Bruce Reid, President and CEO, Bunker Hill Mining Inc (CSE: BNKR) with a Proven Track Record: Developing the Largest Zinc-Lead-Silver Deposit in the Americas

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/26/2017

Bunker Hill Mining Incorporated (formerly Liberty Silver Corp (CSE: LSL) is uniquely positioned to re-develop the largest Zinc-

Lead-Silver deposit in the Americas not in production, located in the Silver Valley, Idaho USA. We learned from Bruce Reid, President

and CEO of Bunker Hill Mining that they are in the process of acquiring the past producing Bunker Hill Mine and changing their name

to Bunker Hill Mining. According to Mr. Reid, who has a great deal of experience in developing projects and getting them to

production, Bunker Hill is easily the largest and most important project he'll ever work on. At the time it was shut down there were

60 million tons of historical resource still in the ground and the company is currently focusing on one of the most promising zones

on the property. Near term plans include financing and underground drilling to complete a 43-101 resource on the Quill Zone. After

that they expect to design the mine plan for the first 18 to 22 years and make a number of repairs.

The Bunker Hill Mine

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Bruce Reid, President and CEO of Bunker

Hill Mining Incorporated (formerly Liberty Silver Corp (CSE: LSL).

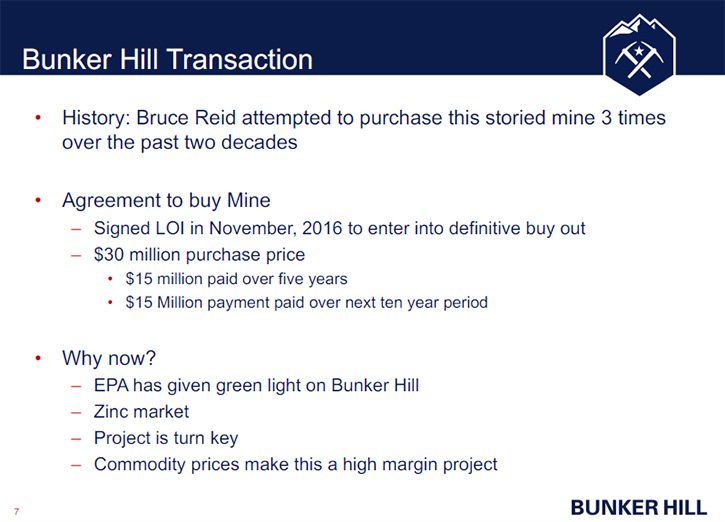

Mr. Bruce Reid: Liberty Silver Corp, LSL is the Shell Company. The current ticker is LSL. We are waiting until the definitive

agreement is completed. It's a three-part agreement and as soon as that's done, hopefully later in August, we will change the name

officially to Bunker Hill Mining Corp, and change the ticker to BNKR.

Dr. Allen Alper: This is an exciting time for you and your company. Would you like to give our readers/investors an overview

of what's happening?

Mr. Bruce Reid: I've worked on quite a number of projects. I think this is the seventh public company that I've created and

hosted various projects. Five of the last six are in production, and the sixth one, Carlisle Goldfields, I sold it to Alamos last

year. This one is easily that largest and most important project I’ll ever work on. The Bunker Hill was operated for 94 years and was

pushed out of production primarily by the Environmental Protection Agency in 1981 because of the smelters that operated in Kellogg,

Idaho where the mine was. The mine itself was never really the subject of any of the cleanup by the EPA. The mine shut down because

the EPA shut down both the mill and primarily the lead smelter, for obvious reasons. The mine was in receivership for nearly a dozen

years and then it was purchased by an individual who didn't want to put the mine into production, but he liked owning it. He

subsisted by mining mineral specimens and selling those all over the world. He passed away about four years ago and his two sons have

decided to sell the asset. We happened to be there at the right time.

We've used Liberty Silver as the shell to accommodate the asset. The mine operated for 94 years. In that period they mined

approximately 36 million tons. When they shut down, they had 60 million tons of historical resource. A substantial amount of ore was

left in the mine when it was shut down because of environmental concerns associated with the smelter. Within that 60 million tons is

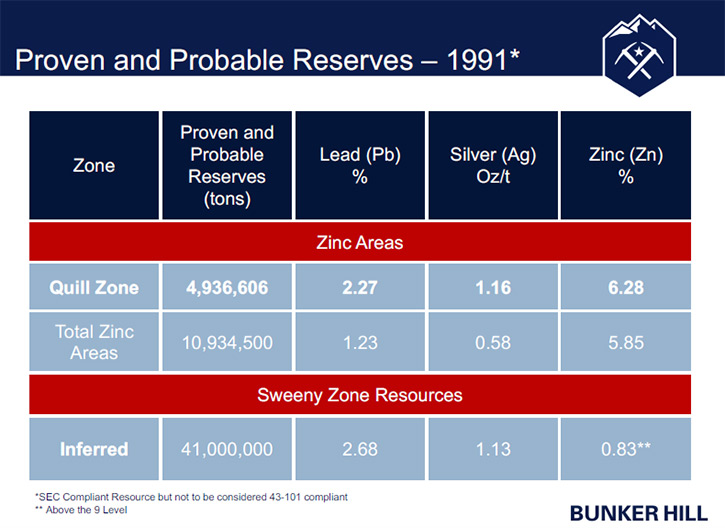

about a 12-million ton historical reserve that was done to SEC class reserves, SEC class, it's considerably more restrictive than the

then current 43-101 class standards. We're focusing on just one zone that is in the mine. There were 24 different zones mined

historically. They identified a total of 40 different zones over the life of the mine, but we're focusing on one, from which they

mined about a million and a half tons, in 1979, '80, and '81 before the mine shut down.

It has about four and half million tons of historical reserve and possibly another million and a half to two million tons of

resource. The grades are roughly 7% zinc, 2% lead, and 1 ounce of silver. Those are approximate and obviously the grades do rise and

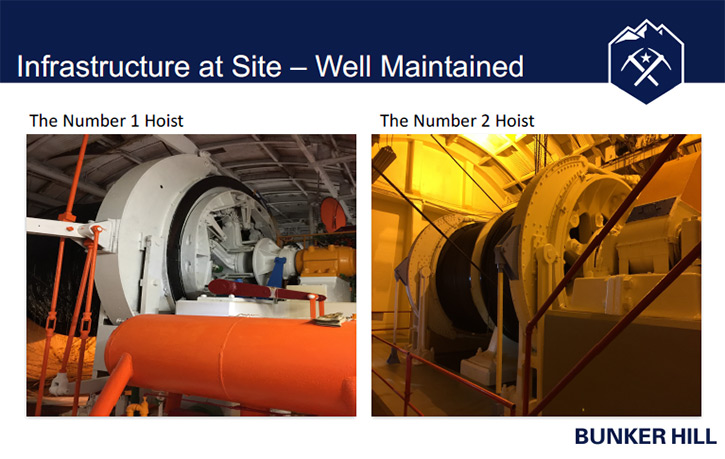

fall in different parts of the zone. I think what differentiates this project from many others is that this mine has been left in

amazing shape. We can access right into the areas that were previously mined and these were wide zones, minimum 20 meters, in many

cases, 70, 80, 90 meters wide. The infrastructure underground is quite remarkable. There's a ramp into the middle of a mine, at a 900

level, and there's about 1,800 feet of ore about us and probably 2000 feet of ore below us.

We'll be focusing on the stuff above the track level during the initial years. But the infrastructure underground is second to none,

big wide zones, relatively naturally ventilated, a terrific mine to operate in. The ambient temperature, all year around, is about 65

Fahrenheit and the zones are quite wide as a result we can use mechanized equipment. The infrastructure makes a huge difference

relative to most of the other mines. It's also in a good location, northern Idaho right beside Interstate 90. There's access to power

and an excellent workforce. A lot of good miners live in the Silver Valley, and we'll be able to access a lot of those miners for our

mining.

Dr. Allen Alper: What are your plans going forward?

Mr. Bruce Reid: We hope to have a definitive agreement signed with the underlying owners soon. We pay roughly $30 million, of

which a portion of it goes to the EPA and a portion to the underlying owners. Then we’ll raise $12 million US or about $16, $17

Canadian, and undertake three different things. We'll go underground with drills and do a lot of underground sampling and do a 43101

resource on the main zone that we call the quill. We'll also be working on a mine plan to block out where we intend to mine month by

month for at least the first 18months.

There are a number of repairs we want to undertake as well. These will help with production down the road, but right at the

moment, they will help with safety on the main access. We want to take some drills and do sampling underground this fall. We need a

little bit of repair. Some of the rail needs to be replaced and things like that. We'll do that over the next 8 to 12 months.

Dr. Allen Alper: After that is done, what are your thoughts? What do you do next?

Mr. Bruce Reid: Our plan is to go into production. We may be able to go into production without rebuilding a mill because

there is a substantial amount of vacant mill capacity in the valley. There are a number of mills sitting vacant right at the moment.

There is an over 1,500 tons of mill capacity available to us. But, I think ultimately we will build our own mill dedicated to that

mine. We're looking at roughly 1,500 tons a day. Our intention next year is to raise sufficient money to go into production. We're

looking at a number scenarios in terms of cost right at the moment. Our best estimate is about $35 million to restart this mine,

maybe a little less if we're tolling our rock through some other mills, and maybe a little more if we build our own mill. We only get

into production next year if we toll.

It's going to take better than 2018 to build our own mill and put it into production, but that's our intention next year. We

may go up for more money, after we're in production, just to pay down some of the owners and the EPA and such things as that. So it's

basically in three steps; first - pre-production, a 43101 mine plan and some repairs initially. Second - production and thirdly, at

the same time, raising enough money to own this mine outright and pay off the EPA.

Dr. Allen Alper: That's excellent. What will you be mining?

Mr. Bruce Reid: This is primarily a zinc mine with both a lead and a silver credit. About 65%, maybe as much as 70%,

depending on the price of the commodity, will come from zinc, maybe another 20% to 25% from lead and 8% to 15% from silver. Let's say

it's primarily a zinc mine, and we'll produce two concentrates, a lead and a zinc concentrate, and these will be for sale. The

obvious candidate is the Trail smelter, owned by Teck, which is about a three and a half hour drive north of where we are in Idaho in

southern British Columbia. The cons are historically known to be quite clean and extremely easy to smelt.

Dr. Allen Alper: Sounds excellent! I know you have a very accomplished background. Could you tell our readers/investors a bit

more about your background, your team and your board?

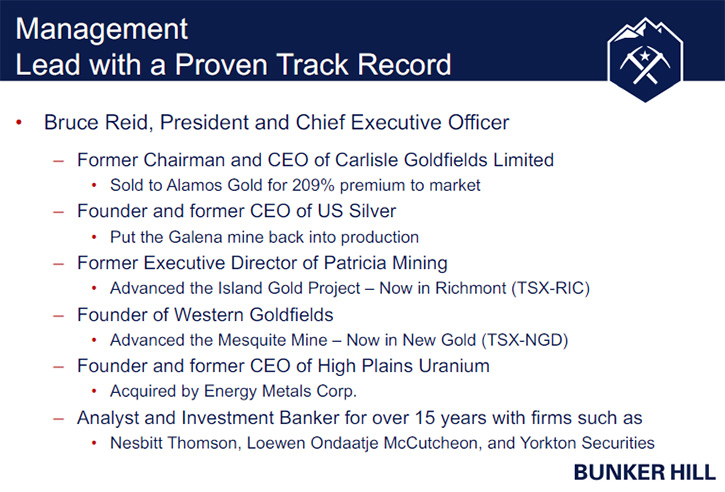

Mr. Bruce Reid: Sure. I'm a geologist by education. I worked about three to four years in the industry in northern Canada in

a variety of mines. I then went back to school, did a finance degree, and came out about 1983 and started working as a metal analyst

for Nesbitt. I worked at three different brokers, the second one was Loewen Ondaatje McCutcheon and, the third one, I worked at

Yorkton Securities and through a good part of the '90s. After that I was out involved with a number of acquisitions of mining assets,

and collectively cleaning them up. Probably the first one was the Mesquite Mine in a company called Western Goldfields that was

purchased from Newmont. It's now the largest asset inside New Gold.

The second one was a company called Patricia, and we bought the Island Gold project from receivership, cleaned it all up,

drilled it, and then sold it to Richmond. It's their largest asset today. I was involved in a uranium project and there's a number of

those that are in production today, and then US Silver. I was the founder of US Silver, which purchased the Galena Mine in the Silver

Valley, which helps substantially with our knowledge of the Silver Valley. A number of the guys I'm involved with on the Bunker are

guys I was involved with at US Silver. We spend about $65 million repairing the Galena and it's now in a company called America's

Silver.

Next I bought a company called Carlisle Goldfields that had gold assets in northern Manitoba. I cleaned that one up and got

it relisted. We raised about $20 to 25 million, took the asset there from 200,000 ounces to 5 million ounces, and I sold it to Alamos

Gold last year. They should be announcing their production decision on that on in the third quarter 2017. I fully expect they'll go

ahead with the production decision on that project. Then late last year after Carlisle, a friend of mine came to me and said he

wanted me to run Liberty Silver. He said, "How do you want to do this?" I said, "Well, you got to get the Bunker." He got the Bunker

and you know the background on that.

The team I have is very similar to the great group I had with US Silver. There are a couple of engineers, a number of geologists, and

also financiers and promoters that I've assembled, most are located out in the Silver Valley. I have a very small group in Toronto, a

CFO myself, and two other people, because that's where the capital markets are. But primarily my crew is in the Silver Valley, in

Kellogg, Idaho, where we're digitizing a lot of the data that was available to us at the Bunker Mine.

Dr. Allen Alper: Sounds like a very experienced, knowledgeable team. You are all ready to move Bunker Hill forward. Sounds

exciting! Could you tell our readers/investors a little about the capital structure?

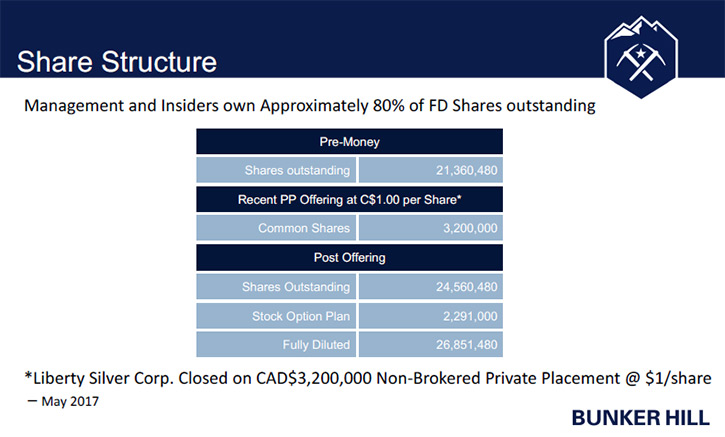

Mr. Bruce Reid: Sure. Liberty Silver came to me with $21.5 million shares. I have raised $3.2 million at a dollar so there's

now $24.5 million shares approximately. There are no warrants on the company but there are about two million options and they strike

at $1. I took all of the original insiders from Liberty Silver plus all the stock that I've bought, and there's also a block that I

have auctioned from some of the underlying owners of Liberty Silver, and I put it, and it's 20 million shares actually, 20 of the 24

and a half, and all of that is tied up in an escrow Trust, and it cannot be sold until there is a change of control or for five

years. There is a significant block of the stock that is not going to be traded, so it's not as if you're ever worried that

management stock goes up and management set to make the shareholders wear it, that's just not going to happen here. A huge block of

the company is tied up pretty much for the life of the mine.

Dr. Allen Alper: Sounds very good. Could you tell us a bit more on the plans going from Liberty Silver to Bunker Hill and when

that will all transpire?

Mr. Bruce Reid: We currently have an LOI, a binding LOI on the project, but we felt we wanted to have the definitive

agreement completely signed there, and then change the name to Bunker Hill Mining Corp, and change the ticker, we're hoping before

the end of August. I think we've had five or six drafts of it go around, so I'm confident we're getting close to the end. We pretty

much agreed on all of the terms. It is just waiting for some of the lawyers to complete the final draft and have it signed in a

couple of weeks.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Bruce Reid: Number one, this is an excellent deposit, reasonably good grades, and it's highly accessible with great

infrastructure, but the company itself also has a very tight corporate structure, and it will remain that way. Foremost this is a

very experienced team, we've done this before. We've done it in the Silver Valley and in other locations within North America. It's a

very experienced management team and board of directors. Pretty much every single person, has been in the mining business for at

least 30 years. It's a tremendous package, tremendous investment package.

Dr. Allen Alper: Sounds good.

http://bunkerhillmining.com/

Bruce Reid: 647-500-4495

br@bunkerhillmining.com

Howard M. Crosby,

Chief Executive Officer

(509) 526-3491

info@libertysilvercorp.com

|

|