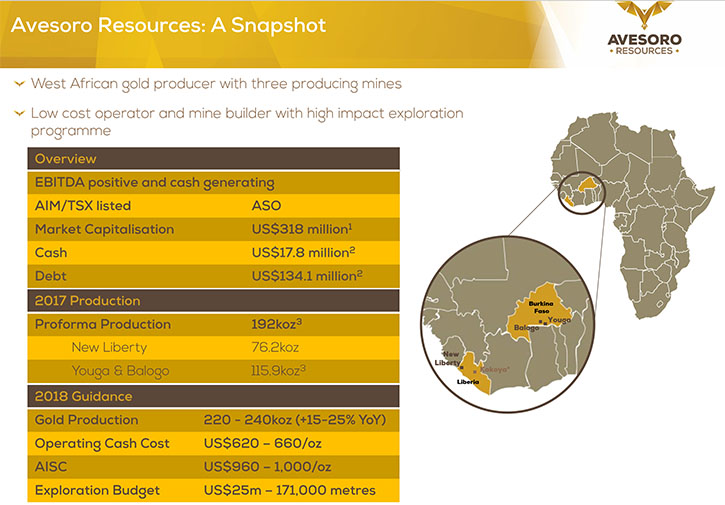

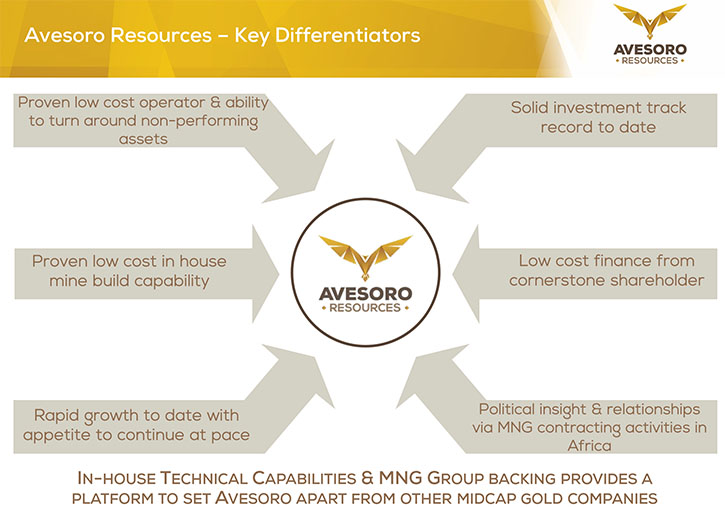

Avesoro Resources Inc. (TSX: ASO, AIM: ASO) is engaged in the exploration and development of gold deposits in highly prospective and under-explored areas of Liberia, Burkina Faso and Cameroon. The company’s vision is to become a premier, mid-tier, West African gold producer and developer. It plans to achieve this in two ways. First, by focusing on resource definition and conversion to expand Mineral Reserves and extend the mine lives at New Liberty, Youga and Balogo, whilst increasing production and significantly improving free cash flow. Further growth will be achieved through maximizing upside potential at their operating mines and through opportunistic and accretive M&A activity. We learned from Nick Smith, Corporate Communications and Investor Relations Manager for Avesoro Resources, that the company's current market cap is just over 300 million dollars and they have three mines, two in the Burkina Faso, and one in Liberia. This year's gold production forecast is 220,000-240,000 ounces. We learned from Mr. Smith that Avesoro is delivering operational improvements and optimized the processing plant to reduce cost and increase production, at the New Liberty Gold Mine, acquired back in July 2016, as well as at the Youga mine. Plans for 2018 include a significant 171,000 meter diamond drilling program to increase their reserve bases and the lives of the mines.

Avesoro Resources Gold Pour

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Nick Smith, Corporate Communications and Investor Relations Manager for Avesoro Resources. Could you give our readers/investors an overview of your company, your focus and current activities?

Mr. Nick Smith: Sure. We're an AIM and TSX listed gold mining company engaged in the exploration,development and production of gold deposits in highly prospective and under-explored areas. We are currently operating in Liberia, Burkina Faso and Cameroon. We have a current market cap of just over 300 million dollars and we have three mines. Two of these mines are in the Burkina Faso, that's the Youga Gold Mine and the Balogo Gold Mine. Our third mine is in Liberia, that's New Liberty Gold Mine and this year we have a gold production goal of 220,000-240,000 ounces.

Dr. Allen Alper: That sounds great. I know your company has reduced cost and increased production. Could you tell our readers/investors a bit about that?

Mr. Nick Smith: Our first initiative is the New Liberty Gold Mine - Liberia’s First and largest commercial gold mine. We came into that asset in July 2016. The asset was built by a company called Aureus Mining and they fell into some financial difficulty. We came in with a 30 million dollar investment to begin with, that gave us 55% of the company. We followed that up with a further 60 million dollar investment, as part of a 76 million dollar fundraise. The majority of the second investment went to buy out the mining contract. The company had a hybrid mining contract with a very high fixed cost base. We saw that as the biggest challenge that the company was facing. The first thing we did, when we took control of the company was cancel that contract and bring the mining fleet in house. That has reduced mining cost from approximately five dollars a ton, down to around two dollars a ton, so significant saving there.

The New Liberty asset is also quite a high strip asset. The life of mine and strip ratio is close to 20 to 1, so reducing the mining cost saves significant money over the life of the mine.

The second thing that we've done to reduce cost is optimize the process plant. The process plant wasn't working correctly when we took control of the company. The reason for that was the previous company didn't have the funds to complete the build as per the original design and started operations without totally completing the process plant. We spent around 2.5 million dollars on the process plant. We added items such as a third crusher, so a tertiary crusher, a second gravity concentrator, an additional oxygen plant. These are fairly low-cost items in the scheme of things, but they make the plant run a lot more efficiently and have allowed us to pretty much half our processing cost from around $40/ton mark to around $20/ton, so significant savings there.

In Burkina Faso, we purchased the Youga Gold Mine from Endeavour Mining. The first thing we did, when we came into that project, was look at the mining contract. It was a mining contractor, their costs weren't quite as bad as in Liberia. The costs were around four to five dollars a ton, but we canceled that contract and processed from the stock pile for six months, while we purchased our own mining fleet, brought the control of the mining in house. Now we're mining in Youga for less than two dollars a ton, so significant savings there.

We've also increased production at Youga by blending the ore at Youga, which is around the 1.8-2 grams a ton with very high-grade ore from our Balogo Gold Mine. The average mined grade today has been 18 grams per tons, so blending the ore from Balogo at Youga has really helped to increase gold production at Youga.

Dr. Allen Alper: Well, your board and your new team have done an excellent job lowering costs, and increasing production. What are your plans for 2018?

Mr. Nick Smith: 2017 was focused on optimizing the business and reorganizing ourselves. In 2018, we recognized that our mine lives are fairly short. We have a mine life of nine years in Burkina Faso and a mine life of 4.5 years in Liberia. This year, we have a 171,000 meter diamond drilling exploration program, which we think is one of the largest in West Africa. That should increase our reserve bases and increase the mine lives.

Dr. Allen Alper: Well that sounds like an excellent program of exploration to increase your resources. That's excellent. Could you tell me a little bit about your board and your team and yourself?

Mr. Nick Smith: Sure. Our chairman, the company's founder, is a gentleman called Mehmet Nazif Günal, (Mr. MNG). He founded the MNG Group in 1970, as a large construction conglomerate. The MNG Group does quite a lot of large scale construction projects across Africa and the Middle East. In 2013, he decided he wanted to get into gold mining. He hired our CEO, Serhan Umurhan, formerly the Technical General Manager at Koza Gold, Turkey's largest gold producer, where he built three gold mines, two CIL mines, and one Heap Leach mine. In 2013, he was hired and asked to create a gold portfolio and that is what he's done.

The first project that he bought was a small project in Liberia called Kokoya. The CEO of Kokoya was called Geoff Eyre and Geoff joined Avesoro as the CFO once the project was purchased. Geoff has been operating in Liberia for over 10 years, so we have a very experienced management team.

Dr. Allen Alper: How about your background, Nick?

Mr. Nick Smith: I worked in engineering for a time, for a multi-disciplinary engineering consultancy, and then I moved to join Avesoro. I moved across from the technical side to investor relations and managing the company’s relationships with shareholders and institutions.

Dr. Allen Alper: That sounds very good. Could you tell me a little bit about your share structure?

Mr. Nick Smith: We are listed on both the TSX and AIM market. The majority of our shares are traded on the AIM market. Current share price is about £2.65 at the moment, and the share price is up about 50% year to date.

Dr. Allen Alper: Okay, well that sounds very good. What are the primary reasons our high-net-worth readers/investors should consider investing in Avesoro Resources Inc.?

Mr. Nick Smith: We consider Avesoro Resource’s to be currently undervalued. We are currently the seventh largest gold producer listed in London and know that there's a lot of value in the share price that hasn't come out yet. I think that's starting to be recognized. The share price is up quite a lot this year, however the Company has actually near doubled in size the last six months. Gold production for 2017 was 76,000 ounces from the New Liberty asset. On the 18th of December 2017 we purchased the Youga and Balogo Gold Mines and brought them into the public group. That's transformed us from a 76,000 ounce a year producer to forecasting a 2018 gold production of 220,000-240,000 ounces, so a significant jump in a very few months.

The share price has really started to pick up in the last month or so. The reason behind that is at beginning of April we released our first quarter results which were very positive. In the first quarter of this year, the company produced 68,000 ounces of gold, so very close to the 2017 full year's gold production. The New Liberty asset, we came into last year, had record production. I think the turn around there is now complete and the Youga Gold Mine had its best quarterly production in the 10 years that it has been operational. We also recently released a Mineral Reserve upgrade for the Youga Gold Mine, adding 29% to the Mineral Reserve, brining the total reserve to 660koz gold.

We're a growing company. We aim to have production guidance of 500,000 ounces per year in the next three years. We plan to do that through both organic growth and M&A.

Dr. Allen Alper: Well, that sounds very good. How is it operating in West Africa?

Mr. Nick Smith: We're comfortable working in West Africa. The team has operated in West Africa for a long time. Our largest shareholder and Chairman, Mr. MNG operates across Africa, so we have the political insight of the MNG Group and also their purchasing power, so we enjoy working in West Africa.

Dr. Allen Alper: That sounds very good. Is there anything else you'd like to add?

Mr. Nick Smith: We have a very large exploration program this year. We're pretty confident that the output of this exploration program will allow us to double our resources in Liberia, and add another 50 percent to those in Burkina Faso. During the third quarter of the year we will provide an update on the New Liberty Resource and Reserves as well.

Dr. Allen Alper: That sounds excellent!

https://avesoro.com/

Avesoro Resources Inc.

Geoff Eyre / Nick Smith

Tel: +44(0) 20 3874 4740

|

|