Continental Gold (TSX: CNL; OTCQX: CGOOF), Interview with Paul Begin, CFO: High-Grade, Multi-Million-Ounce, Precious-Metal Project Scheduled for Production in Early 2020

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/27/2017

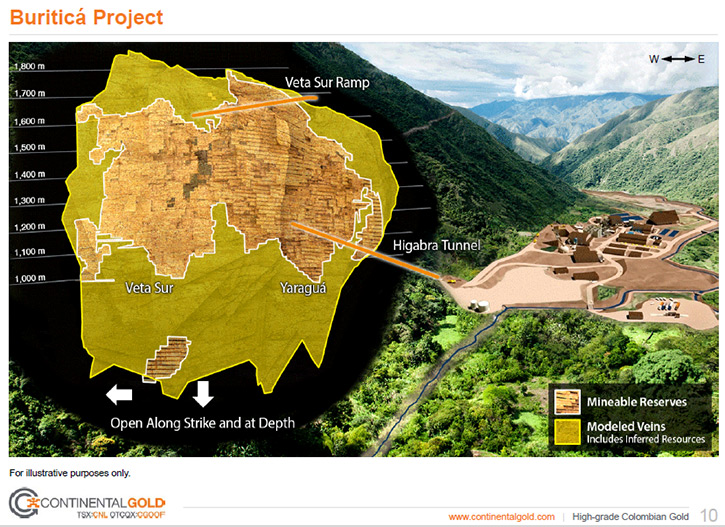

Continental Gold (TSX: CNL; OTCQX: CGOOF) is a development-stage gold mining company,

with a portfolio of high-grade and high impact exploration and development properties in

Colombia. Their flagship Buriticá project is a high-grade, multi-million-ounce, precious-

metal project scheduled for production in early 2020. We learned from Paul Begin, CFO of

Continental Gold, that with recent investments from Newmont Mining and Red Kite the

company is well-funded to initiate construction of the Buriticá mine and initiate

aggressive drill-programs throughout its portfolio of properties. According to Mr. Begin,

Buriticá is a very large project, with tremendous growth potential, and their other

exploration targets are also very promising.

Higabra Valley

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News,

interviewing Paul Begin, CFO of Continental Gold.

This is a really exciting time for Continental Gold; you have a great project, you

have funding and you have your plans to move forward. Please give our readers/investors an

overview of Continental Gold; what your plans are, what your goals are, et cetera.

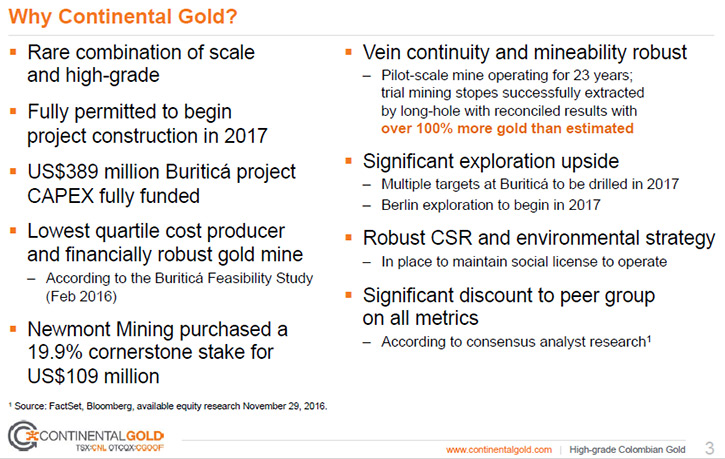

Mr. Paul Begin: Continental Gold is Toronto-based, with high-grade Colombian

assets. We’ve advanced our flagship property called Buriticá over the last eight years or

so. We've built it from an exploration target to a large, high-grade deposit. Resource-

wise, we have 8.98 million ounces of gold plus silver in all categories (28.49 million

tonnes) at roughly ten grams per ton, and on a reserve basis we have 3.71 million ounces

of gold (13.72 million tonnes) at 8.4 grams per ton gold. If your readers/investors want

more detailed information, they can go to our website.

It's a large resource, open both at depth and to the west, so it has plenty of room for

growth. We're advancing that now with exploration drilling resuming after a few years off.

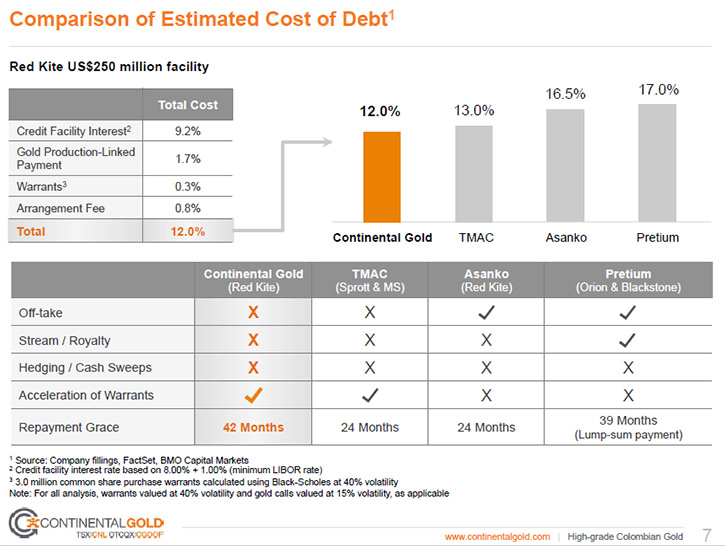

We published a feasibility study in early 2016 and just raised US$250 million in secured

debt from Red Kite. We've also recently closed an equity transaction, raising US$109

million from Newmont Mining and s US$25 million from Red Kite. So, we have plenty of

funding, and construction activity is underway. Long lead items have been ordered and

we're targeting production for the first half of 2020.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors a bit of

what differentiates your property from others?

Mr. Paul Begin: There are a number of factors; first and foremost, it's a large

deposit with tremendous growth potential - it's open at depth and to the west.

Additionally, we have other very promising exploration targets in and around the Buriticá

area. Buriticá has straightforward metallurgy and most of the ore body is located above

the valley floor, so we will have gravity working to our favor. In summary, it’s a rare

combination of size, grade, growth potential and straightforward metallurgy. It's also

rich in infrastructure, literally right off the Pan American Highway and there is an

abundance of human resources around as well.

Dr. Allen Alper: Sounds excellent! Could you tell me a bit about your background;

the teams and the Board?

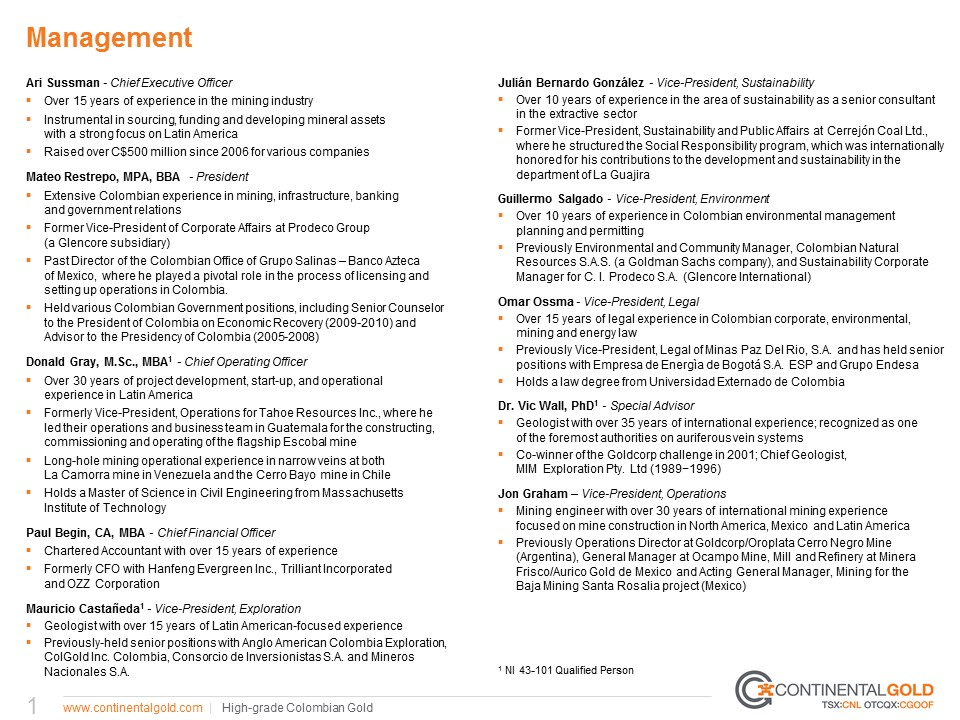

Mr. Paul Begin: I've been with the company now for nearly seven years. I started

when it was just a drill target. I met Ari Sussman through a mutual friend of mine. Ari is

the founder of the company. He launched the business in 2010. He has a long history

throughout South America and decided he wanted to open business in Colombia. He had met

most of the mining people in Colombia - which weren't that many back then - and met an

individual named Bob Allen. Bob had a company that controlled many hectares in Colombia -

roughly four million hectares of exploration potential grounds. Ari convinced him to put

his high-grade targets into a company and let Ari run the company and take it public.

Ari's got a long history in mining. Our Chief Operating Officer is Don Gray. Don is a

seasoned operator who just recently came off from building Tahoe's Escobal mine in

Guatemala. He was the first guy on the ground in Guatemala and stuck with the project,

right through commercial production.

Our President is Mateo Restrepo, a Colombian from Antioquia. We recently recruited

him from Glencore. Previously he worked in the Colombian government so he has strong

government ties and is a local here from Medellin.

Dr. Allen Alper: That sounds like a great team you have there. Experienced,

powerful, great backgrounds. Sounds excellent! Could you tell me a little bit about your

capital structure?

Mr. Paul Begin: With the equity raise we just did with Newmont and Red Kite, it is

roughly 187.9 million shares outstanding. There are an additional 8.8 million warrants and

8.4 million options outstanding. The exact numbers are available on our website.

Dr. Allen Alper: Where is your stock being traded?

Mr. Paul Begin: The majority of our stock is traded on the TSX.

Dr. Allen Alper: And could you tell our readers/investors how it is operating in

Colombia?

Mr. Paul Begin: Actually, it's very good operating in Colombia. Colombia is by far

the most right-wing-thinking country in Latin America. If you compare it to some of its

neighbors, it's night and day. They've elected a right-wing government for close to 50

years now. It's never been politics that has been the problem in Colombia; it's always

been security. And with the recently announced peace deal with FARC, there is a continuing

trend of improved security conditions in the country. So it's actually great to operate

here. Colombia has a judicial system that is separate from its political system and

foreigners have the exact same rights as its citizens or local companies; thus, the

company is actually well-received. I think it's becoming more and more well-known within

the business community that Colombia is a place to invest, particularly now that it's

opening up from a security point of view.

Dr. Allen Alper: That's excellent. What you're doing must be the right thing since

you're getting such strong support and investment from Newmont. Newmont is a great

company.

Mr. Paul Begin: Yes, we were very excited about the prospects of Newmont becoming

a 19.9 percent shareholder for a number of reasons. Newmont is a very well-respected

company, as you mentioned, with a large market cap and a balance sheet that has the

flexibility to do things.

More importantly, Newmont doesn't go around the industry making these kinds of

investments on a regular basis. The amount of due diligence that Newmont performed prior

to making the investment was astronomical. It far surpassed the due diligence that our

lenders did prior to committing their $250 million. Very senior people from Newmont came

to Colombia, toured the project and talked to the local, departmental and national

governments. We feel it's a bit of a validation of the project and of us, quite frankly,

so we're pretty excited to have them on board.

We're plan to leverage our relationship with Newmont and their technical

expertise. We've formed joint management committees with Newmont where they can assist us

in the actual build-out. The more technical expertise and experience we can have on our

side, the better.

Dr. Allen Alper: It's excellent to have Newmont involved, both technically and

financially. They are highly respected and they bring that respect to any company they

endorse. Excellent! What are the primary reasons our high-net-worth readers/investors

should consider investing in Continental Gold?

Mr. Paul Begin: I think there are a couple factors. Number one, the project speaks

for itself. This is a very special project; they don't come around very often. Size,

grade, straightforward metallurgy, strong social license - all these things are working in

its favor. Unless you tick all the right boxes, any project could fail. You could have a

great project with straightforward metallurgy, but if you don't have a social license,

then forget about it, right? It's not going to happen. Fortunately, Buriticá ticks all the

boxes, so that's first and foremost. The second is that our valuation is extremely

compelling right now. If you look at our P/NAV compared to our peers, we are trading at a

significant discount and I think the reasons for that are because of the recent GDXJ

rebalancing; we were hurt badly by that. That's over now and we should start seeing a

recovery; we should start seeing our valuation trading more in line with our peers.

I consider our peers to be Pretium and TMAC. Both are trading just below 0.8 or0

.9 NAV and we're trading as low as 0.4 NAV – these are approximations - so there is a

significant valuation gap there. Yes, they are further advanced than we are but, as we

progress building this mine, that valuation gap should start to close.

Dr. Allen Alper: That's excellent. There are some very strong reasons for our

high-net-worth readers/investors to consider investing in Continental Gold. Is there

anything else you'd like to add?

Mr. Paul Begin: I appreciate having the opportunity, Dr. Alper, to share

Continental Gold’s progress and promise with you and your readers/investors.

http://www.continentalgold.com/

Paul Begin

+1-416-583-5617

+1-877-273-8228

p.begin@continentalgold.com

|

|