Ian Ball, President/CEO of Abitibi Royalties Inc. (TSX-V: RZZ): A Growing Royalty Company with Three Percent Royalty on the eastern part of Canada's Largest Gold Mine, the Canadian Malartic Mine, Operated by Agnico Eagle and Yamana Gold

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/17/2017

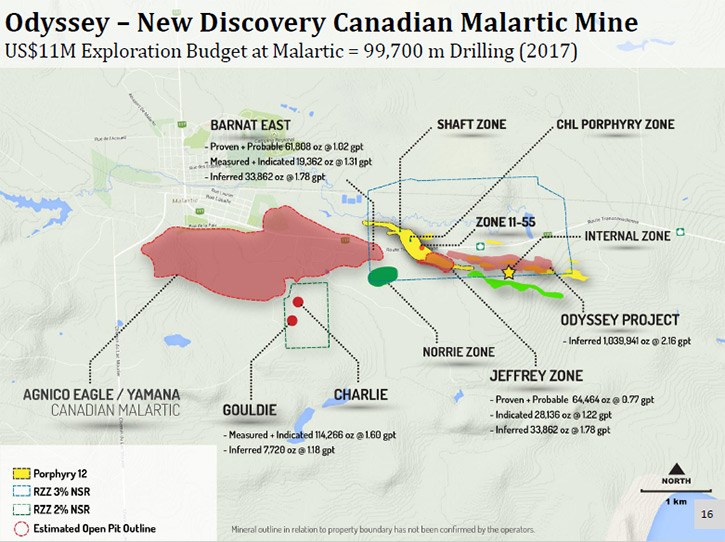

We learned from Ian Ball, President/CEO of Abitibi Royalties Inc. (TSX-V: RZZ) that his company is focused on

the royalties space. Their main asset is a three percent royalty on the eastern part of the Canadian Malartic

Mine, which is operated by Agnico Eagle and Yamana Gold in the province of Quebec and is Canada's largest gold

mine. The areas where Abitibi Royalties has a royalty are set to begin production starting next year. According to

Mr. Ball, they expect that the royalty income will start to increase from 2018 into 2019, with the biggest asset

called Odyssey - currently in the exploration phase - showing some very impressive drill results and continuing to

be the key driver for the company's shareholders.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mr. Ian Ball,

President/CEO of Abitibi Royalties Inc. Ian could you update our readers/investors, give them an overview of your

company, your mission, and what differentiates your company from other companies?

Mr. Ian Ball: Sure. I would be happy to. Abitibi Royalties is a company focused on the royalties space.

Its main asset is a three percent royalty on the eastern part of the Canadian Malartic Mine, which is operated by

Agnico Eagle and Yamana Gold in the province of Quebec and is Canada's largest gold mine. The areas where we have

a royalty are set to begin production starting next year. We expect the royalty income will start to increase from

2018 into 2019, with the biggest asset that we have currently in the exploration phase at that mine, called

Odyssey North. We're seeing a lot of growth activity currently on that project and some very impressive drill

results. We expect Odyssey North to continue to be the key driver for our shareholders.

Dr. Allen Alper: Sounds excellent! Could you tell our readers/investors a bit more about that royalty and

why it's so important?

Mr. Ian Ball: Certainly. This is the largest gold mine in Canada, a big operation, which has proven to

have big discoveries in the past. This royalty covers the newest discovery at that mine called Odyssey. They

continue to make new discoveries there, occurring almost on a quarterly basis now. In addition to Odyssey, there's

another historical zone known as the East Malartic Mine, which is below the open pit where the 600,000 ounces of

gold is being mined by the operators annually. We think that area, based on historical production and drill

results, has some excellent potential. Drilling has just begun on that area.

Dr. Allen Alper: Sounds great! Could you tell us a bit about some of the other royalties you have

negotiated?

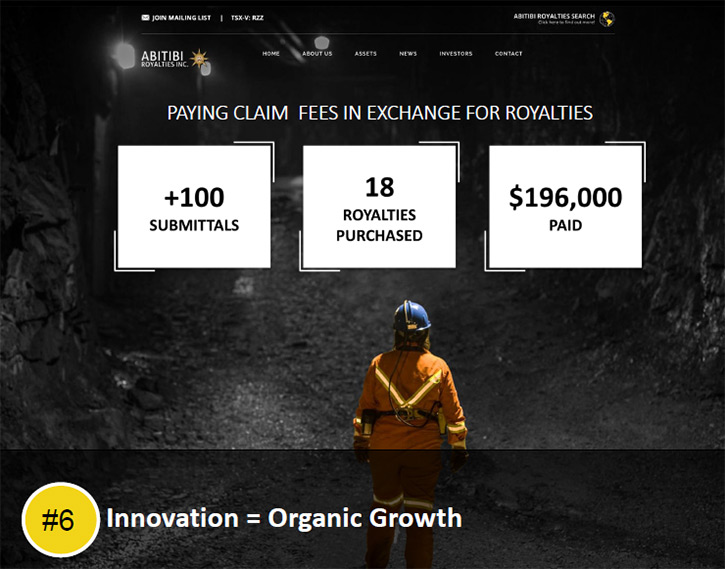

Mr. Ian Ball: We started the Abitibi Royalty Search, which is an online platform that allows prospectors

and other junior mining companies to submit their properties. If they're new and existing mines, if they have

signs of gold mineralization and good geology, and if they find that they're in need of funding, we will pay the

property taxes so those properties stay in good standing. We had about 130 online submissions and we've completed

approximately 18 transactions to-date. They are early stage properties, but they are all surrounding a number of

major mines mostly in Canada.

Dr. Allen Alper: That sounds great. Any fairly notables that you would like to point out as examples?

Mr. Ian Ball: In Canada, we have royalties around New Gold’s Rainy River mine in Ontario, around Hudbay

777 mine in Manitoba, around Alamos Gold’s Young Davidson Mine also in Ontario. And then the only royalty we

purchased outside of Canada was around one of Eldorado's mines in Turkey.

Dr. Allen Alper: Sounds excellent! Could you tell our readers/investors what your plans are for the rest of

2017 going into 2018?

Mr. Ian Ball: We are expecting to get an exploration update on Odyssey, as well as the surrounding

areas, where we have a royalty at Canadian Malartic. We don't have any definitive time frames on that, but the

operators have been drilling approximately 25,000 meters per quarter, and they have indicated that good

mineralization is being encountered. But we have not yet received any quantitative assays to determine just how

good the drilling has been. We expect an exploration update on that. Two areas at the mine, where we have a

royalty, just received their permits. That's where we're expecting to see royalty cash flow beginning next year.

That would be a second catalyst to build our cash flow.

Dr. Allen Alper: Sounds excellent. Could you tell our readers/investors a bit about your share structure?

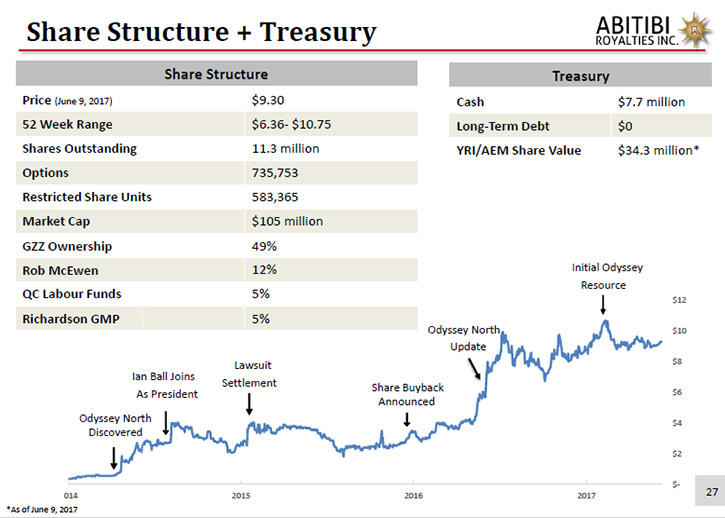

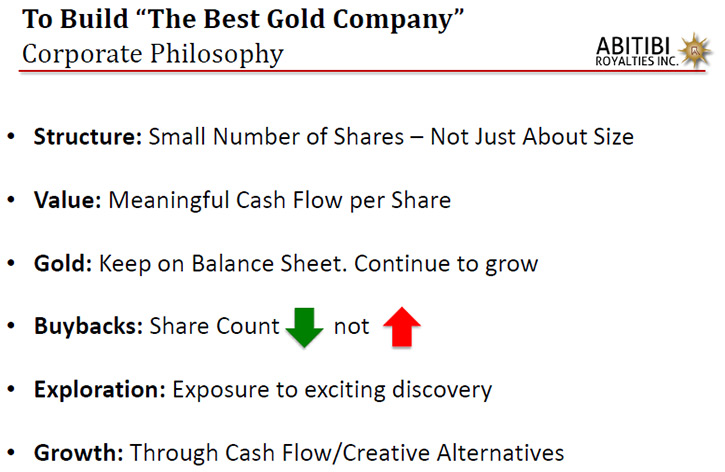

Mr. Ian Ball: Currently, there are 11.4 million shares outstanding. There has never been a rollback in

the company. Basically, the number of shares is very similar to what the company started with. We are opposed to

issuing stock. The company has been buying back shares. We expect that's going to continue for the foreseeable

future. Unlike most junior mining companies, our share count will decrease not increase. I think that's one of our

benefits. In most exploration companies, in which you invest, the share account can go up quite rapidly. That's

not the case with our company. We’ve had very good restraint on issuing shares, in fact, it's gone down.

Dr. Allen Alper: Well done. Could you tell us about some of the significant shareholders?

Mr. Ian Ball: The largest shareholder in the company is Golden Valley Mines. Abitibi was spun out of

Golden Valley in 2011. The second largest shareholder is Rob McEwen, who owns just over twelve percent. He

invested approximately 4-1/2 million dollars into the company. He made an investment on two separate occasions.

The third is a financial advisor, with Richardson GMP out of Toronto. His clients own approximately 6%. The

management team holds approximately 5%, and the Quebec Labor Fund also owns about 5% of the company. So there're a

number of large shareholders who make up a good portion of the outstanding shares.

Dr. Allen Alper: That sounds excellent. Could you refresh the memories of our readers/ investors, and tell

us about your background?

Mr. Ian Ball: I began working at Goldcorp back in 2003 and then that company was merged with Wheaton

River. I then joined what became McEwen Mining with the core responsibility of running the exploration program

initially in Mexico, where we were successful making a reasonable sized silver discovery. Then I was moved over to

the operations side to construct a mine in Mexico and then, based on that, was promoted to President of McEwen

Mining, overseeing all facets of exploration and construction and production, before I joined Abitibi in 2014.

Dr. Allen Alper: That sounds excellent. Could you tell me a little bit about your Chairman?

Mr. Ian Ball: Glenn Mullan, he was the original founder of Abitibi Royalties in 2010, 2011. He started

Canadian Royalties, which is now producing nickel in northern Quebec. Glenn is also President of PDAC.

Dr. Allen Alper: Sounds like an excellent group! What are the primary reasons our high-net-worth

readers/investors should consider investing in Abitibi Royalties Inc. (TSX-V: RZZ)?

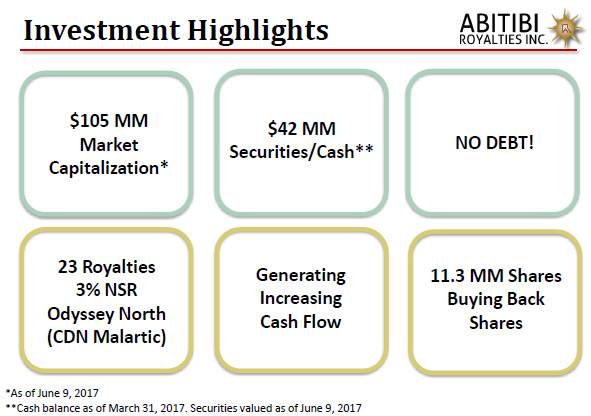

Mr. Ian Ball: Well, it's no guarantee for a success, but the 3 years that I've been with Abitibi, I've

taken all of my salary and bonus and invested it back into the company. I am investing on the same terms as

everybody else, and I'm getting no free cash out of this. It's all going back into the company. I expect to align

myself with every other shareholder on equal terms. The company will not suffer from share dilution. It is

producing cash flow. The share account is actually going down. It's probably the only royalty company where the

primary focus is on a major discovery. So you're getting exposure to exploration, without having to pay for it. I

think that's a pretty unique combination. Approximately 40 to 50% of our market cap is made up of cash or

marketable securities, which today stands at about 40 to 45 million dollars Canadian. And we're debt-free.

Dr. Allen Alper: Well, that sounds excellent.

http://abitibiroyalties.com/

Shanda Kilborn - Director, Corporate Development

2864 chemin Sullivan

Val-d’Or, Québec J9P 0B9

Tel.: 1-888-392-3857

Email: info@abitibiroyalties.com

|

|