Patrick Mutz, Managing Director of Image Resources NL (ASX: IMA) Has a Binding Off-Take Contract for its Australian High-Grade, High-Value Heavy Minerals Projects

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/3/2017

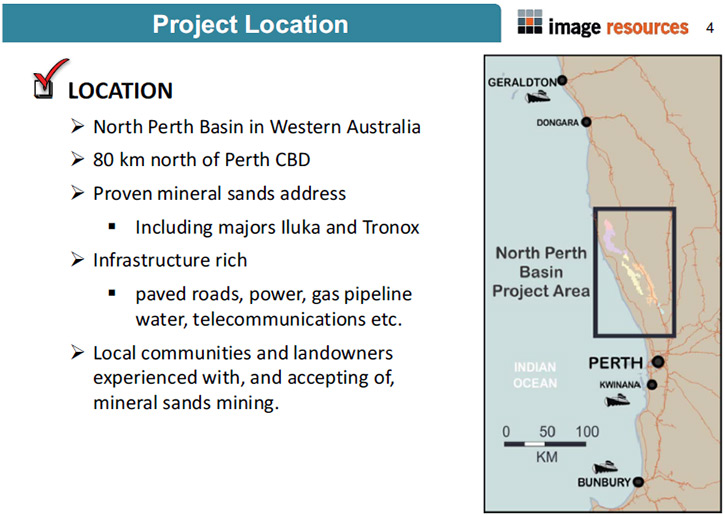

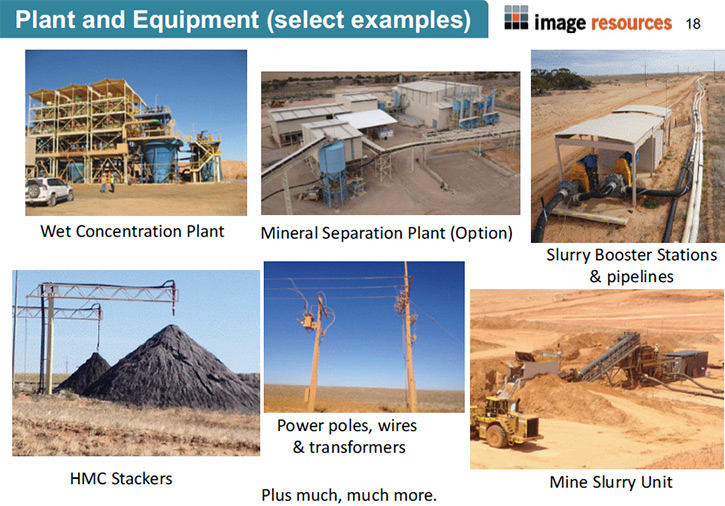

Image Resources NL (ASX: IMA) is an advanced exploration company located in Australia. It is currently focused on the development of its 100%-owned, flagship Boonanarring and Atlas projects with high-grade, high-value mineral resources. We learned from Patrick Mutz, Managing Director of Image Resources, that the projects are located in a well-established infrastructure area, with no shortage of skilled workforce. From the standpoint of heavy minerals content, the Boonanarring project is arguably the highest grade, high-zircon, undeveloped mineral sand project in Australia and potentially elsewhere. Zircon is one of the four products that will be made from the mining of the Boonanarring deposit, and it represents 65 to 70% of total revenue. In 2016, Image Resources acquired a wet-concentrate plant and the majority of associated equipment, required to process ore at Boonanarring into a heavy mineral concentrate (HMC). The company has a binding off-take contract for 100% of the HMC for the life of the project. According to Mr. Mutz the company plans to be moving into production in 2018.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Patrick Mutz, Managing Director of Image Resources. Could you give our readers/investors an overview of your company, what it does, its objective and focus?

Mr. Patrick Mutz: Happy to, Allen. Image Resources is an advanced exploration company, located in Australia. We are headquartered in the state of Western Australia, in Perth. Our objective and sole focus is mineral sand exploration. But we are an advanced explorer, and in fact, have a plan to be moving into production in 2018.

Image's primary focus right now is a project area just 80 kilometers north of the city of Perth. It's in a very well established infrastructure area where mineral sands have been mined for more than 25 years. Therefore, there's no shortage of infrastructure and no requirement for fly-in, fly-out, or drive-in, drive-out. Employees, working at the mine and at the processing plant, will simply go to work in the morning and go back home at the end of the day, which is a very important thing from the standpoint of attracting local employees. There's a good workforce of qualified people that have worked in mineral sands before in the area.

Importantly, the Boonanarring project, on which we have recently completed a bankable feasibility study, is arguably the highest heavy mineral (HM) grade, high zircon, undeveloped mineral sands project in Australia and potentially elsewhere. This is really about high-grade ore, rich in zircon. Zircon is one of the four products to be made from the mining of the Boonanarring deposit. The zircon is the value adder, the value carrier, in other words, of the four products, the zircon represents about 65 to 70% of total revenue.

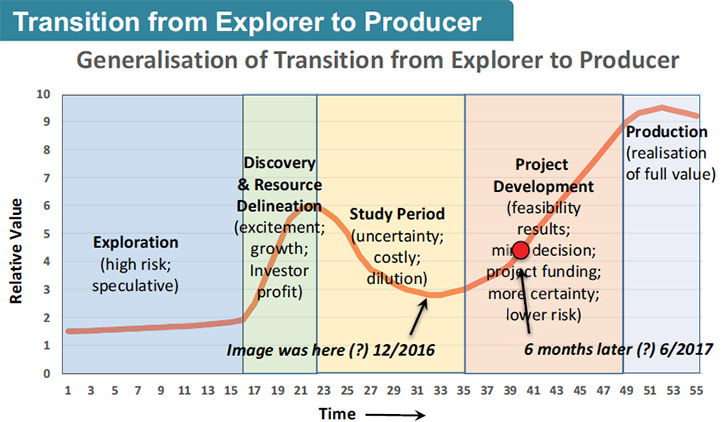

We are fast-tracking the development of the Boonanarring project and looking to transition from advanced explorer to miner as quickly as practicable. We published the bankable feasibility study results in May 2017 and we are currently in the middle of securing bank financing, which will then lead to the balance of the project financing through equity raising. All of which is scheduled to occur across the next two months. July of 2016, we published a project development schedule, and we are still living in accordance with that schedule which shows we will be in production in April of 2018. It's a very fast-tracked production schedule.

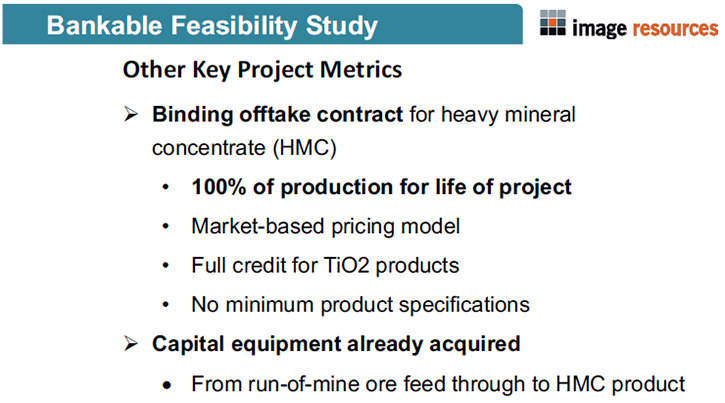

It is also a project with very low capital requirements. The published number in the feasibility study indicates only $52 million in project capital to get the project constructed and in operation. One of the reasons for the low capital cost is that we already own most of the capital equipment required for the project to make a product called heavy mineral concentrate or HMC, which will be the salable final product.

The company has secured an off-take agreement for 100% of the product, for the life of the mine. We have ticked many of the very significant boxes required for investors to understand that this is a very positive project, and I believe, securing 100% of the revenue for the life of the project is one of the most important.

Dr. Allen Alper: Excellent! Could you tell us a bit about your off-take customer?

Mr. Patrick Mutz: Certainly. Image Resources completed an asset purchase deal in June of 2016, with a company called Murray Zircon, a previously, privately held, mineral sands producer in South Australia in Australia. The key component of the deal was that Image acquired from Murray Zircon, all the necessary capital equipment to allow Image to produce a heavy mineral concentrate product from its Boonanarring project, and in return, Murray Zircon received 42% of share capital of Image. In addition, Murray Zircon's parent company in China, Guangdong Orient Zirconic, a zircon processing company for more than 20 years, provided an off-take agreement for all of the zircon to be produced by Image.

Orient Zirconic is a very large company, with five factories in China. It is a publicly listed company on the Shenzhen Stock Exchange. Its equivalent market capitalisation, in Australian dollars, is about $1.5 billion. The zircon off-take agreement, as originally negotiated with Orient Zirconic, would secure 65-70% of the project revenue for Image.

Prior to completing the BFS however, Image negotiated a change in the zircon offtake agreement with Orient Zirconic. The end results of the negotiations were that instead of Image having an off-take agreement for 65-70% of revenue, it now has an off-take agreement for 100% of its revenue through the sale of the total heavy mineral concentrate (HMC) produced by Image for the life of the mine. The new HMC off-take agreement is not directly with Orient Zirconic, but rather with its preferred HMC processing company in China, and Orient Zirconic will then purchase the zircon from the processor.

The processing company that is providing the HMC off-take is Shantou Natfort Zirconium and Titanium Co., Ltd. Natfort has been providing zircon to Orient Zirconic for many years. Contractually, Natfort will be providing off-take of HMC from Image, securing 100% of Image’s project revenue, and Orient Zirconic will be providing Natfort with contracts for taking the zircon from them. That will secure 65-70% of Natfort’s revenue.

Dr. Allen Alper: That sounds excellent. Sounds like you have a very strong off-take arrangement. Sounds like Image also made an excellent deal to get capital equipment to do the processing of your sand. Sounds like it's all working out extremely well. That package is probably going to facilitate getting funding from a bank or another lending institution. Is that correct?

Mr. Patrick Mutz: That's correct. We are working on a simplified model of raising the project capital we need, which will be a little more than just the $52 million project capital. That is because we are a one project company at this time, so we think we will be required, by the banks, to raise a total amount of capital that will, in fact, include corporate overhead and perhaps additional exploration.

We are using a figure we believe to be correct, of a total of $70 million. We are looking to raise 50-60% of the total amount as debt from one or more of the big four banks in Australia. If we can attract the attention of the big four banks, we can get the lowest cost of capital for the debt. That's where we're starting. We believe the financial metrics of the project are such that it will garner the attention of the big banks. We are currently in the middle of that process.The balance of the project capital will be raised as equity from shareholders, including new shareholders.

Dr. Allen Alper: Sounds like an excellent approach. Could you tell our readers/investors a bit about how zircon is used and its applications? Is that primarily for refractory materials?

Mr. Patrick Mutz: I'm happy to do that. There are four final products that can be produced from our HMC intermediate product. The most valuable is zircon. Zircon is used for many things, but principally for ceramic tiles. This is the higher volume, but lower value end of the spectrum. Zircon is also used for the refractory linings for rotary furnaces and in fire resistant bricks because it’s resistant to high temperatures. It is also used for high quality ceramic bearings and bushings in many different industries.

On the very highest value side, zircon is also used in nuclear reactors as a moderating agent for neutron absorption. It's called zirconium sponge. Orient Zirconic is one of the only companies, if not the only company in China, licensed to produce nuclear grade zirconium sponge for nuclear reactors.

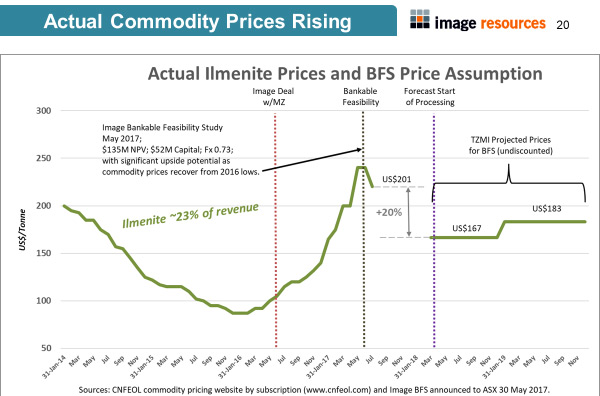

Of the other products, the second one, as far as total value to the revenue, is called ilmenite. Ilmenite is used for many things as well, primarily though as a paint additive. It is used as a whitening agent in many things as well. It is the lowest value per ton of all four products, but it's the largest quantity. It represents about 60% of the total mass of our products and about 23% of the total revenue.

The thing that's important about these products is that they are always in demand and they basically follow price curves that are very much in line, on a macro basis, with global GDP. In other words, when general construction is at a high level and the world is growing, these products are in demand.

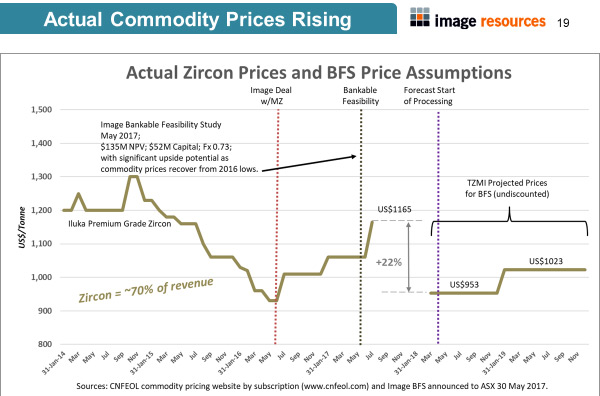

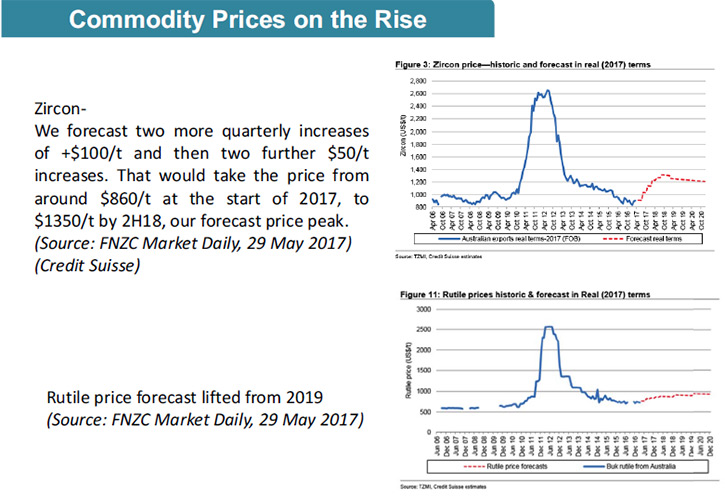

We've recently come through a period of very low commodity prices for the last two or three years. But for the last six months to a year now, prices are beginning to climb again, and in the case of zircon, very quickly. The importance of this, from the standpoint of Image’s project that we are planning to move into production early next year, and the overall profitability of the project quickly improves with rising commodity prices. However, our bankable feasibility results show that even if commodity prices do not increase, the project will be profitable.

However, all of the projections are showing increasing prices. We now have almost one year of demonstrated increasing prices. Therefore, the upside potential for the project is quite strong. It's an important point that the Image investment proposition is a counter-cyclical investment. We were able to acquire the capital equipment and complete a bankable feasibility study that will allow the company to move to production quickly, all during the low spot in the commodities market. Consequently, the company and its shareholders will be able to realize the upside potential as commodity prices increase across the next few years.

Dr. Allen Alper: Sounds excellent. Could you tell us a bit about the other products?

Mr. Patrick Mutz: Yes. The other two products are rutile and leucoxene. Each only amounts to three to four percent of the total product mix. They don't add a lot of revenue, but they will be recovered and sold. Rutile is used principally for things like the flux coating of welding rods. Leucoxene is essentially a weathered ilmenite, so it can also be used in paints. It can also be used as a flux in welding rods. Leucoxene is much more valuable than ilmenite because it has a higher titanium dioxide (TiO2) content.

Dr. Allen Alper: That's very good. Could you tell us a bit about your background, your team, and your board?

Mr. Patrick Mutz: I'm a US citizen, but I have been in Australia for the last 15 years working in the mining industry. My background is metallurgy and I have worked my whole career of 30+ years in mining. I started in the US, then here in Australia, but I have also worked in Germany and Africa.

I've been working in the mineral sands industry since 2011 as CEO for Murray Zircon in South Australia. We developed and operated a mine and processing plant for a number of years until the drop in commodity prices caused us to have to put the project on care and maintenance. Then in June of 2016, with the completion of the deal between Image and Murray Zircon, I came across to Image as its MD. Importantly, we also brought to Image a handful of very experienced senior managers with mineral sands operating experience.

As a result, we have a management team that will be very beneficial when we move to production early next year.

Dr. Allen Alper: That sounds like you are very well positioned to move the company forward, and you have a very experienced, excellent team. How about the board?

Mr. Patrick Mutz: Another important component of the deal between Image and Murray Zircon was the inclusion of 3 directors (including myself) plus an independent Chairman to the Image board, all of which have significant mineral sands project development and operations experience. This gives Image a major advantage with its efforts to fast-track the development of the Boonanarring project and transitioning the company to be a mining company.

Dr. Allen Alper: That's great. Could you tell us a bit about your share and capital structure?

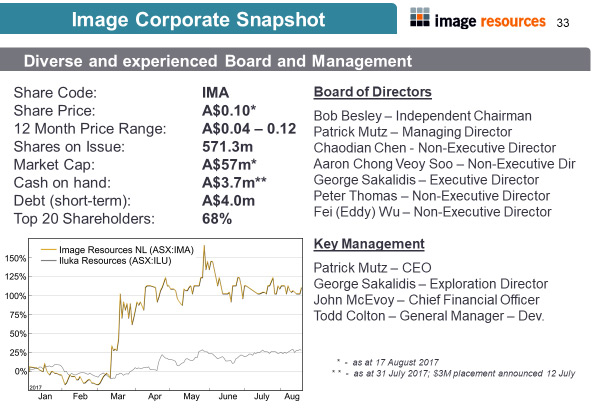

Mr. Patrick Mutz: Absolutely. Image is not a new publicly listed company. It listed originally in Australia on the ASX in 2002, and it has been a very successful exploration company through that period. Today, we have a total of 570 million shares on issue, and at a share price of 10 cents, we have a market cap of roughly $57 million.

Since the completion of the deal with Murray Zircon, the share price has increased from a low of five cents in December of 2016, to the current level of about 10 cents. We raised $6.25 million in January 2017 at a price of 5 cents, so our shareholders are quite happy that we've already demonstrated added value. And I believe, if we are successful in securing project debt financing from an Australian tier one bank, and we announce this to the market, we will get further buoyancy in the share price. Once the debt financing is secured we will commence raising the balance of project capital as equity from new and existing very supportive shareholders.

Dr. Allen Alper: That sounds excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in Image Resources NL (ASX: IMA)?

Mr. Patrick Mutz: I think I can perhaps give a few reasons. I'll draw on my own research that I did on Image Resources prior to starting negotiations to become part of the company. Image Resources owns very high-grade, high zircon, heavy mineral ore reserves in an infrastructure rich area in a proven mining district in Western Australia. The project requires very little capital, especially since the company has acquired the capital equipment required to move the project to production.

In addition, the time it will take for the company to get to actual cash flow is very short. That is very important. When it only takes a small amount of capital, and you have the expertise and the team, and you can get to cash flow quickly, obviously risks, overall, are lower. Because we are a publicly listed and in Australia, we have to live in accordance with the JORC Code of reporting resources and ore reserves. Therefore, investors can have confidence in the fact that the resources and reserves actually exist and can be mined economically. And of course, we also used an independent expert group to conduct the feasibility study and publish the results, which means a proper look at the value proposition for shareholders.

Going further, the results of the feasibility study help to present the value to a potential investor. This is a project that has a positive NPV of $135 million. This is on a pre-tax basis at an 8% discount rate. The IRR of the project is 64%, which is to say, it is a very quick cash generator. Therefore, the capital payback period is estimated to be less than two years. Only 22 months! This is one of the key reasons we believe the project is bankable to a tier 1 bank, which will provide the lowest cost capital for the company.

Dr. Allen Alper: Excellent reasons to consider investing in your company.

Mr. Patrick Mutz: A final reason investors may want to consider Image as an investment opportunity is based on the upside potential of its portfolio of projects with high grade mineral resources. In addition to the Boonanarring and Atlas projects being fast-tracked to production in early 2018, Image has a number of other projects that have the potential to extend the operating mine life of planned operations, or to become development projects in their own right.

Of particular interest is the company’s 100%-owned Bidaminna project which has the potential to grown into a low-cost, standalone, dredge mining operation. Bidaminna could become the company’s phase-two growth project. It's a very important consideration for investors to understand the upside potential of a second operating mining project.

Dr. Allen Alper: Well, that sounds very good, Patrick. Is there anything else you would like to add?

Mr. Patrick Mutz: Thank you for giving me the opportunity to share the story and investment opportunity of Image Resources NL (ASX: IMA). We have only recently started to market the company, and we find that every time we tell the story and introduce the investment opportunity, it resonates very positively. Therefore it could be argued that those that get into the stock early could be the biggest winners.

Dr. Allen Alper: Well, that's excellent. By the way, if you work your way towards New York, I have colleagues, who are very influential in this area, in raising funds and getting people next to the right people for investing.

http://www.imageres.com.au/

Patrick Mutz

Managing Director

+61 8 9485 2410

info@imageres.com.au

|

|