Interview with Mr. Rob McEwen, Chairman & Chief Owner, McEwen Mining Inc. (NYSE: MUX, TSX: MUX)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/17/2017

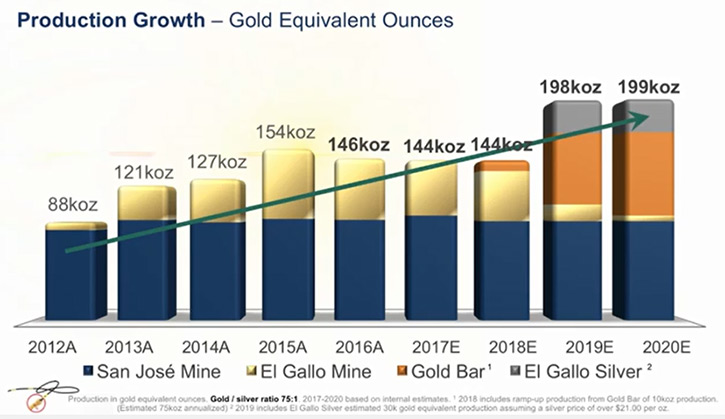

McEwen Mining Inc. (NYSE: MUX, TSX: MUX) is a growing gold and silver producer in the Americas. McEwen Mining's principal assets consist of; the San José Mine in Santa Cruz, Argentina (49% interest), the El Gallo Mine and El Gallo Silver project in Sinaloa, Mexico, the Gold Bar project in Nevada, USA, and the Los Azules copper project in San Juan, Argentina. Mr. Rob McEwen, Chairman & Chief Owner, owns 25% of the outstanding shares. Mr McEwen was the founder and former chairman and CEO of Goldcorp Inc., which is one of the world’s largest gold producers based on market capitalization. We learned from Mr. McEwen, that their treasury almost doubled over the year and they have an offer to buy a junior exploration company, with some advanced high-grade near-term exploration projects in Timmins, which is one of the biggest gold districts in the world. The company has no debt, is generating positive cash-flow, has not sold the upside, or given away a large part through selling a royalty or a metal stream. McEwen Mining is working towards qualifying for inclusion in the S&P 500.

PDAC 2017: Mr. Rob McEwen, Chairman & Chief Owner, McEwen Mining Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, here at PDAC 2017 interviewing Mr. Rob McEwen. Rob could you tell us what's happening with McEwen Mining and also what's happening with gold?

Mr. Rob McEwen: Good Morning Al. Happy to talk about McEwen Mining. We had a great year in 2016. Our treasury has almost doubled over the year to $53.1 million. We earned 7 cents per share, had cash flow of 8 cents per share as opposed to negative numbers in the 2 prior years. We have no debt and have not done a financing in the past 3 years. In addition, we haven't limited our future revenue upside by selling a metal stream royalty or by hedging our future production. The company is in a good position financially. We are awaiting the Bureau of Land Management to approve the construction and operation of our Gold Bar Mine. We hope to receive that approval in the third quarter and start construction in the fourth quarter of this year. On that basis, we expect production to start in the fourth quarter of 2018 at Gold Bar.

In Mexico, our El Gallo silver project needs a higher silver price of $21, to generate our hurdle rate of 20% IRR after tax before we would start construction. Our El Gallo gold mine based on our current oxide resources is close to the end of its life. However, there is a significant sulphide resource and we are assessing the best way to process this ore and continue production. This year the exploration budget in Mexico is $6 million.

In Argentina, the San Jose mine remains a steady, contributing high-grade silver and gold producer. The country’s new government has significantly improved the economic environment for business and mining. Our large copper project, Los Azules, represents a big wild card in our portfolio. If you were to put its copper resource on a gold equivalent basis, it would amount to approximately 40 million ounces of gold.

Activities at Los Azules this year include drilling to test for extensions of the ore zones, revising the mine plan and process facility and determining the optimum logistic and power configurations.

On the table we also have an offer to buy a junior exploration company which has several advanced exploration projects in Timmins, Canada, one of the biggest gold districts in the world. The properties we will acquire are former producers that host high grade gold showings. We believe production from some of these properties could happen within two years.

Dr. Allen Alper: That sounds exciting. What do you think of President Trump's potential impact on the mining industry?

Mr. Rob McEwen: President Trump has had a huge positive impact on the stock market. The market is embracing his concepts of deregulation and lower taxes. If approved, these changes would benefit the mining industry.

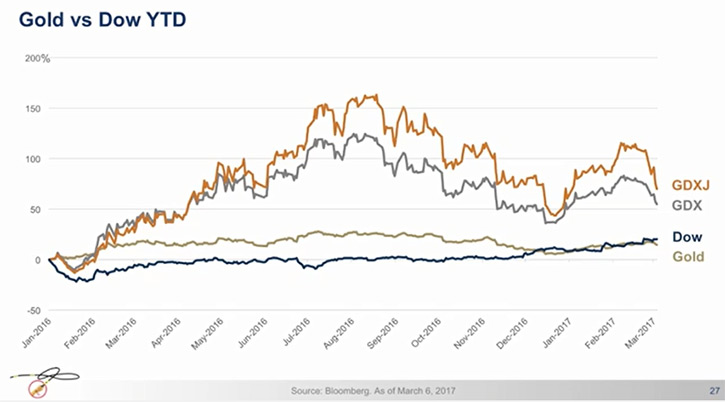

Dr. Allen Alper: What do you think will happen with gold?

Mr. Rob McEwen: For the moment, gold is having trouble moving forward due to the strong dollar. As the year progresses, I expect we are going to see higher gold and silver prices.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider investing in McEwen stock?

Mr. Rob McEwen: If they want large leverage to the gold price, they should consider MUX. We have a high 2.7 beta to gold. We are generating positive free cash flow, have excellent market trading liquidity and a diversified resource base, consisting of gold, silver and copper. We have no debt. We haven’t mortgaged our future revenue by way of selling metal streams, royalties or hedging, as much of the industry has done. We have been building our management team to facilitate our planned growth.

I am the company’s largest shareholder and my cost base is $127 million dollars. My annual salary is $1.00 and by my choice I do not receive a bonus or any options. The only compensation I receive will be earned the same way my fellow share owners will benefit and that is by way of a higher share price.

Dr. Allen Alper: Thank you, Rob.

Mr. Rob McEwen: Thank you, Al.

Dr. Allen Alper: Very impressive company! You've done a great job!

Disclosure: The Alper family owns McEwen Mining Stock.

http://www.mcewenmining.com/

150 King Street West

Suite 2800, P.O. Box 24

Toronto, Ontario, Canada

M5H 1J9

(866) 441-0690

Mihaela Iancu

Investor Relations

(647) 258-0395 ext. 320

info@mcewenmining.com

|

|