AuRico Metals Inc. (TSX: AMI): A Mining Development and Precious Metals Royalty Company with the Advanced Stage Past Producing Kemess Project in British Columbia, Interview with John Miniotis, VP of Corporate Development

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/26/2017

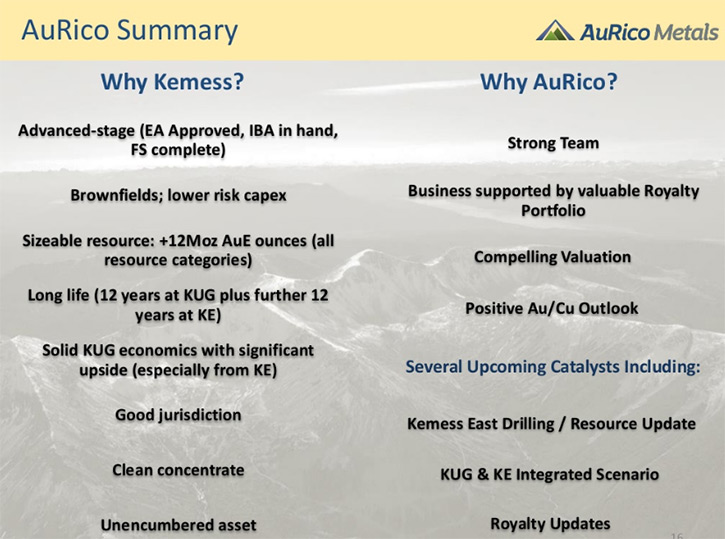

AuRico Metals Inc. (TSX: AMI) is a mining development and precious metals royalty company that is combining high-quality, cash-

flowing precious metals royalties, with an advanced-stage Canadian development project. AuRico's producing royalty assets include a

1.5% NSR on the Young-Davidson Gold Mine, a 0.25% NSR on the Williams mine at Hemlo, and a 0.5% NSR on the Eagle River mine – all

located in Ontario, Canada, plus a 2% NSR on the Fosterville Mine, located in Victoria, Australia. AuRico Metals holds a 100%

interest in the Kemess property in British Columbia, Canada. The Kemess property hosts the feasibility-stage Kemess Underground

Gold-Copper project, the Kemess East exploration project, and the infrastructure pertaining to the past producing Kemess South mine.

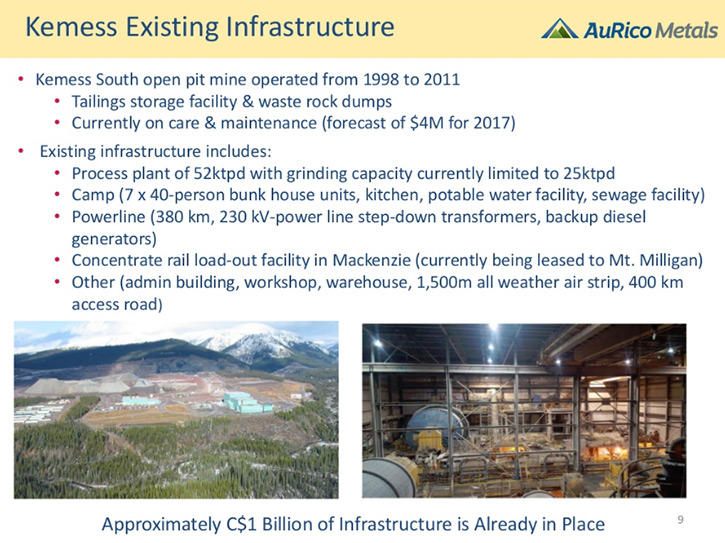

We learned from John Miniotis, VP of Corporate Development of AuRico Metals, the existing infrastructure in place at Kemess has an

estimated replacement value of Cdn$1 billion and includes a 50,000 ton-per-day processing plant, power lines, roads, admin

buildings, etc. The company has already received its Environmental Assessment certificate and signed an Impact Benefits Agreement

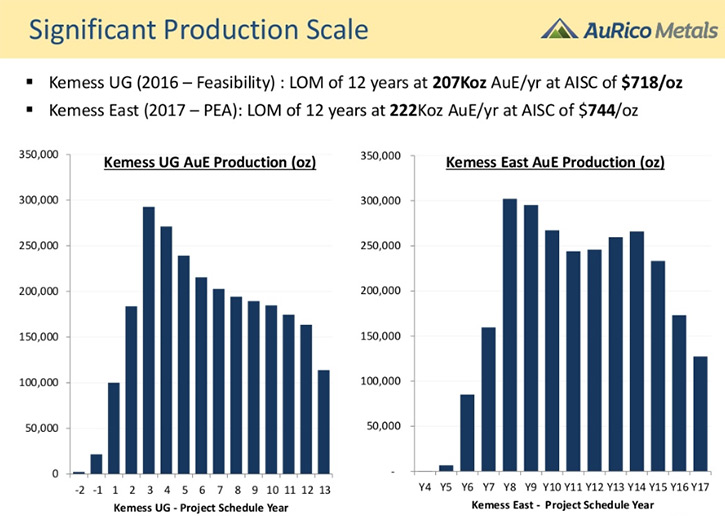

with the three local First Nations on the Kemess Underground project. According to the feasibility study, the Kemess Underground

project has a 12-year mine life with a production rate of over 200,000 ounces a year of gold equivalent at very attractive cash costs

of about $718 per ounce.

Kemess Site (2015) showing existing facilities

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing John Miniotis, VP of Corporate

Development of AuRico Metals. You have an excellent company. Would you like to give our readers/investors an overview of your

company?

Mr. John Miniotis: Sure. I'd be glad to. AuRico Metals is a relatively new company. We were formed about two years ago

at the time of the merger between Alamos Gold and AuRico Gold, two intermediate gold producers. We were spun out specifically to hold

the Kemess Underground development project, which is a large-scale, advanced-stage project located in British Columbia. Thankfully,

the directors and the management team at the time had the foresight to include in the company some high-quality cash-flowing

royalties. Really, since the inception, we've had a pretty unique combination. We're essentially a developer with revenue. We think

that combination has definitely worked well for us and represents an excellent opportunity for investors going forward.

If you'd like, I can give you a bit more details on Kemess and royalties.

Dr. Allen Alper: Yes, that would be great.

Mr. John Miniotis: Great. Kemess was historically a past producer. Between 1998 and 2011, it produced over three million

ounces of gold, 750 million pounds of copper. All the infrastructure associated with Kemess South is wholly owned by AuRico and is

still in very good shape. Since it closed in 2011, all the infrastructure has been maintained on care and maintenance, and we like to

say we have over Cdn$1 billion of infrastructure in place already. That's the estimated replacement cost to build it today, including

a 50,000 ton per day processing plant, power lines, roads, admin buildings, etc. It's all on site.

What we're looking to develop Kemess Underground, is located just six kilometers to the north of the past producing Kemess

South mine. We announced a feasibility study on Kemess Underground last year in 2016, and this year we've achieved several important

milestones, including receiving our Environmental Assessment certificate from both the federal and provincial governments, which is a

critical milestone. Those are the overarching environmental permits that are required, so that was definitely a big catalyst for us.

Also, more recently, we signed an Impact Benefits Agreement with the three local First Nations, so we're very happy to have the First

Nations’ full support behind the project going forward.

At the moment at Kemess Underground, we're focused on regular course permitting and detailed engineering. We'll be submitting all our

permits at the end of this month, the end of August, and so we expect to have the construction permits needed to commence

construction in hand by the end of Q2 2018. At that stage, Kemess could commence access corridor construction which is expected to

account for the first twelve months in the construction schedule. As per the feasibility study, Kemess Underground is significant in

scale, producing over 200,000 ounces a year of gold equivalent at very attractive cash costs of about $718 per ounce and has a 12-

year mine life based on current Proven and Probable reserves.

Separate from Kemess Underground, we also have the Kemess East deposit, which is located just one kilometer to the east. We announced

a Preliminary Economic Assessment study on that in May which showed very attractive economics, similar in size and in scale to Kemess

Underground. We're actively drilling at Kemess East at the moment, and we believe it has good potential to continue to grow.

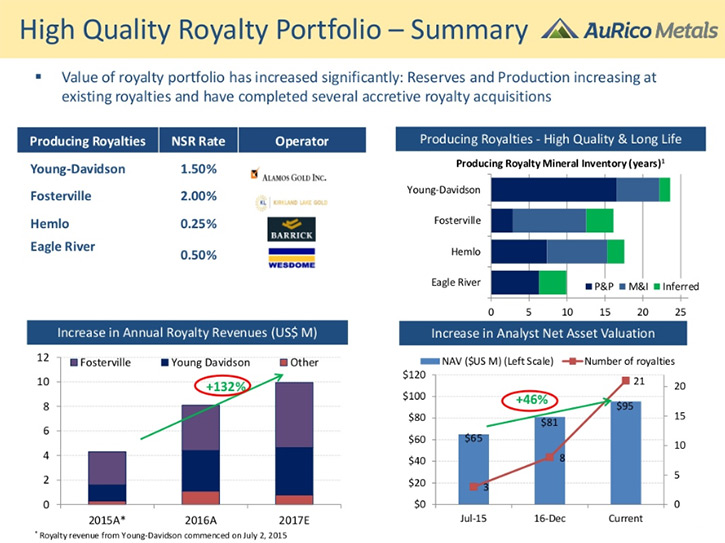

In terms of the royalties, that business does very well for us. We have at the moment 21 royalties, four of which are in

production and are generating over CDN $13 million a year of revenue for us. We have some very high-quality royalties in good, safe

jurisdictions. I'd say the first key royalty we have is a 1.5% NSR on the Young Davidson operation, which is owned by Alamos Gold.

It's their cornerstone operation, and has a 17-year reserve life, and they're producing over 200,000 ounces a year. That's clearly an

excellent royalty.

The second key royalty we have is a 2% NSR on Kirkland Lake's Fosterville operation. Fosterville has had tremendous

exploration success as of late. They just recently increased their reserves by 110%, and that comes on the back of, six months ago,

increasing the reserves by 66%. Their reserve grade has gone from approximately 7 grams per ton to close to 18 grams per ton. That's

pretty phenomenal success they've had and we have a 2% NSR which covers 500 square kilometers in and around Fosterville. I'd say

those are the two cornerstone royalties in our portfolio, plus we have several other royalties with excellent upside potential.

Dr. Allen Alper: Sounds like your company's very well-positioned with royalties and great development projects underway in

British Columbia. Sounds great.

Mr. John Miniotis: Yes we are very excited about the milestones that have been achieved and the catalysts that lie

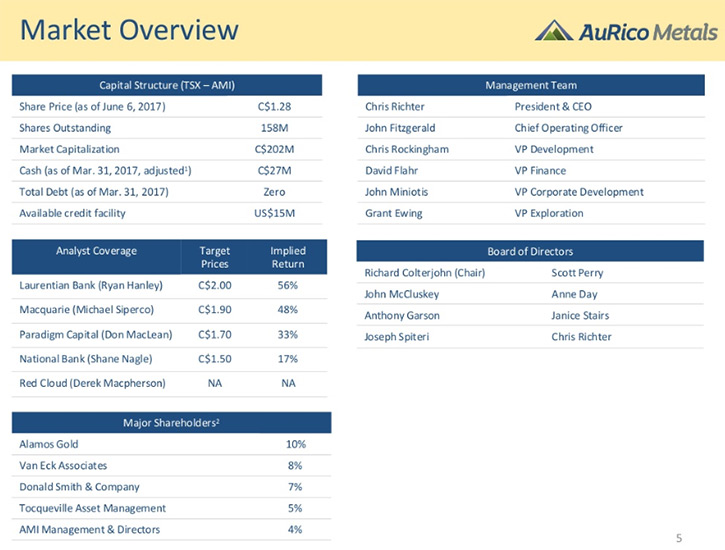

ahead. For a company our size, we have a market cap of $200 million, a strong balance sheet, and I think we're very well-positioned

to continue to create value on both sides of the business moving forward.

Dr. Allen Alper: Could you tell me a bit about your background and the team and the board?

Mr. John Miniotis: Absolutely. I joined the company just about one year ago. I'm the VP Corporate Development. I have a

financial background and joined AuRico from Lundin Mining, where I was in corporate development for the previous seven years and

played a key role in several acquisitions over that time.

In terms of the other key management, Chris Richter is our President and CEO, and was involved with AuRico Gold. He was their

senior VP corporate development, and also has a corporate development and finance background. Our technical team is led by our COO,

Chief Operating Officer, John Fitzgerald. He has a tremendous amount of knowledge and technical expertise. He's been involved with

several block cave operations around the world, have worked at Rio Tinto, Barrick and DeBeers.

John Fitzgerald is responsible for the development of Kemess and oversees all technical aspects of the project. He's been

ramping up his team as well. We've recently hired several people on the technical side, including a mining project manager, who was

previously a project manager at New Gold's New Afton mine, which is a very comparable project to what we have at Kemess. We also

recently hired a surface construction project manager, so I'd say we have an excellent core technical group that continues to grow.

In terms of the board of directors, we have several well-known board members, including John McCluskey, who was the CEO and founder

of Alamos Gold. We have Scott Perry, the CEO of Centerra Gold, and Richard Colterjohn, our chairman who’s on the boards of several

companies, including Roxgold, Harte Gold and MAG Silver. In addition we have several other board members which all contribute a

wealth of knowledge and experience.

Dr. Allen Alper: A very, very strong team you have there. Excellent! Great knowledge, great success, a great team. Could you

tell us a little bit about your capital structure?

Mr. John Miniotis: Sure. We have about 162 million shares outstanding. We're trading at about $1.20 per share, so again,

a market cap of close to $200 million. We have a cash balance of about $27 million Canadian and zero debt so a very, very strong

capital structure, I'd say, and lots of financial flexibility. Of course, we have the royalties generating $13 million a year, which

will continue to bring in cash for us going forward.

Dr. Allen Alper: Fantastic! Your plans to develop Kemess, when do you think you'll get it into production?

Mr. John Miniotis: The key catalyst for us, which we've already received, was the receipt of the Environmental

Assessment certificate. That's really your overarching environmental permit, but of course, before you start construction, you also

need your regular course permits, which we'll be submitting by the end of August. That's a very defined process, so we expect to have

permits in place by the end of the second quarter of next year, at which stage, subject to financing we could start construction

activities at Kemess.

The construction profile is a four-year build, so we would expect to be in production around 2022, which could represent very

exciting timing from a copper perspective as most analysts are projecting a copper deficit to have emerged by then, which would be

favourable for us as the project revenues are approximately 50% copper and 50% gold.

Dr. Allen Alper: That sounds excellent. What are the primary reasons our high-net-worth readers/investors should consider

investing in AuRico Metals?

Mr. John Miniotis: I'd say our valuation represents a very, very compelling opportunity. We have five analysts that

cover us on the research side. You look at the value that they ascribe to the royalty profile, they're currently ascribing $130

million of net present value and that continues to grow. As I mentioned, Fosterville has had tremendous success as of late, so that

figure doesn't really reflect all the recent updates there.

So when you look at our market cap, and back out the value for the royalties and cash, you can see that our shareholders are

receiving Kemess which is an advanced-stage project, with environmental approvals in place and $1 billion of infrastructure in B.C.,

at a very attractive valuation. We believe there's tremendous upside opportunity for our share price as Kemess starts to gain more

recognition in the market and starts to pick up value. I’d say we're pretty unique given our share price is very well protected on

the downside by the value of our royalties, so I think the risk-reward dynamics for us are very, very compelling and I'd say that's

what sets us apart from most other developers that you would see.

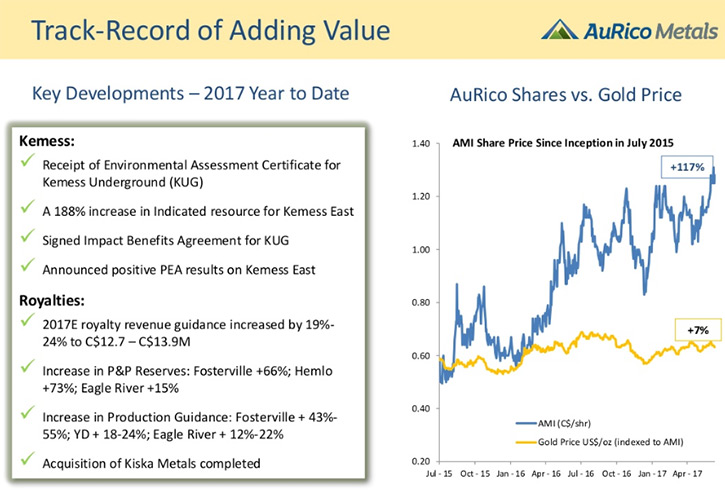

Dr. Allen Alper: Your stock has done much better than gold has in the last couple of years.

Mr. John Miniotis: We've performed quite well. When we were spun out in 2015, we were trading at close to 60 cents per

share and we're now close to $1.20 or so. We've essentially doubled in value. But I would argue that right now we're actually cheaper

than ever on a relative value basis when you look at all the milestones we have achieved at Kemess. I've already spoken about the EA

approvals, the IBA, etc., how big Kemess East has grown, and we've put out a PEA on Kemess East, and you look at how much the royalty

values have increased. I'd rather be buying the shares today at $1.20, given how much the value of the company has grown. I think

that is a more compelling buying opportunity than two years ago at 60 cents. So even though we've performed quite well, I think

there's incredible upside opportunity still to come. We're very excited.

Dr. Allen Alper: Sounds great! Very promising! You're in a real position to have that royalty income flow. The cost

projections on the cost of mining gold versus the price of gold is impressive, too.

Mr. John Miniotis: Yes, Kemess will be a very low-cost producer. The mining method we'd be using here is underground

panel caving which is the most efficient underground mining method. Typically the operating costs for panel cave operations around

the world are in the best quartile of the cost curve. Based on our feasibility study, that's where we expect Kemess to be as well.

We expect to have excellent margins, even at current spot prices.

Dr. Allen Alper: Sounds great!

http://www.auricometals.ca/

Chris Richter

President and Chief Executive Officer

416-216-2780

chris.richter@auricometals.ca

John Miniotis

Vice President, Corporate Development

416-216-2780

john.miniotis@auricometals.ca

|

|