Murchison Minerals Ltd (CSE: MUR): Advancing High-Grade Zinc Project; Interview with Kent Pearson, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/27/2017

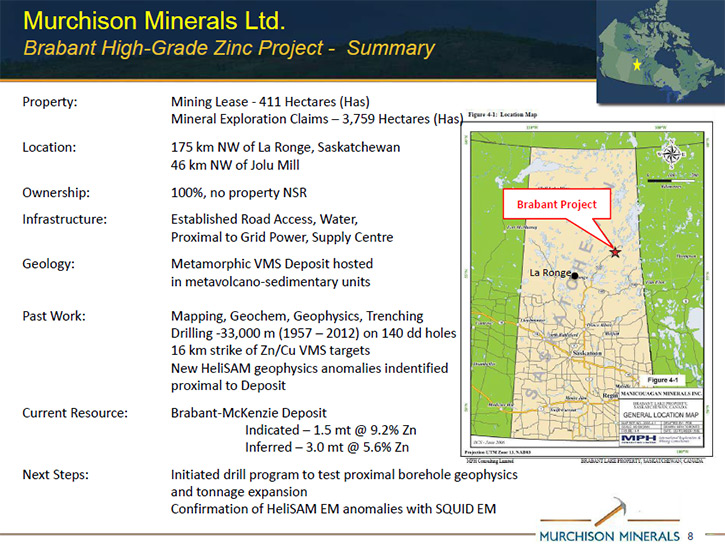

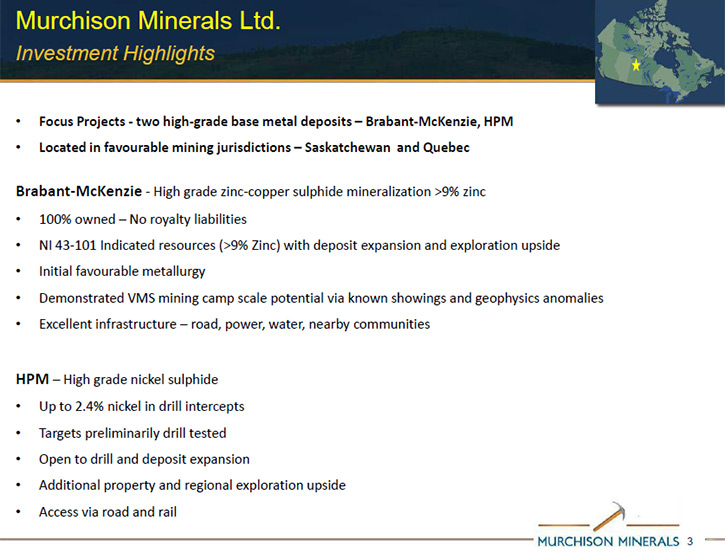

Murchison Minerals Ltd. (CSE: MUR), a Canadian based exploration company with a diversified portfolio of properties, including the

Brabant-McKenzie Zinc-Copper deposit in north-central Saskatchewan and the HPM Nickel/Copper/Cobalt project in Quebec. Murchison also

holds gold claims in the Pickle Lake area of northwestern Ontario. We learned from Kent Pearson, President and CEO of Murchison

Minerals, they are currently active at the Brabant-McKenzie project and recently completed a 5,600 metre drilling program on the

current deposit. They also completed a followup geophysics program on recently identified targets. The goal of the drilling was to

test the extent of the deposit and add tonnage. They expect to see the results by late April-early May. Mr. Pearson believes there

is substantially more upside on this project than the market realizes.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Kent Pearson, President and CEO of

Murchison Minerals. Could you give our readers/investors an overview of your company?

Kent Pearson: Murchison Minerals is listed on the Canadian Securities Exchange under the symbol MUR. The company was formed

through the merger (RTO) of Manicouagan Minerals Inc. and Flemish Gold Corp., a private exploration company. We are focused in Canada

and our two main projects are in Saskatchewan and Quebec. Specifically, our current focus is on our Saskatchewan project, the

Brabant-McKenzie zinc-copper VMS deposit. We completed our drilling program late March and are waiting for results. We also completed

a follow up ground geophysics on targets we identified, using a deep-penetrating, geophysics system called HeliSAM and are currently

having the data interpreted. We should have results from this program back to us in early May.

The deposit currently has a 43-101 resource outlining an indicated 1.5 million tons grading 9.2% zinc, 0.8% copper and an ounce of

silver, and another 3.0 million tons in the inferred category, grading 5.6% zinc, 0.6% copper, and half an ounce of silver.

The company has been working to move this project forward since late 2014. I got involved, on a consulting basis, in the

spring of 2015. Over the course of six months from the beginning with my involvement, we conducted a desktop study which involved a

full compilation of almost 60 years of technical information on the project.

The deposit was initially discovered in 1956 by a Lawrence McKenzie, a local prospector. Since the initial discovery, the project

has undergone a series of sporadic drilling campaigns. The first round occurred in the late 1950s until the mid-1960s and involved a

junior company and Rio Tinto.

From the mid-1960’s until 1988 the project sat dormant when another junior, Samson Resources, completed an 18 hole drill program.

Samson went bankrupt after that program, as we understand it, and the project fell into the hands of the drilling contractor, Boart

Longyear as payment. Boart Longyear optioned it to Phelps Dodge in 1993 who then completed a 12 hole drill program both on the

deposit and regionally. Phelps Dodge also completed some initial metallurgical work, the results of which demonstrated the viability

of the deposit to produce a commercial grade zinc concentrate. Because their sample sizes where small, Phelps Dodge concluded more

sample testing was needed to determine the viability of a copper and lead concentrate.

Phelps Dodge’s exploration mandate changed in 1995 and they handed the project back to Boart Longyear.

The project once again sat dormant until the mid-2000s when Manicouagan Minerals then picked it up from Boart Longyear for $300,000.

Manicouagan then spent two years drilling the main part of the deposit. Based on the results, Manicouagan (now Murchison) generated

the maiden 43-101 resource statement in 2008.

With another downturn in the market in 2008, the project sat dormant again until about 2011 when Murchison optioned it to Votorantim

Metals Canada Inc., an exploration subsidiary of Votorantim Zinco based in Brazil.

Votorantim flew a regional VTEM geophysics program along the 16 km strike length of the property. The survey identified numerous

conductors property-wide, modeled up 10 conductor targets and tested them with 13 drill holes. Because they didn’t get the big hit

right away, Votorantim handed the project back to Murchison.

Flemish Gold was a private company and its CEO, Jean-Charles (JC) Potvin, was looking for a way to go public and approached

Manicouagan (at the time) about a merger. That merger was completed in the form of a RTO in mid-2014 and JC took another look at the

Brabant-McKenzie deposit. As I mentioned, I became involved in the spring of 2015 as a consultant. Our team spent six months’

conducting a desktop study of all information that was available to better understand the geological and geophysical characteristics

of the deposit. In the fall of 2015, JC recommended to the board of Murchison that I take on the CEO position of Murchison, which I

did in November 2015.

Since then, we have completed a corporate cleanup, including a 10 for 1 rollback of our capital structure, which had been

pre-approved by our shareholders. We rolled back the 150 million shares at the time to about 15 million shares. We also satisfied

all the payables and got our balance sheet into good condition. In May 2016, we began a fundraising campaign and were successful in

raising about $2.6 million, of which half was flow-through and half was hard dollars. We closed financing in August 2016.

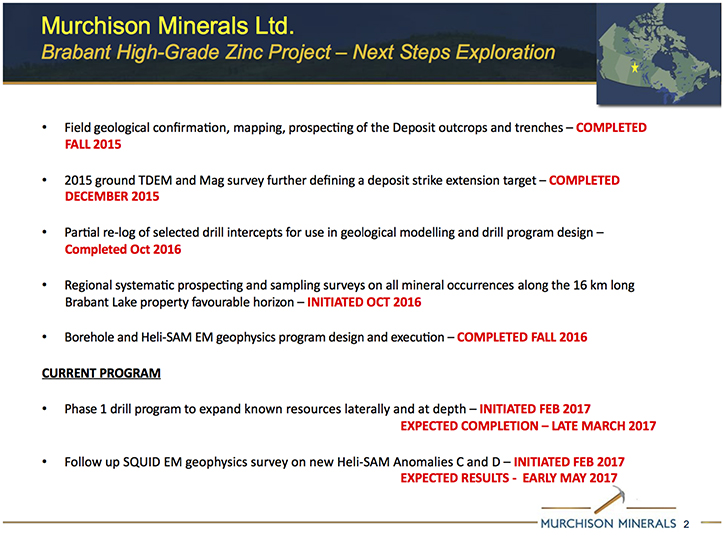

With the company funded, we went back to the property to begin regional follow up work on the Votorantim geophysics anomalies and the

numerous known mineralized showings along the length of the property. We also began preparing the project for a downhole geophysics

program as well as a deep-penetrating, airborne EM geophysical survey, using a system called HeliSAM. Both programs were completed in

December 2016. Results from the surveys were used in helping design our current drill program.

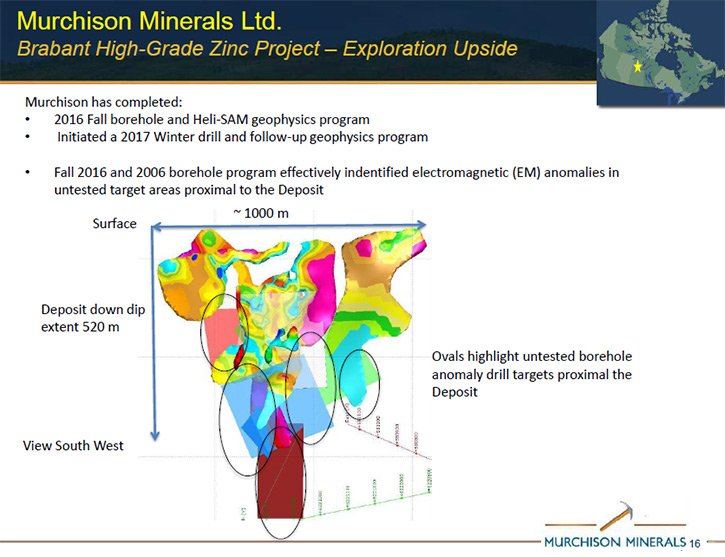

We began drilling the deposit in February. The whole idea behind our drill campaign was to identify the extents of the

deposit and to try to add additional tonnage, as opposed to confirming what is known. The results from the HeliSAM survey gave us an

indication the deposit may actually extend from the current 500 metres, as it is defined now, down to about 1,000 metres. We

completed our drill program at the end of March and are waiting for assay results.

In addition to the deposit HeliSAM results, we also made two new additional HeliSAM discoveries that sit about a kilometer and a

half, and a kilometer just southwest and south of the main deposit. We are conducted a follow up ground survey on those two off-

deposit targets to try to better-define them. We are currently having the data interpreted. Once we have a sense of the results and

if they merit further work, we'll likely get back in and drill-test those targets.

We started with a deposit, and we've slowly started to build a bit of a pipeline of targets around the deposit itself and

regionally. The three targets that we have now, the main deposit and the two new geophysical discoveries, are all within about a four

kilometre radius of each other. Our thought is that this project appears to be demonstrating a potential for a clustering of the VMS

targets.

Dr. Allen Alper: Wow! That sounds very good. Sounds like you have a great drilling program planned and are getting a lot of

data and information about your deposit.

Kent Pearson: Our team is taking a holistic approach to this project and trying to get a bigger picture of the deposit and

determine whether or not we think it has the potential to get bigger. Right now, the deposit’s tonnage is within the 5 to 15 million

tonne range of typical VMS deposits. Its zinc and zinc equivalent grade on the other hand is considered high grade.

As we move forward on the project, we will want to include an in-fill drill program to define our tonnage and grade better.

Current inferred drilling is quite widely spaced and we think the deposit pinches and swells, as we expect it to. So we might be

able to capture “internal” tonnage from in-fill drilling. We also want to try and capture additional grade. Although the inferred

grade is 5.6% zinc right now, we have intercepts that are running 13% and 19% zinc. These types of grades will have been diluted over

the resource domains because of the distance between holes.

Dr. Allen Alper: Sounds great! Could you tell me a little bit about your background, Kent?

Kent Pearson: I’ve been involved in the resources sector for almost 30 years. I'm a geologist by training and my background

spans grassroots exploration through to production. My production experience is related to VMS deposits in British Columbia. I’ve

worked in the capital markets sector first in mining research, debt research on the mining resources side and finally in investment

banking. I left the investment banking sector in 2008 and went out consulting on my own. I consulted for different groups, both from

a capital markets perspective and from a technical perspective, looking for and assessing assets for companies.

It was through my consulting that I came across this opportunity. It was introduced to me at PDAC in 2015 by one of the

directors of Murchison. He suggested I talk to J.C. about it. I met JC and he mentioned, he could really use a hand marketing and

advancing the project. From my perspective, I had to really get a good technical understanding of the project prior to marketing the

asset. That's why we did the full technical due diligence on the project focusing on its potential. When we completed the desktop

study we conducted a site visit in the fall of 2015 to get the lay of the land at the project. Based on this work, we concluded that

the project had potential. I agreed to take on the CEO role as a result and try to move the project and company forward.

Dr. Allen Alper: That sounds very good. Could you tell me a bit more about your team and your board?

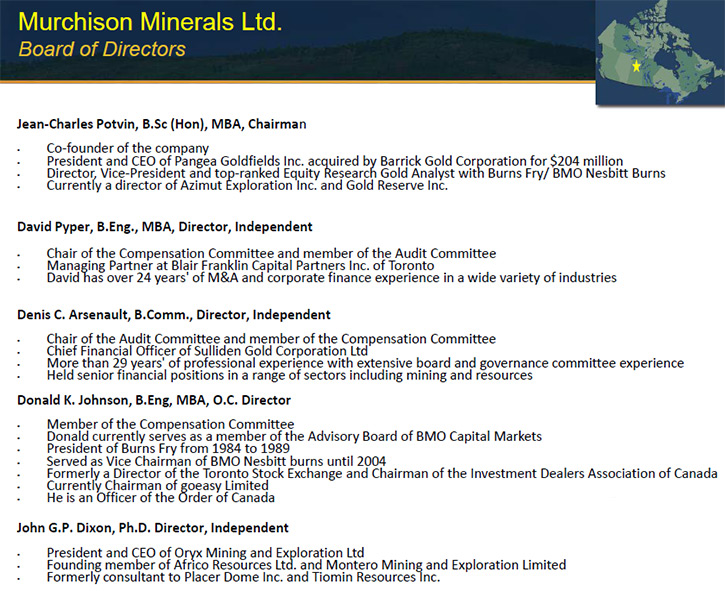

Kent Pearson: The board is comprised of JC, our Chairman, Don Johnson, David Pyper, Denis Arsenault and John Dixon. JC has

been extensively involved in the junior mining sector as an executive. He was previously CEO of Pangea Goldfields which was acquired

by Barrick Gold. He was CEO of Flemish Gold.

Don Johnson, is also our largest shareholder. He came into Murchison Minerals as a director and shareholder of Manicouagan. He has

had an extensive career within the BMO organization and is currently a member of the Advisory Board for BMO Capital Markets.

David Pyper is chair of the Compensation Committee and a member of our Audit Committee. He is a longtime investment banker and he

brings an excellent capital markets skill set to our board.

Denis Arsenault chairs our Auditing Committee. He has 30+ years of financial and accounting experience, with extensive

involvement within the resources sector.

John Dixon comes to Murchison through his prior involvement and directorship in Flemish Gold. He is a geologist by training and along

with JC, brings a technical skill set to our board. John was instrumental in helping JC when Flemish was operating in Africa.

The board is active and has been supportive of our efforts and strategy to move Murchison forward. They provide the type of excellent

advice we need to make good decisions for the company. I don't think I could ask for a better board.

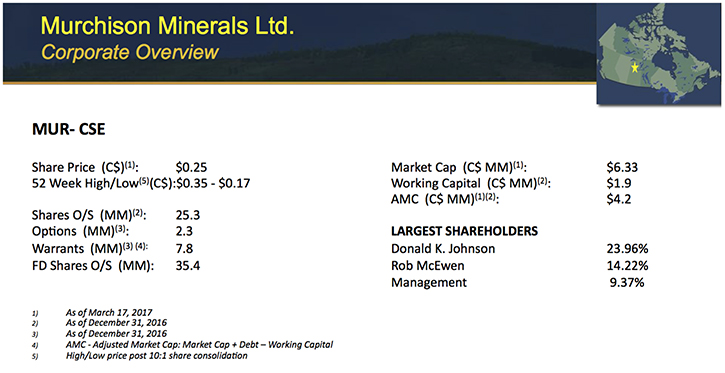

Dr. Allen Alper: That sounds good. Tell me about your largest shareholders.

Kent Pearson: Largest shareholders are Don (24%) and Rob McEwen (14%). I’ve previously mentioned how Don became involved

with Murchison. Rob is a shareholder in our company through his prior involvement with Flemish Gold. Both Don and Rob participated in

our last financing in August 2016 and were the first to put a lead order into our financing to get things kick-started. Both have

been incredibly supportive and Don is very active in trying to get our story in front of people.

Other directors and management control just over 9.0%

Dr. Allen Alper: That sounds great. By the way, I have done over 10 interviews with Rob McEwen, and I've written more than 10

featured articles about Rob McEwen. He's a great guy. I really like him.

Kent Pearson: Rob and Don have been long term business acquaintances. I've known Rob now for about 20 years, having first

met him during my days in mining research. He always seems to have time to pick the phone up when I call, and listen to what I have

to say. One thing I try to do with all our shareholders is stay in touch with them, and keep them informed. I think Rob's interested

in what we are doing and how it's going to play out.

We have provided what we believe is a comprehensive approach to move the project forward. We want to make sure we are

applying good science to the exploration and consequently ensure that we are really adding value to the project. In the end we hope

we can add some value back to both the current and longer term shareholders.

Dr. Allen Alper: That sounds like an excellent objective. What are the primary reasons our high-net-worth readers/investors

should consider investing in Murchison Minerals?

Kent Pearson: Our enterprise value is about $3 million. The in-situ ground value of this project is probably about $6 or $7

million. Prior to getting our HeliSAM results, we wondered if there were some real tonnage expansion potential. The HeliSAM results

suggest there may be substantially more upside on this project than the market realizes. The two new geophysical targets identified

could substantially add to the tonnage of the project as a whole. At this point, the project continues to show good blue sky

potential. The deposit grade also is fairly robust.

One of the things I was looking for in a project, was something robust enough to be attractive at low-end commodity prices.

If I get shareholders in, I want to make sure they have some protection on the downside in a low commodity price cycle. If the

project makes it to production, we believe Brabant-McKenzie has a chance to be that type of project.

We have a pretty good technical team working with us. Graham Gill has been very instrumental in a lot of the logistics and

technical review in helping me move this project forward to where it is now. He has more than 35 years’ exploration experience,

including his work in the Bathurst, New Brunswick zinc camp, and it really shows.

We just added another great guy, Finley Bakker, who had looked at this project with me and commented that the project has

similarities to the Geco mine, which was a 50 million tonne deposit in the Manitouwadge, Ontario. As a VMS specialist, Finley has

great experience in this type of deposit environment. He says he likes what he sees so far.

Ehsan Salmabadi who's joined us for this drill program. He has worked extensively with Finley over the last six or seven

years. We've put a team together, with the type of experience we need for this type of deposit. With Finley and Graham we have

brought in some continuity in terms of knowledge of this deposit. I did a lot of the initial interpretation on this, but a lot of it

was done in a vacuum. Bringing Finley, Graham and Ehsan on board has helped me bring other sets of eyes to the project, and really

open up what we think may be here.

In terms of management skill, I bring a good technical background, but also a good capital markets and fundraising

understanding. People need to understand what we're doing to be able to get involved in financing going forward. I think the

combination of both the capital markets and the technical background has really helped me lay out a strategy for the company going

forward. So far, it seems to be working.

In terms of financial management, Erik Martin is our CFO and has significant financial management experience in the junior

mining space. He's been fantastic in terms of making sure we not only have our financials in order but also ensures that we are

meeting all regulatory obligations with the CSE at a level similar to the TSXV.

We started financing the company with $40,000 in the bank. Because we were so short on cash, the company cut down on all of

its costs. . We have decentralized our operations, using a virtual office in Toronto and minimizing our administrative costs. We are

reviewing this process regularly and future results will guide the next approach. With respect to our financing campaign last year,

Erik was instrumental in looking after our backroom affairs, which really reduced our financing costs. We've really tried to stay

very frugal with our finances. I promised the shareholders in the last round that I'd try to watch every dime spent by the company

and make sure we got value out of every dollar.

Dr. Allen Alper: That's great. It sounds like you and your team are doing a great job.

Kent Pearson: We haven't had any hiccups getting to where we are now, but we don't take anything for granted.

Dr. Allen Alper: You're doing a great job with the turnaround. That's excellent. Is there anything else you'd like to add,

Kent?

Kent Pearson: Our team is watching every detail as we move this company forward. We have a great, knowledgeable board,

smart, experienced shareholders and a good management team and team of technical consultants. We have an amazing property. We

believe it holds a lot of potential.

Dr. Allen Alper: That's great. I'm very impressed with what you and your team are doing to turn your company around and get it

moving, and then to find what you have there, and seeing how big your VMS project is. It looks like you're on your way to determining

the outlook, but you have been. It looks like there's big opportunity there.

Kent Pearson: Yes. I hear numerous folks tell me that we’re in a good space with zinc and its price. However, I believe we

are in a good space because we have a high grade and robust zinc deposit with good blue sky potential. I think that’s what's most

important. But if you can be the flavor of the day and can also demonstrate that you have a viable project at depressed commodity

prices, that’s better yet.

Dr. Allen Alper: That sounds great.

http://www.murchisonminerals.com/

Kent Pearson, President and Chief Executive Officer

info@murchisonminerals.com

(416) 350-3776

|

|