Interview with Darren Blasutti, CEO of Americas Silver Corporation (TSX: USA; NYSE "MKT": USAS): Positioned to Become One of the Lowest Cost Silver Producers in 2018

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/7/2017

Americas Silver Corporation (TSX: USA; NYSE "MKT": USAS) is a leading Canadian-based junior silver

producer, with assets in the Americas and a strong operating platform. The company owns and operates the

Cosalá Operations in Sinaloa, Mexico and the Galena Complex in Idaho, USA. A third mine is in

construction in Mexico, and an advanced stage exploration project. We learned from Darren Blasutti, who

is CEO of Americas Silver, that their new mine comes on in the fourth quarter of this year, which will

dramatically decrease their all-in silver cost for 2018. According to Mr. Blasutti, the company's vision

is to be leveraged fully to the silver price, owning 100% of their properties, and having no third party

royalties. With the market turnaround, Mr. Blasutti believes Americas Silver can develop some real

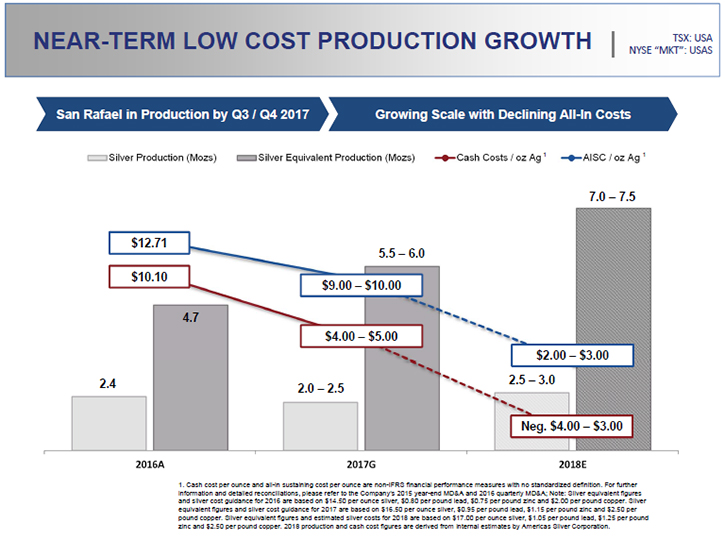

momentum and growth around their asset base. Annual production for 2017 is expected to be 5.5-6.0 million

silver equivalent ounces.

Americas Silver Corporation

Dr Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Darren

Blasutti, President & Chief Executive Officer of Americas Silver Corporation. Could you give our

readers/investors an overview of your company?

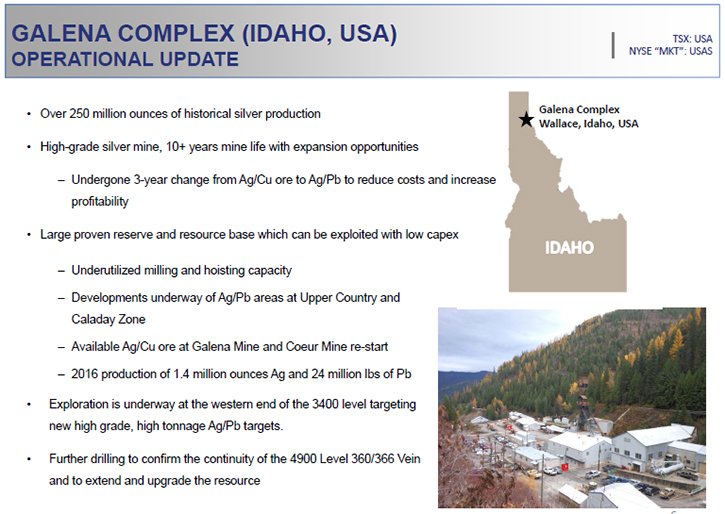

Mr. Darren Blasutti: We are a silver producer. We have two mines, one in the United States in

the Silver Valley, about seven miles from Hecla's Lucky Friday project, and that is the Galena Complex.

We're also in Mexico, in Sinaloa state, near Mazatlán, on a property we call our Cosalá operations. Those

two mines produce around 2- 2.5 million ounces of silver. They have some zinc, lead and copper by-product

credits that are also produced. In 2017, we expect to produce roughly two and half million ounces, about

$9 -$10 dollars all-in cost, for silver. We expect that that cost number will decrease dramatically in

2018, as our new mine comes on in the fourth quarter this year. It is in Mexico and it is called San

Rafael.

So that's a quick overview, Al, of the company. We are fully leveraged to the silver price. We have no

hedging; we have 100% of our properties owned, and we have no third party royalties. We of course have

the Mexican royalty tax, in Mexico. But we effectively have full leverage to the commodities, which we

have in our resource base. The overall resource base is about 120 million ounces of silver, about 32

million of which are reserves, 55 or so in Measured and Indicated resources, and the remainder in

Inferred. We have about a billion pounds of lead in our reserve and resource, and about 700 million

pounds of zinc. So we do have fairly big reserves and resources. In the future we plan to exploit more,

to increase our production from our own mine sites.

Dr Allen Alper: That's amazing, you have really very large resources, and I've noticed you're

doing excellent work lowering your costs. Could you tell our investors/readers a bit about that?

Mr. Darren Blasutti: We acquired two companies as a management team and board, because we saw

the value of the large resource base, but they had very high costs. Our view was neither of those

companies had been operated very efficiently. In 2012 we bought a company called US Silver, it was

producing at about $33 dollars an ounce in September 2012 when we acquired it. We understood they were

mining high grade silver tons, but the productivity of those tons was not very good. They were chasing

very narrow veins, 18 inches to three feet wide, with very expensive mining methods; i.e. conventional

mining methods, high cost labor, with low productivity.

The mine at that time, in 2012, was producing silver and a little bit of copper ore. We

identified in our review of the company before we bought it, that there was some really good silver lead

ore that could be mined more cheaply, because it was seven to 30 feet wide instead of 18 inches to three

feet wide, and that would allow us to reduce the work force. Silver was declining quite rapidly and the

company was still at $30 costs. We came in and changed the mining method from silver copper and

conventional, labor intensive mining, to more bulk mechanized mining and were able to reduce the work

force by 45%. Given that the stopes were much bigger, and therefore could have bulk mining attached, we

managed to lower our costs from about $300 per tonne then to about $140 per tonne today.

So that's been the dramatic changeover. Also the value per tonne of the rock that we have been mining is

higher because it is effectively higher grade, when you include the lead. The silver was on its own

before. So we went from about mining 12 ounce silver, with about 0.3 or 0.4% copper in it, to mining

about 7-8 ounce silver with 7 to 8% lead in it. So roughly 15 ounce equivalent rock, mined at much wider

areas, allowed us to reduce the work force and increase productivity. That was our strategy.

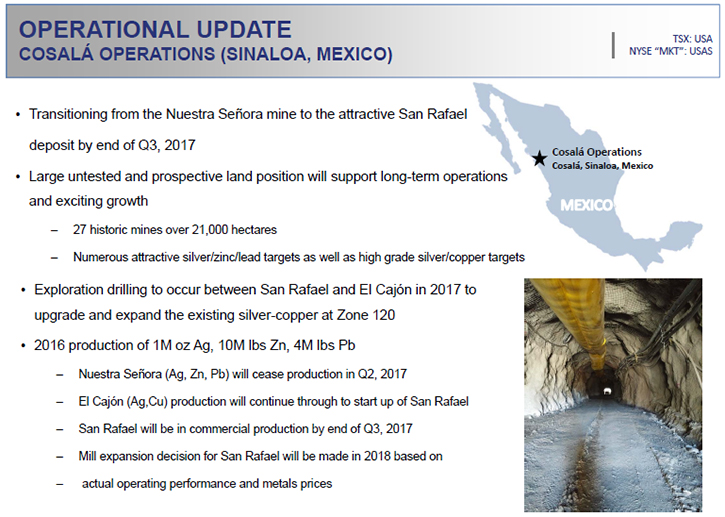

In Mexico, the mines were operating well from a labor standpoint, but they were operating silver

mines that weren't making any money. So we shut the El Cajón property down when we got about a month into

taking over Scorpio Mining, in 2014. We shut down the mine despite the fact it had just been built. We

re-explored the Nuestra Senora mine they were operating that had higher margins. We managed to increase

the mine life by a couple of years there, through exploration drilling, and that has done very well for

us. The costs were about 24 dollars in 2014, last year they were about $8.50 dollars per ounce. They're

going to about $2- $3 dollars an ounce this year.

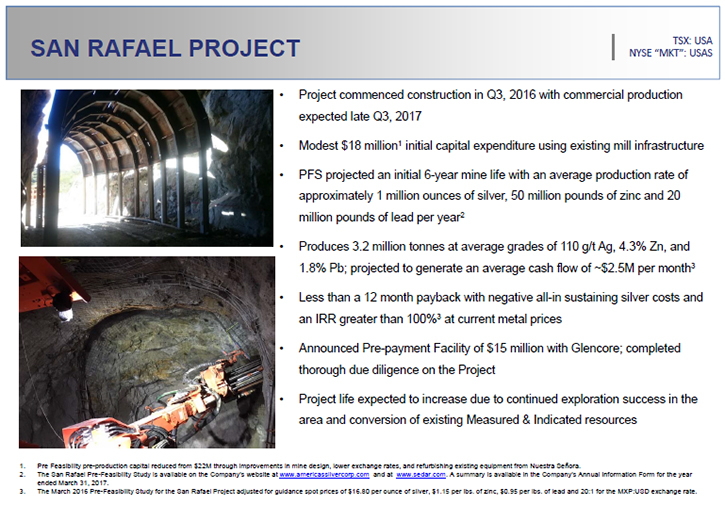

Then of course our new mine, San Rafael. The Mexican Company, which was Scorpio Mining, the Cosalá

operations, had a development project called San Rafael, and San Rafael is really the future of our

company. It was slated to be an open pit mine, with a capital cost north of $200 million. We turned it

into lower tonnage, but higher grade for about $18 million, which raised the return from around 10% to

north of 100%, on a post-tax and unlevered basis. That mine will start producing in the fourth quarter.

Its costs will be negative $10 dollars an ounce, all-in costs at current metal prices, because it has

very good zinc, high grade zinc, and high grade lead.

We’ve moved the company from $30 down per ounce costs to $10 this year, as a result of shutting mines,

reducing cost, and increasing productivity, and then bringing the new mine on next year will make a step

change down in our cost base, as we bring on this additional lead and zinc, while maintaining and

slightly growing our silver production.

Dr Allen Alper: Well, that's an amazing job. I'm very impressed with the work your team has done.

Mr. Darren Blasutti: Well it's never fun to have to let people go, Al, that's the hard part of

the business. As you know, having been in the industry for a long time now, you go after tons because the

metal prices are high, you hire people, and the people you hire, you're training and they're not as good

as the workers you already have, and then you get those incremental miners into incremental stopes, and

your costs just snowball into being much higher. So we've now reset our company, on a cost basis. We're

trying to grow our silver production now. But at $17 it's hard to make money for a lot of the guys in the

industry. So we're looking at how we can increase our silver production without increasing our cost base

back up again. That's the real trick.

We're taking these really smart guys, who spent the last four or five years reducing costs,

finding better productivity in the mines, and cutting them loose on mine planning to increase our silver

production. We'd like to get from about two and a half million ounces to four or five million ounces by

2020, from our asset base. That's really the goal of the company. We think at a minimum we should be

making $10 an ounce on our silver. If we're not, when you think about the cost to acquire properties,

drill, permit, and build mines, I don't know how you make a return for your shareholders if you get less.

We have this big asset base of 120 million ounces of silver. Instead of having a 55 or 60 year implied

mine life, we'd like to have a 20 year life. That means increasing production. But we don’t want to

increase silver production based on a hope that the silver price will go up this year. We want to do it

at current prices and make money at current prices, and be ready for when the higher prices return. So

we’ve reduced our silver production and increased our base metal production. That's something we had to

do, not something we wanted to do this year.

Lead and zinc are at historically high prices so we are producing more lead and zinc. We will

accumulate cash on the balance sheet and be ready for when silver prices recover, so that we can be

producing that much more silver. We won't have to buy a new company to increase our production. We can do

it from our asset base, and that's really the strategy of the company as we go forward.

Dr Allen Alper: Well that's very good. It sounds like a very sound strategy, and you’re executing

it very well. It sounds like you're very competitive, versus your peers. Could you tell our

readers/investors more about that?

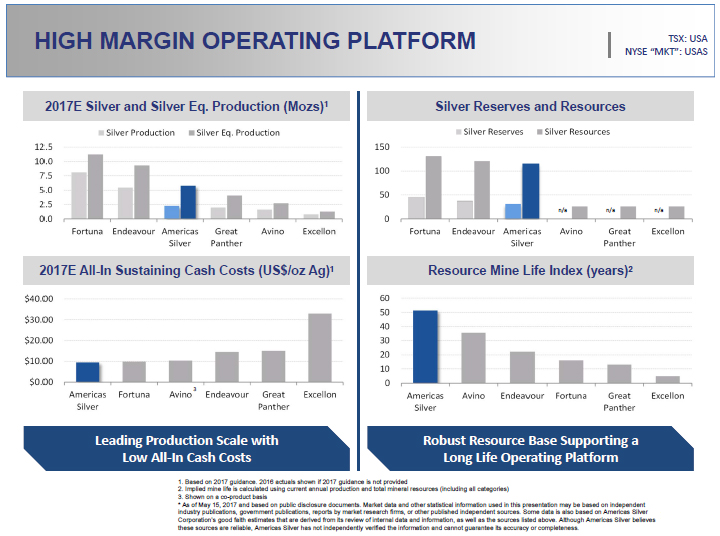

Mr. Darren Blasutti: Neither of the companies we acquired were well run at the time and were

very high cost producers. Investors, shareholders have been impressed with our cost reduction, down to

$9- $10 this year, which in our peer group is the lowest cost. You'll see from our presentation, and

going forward, we will fall to one of the lowest all-in cost producer next year in the entire silver

industry. We trade at very low multiples compared to our peer group. So despite the fact that we have the

most leverage to silver production, and silver resources, despite the fact that we have our costs

lowered, and we're going to be the lowest cost in the industry, we trade at very low multiples compared

to our peer group.

But, now we’ve started marketing the company, letting people know what we’re doing, about the

turnaround. We are continuing to fix our mines internally, and now we're out a little bit behind the

eight ball, working on catching up with the really well-known silver names like Great Panther, First

Majestic, and Hecla. People have not really heard of Americas Silver, so we are out marketing.

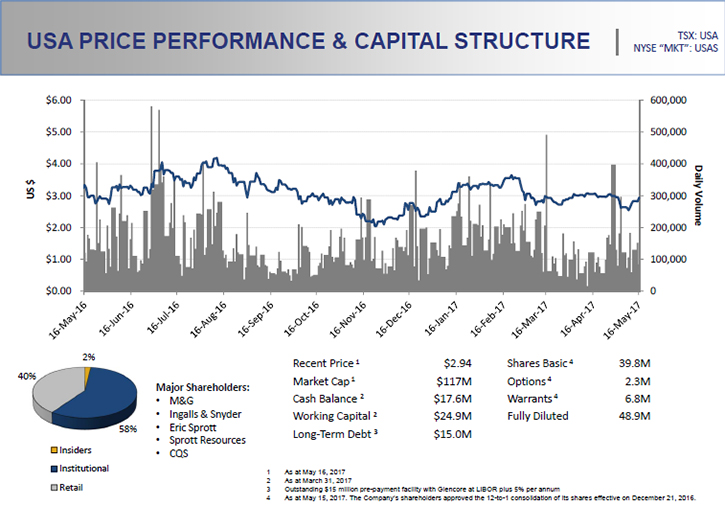

We went on the New York Stock Exchange this year, in mid to late January, so now you can buy

Americas Silver Corporation (TSX: USA; NYSE "MKT": USAS) on the New York Stock Exchange, in the MKT

market, or an MKT platform. We're working hard to making it more available. We're about 58%

institutionally owned, we're about 38% to 40% retail owned, a lot of that is Canadian retail, familiar

with the management team and board. But we expect to make penetration into the US retail base because we

have a US asset.

I think a lot of people are waiting for this new mine to come on, in the fourth quarter, because

it's such a company builder. I think we are going to get a re-rate as we get closer to that mine date,

and our costs continue to drop. We expect our second quarter to be a very good quarter for the company as

far as earnings and cash flow and low costs. We expect to pick up some ground from our competitors.

We expect Galena, which was producing at $30, to produce at $12 or $13. Scorpio that was at $24 can

produce at $3 this year. We have institutional shareholders and we’re getting the word out to the rest of

the market. We've been marketing all over the US. We performed pretty well in 2017, compared to our

peers, but we've got a long way to go to catch up with where we should be trading.

At the new project: The reason the capital cost is so low at $18 million is because it's an

underground mine and we already have an existing mill facility. The commissioning and the ramp-up that

people normally worry about with new projects, is not there for us. Because the mill has been operating

these kinds of products since 2008. Of that $18 million, about $14 million is development capital. So

this thing, when it comes up in the fourth quarter, will change our Mexican operations. It will allow us

to reinvest some dollars into exploration, which we haven't been able to do. Companies in the industry

have not been spent exploration dollars because nobody's had any money.

We're very high on the exploration potential of our properties, especially in Mexico. There’re a

lot of discovered resources and reserves in Galena, which can come on from existing stopes at higher

prices, but Mexico's really in the forefront of discovery for us. We think we have multiple mine

scenarios there, potentially as many as three or four mines that could be operating at better prices. Our

exploration dollars, put on the balance sheet from our new project, will allow us to exploit those things

in the next couple of years, so we're very excited about that.

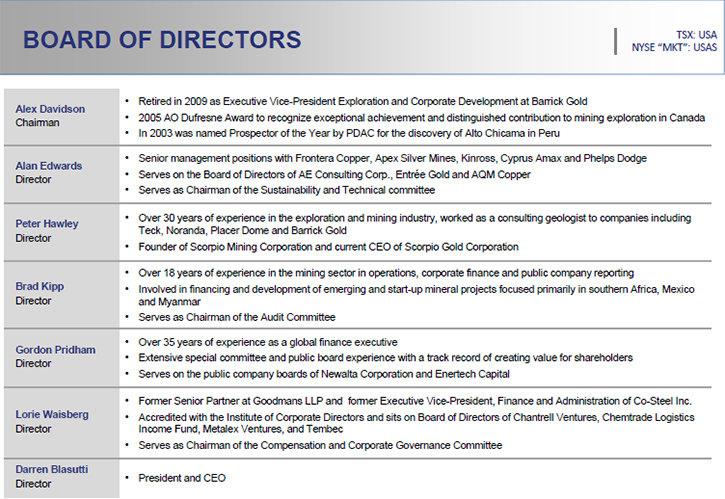

Dr Allen Alper: Sounds very exciting! Could you tell me a little bit about your background, your

team, and your board?

Mr. Darren Blasutti: The majority of the management team, four of the five guys, are actually

ex-Barrick. We call it Pre-Equinox Post-Barrick. We were gone before the bad era, 2010-11 for Barrick. I

was the head of corporate development at Barrick. I took a team of young guys, experienced in big

companies, who understood the importance of safety, proper organization and disclosure to the market, and

all those kinds of things, from a very professional level.

In the last five years we had to work in a serious downturn in the mining industry. That

experience, coupled with our Barrick experience, really gives us a lot of confidence. Not many people can

say they took the two highest cost silver producers in the world and made them into the lowest cost miner

in the world. So we've had a lot of experience, maybe more experience than we wanted, quite frankly, last

five years, it's been a very difficult period. But it's been a very good learning period for our board

and management.

I'm a chartered accountant, but I was the kind of guy, who was sent around the world at Barrick, with all

the mining engineers and geologists, to look and acquire properties everywhere. So I certainly have a

good understanding of how to look at properties that are out of the money, or undervalued, figure out how

to pick them up cheaply and turn them into valuable resources. So that experience is what we put in play

when the silver price went to $13 from $35. We worked it out and came out of it as a better company.

We've come out of it stronger. As a management team, we're highly educated professional engineers,

chartered accountants, with good technical expertise from the Barrick training. Additionally we have our

own, on the ground training, for dealing with junior assets, smaller assets and capital markets

experience. We are prepared to move forward in the future. We can look at exciting, big opportunities. We

can also look at things which are undervalued and come in and fix them.

We hired a lawyer, unusual for a company our size, who was a really high performer at Weil Gotshal in New

York, which is a big M&A firm there. The Chairman of our board was head of exploration at Barrick. We

have two mine builders in Peter Hawley and Alan Edwards on our board. Alan notably was with Phelps Dodge,

and was the head of technical services there. So we have a very strong technical base on our board. Peter

Hawley was the founder of Scorpio Mining, and was very good at finding assets and getting them built.

Then we have a nice mix of legal, accounting and capital markets experience to ensure that the regulatory

and disclosures etc. are well taken care of, and that I can lean on as a manager. So as a small company

we have a very experienced board. I think our next venture is to find a great Mexican director to add to

the company. I think that's where we need more experience. We think there's a lot of growth for us in

Mexico. We’re always trying to make our Company better.

I think it's very attractive that we have a very tight capital structure. We only have 40

million shares outstanding, on a basic basis, and about 49 million when you include options and warrants.

The warrants are to Eric Sprott, and to a shareholder group called CQS, and they're long-term holders of

the stock. As we show our low costs and bring the new mine into play, there are going to be very few

shares to acquire, because we don't have a big float. We think that bodes well for the stock price as we

deliver on the results. The capital structure of our company is very attractive.

We have $15 million of long-term debt. We have about $26 million of working capital today. We're

going to build our new project, which we expect will generate over $2 million of cash flow a month. We're

going to use that cash to reinvest into our projects so that our numbers on a per-share basis continue to

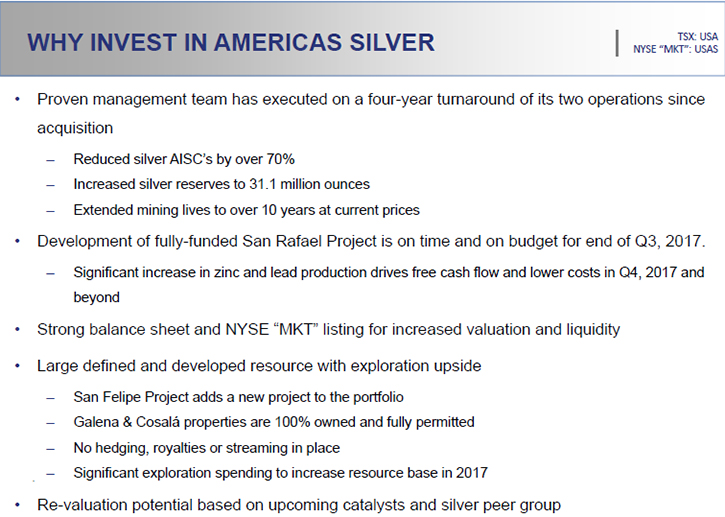

skyrocket. That's the strategy of the company. Investors in Americas Silver are getting a proven

management team that executed a four year turnaround.

We've not only reduced our own costs about 70-75%, we've increased our silver reserves and our resources.

We went from having no mine plan at either of those two mines, to a 10 year mine plan at current prices.

We have a lot of production ahead of us at this two and a half million ounce mark. We're focused on

getting to a four or five million ounce mark, on a silver production basis. Of course next year, we're

going to about seven and a half million of silver equivalent ounces. We have a lot of lead zinc exposure

there as well.

Dr Allen Alper: Very impressive team! Very impressive results! Very aggressive plans!

Mr. Darren Blasutti: It's hard to understand how bad the industry was, the last couple of

years. So we're not going to take this for granted. We're not just going to go out and make the same

mistakes everybody else made. We did two acquisitions, and paid a premium for neither. At Barrick, we

made a lot of great deals, but we always ended up paying premiums for those companies, taking our

shareholders' value and transferring it to somebody else. We want to do deals with people, attracted to

the management team, attracted to what we can do, who want to put their assets into us because they know

we can do better for them.

We're not just going to take the 40 million shares for granted. We're going to work very hard to

find assets that we can buy cheaply. Or strategy number one is to get more out of the big asset and

resource base that we have. That has been a real change in the company. For four years we've been

thinking about nothing but cutting costs. Now we're happy to be in a more exciting place, where we can

develop some real momentum and growth around our own asset base for the shareholders.

Dr Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider

investing in Americas Silver Corporation?

Mr. Darren Blasutti: We have a very big resource base that we believe can do a lot more than

it's currently doing. We have a small number of shares, so when our prices go up, we will see the benefit

in the stock price. We have cash, to develop our own exploration, our own projects, without having to

raise more money. We have a proven team that has not only reduced costs by 70% over four years, but have

increased the reserves, and resources, and increased the mine lives of each of these assets, despite low

prices.

We think buying us today, is buying the lowest cost silver producer in 2018 at a discount to its peer

group; not only at a discount based on financial multiples, but with the most leverage to silver

production and the most leverage to silver in the ground, i.e. the resources that we have, based on the

charts you see on our website. So when you take that combination of management team, a big asset base

that is untapped, cash flow we'll be generating with the new mine, and going forward, our ability to

extract value from that base, without having to raise equity. That's our advantage.

To do something, in this market, most others have to raise money. They have to go out and issue

stock, to either buy things or keep their production flat. In order to grow they're going to go out and

acquire companies. We don't need to do either of those things. We intend to get our silver production

from two and a half million ounces to four or five without issuing a single share. That's how we think

about our company, and we think we can achieve that. Now it's going to take a few years, but in the

interim we're going to be generating lots of cash on the balance sheet, and that's going to fund our

growth. So I think that's what differentiates us from anyone else in the silver sector today.

Dr Allen Alper: Excellent!

http://www.americassilvercorp.com/

Darren Blasutti

President and CEO

416-848-9503

|

|