Lake Resources N.L. (ASX: LKE): Among the Majors in the Lithium Triangle; Interview with Steve Promnitz, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/23/2017

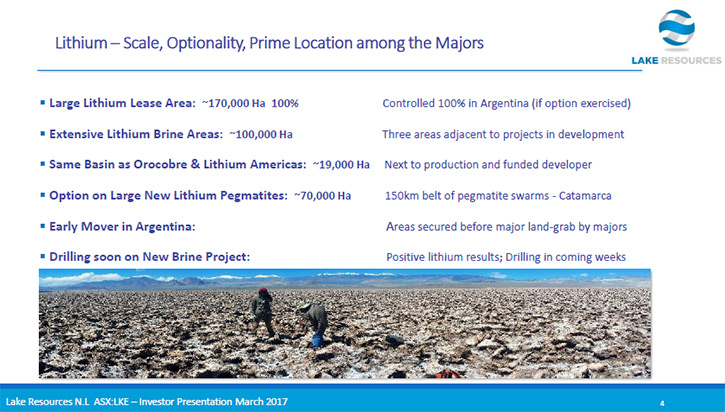

Lake Resources N.L. (ASX: LKE) holds one of the largest lithium tenement packages in Argentina and is one of the emerging players in the lithium sector. Lake owns 100% of three key lithium brine projects strategically located in the Lithium Triangle alongside the majors: Olaroz/Cauchari, Paso and Kachi in the highly prospective Jujuy and Catamarca Provinces of Argentina. In addition, Lake owns one large package of lithium pegmatite properties, which were unappreciated sources of lithium in Argentina until recently. We learned from Steve Promnitz, managing director of Lake Resources, the company foresaw the interest in lithium prior to the significant rush by major companies and put its properties together as soon as the government changed in Argentina. We learned from Mr. Promnitz, they have been having discussions with potential off-take partners in China, Japan and Korea, and are currently developing all projects at the same time to collect sufficient data to demonstrate how these projects could be advanced in the next 12-18 months.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Steve Promnitz, managing director of Lake Resources. Steve, could you give our readers/investors an overview of your company and your goals?

Mr. Stephen Promnitz: Certainly. As you know, there are now a lot of players in the lithium space whereas 15 months ago there were not. We put these projects together as soon as the government changed in Argentina, because we could see an interest in lithium and, given that half the world's lithium production comes from Northern Chile and north-western Argentina, it was the right place to go.

Initially we looked at putting together transactions with current holders, but inevitably there are some issues around property security, so we decided to start from zero applying for land so we knew exactly what we were entering into. Through that, we have now put together one of the largest property packages in Argentina, with an offering in both lithium brines with over 100,000 hectares (owned by Lake) and lithium pegmatites with about 70,000 hectares under option. If we exercise the auction, all of these projects would be owned 100% by Lake, so there aren't any intermediaries.

The focus has been to develop each of these projects and generate enough information, particularly from the lithium brine projects, to produce a scoping study and an initial resource, so we can continue discussions with potential offtake partners. We have been having discussions in Asia - China, Japan and Korea - and now intend to advance those discussions, when we have sufficient data to demonstrate how these projects could be advanced in the next 12-18 months.

In December 2016 and February 2017, we conducted a small capital raising, which in total was just over 2 million Australian dollars and that's sufficient to fund the exploration program for this initial stage in 2017. We anticipate a substantial amount of news flow. I think it's going to be a pretty exciting year.

Lake Resources’ key offering is that we have both lithium brines and lithium pegmatites, one of the largest land holdings, on a 100% basis. We're funded to advance this project and produce the sort of information that can lead to genuine development proposals. Our aim is to do that together with an offtake partner out of East Asia.

Dr. Allen Alper: Right, sounds great! Sounds like you have a great property and you're looking for excellent offtake partners. Sounds very promising! Could you tell our readers /investors a bit about yourself, your board and your management?

Mr. Stephen Promnitz: I've now worked in the resources space for the last 30 years. I've been in exploration and project development and mining for companies mid-size and large such as Rio Tinto and CRA before they were purchased by Rio Tinto, as well as Western Mining before they were purchased by BHP. I've also worked in banking and equities for Citi Group, one of the banks in Australia, and also as the CEO of two companies in the mid-tier precious metals space. So that provides an opportunity to have an understanding of each investor's needs and also what companies are looking for, and what the market is looking for.

Specifically with Argentina, I worked in South America for 6 years in Argentina, Chile, Peru and Brazil during the 1990s. That helped me establish quite a good network of technical, legal and accounting professionals to be able to help put this property package together and then advance it.

My chairman has had more than 30 years in the financial markets, mainly in stock brokering and also in investor relations. He is currently the director of a series of small to mid-tier mining companies listed in Australia and London. Our third director, Peter Gilchrist, started in the mining industry back in the late 60s. Now he has a private company, which does water treatment. He has a team of over 50 engineers and chemists who specifically focus on water treatment. When looking at the processing of lithium brines, it actually isn't mining, it's actually about chemistry and water treatment at the end of the day.

Based on that grouping, I think we have the board to be able to take this forward. We have a technical team of geologists, lawyers, accountants and field assistants in Argentina, who are able to conduct the activities we need together with contractors in Salta, Jujuy and Catamarca provinces in the north-west of Argentina.

Dr. Allen Alper: That sounds very good. A very strong team. You have an impressive background with established success. That's excellent. Could you tell me a bit about your share and capital structure?

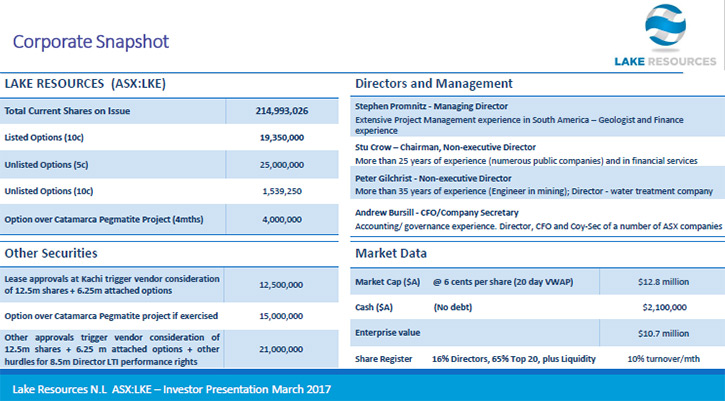

Mr. Stephen Promnitz: Certainly. Lake Resources has a code LKE on the ASX, a very clean structure. It has 215 million shares on issue, and while that is surprising for people in North America, 215 million is actually a very small number of shares on the ASX. The projects were put together in a private vehicle, which was vended into Lake Resources in November last year, and the company has no debt. It does have some options, both listed and unlisted, listed options are ten cents and unlisted option at 5 cents.

But it's a pretty straightforward capital structure. There are no deeply embedded convertible notes or large numbers of free options. Management owns 15% of the shares, and most of the investors to date have been high-net-worth investors who are looking more for a 12-18 month investment time horizon. As the company grows, we will continue conversations with the Micro-Cap Institutional Funds, but at the moment this is very much a private investor type play, given the market cap of the company, which is around 12 or 13 million Australian dollars, which is just under 10 million US dollars.

Dr. Allen Alper: Sounds very good. What are the primary reasons our high-net-worth readers/investors should consider investing in Lake Resources?

Mr. Stephen Promnitz: It's quite straightforward. First of all, Lake Resources has projects on 100% basis with a large property holding in both lithium brines and lithium pegmatites. On a pure comparative basis, a company recently listed during February, has a market cap of around a 115 million Canadian, after raising 40 million in the market, and they have a lithium brine package, slightly larger but of a similar style to what Lake Resources has in Argentina. So that's a market cap 10 times larger than ours.

Just on our lithium pegmatite project alone, Lake is one of two companies that control an entire belt about 100 miles long; and the other company, also in Australia, is called Latin Resources (ticker code LRS). They have a market cap of about 25-30 million Australian. So that's two and a half, three times our market cap, just based on one of the projects, ignoring the lithium brine projects we have.

One of Lake’s brine projects is in Jujuy province, next to Orocobre, (ticker code ORE) on the ASX, which has a market cap of about 600 million, and on the other side Lithium Americas, (ticket code LAC) on the TSX-V. And Lithium Americas has a market cap of about 300 million Canadian. Our leases actually adjoin them in Jujuy province. When we are able to drill those, we should be able to realize some of the unlocked value there. On a pure comparative basis, there's significant deep unlocked value in Lake, which we think can be brought to the fore over the next 12 months.

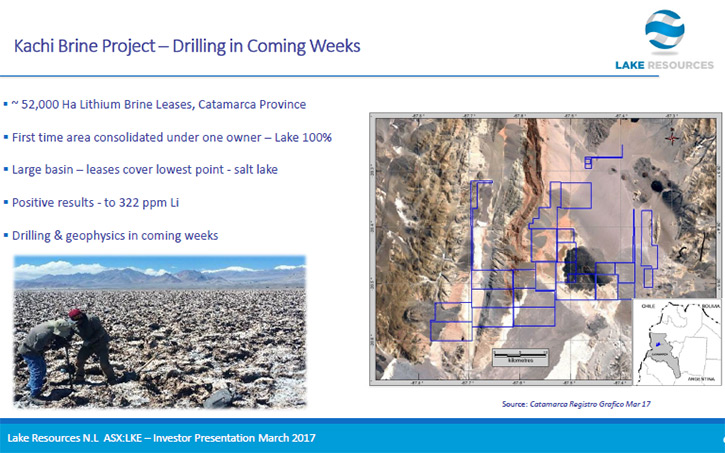

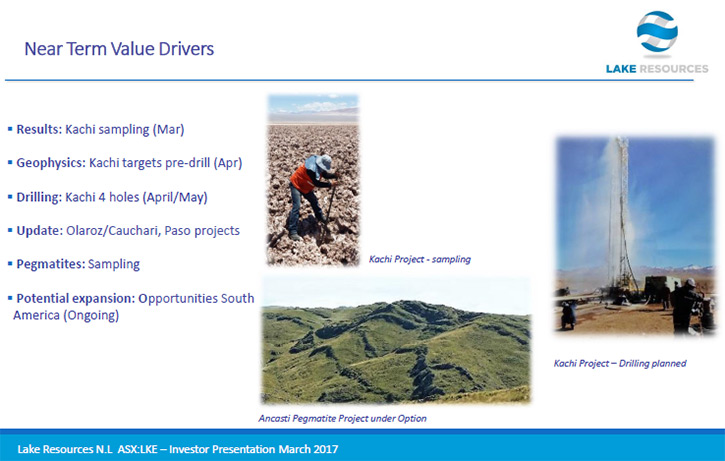

We intend to unlock that value via a series of catalysts in the market related to our expected news-flow; the first one being our maiden drilling program on our Kachi lithium project in Catamarca. We'll be drilling on this project over the coming weeks. This is a project that's never been drilled before. It’s a very large basin, about 70 miles long, and we're in the deepest and lowest part, which is where all the salts concentrate. We've had some pretty encouraging numbers at surface in the order of 200-320 PPM Lithium. These are encouraging signs, but really it comes down to the drilling results, which will determine where that leads. That will be an immediate candidate for advancing discussions with potential offtake partners.

The next market catalyst would be once we get approvals to drill in Jujuy province, next to Lithium Americas and Orocobre. Just by way of example, Lithium Americas signed a deal in late January with an offtake partner Gangfeng out of China and Bangchak out of Thailand, where they raised 106 million equity investment for 28% of their company with a 210 million US debt facility. And that is on the project adjoining us in Jujuy province. So I think that's a series of good potential catalysts connected to upcoming news-flow.

On top of that, results from sampling in pegmatites will be a further catalyst. We are aiming to locate a place where the pegmatites have coalesced in Catamarca, with an appropriate width that could be a development site for moving forward the lithium pegmatites.

There're a series of different catalysts, which could provide significant uplift in the share price. Given where we are now, I believe there is limited downside at the moment. It's quite an ideal opportunity right now. I think, as the news flow continues to build over the coming months, we'll see the deep unlocked value beginning to materialize.

Dr. Allen Alper: Those are very compelling reasons for high-net-worth readers/investors to consider investing in Lake Resources. Steve, is there anything else you'd like to add?

Mr. Stephen Promnitz: The reason I'm running this company is that my normal work is in an advisory role, where I either source projects or source financing, or source teams to put projects together. I was looking at lithium in Chile in late 2015 because there was a major transaction that occurred in the market. A chemical company called Albemarle entered into this tiny strategic light metal called lithium in October 2015 and they purchased a producer in Chile called Rockwood for 6.2 billion dollars. At that stage I thought, "for somebody to step into what is really a specialty metal, they must know something I don't." So I started reviewing lithium projects in Chile, and then lo and behold, the government changed in Argentina and suddenly it went from a pariah in the investment space to a suitable foreign investment destination, in a few short months, by doing the right things to make it suitable for foreign investment.

So we were an early mover before the rest of the lithium plays. I looked around for somebody to head this up, but at the end of the day when you bring in private investors on a project that looks this promising, you want to make certain it happens. That's why I decided to join the board and run things, given I have a background in Argentina, speaking Spanish with good contacts.

The reason I mention those things is that there are a lot of offerings both in lithium and across the resources space. It is difficult, as a private investor, to ascertain what the key drivers are behind the management - both in putting the company together and driving it forward. I think it's an exciting time for lithium and will be over the next few years. This is the right place to be and I think we have the right sort of projects. Albeit, there is the risk that this is an exploration play, but I think downside has been well covered and there's significant opportunity for upsize if investors get in, in the near term.

Dr. Allen Alper: Sounds excellent! Sounds like you're going to have a great and exciting year in 2017.

Mr. Stephen Promnitz: You've been around this space a long time now. There are only a few times things come together. It can be quite frustrating. People, who do well in this space; whether it's in lithium, in some other commodity, in the oil and gas space, quite often it comes down to timing and just luck. We think we've put together a property package that fits the fundamentals to make this one work. I just hope the market doesn't go pear-shaped. However, since we've put this together, I continue to see transactions in the tens to hundreds of millions of dollars in the lithium space, predominantly in North America. I think through Lake Resources, investors with have plenty of opportunities to make some genuine money. After all, that's the only reason we do it.

Dr. Allen Alper: Sounds great! Sounds like you have the right location, excellent projects, a great background and a strong team. You have a lot of good things going for you and you're looking at a great area for trying to joint venture or partner. All sounds very good!

Mr. Stephen Promnitz: The reason we're doing that joint venture or partnering, is even if we went from 10 million to 100 million market cap, it would still be hard to source the 250 million, required to develop one of these projects. Also, investors are circumspect, when you're a new player in the space, about your abilities to deliver on developing projects, whether in gold or copper or lithium. It's always better to work with somebody in development.

Furthermore, I'm keen to work with an offtake partner who's actually in battery manufacturing, so that they have a vested interest in making sure the project moves forward.

Dr. Allen Alper: Sounds like a wise approach! Very good!

http://www.lakeresources.com.au/

Lake Resources N.L.

(ACN 079 471 980) ASX:LKE

Suite 4, Level 9,

341 George St, Sydney

NSW 2000, Australia

T: +61 2 9188 7864

E: lakeresources@lakeresources.com.au

|

|