Interview with David Sidoo, President of Advantage Lithium Corp. (TSX VENTURE: AAL): Top Tier Lithium Explorer with a Leading Technical and Management Team

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/5/2017

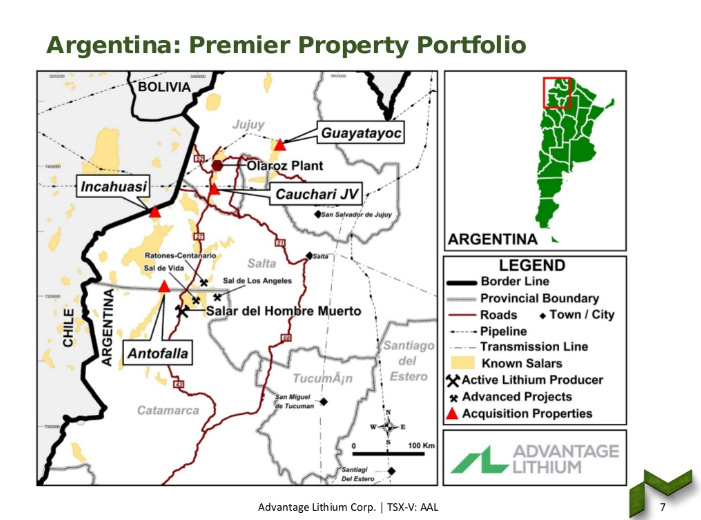

Advantage Lithium Corp. (TSX VENTURE: AAL) is a Vancouver-based lithium explorer and developer with top tier management and an

international portfolio of quality assets. Advantage Lithium has a partnership with Orocobre – one of Argentina’s leading lithium producers

– to develop its Cauchari asset, which hosts an inferred resource and includes a large exploration target. The company recently acquired

five projects in Argentina from Orocobre, as well as up to 75% in Cauchari. We learned from David Sidoo, President of Advantage Lithium,

they have also recently completed a large financing, with institutional investment and now have just under $23 million Canadian in cash and

five different properties in Nevada, including Clayton Northeast, where the company has completed two very successful rounds of drilling.

Plans for 2017 include the new drill program at Cauchari that has just started and is aimed at expanding the resource, by focusing on the

already-defined exploration target, as well as building a resource in Nevada. According to Mr. Sidoo, Advantage Lithium will produce lithium

in the next three years.

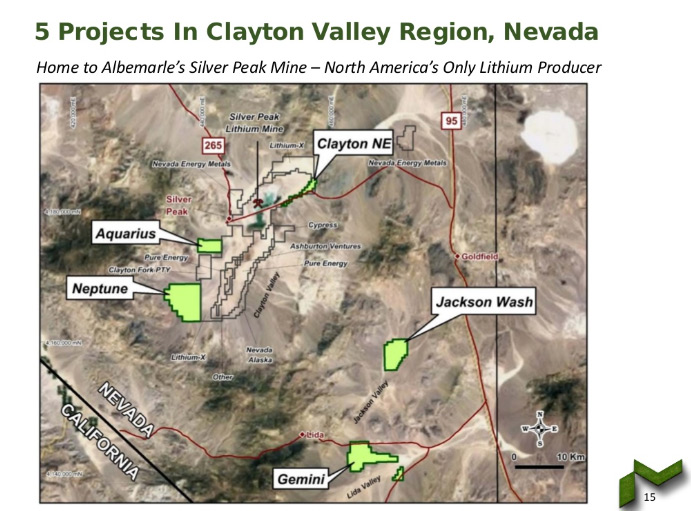

Clayton Valley & Lida Valley, Nevada

Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing David Sidoo, President of Advantage Lithium.

Could you give our readers/investors, an overview of Advantage Lithium, David?

David Sidoo: Sure Allen. First off thanks for interviewing me about Advantage Lithium. We're a lithium company that has assets in

Nevada and in Argentina. We just completed a large funding financing with institutional investments of $20 million dollars. Advantage

Lithium has just under $23 million Canadian in cash and has five different properties in Nevada, one called Clayton Northeast, on which we

now drilled six holes, with some great results. We press-released the results of all those holes, and we're now embarking on another drill

program on some of the other properties we have there. We've had some very strong results from our first wells drilled in Nevada,

strategically located close, about 100 to 150 meters from Albemarle. That's the only producer in North America of lithium brine and the

largest producer of lithium in the world. We're going to continue that program.

We also did a deal with a company called Orocobre, who's one of the only producers in Argentina, and in that lithium triangle,

Bolivia, Argentina, and Chile. Orocobre produces about twelve and a half to 13,000 tons of lithium a year. They've been in Argentina for

over a decade. We did a deal with them, Allen, where we acquired 100% of five properties in the middle of salars for more exploration. We

also acquired and joint ventured with them on a property called Cauchari in the Cauchari Basin in Salta, Jujuy, of which we own an initial

50%. We'll earn another 25% by spending five million US on developing the existing resource. We budgeted for five million to spend by the

end of this year, so we will own that other 25%. We'll own 75% of Cauchari. It has just under 500,000 tons of inferred lithium carbonate

equivalent on the property right now and a very large exploration target.

We have five holes, rotary holes permitted, in Cauchari that we started drilling April 17th. Those five rotary holes will go down to 400 to

450 meters in depth. Off from those five rotary holes, we have permits to drill a further 12 diamond holes, which are down to 200 to 250

meters. We're going to have news flow from here to year end. We're hoping by Christmas, we can be well into a pre-feasibility study,

delineating a new total resource we have there in Cauchari. Unlike other juniors, we actually have assets in the middle of salars. We have a

developed asset, from which we're going to be producing more results. We've drilled quite a few holes in Nevada to build another resource

there. We're well cashed up and don't need to raise any further funds, under the current programs we have for the next three to three and a

half years.

Allen Alper: Awesome! What your company has done in such a short period is outstanding. It's really amazing. Great job!

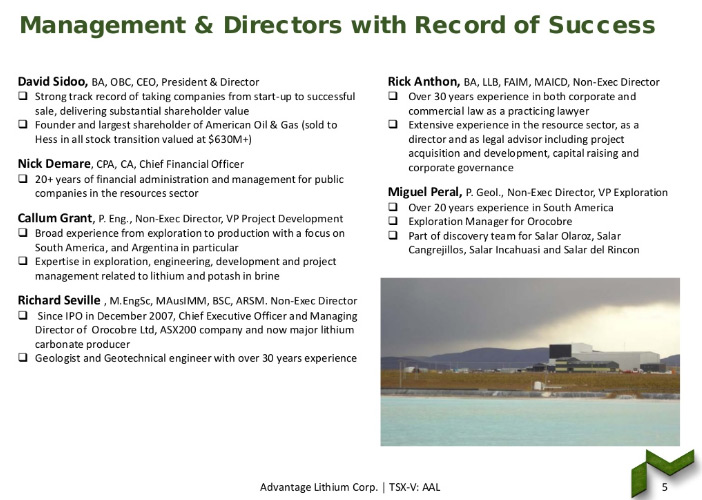

David Sidoo: Thank you very much, Allen. I think it's a testament to our management team. When we did the deal with Orocobre,

they had many, many suitors from the Japanese, the Chinese, to large companies, in the industry, to many, many juniors that were chasing

them. They decided to go with us for a couple of reasons. First, our management team is very experienced in the mining sector. Secondly, we

have the ability to raise a lot of capital. Thirdly, we've monetized a lot of these assets, in which, we've been involved in the past. We're

not transaction-oriented. We're not doing four deals a year. We stay focused on one deal, and that's what they liked about us. Hence we

partnered with them. Just so your readers and followers are aware, Orocobre has become the largest shareholder in our company. They own 30%

of Advantage Lithium. They've tied those shares up in a pooling agreement, along with management and insiders of Advantage, an over two and

a half year pooling agreement. That's very significant. That's over 50 million shares of the company tied up, as we develop this resource.

So we're in this for the long term.

Allen Alper: That's outstanding. I know you have a management team and directors, with a successful track record. Could you tell

me about yourself, David? Your background, and the rest of your team and directors.

David Sidoo: I graduated from the University of British Columbia, and I played six years in the Canadian football league,

professional football. I became an investment advisor at Canaccord in the late 1980's, and then I moved on to Yorkton Securities in 1990,

91. I spent eight years there. I was a vice-president and partner, when I left the firm in 2001. I formed a couple of oil and gas companies,

when I was there, Gasco Energy. When I left Yorkton, I put a company together called American Oil & Gas, similarly to what I did with

Advantage Lithium. I put the board of directors together and the technical team together. We picked up very good assets that were strategic

and were hot at that time. With Gasco, it was in the Powder River Basin. We were bought out by Pioneer for 400 million. With American Oil &

Gas, it was a Balkan oil plate, and we were bought out five years later by Hess for 630 million. Those deals took four or five years to

build. We stayed with them long term. I basically put this one together, doing my research the last year about lithium. I used the same

formula I did for those other two projects.

My background is strong leadership and bringing key management people and technical people together, raising the capital and

monetizing those assets. Whether we are bought out or we stay public and continue to move forward, I stick with the deals long term. Talking

about my team a little bit. We have Callum Grant and Miguel Peral and Murray Booker, who are handling our Argentinian operations. Miguel

Peral was a former employee of Orocobre. He put all of their assets together. He helped build their resource, from which they're producing

right now. We've engaged him full time with his exploration staff in Argentina. Callum Grant, head of our operations in Argentina, lives in

Buenos Aires and has been in Salta, Jujuy and worked on many, many different types of salars his entire career. He understands the metal. He

understands how to drill and produce. Callum's full time down there for us, as well.

Murray Booker is one of our chief geologists, who does all our reserve calculations. He has also worked with Orocobre. He is very

key to our drill program. He's picking the locations and targets. He also helped build out the large six million ton resource Orocobre has

right now. We have a strong management team in Argentina, and we're joint ventured with Nevada Sunrise in Nevada. One of our consultants,

Ross McElroy, is President, COO of Fission Uranium. Ross is an award-winning geologist and he's working very closely with the people at

Nevada Sunrise, who are the operators of our drill program down there. We have a strong management team, with experience in building out

assets. Myself, a strong background in raising capital and bringing management teams together and identifying assets. I think that

combination is sort of a four legged table that I talk about.

Every table needs four legs to stand firmly. It can stand with three legs, kind of wobbly, but the four legs that are really

important to make a successful deal, are: the management team, which I believe we have, with experience in building up good assets. You need

the assets, quality assets, which we have with our deal with Orocobre and our deal with Nevada Sunrise in Clayton Valley. Thirdly you need

the ability to raise capital, which I have. I've raised 29 million dollars for Advantage Lithium in the last six months. Fourthly you need a

group that can tell the story to people like yourself and create liquidity in the market. I always tell people that good deals are hard to

get into and easy to get out of. Bad deals are easy to get into and hard to get out of. It's important to create liquidity for people, when

they need it.

Allen Alper: Well, you have a great background and a great team. I like your four legs of a table. That sounds excellent.

David Sidoo: Thank you, Allen.

Allen Alper: I'm very impressed with all of you. I've known Ross for a long time, and I have great respect for him.

David Sidoo: He's a good man. He's a good man, that's for sure.

Allen Alper: Our readers and investors know lithium quite well, but there may be some new ones, who might read on. Could you

briefly highlight why lithium's so important, what's happening, and why many people call it the new gasoline?

David Sidoo: Yeah. Goldman's Sachs actually put out a research report about a year ago, saying lithium is the new gasoline of the

future. What's happening in these emerging growth countries, like China, the UK, and North America, there are huge issues with pollution,

both noise and air pollution. Tesla is in the real forefront in this whole industry. Elon Musk was the real founder of this whole emergence

of the EV vehicles. He believed he could take on the big car companies and create a cost-efficient vehicle, affordable for the general

public that would conform to the environment in a positive fashion, with very little pollution and very little maintenance on the vehicle.

He started building these electric vehicles. At first people didn't take them seriously, but now as the industry's starting to evolve, and

these vehicles are becoming cheaper and cheaper to build, you see the larger car companies from Volkswagen to General Motors to Mercedes,

all coming into the business now. Ford, I mean I could go on and on about the news that's out there in the marketplace about all the major

companies coming into the electric vehicle market.

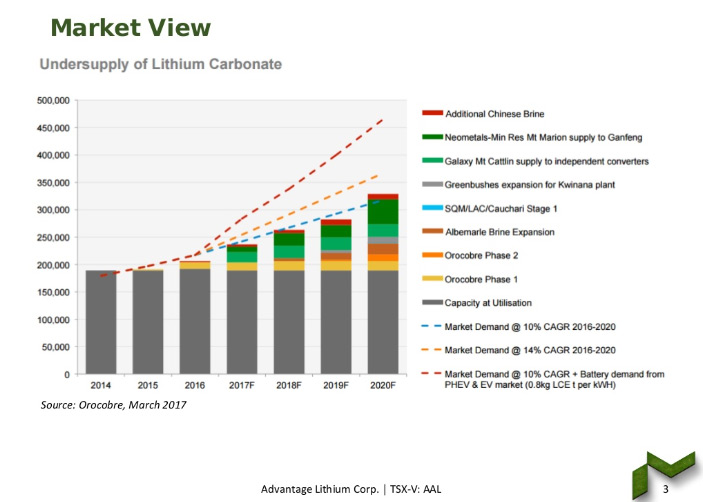

By 2020 to 2023, or so 35% of the world's vehicles could be electric vehicles. What's really significant is you're seeing the growth

in China. Right now, Allen, there are major gigafactories being built to produce these ion batteries that power these electric vehicles in

China. Tesla's built one in Nevada. We're hearing that the Japanese want to build one in Japan. They understand this industry has a long way

to go. The main product in these lithium batteries is lithium carbonate, produced in Argentina, Chile, Australia and in some parts of China.

The supply of lithium carbonate right now, required for these vehicles, fleet vehicles and buses, not only vehicles, but electronics, is not

going to be there by 2020 when this demand is there. Now a ton of companies are going into exploration to try and produce lithium, but it's

a very difficult product to produce. There are only five main producers in the world. We're fortunate to have partnered with one of them. I

see this as a long term cycle. I don't see the prices deviating much from eight to ten thousand a ton, where it's sold now.

To produce lithium, if you do it properly like our partners Orocobre do, the production costs from $3,000 to $3,500 a ton, so the

profit margins are very, very high. You're going to get a lot of pretenders and a lot of people that say they're going to produce lithium,

but it's not easy. It takes a lot of money, a lot of expertise, and people, who understand how to develop it. Partnering with Orocobre, I

feel we have that team, we're expecting to get into the market to actually produce lithium in the next two to three years, which is right in

the window of when major supply's going to be required in the world.

China wants to become the largest electric vehicle country in the world and lead the world in producing batteries and electric vehicle

usage. To get a driver's license now in China, you have to go into a lottery. If and when you're fortunate enough to be picked out of that

lottery to get a driver's license to buy a vehicle, the vehicle you have to buy must be an electric vehicle. That's very significant.

One percent of the Chinese population converting to EV's and buying electric vehicles, that's going to be a multi-billion dollar

industry down the road. That's why you're seeing the Japanese, the Koreans, and the Chinese trying to acquire and do deals with any of these

public companies that either are producing lithium now or are a year, two, or three years away from producing lithium, doing these off-take

deals with them and investing in them in big ways. They need the supply. They know they're going to need the supply, so they want to tie up

that supply now.

Allen Alper: That sounds excellent. That looks like a bright future for electric batteries and electric cars and for lithium.

That's outstanding. Could you elaborate a bit on your share structure?

David Sidoo: Sure. Right now there are about 134 million shares outstanding in the company. About 40% of those are tied up in

that pooling agreement. If you go fully diluted with warrants and everything, but they're not in the money, the company has 153 million

shares outstanding. That's with warrants, anywhere from 75 cents to 90 cents that are currently not in the money right now. Advantage

Lithium Corp. is trading at about a 60 to 70 million dollar market cap. Advantage’s peers, in the industry, are trading at about a 400 to

500 million dollar market cap. The only reason is they're about a year ahead of Advantage Lithium in terms of developing their resource out.

In the Cauchari basin itself, FQM and Lithium Americas have 12 million tons that they've proved out, and they have a half a billion

dollar market cap. Lithium Americas does. That's six million tons to them and six million tons to FQM. Orocobre has a six million ton

resource there, and they're trading at about a 750 million market cap. We're hoping to build out in this initial drill program anywhere from

a million and a half to two million tons of a resource and do a pre-feasibility study with that. Once we hit that target, we're in the game

in terms of a major potential producer in the next couple years.

Allen Alper: That sounds excellent. What are the primary reasons our high-net-worth readers/investors should consider investing

in your company?

David Sidoo: The main reason is the management team. We have a world class team that's developed assets and funded them.

Secondly, the sector is not just hot, but it's an industry changer right now. We're moving from the hydrocarbon vehicle into electric

vehicles, and that's happening. It's not an aberration. It's not just a hot space that's going to be there for a while like uranium was. It

is a long term investment cycle. If you want to invest in this sector because you believe in it, then you have to look at the management

team, the assets that they have, and their ability to raise the capital to monetize those assets. Advantage Lithium has all three of those.

Additionally, we have a partner in Orocobre that's already gone through all the ups and downs in terms of getting permitting, working with

the locals, and actually producing 99.9% lithium grade lithium for these batteries. They've gone through all the heartache. We're going to

leverage off all that and come to the market with lithium much faster.

We're a company that's going to develop our assets, build our footprint, and produce lithium in the next three years. We believe we're

highly undervalued right now. When you look at the relative market caps of companies in our range, we're probably a third of what we should

be. The more success we have in our upcoming drill results and the major news we're going to have over the next four to five months - Those

are the sort of catalysts that can move a company’s stock.

Allen Alper: Those all sound like excellent reasons for our high-net-worth readers/investors to consider investing in your

company. Is there anything else you'd like to add, David?

David Sidoo: To produce lithium, you need a processing plant. That's anywhere from 250 to 400 million dollars. Where we're

strategically located in Cauchari, we have access to our partner, Orocobre’s facility, where they're producing their lithium. It's about 10

kilometers from one site, where we're drilling and 20 kilometers from the other one. We're very close to infrastructure and very close to

their production facility. We could conceivably, in the next couple years, build a pipeline, which would cost us less than five million

dollars, directly to their facility called Olaroz and produce the lithium. Hence we wouldn't have the big three, four hundred million cost.

That's been an issue with other companies. That gives us a competitive advantage over some of our competition in the industry. I believe,

in the next four to five months, investors should watch us quite closely and pay attention to the news we put out of Nevada and out of

Argentina on our drill results.

Allen Alper: Excellent!

http://advantagelithium.com/

#1305 – 1090 W. Georgia Street

Vancouver, BC

V6E 3V7

604-685-9316

604-683-1585

|

|