Cobalt Blue Holdings Limited (ASX: COB): World Class Pure Cobalt Play; Interview with Joe Kaderavek, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/27/2017

Cobalt Blue Holdings Limited (ASX:COB) is a pure-play, cobalt-explorer/developer, incorporated on the 26th of August 2016 for the express purpose of developing the Thackaringa Cobalt Project in New South Wales, Australia, with the goal of achieving commercial production of cobalt. We interviewed Joe Kaderavek, CEO of Cobalt Blue Holdings, and learned the company has approximately $9.5 million cash in the bank and an accelerated timeframe to deliver a bankable feasibility study by mid-2019. Thackaringa is a rare case of a world class cobalt project located next to a major city, with strong infrastructure that will substantially lower operating costs. Plans for 2017 include upgrading the resource to 100 million tons and delivering a Scoping Study. Strong cobalt demand, driven by lithium ion batteries, coupled with an increasingly fragile supply chain, dependent upon production from the Democratic Republic of Congo, creates a positive future.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Joe Kaderavek, CEO of Cobalt Holdings, Ltd. Joe, could you give our readers/investors an overview of Cobalt Blue?

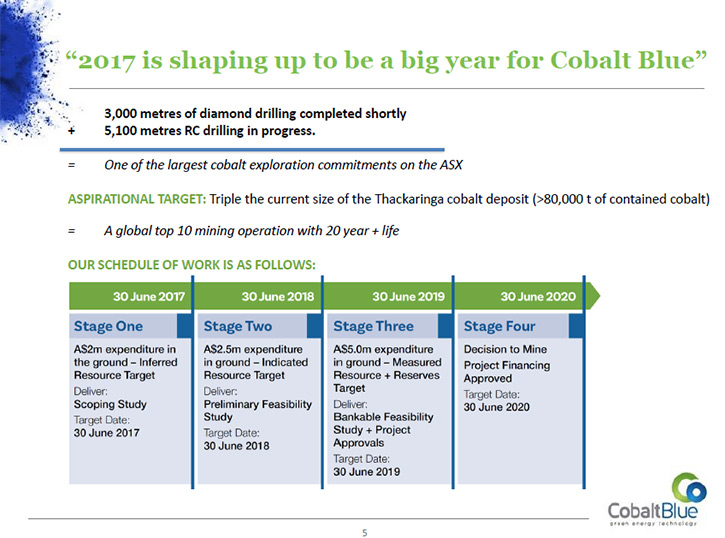

Joe Kaderavek: Sure. Cobalt Blue was formed in August 2016 as a spin-out from an existing listed explorer, Broken Hill Prospecting (ASX: BPL). BPL had held the Thackaringa Cobalt project for well over a decade, and they decided to spin it out as a sole purpose asset. Cobalt Blue was subsequently listed in February 2017. We have cash in the bank of approximately $9.5 million and an accelerated feasibility timeframe ahead of us. Our aim is to deliver a bankable feasibility study by mid-2019.

Dr. Allen Alper: Sounds great! Could you tell me a bit about your property, its location and what differentiates your company from others?

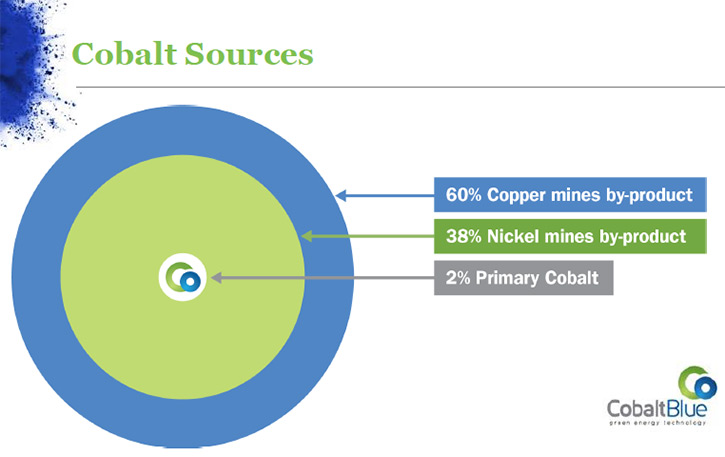

Joe Kaderavek: Certainly. We are a primary cobalt deposit. Approximately 98% of the world's cobalt is produced as a bi-product of either nickel or copper, which means the cobalt produced today is overwhelmingly beholden to copper or nickel market economics. There are numerous examples of cobalt mines that have been kicked offline because they simply couldn't make the nickel or copper work. As a primary cobalt developer, we offer investors cobalt leverage of around 80 cents on the dollar of our total revenue. There are only 1 or 2 cobalt developers globally that offer that leverage.

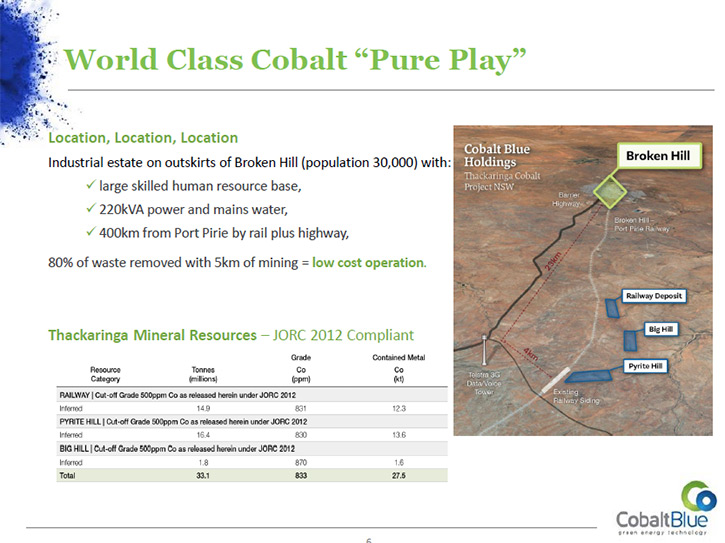

The other key differentiation is our jurisdiction. We are located about 20 kilometers west of Broken Hill in New South Wales, Australia. That puts us under Australian law, a very safe global jurisdiction. It also means we are located near a major township with people, power, water, rail and road access, these would significantly compress our operating costs. I believe those are our two key differentials, namely, we are a primary cobalt producer with world class logistics.

Dr. Allen Alper: That sounds excellent. What are your major plans for 2017?

Joe Kaderavek: Having just listed, we have quite an accelerated program in mind. In 2017, our key target is to perform a resource upgrade by the drill bit and an accompanying Scoping Study. We expect to upgrade our inferred resource, from 35 million tons to 100 million tons, containing over 80 thousand tons of cobalt metal in the ground, by the time we are finished. If you picture that in terms of the global market for cobalt, which is somewhere around 100 thousand tons, that's a very sizeable number. It will also give us the confidence to go to the market and plan a 20 year life for a 4000 ton a year cobalt mine. That is a global top ten long-life mine. In conjunction with our drill bit work, we are also doing some feasibility work in engineering, etc. That will also give us, by mid-year, the first look at the economics of the project.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors why cobalt is so important as an industrial product?

Joe Kaderavek: Yes. Cobalt is going through a renaissance. Even as recently as 15 years ago, the key uses of cobalt were as an alloy in commercial applications. It’s also magnetic, so it's used in a variety of applications in information technology, for example hard disk drives. Its magnetic properties also lend it to MRI scanners and other medical applications. The advent of the lithium ion battery, particularly those that need high energy densities, which cobalt supports, has meant that today we are witnessing a 9% annualized growth rate over the next decade.

The cobalt market also has an increasingly fragile supply chain, being predominantly mined in high-risk jurisdictions, such as the Democratic Republic of Congo, as well as being a bi-product of copper and nickel. Also, key Western consumers, including Apple and Tesla, are looking to increasingly audit their supply chains for cobalt, because it is seen as a conflict mineral. About 10% of the world's production, around 10,000 tons, is mined at village level in artesian circumstances in conflict zones.

Dr. Allen Alper: Thanks for the overview that's great. Sounds like it’s a very important emerging and growing market.

Joe Kaderavek: It is, yes.

Dr. Allen Alper: Could you give us more information about your background, your team and your board?

Joe Kaderavek: Sure. I'm an aeronautical engineer by background, so I spent my first 8 years as an Air Force engineering officer, where I first came across cobalt as an alloy that strengthens air frames and gives engines high temperature characteristics, so I've seen cobalt in the real world for the last 25 to 30 years. My background, beyond that point, was working as a consultant with BHP Billiton and Rio Tinto in large scale open cut mining, which is one of the prerequisites of my current job. I then spent the last 15 years in various research roles, looking at not only resource investing, but also the role of the lithium ion battery in energy storage, and why energy storage is a very important part of the future global economy. I was also Head of Resources at Deutsche Bank for a number of years, which gave me the background to market and pursue commercial contacts with institutions, high-net-worth individuals, and family offices.

Cobalt Blue has a four person board. I am the only executive director on the board. My chairman is Robert Biancardi. Rob is not a mining guy, he is a high-net-worth entrepreneur, and his background is successfully bringing companies to the ASX and either running them as a CEO himself, or as the Chairman. One of the advantages Rob brings to our board, apart from that experience, is that he is well connected with a broad range of investors, helping bring “non traditional” shareholders onto our register.

The other two board members are also non-executive directors. Hugh Keller is a 35 year plus veteran in corporate law. His last role was as managing partner of a significant global corporate law practice called Blake Dawson, which is today known as Ashurst.

The last director is Anthony "Trangie" Johnston, "Trangie" is an experienced mining CEO and an exploration geologist. He brings that combination of geology and technical experience as well as commercial experience as a CEO. That's our four person board and we think it’s the right board to bring the asset to the market.

Dr. Allen Alper: That sounds like a very strong, diversified board. Could you tell us a bit about your share and capital structure?

Joe Kaderavek: Sure. We were given a lot of advice on trying to keep the structure tight and provide incentives to hold. We are focused on building up and improving the quality of the shareholder register over time. So from day one there are 95 million shares in circulation.

We also have another 28 million options, which have been granted to incoming shareholders on a one to four basis. The options have a price of 25 cents. The options will list three months after the stock lists, which will be on the second of May, 2017. The options will have a three year duration. The advantage for shareholders is that the options are listed, and they can freely trade those options without having to exercise them going forward. So, I think we have a very tight book, and the incentives that we have, with the option structures, will incentivize shareholders to continue to hold our stock.

Dr. Allen Alper: That sounds good, very good. Does your company have plans, not only to be a mine, but to be more vertically integrated?

Joe Kaderavek: Yes, we do. It's a good question. When we went to market and declared our intentions, cobalt was our core product. But we also quarantined up to $1,000,000 to examine a technological investment, firstly upstream research style investments, with a university or a cooperative to look at, for example, nanotechnologies or battery making. The other option we have is late cycle activities, such as recycling. So there are technologies around where companies are looking at recycling lithium ion batteries in the future and recycling the metals that go into those, and capturing that value.

Dr. Allen Alper: That sounds very good. What are the primary reasons our high-net-worth readers/investors should consider investing in Cobalt Blue Holdings?

Joe Kaderavek: First and foremost, we are a primary cobalt resource, which means that shareholders will get amongst the highest cobalt price leverage of any invested company. Secondly, we are a large scale world class resource. We aim to be a top ten cobalt producer, and we aim to be embedded in the global supply curve over a 20 plus year mine life. Our strong logistics will create a low cost operation. Thirdly, jurisdiction, we are in a very safe mining area. Lastly, we are a shallow, low-ratio, open-cut mine. There are no deleterious metals in the ore body, there're no arsenic or other contaminants typically associated with cobalt.

Dr. Allen Alper: Sounds excellent. Is there anything else you'd like to add?

Joe Kaderavek: No. I think we've covered the key issues.

Dr. Allen Alper: I enjoyed talking to you Joe and learning about your company, and the team.

https://www.cobaltblueholdings.com/

Joe Kaderavek

Chief Executive Officer

info@cobaltblueholdings.com

Level 2, 66 Hunter Street

Sydney NSW 2000 Australia

|

|