Developing Granada Gold Mine Inc. (TSX.V: GGM): A High-Grade Past Producer in the Heart of the Famous Abitibi Greenstone Belt, Interview with Frank Basa, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/22/2017

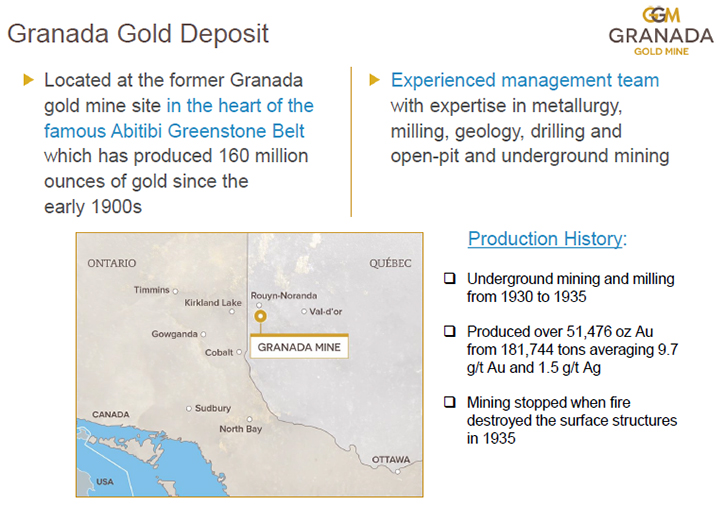

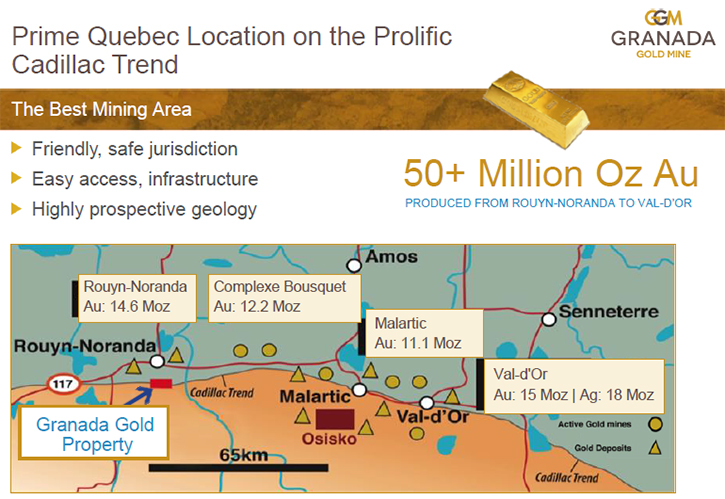

Granada Gold Mine Inc. (TSX.V: GGM) is a Canadian junior mining and exploration company focused on

developing the Granada Gold Property, a high grade past producer, located near Rouyn-Noranda, Quebec,

in the heart of the famous Abitibi Greenstone Belt and along the prolific Cadillac Trend. We learned

from Frank Basa, President and CEO of Granada Gold Mine Inc. that five million ounces of gold have been

found so far, with very good further exploration potential. The property is fully permitted and shovel

ready. The area offers excellent infrastructure and a very good supply of skilled labor. Plans for

2017/2018 include the drill program and feasibility study, with the end goal of bringing the project

into production.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Frank

Basa, President and CEO of Granada Gold Mine Inc. Could you give our readers/investors an overview of

your company, Frank?

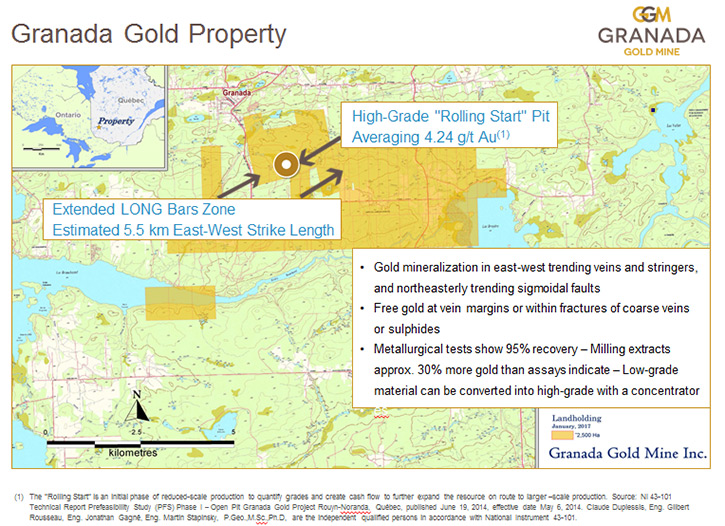

Mr. Frank Basa: It's a property located in Quebec, on the Cadillac Trend. It's a former

producer. The grade that they used to mine there was 9 to 12 grams per tonne. It's basically a quartz

structure. It's about 13 kilometers long. We've explored only 1.5 kilometers of it. We found it was

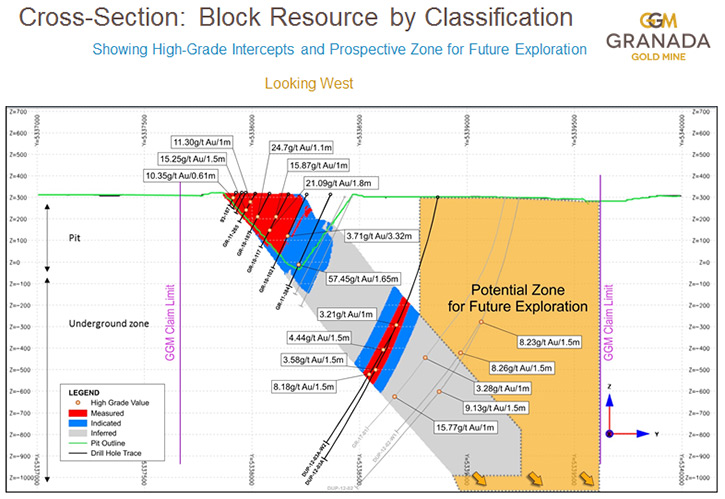

mineralized for a strike length of 5.5 kilometers and so far we have found about five million ounces on

the 1.5 kilometers that we did explore. There's one gram material, open pitable, and 4.6 gram material

underground. We spent about 52 million dollars exploring it. We did about 122,000 meters of drilling

and now have about 925 holes.

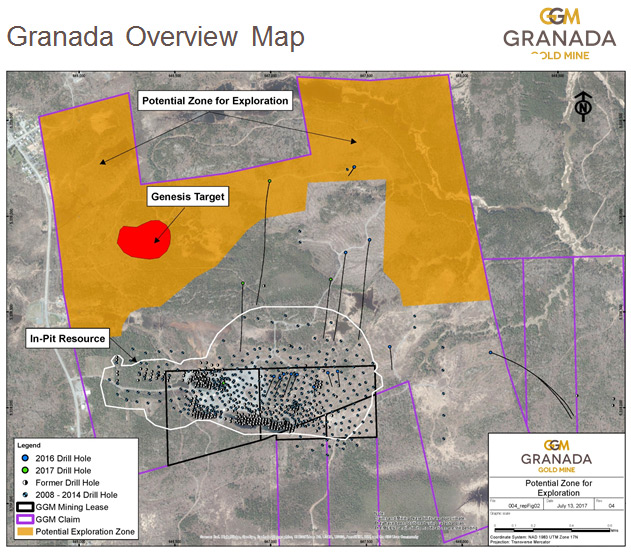

We still have more targets to drill in the north, which will yield high-grade underground

material. We're looking to add possibly another 1.2 to 2 million ounces at four and a half grams per

tonne or higher. We also have the extensions going to the east, which require exploration as well. We

expect to be able to exceed the five million ounces in the next few years.

The property is fully permitted. It took us about two years to get our permits. We're permitted to go

into production, we're shovel ready. We'd like to carry on with our exploration program, and see how

much higher in ounces we can go with this property.

Dr. Allen Alper: What are your plans, going forward, for 2017 into 2018?

Mr. Frank Basa: We'd like to carry on with our drill program and then see if we can get the

project into production. It'd be something like the Atlantic Gold Project on the east coast of Canada.

They basically put a project into production that had about 800,000 ounces open-pitable at about one

gram and they were able to raise about 115 million dollars as a loan. I think their cash cost was only

about $550 per ounce.

Dr. Allen Alper: Well that sounds very promising. Could you tell us a bit about your background,

your team, and your board?

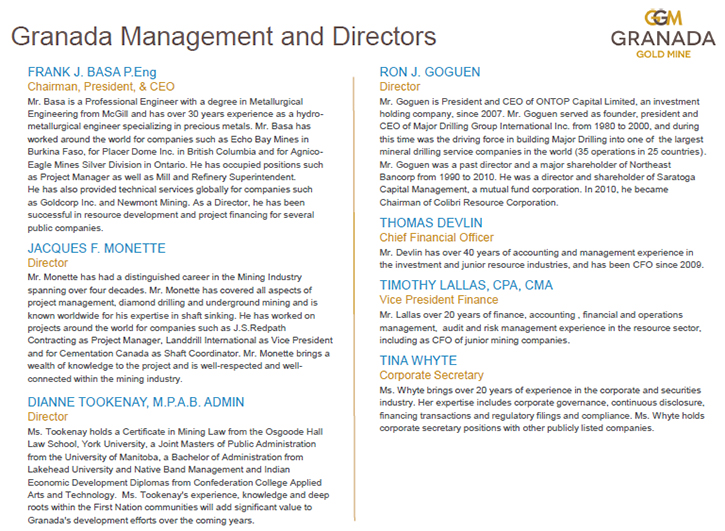

Mr. Frank Basa: We're hands on operational people. Normally we acquire former producers with

historical data. We have a tendency to put a good deal together and initiate a drill program and a

marketing program.

When we first started in this company, we took it from a halted company, to a market capital of

about $121 million in 18 months. Now we're trying to take it to the next level, which would be to add

more ounces, and take it into production.

So, we're hands on operational people. I'm actually the youngest one on my board, at 60. Most

of my people have worked with me for multiple years. We're used to being able to work on projects that

are realistic in their ability to go into production.

Dr. Allen Alper: Do you plan to take the property into production if everything looks good?

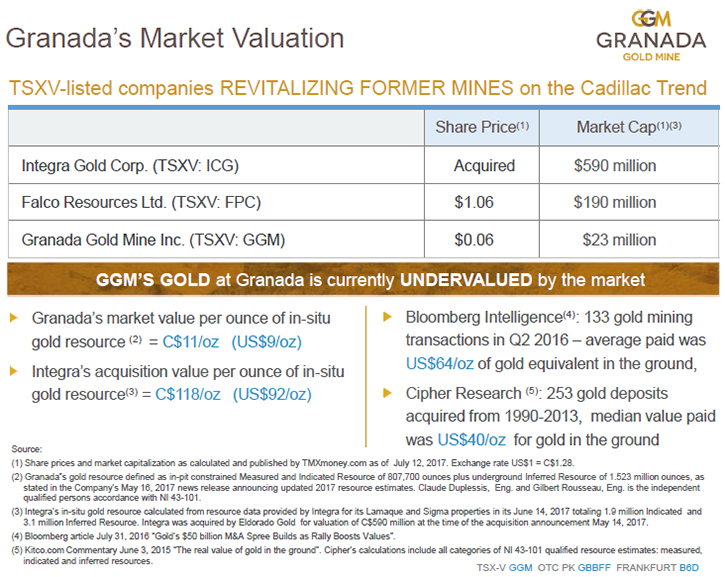

Mr. Frank Basa: Yes, we got three offers, which we felt were not really adequate in

representing the fair value of the assets. So we've changed the name. I've changed part of the board,

and there'll be some more board changes going forward. Within that two to three year timeframe, we'd

like to see if we can take it to about 100,000 ounces a year as a producer.

Dr. Allen Alper: Could you tell us a bit more about your share structure, capital structure and

your investors?

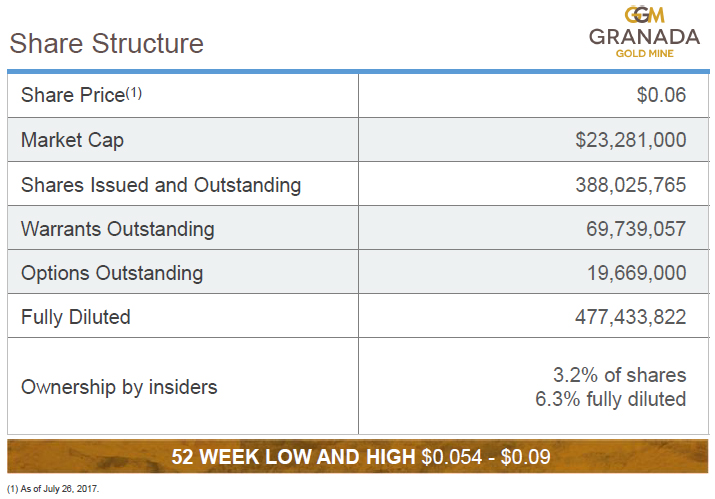

Mr. Frank Basa: Of course. The share structure, we have about 380 million shares outstanding.

We're considering rolling back the stock when we do another financing in order to take the company to

the next level.

Right now we have too many shares out. We feel the ideal thing is to roll back the stock and

finance it at the same time.

Dr. Allen Alper: Sounds good. What are the primary reasons our high-net-worth readers/investors

should consider investing in Granada Gold Mine, Inc.?

Mr. Frank Basa: Well its location, the site’s jurisdiction, a very good skill set, a mining

base community, limited risk. We've done all, what I call. the heavy work, putting the action together.

It was quite complicated and took us quite a few years to put together.

We drilled it and have shown the world we can find the gold. We've gotten the permits, a

somewhat complex process now anywhere in the world, which took us a couple years. We had to pay out

about $6 million for studies to get the thing done.

So, it became shovel ready. The potential is that we can probably exceed the five million ounces. We

don't know how much higher we can take it, and to get into production, if you look at Atlantic Gold,

they're doing about 87,000 ounces a year and they have a market capital of $270 million. We have a

market capital of only about $24 million.

Dr. Allen Alper: Sounds like excellent reasons.

Mr. Frank Basa: Yes, there's a lot of room to grow.

Dr. Allen Alper: Is there anything else you'd like to add, Frank?

Mr. Frank Basa: No, that's about it. It's a simple project. The grades are good, the metallurgy

is good to get 90-94% recovery, good jurisdiction, cash costs are reasonable. We're very conservative,

the way we did our resource. We intend to repackage the assets, and take it into production

hopefully within two or three years, pouring 100,000 ounces of gold a year.

Dr. Allen Alper: Wow that sounds excellent!

https://www.granadagoldmine.com/

For further information, please contact:

Frank J. Basa, P. Eng.,

President and CEO 1-819-797-4144

or

Wayne Cheveldayoff,

Investor Relations,

416-710-2410

waynecheveldayoff@gmail.com

|

|