Michael Tamlin, COO, Neometals Ltd (ASX: NMT): Discusses Progress of Their Value-Added Integrated Lithium, Titanium and Cobalt Chemical Production Strategy

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/22/2017

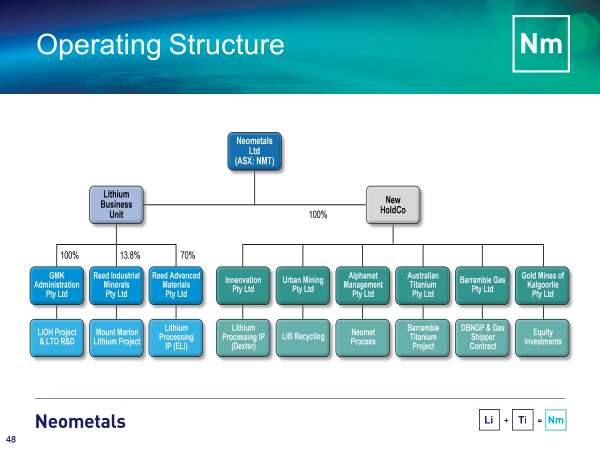

We learned from Michael Tamlin, COO of Neometals Ltd (ASX: NMT), that they are an Australian

minerals project developer and chemical production company with a primary focus on adding value to

resources in the ground to produce a relevant product in global markets. The company's principal

activities are related to lithium and titanium. They are adding cobalt to their portfolio through

battery recycling. Neometals' main project is the high-grade Mt Marion Lithium JV project with Mineral

Resources Ltd and Ganfeng Lithium. In the titanium space, they have the early stage, Barrambie Deposit

in Western Australia. Neometals have also developed a process, now in pilot stage, which can extract

cobalt, lithium, nickel, and copper at high purity and return them to the battery manufacturing

process. According to Mr. Tamlin, last year, the company paid two dividends to its shareholders, and

have been engaged in a share buyback program this year. The company is debt free and has positive cash.

Plans, for the next 2-3 years, include taking the Mt Marion project from a concentrate producer into a

lithium hydroxide producer, which will uplift the value of their lithium unit by a significant

amount.

Mt Marion Lithium Project Aerial Photograph January

2017

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Michael

Tamlin, COO of Neometals. Could you give our readers/investors an overview of your company? Bring them

up-to-date?

Mr. Michael Tamlin: Certainly Allen, We've had quite a bit of development in the time since

we spoke. Neometals is a resource development and chemical production company. Our primary focus is to

add value to resources in the ground, to produce them, as mineral products, at as low a cost as

possible, and certainly to add value to them, and produce a relevant product in global markets.

Dr. Allen Alper: Could you elaborate on some of your properties and resources?

Mr. Michael Tamlin: Yes. Our principal activities are related to lithium and to titanium.

We are now adding cobalt to our portfolio through battery recycling. We're an Australian company. We

operate all of our mining operations in Australia, in the state of Western Australia. We're listed on

the Australian stock exchange under the ticker ASX: NMT and we conduct process research at a number of

locations in Australia and in North America. The research is oriented towards developing processing

technology solutions to help us add value to the commodities in which we're investing and to do more

efficient production at lower operating costs.

When it comes to operating costs, I think there's a general trend in mineral markets in

particular, and certainly in lithium markets. As resources tend to become more difficult to process or

lower grade, we need to offset that trend by improving the way they're processed and extracted and to

be able to do it at a lower cost with a smaller environmental footprint. That's the direction of our

process research.

In lithium, we operate a Hard Rock lithium mine, mining the mineral spodumene and concentrating

that into spodumene concentrate, which is raw material for lithium chemical production. The mine is

called Mount Marion and we're a co-shareholder with two companies. One is an Australian contract

processor of minerals called Mineral Resources Limited, who is also the processing contract partner.

The other partner is Ganfeng Lithium, one of the largest lithium convertors in China.

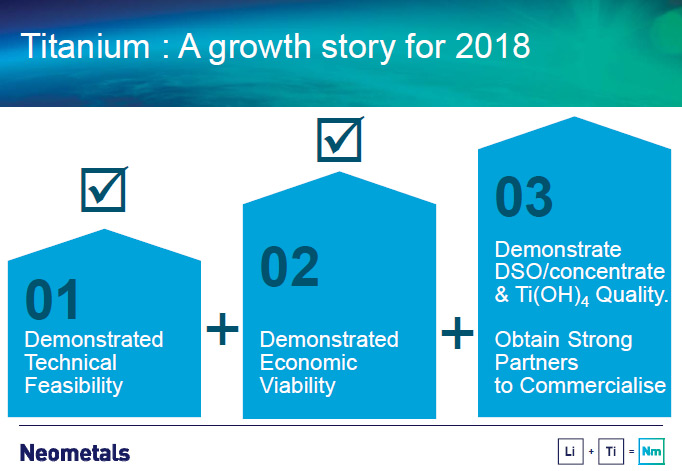

In titanium, we have a resource called Barrambie, which is also located in Western Australia. It is as

yet undeveloped, but we're just commencing the process of the applications for mining and proving up

the process that we're going to use to extract the concentrate and further process it into titanium

dioxide.

In battery resources, the battery market, while it is still quite young in terms of electric

vehicles, still generates quite a lot of scrap through the manufacturing process and we've developed a

process that is now in pilot stage, where we can extract cobalt, lithium, nickel, and copper at high

purity and return them to the battery manufacturing process.

Those are the principal areas of our activity.

Dr. Allen Alper: That's excellent! You must have a very broad-range staff of miners,

metallurgists, chemists, engineers. Could you tell us a bit about that?

Mr. Michael Tamlin: You're correct. Our activities have a broad range of disciplines and

one of the challenges is to harness all of those disciplines and coordinate them properly to get the

required result and at the same time, control the organization in terms of its size and its complexity.

We engage a number of consulting firms to conduct the research on our behalf under our

direction and we also have a philosophy in terms of mine development where, while we're the principal,

we find strong operating partners to share the burden in terms of staffing and in terms of capital.

We've deployed this model successfully in the development of Mount Marion, where we have

developed one of the largest operating lithium mines in the world, at no capital expense to us, while

using the very strong capabilities of Mineral Resources to develop the mine and the concentrating

plant.

We look forward to using a similar model when we develop the Barrambie mine, to minimize the capital

burden on our shareholders and to maximize the returns.

Dr. Allen Alper: Well, that's an excellent approach. That's a very wise way of commercializing

your products and mines. That's very good.

Mr. Michael Tamlin: Thank you. We always focus on minimizing risk and maximizing return and

we've found a successful way of doing it.

Dr. Allen Alper: Well, that's an excellent approach. You've developed quite a bit of proprietary

technology. Is that correct?

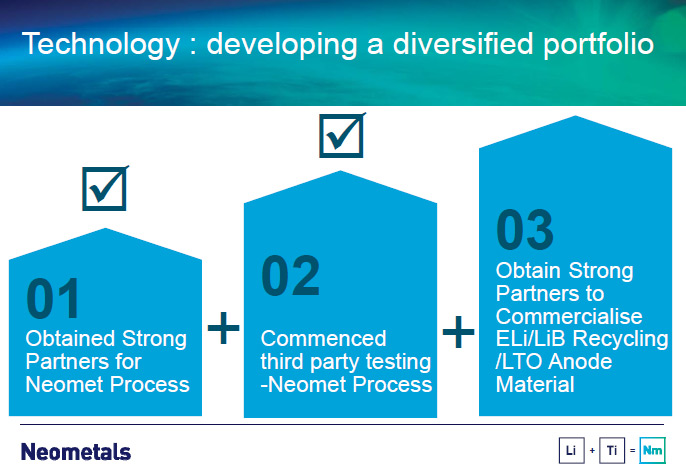

Mr. Michael Tamlin: That's correct, yes. We do use IP advocates a lot. We have a firm in

Australia that is working very closely with us to help us protect the IP that we've developed and to

help us during the commercialization process in terms of either licensing or in terms of deployment.

Dr. Allen Alper: That's excellent! It sounds like you've had proprietary technology in the

lithium area, also in the titanium area, and now in the lithium ion battery recycling area. Is that

correct?

Mr. Michael Tamlin: Yes, that's correct. Certainly, while mineral processing is relatively

straight forward, there's a lot of trade secret type knowledge or knowhow involved in adjusting plant

operations to be efficient and to produce the right product. When it comes to chemical processing, we

certainly have taken a different path, while controlling the risk of implementing new processes, which

is always present.

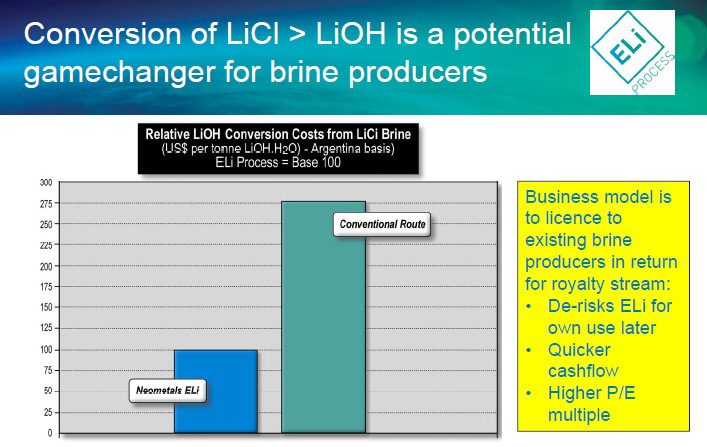

In lithium, we're now developing a process flow sheet towards piloting. We've talked about this in the

past. It is the E-L-I, or ELi, process using electrolysis to make lithium hydroxide for the battery

industry.

In titanium dioxide, one of the key aspects of processing pigments in the world is that good

quality feed stocks are in diminishing availability, while the Western producers of titanium pigment

processing conventional feed stocks have very small operating margins. In the Chinese market, they've

installed probably too much capacity at the expense of the Western producers and operated at low costs,

but the concerns of the government are that the generation of iron sulfate waste from the sulfate

process is leading towards environmental problems.

We actually have something to offer our partners in titanium dioxide, where we have

significantly reduced the operating expenditure on titanium dioxide production while eliminating nearly

all of iron sulfate waste. We can have a product that has low impurities, very low environmental

footprint, and can exploit a Hard Rock deposit without relying on the mineral sand industry to supply

feed stock. We can provide a fully integrated operation from raw material through to the pigment

precursor.

Dr. Allen Alper: Excellent! You're thinking of licensing some of this technology. Is that

correct?

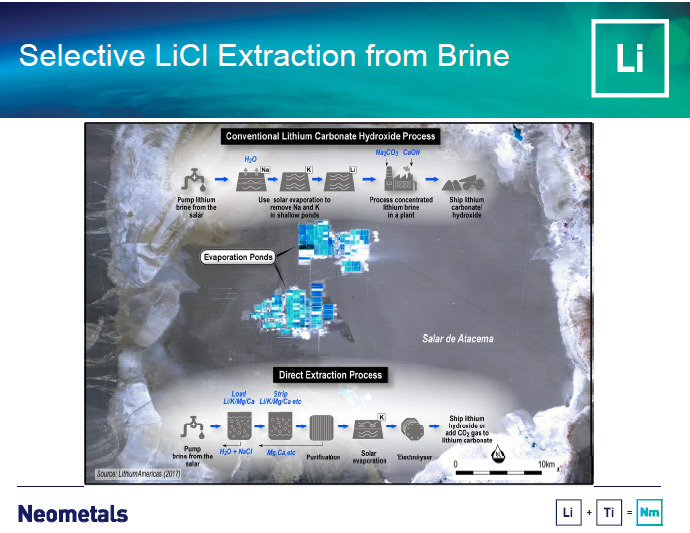

Mr. Michael Tamlin: Yes. Some technology we've developed, and which we're developing, is

actually not applicable to our Lithium Hard Rock deposits. We're developing processing technology for

directly extracting lithium from brine. We don't own a brine deposit, so we are interested in possibly

licensing to those that do own brine deposits. We're looking to reduce the cost of production further

from the already recently low cost of brine producers and to reduce the environmental footprint by

avoiding depleting the water table in very arid and environmentally sensitive areas.

That's one example of how we would look to be licensing technology, but also in the titanium area, we

foresee that we would not be investing ourselves in the entire production of titanium dioxide from our

mine capacity and we'd certainly be looking to engage partners who are interested in taking up a

processing license.

Dr. Allen Alper: Well, that sounds excellent. Could you refresh the memory, of our high-net-

worth readers/investors about your background and your team’s at Neometals?

Mr. Michael Tamlin: Yes, certainly. For me it's been an interesting journey from university

where I studied metallurgy. After some time working in metallurgical operations in base metals, I've

been in the lithium industry for more than 20 years. I've also been associated with the commercial and

executive management in the resources industry. That's led me through Hard Rock and brine lithium

resource companyies to the present position as Chief Operating Officer.

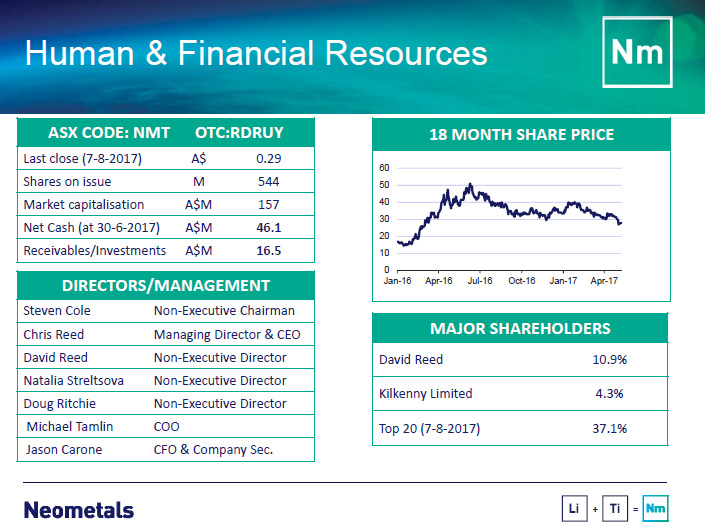

Chris Reed, our Chief Executive Officer, is the very interesting case of a person who founded a

mining company together with his father. He founded Reed Resources, which has now been transformed into

Neometals, and Chris holds a Bachelor of Commerce and also is qualified in Mineral Economics from the

West Australian School of Mines. Now he’s been operating this company for more than 15 years, which I

think speaks for itself.

We have a very competent financial team led by Jason Carone, our CFO, and we have excellent

technical and project management staff. We also have a very capable board that guides us and supports

us. Steven Cole, Chairman is a very experienced legal consultant and specializes in corporate

governance and in other aspects of the corporate sector.

David Reed is a Non-executive Director now, after having been Chair of the company for a decade

or more and we have two independent, Non-executive Directors now. Natalia Streltsova, a PhD Chemical

Engineer, with long and extensive experience in the minerals industry. She has worked for major

companies including Western Mining Corporation, BHP, and Valley. She's an extremely valuable asset for

us in the area of process development and commercialization.

Doug Ritchie is a Non-executive Director, very senior resources industry executive with long

experience including 28 years working for Rio Tinto. He's the guiding hand for us in terms of both

commercialization and corporate development, which is extremely valuable.

Dr. Allen Alper: Well, you have an excellent, balanced, knowledgeable and experienced team and

board. Very good! Could you tell me a little bit about your capital structure?

Mr. Michael Tamlin: Our company is listed on the Australian stock exchange (ASX:NMT and

OTC:RDRUY for overseas investors). It has shareholders, generally based in Australia, but with some

overseas investors. We have mainly retail investors and are certainly seeking to build up the

institutional investor shareholding. Our market capitalization in American dollars is roughly $125

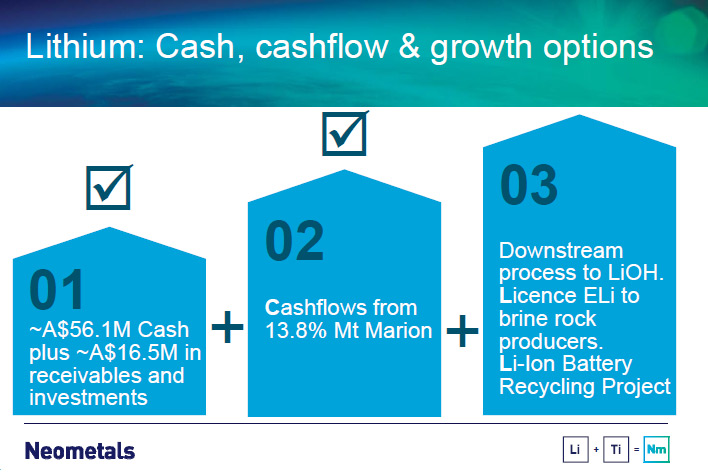

million and fortunately for us, we have net cash of $46 million Australian dollars to support our

development activities and no debt. We're in a position where we can now kick off development of the

lithium hydroxide project and the titanium project as well as the battery recycling and continue the

research.

Importantly, from a company point of view, a big development since we last spoke, is that Mount

Marion mine is now in operation. It's operating at design capacity. It has been shipping spodumene

concentrate now for the last 4 or 5 months. More than 115,000 tons of concentrate has been shipped. The

company RIM that is the operating company for the Mount Marion mine is now paying its own bills without

input from the three shareholders and is accumulating cash. We are looking forward to shareholder

dividends back to Neometals to add to our cash position.

From that point of view, the biggest development for us is the start of revenue from an

operation to support our aspirations in the future and to support any future opportunities to make

returns to shareholders.

Dr. Allen Alper: Very very good! That's in an excellent position to be in and you're right at

the forefront of lithium development and production. Great!

Mr. Michael Tamlin: We overcame two big hurdles. First, we managed, through the efforts of

our co-shareholder in the mine, to acquire the necessary capital. Secondly, the technical aspects of

developing a mine and stabilizing production is extremely significant and often overlooked and we've

managed to eliminate the project risks through reaching production, a very significant milestone.

Dr. Allen Alper: That's excellent. What are the primary reasons our high-net-worth

readers/investors should consider investing in Neometals?

Mr. Michael Tamlin: We're here to generate shareholder returns. Last year, we paid two

dividends to our shareholders and we have been engaged in a share buyback scheme this year. Existing

shareholders have been well-served in recent times. We also have excellent prospects for the future.

From our no-debt, cashed up position, we now have the opportunity to take the Mount Marion project from

not only a concentrate producer into a lithium hydroxide producer.

In the next 2 to 3 years, we'll be developing that project so that our production, in 2021 will be

supplying the battery industry. That will give us an uplift in the value of our lithium unit by a

significant amount and provide revenue.

Every $1 of spodumene produced is worth about $3 of lithium hydroxide and about $8 as materials

in batteries, such as lithium titanate, for which we also have an R&D project under advanced

development. Now we're looking to add value to what we're already doing and in the lithium hydroxide

space. That is a 2021 goal.

In lithium battery recycling, our pilot plant is now under construction and will start

operating in the next month or so. By the end of the year, we will have the operating results that will

then be converted into the engineering of the first modular commercial scale plant, which we are aiming

to have in production by the end of 2018 or the beginning of 2019.

That's a particularly high return on investment for us based, firstly, on the cobalt and lithium

prices, secondly, on the tight supply in both the cobalt and lithium markets and so we would expect to

be seeing returns from those investments in the 18 month time frame.

When it comes to lithium titanate, possibly a little longer in the development time based on

the time it takes to prove up technology in batteries, but taking our lithium hydroxide to lithium

titanate, going from a three times valued product to an eight times valued product, I think, has a lot

potential for us.

In titanium, we have the prospect of evaluating direct shipping ore and our revenue from the

mine in the next one and a half years. In product development, we are looking at upgrading our titanium

Hard Rock into titanium dioxide, using pilot plant activities from the end of the battery recycling

project, about the end of this year through the first 3 to 6 months of 2018.

That's a slightly longer commercialization time, but we will be looking to work with potential project

partners over the next 12 months. I think we’ll be re-rating the way people look at Neometals over that

time. In addition, we've announced that, subject to approval from the shareholders, we will be

considering a de-merger of our company operations to provide focus on the lithium sector and the

titanium sector. This may be an opportunity for your high-net-worth readers/investors to consider

Dr. Allen Alper: Well done! An excellent strategy to keep adding high value to products in your

portfolio. It increases your margin, profit and cash flow. That's an excellent approach.

Is there anything else you would like to add?

Mr. Michael Tamlin: Thank you for the opportunity to update your readers on Neometals. Our

website, www.neometals.com.au, has access to our corporate presentation and contains more detailed

supporting information on what we've discussed today. Certainly I would invite anybody who is

interested to contact me. We're happy to talk about further details on our development activities and

on potential partnership arrangements. We have a few aspects we haven't covered, including some of the

technology developments. You may want to look at our website and our corporate presentation to

supplement this interview.

Dr. Allen Alper: That sounds excellent.

http://www.neometals.com.au/

Chris Reed

Managing Director

Neometals Ltd

info@neometals.com.au

Michael Tamlin

Chief Operating Officer

Neometals Ltd

T: +61 8 9322 1182

|

|