Anaconda Mining Inc. (TSX: ANX): Growth-Oriented, Gold Mining and Exploration Company in Newfoundland, Expanding to Greater Atlantic Canada; Interview with Dustin Angelo, President and CEO

|

By Allen Alper, Jr., President of Metals News

on 3/26/2017

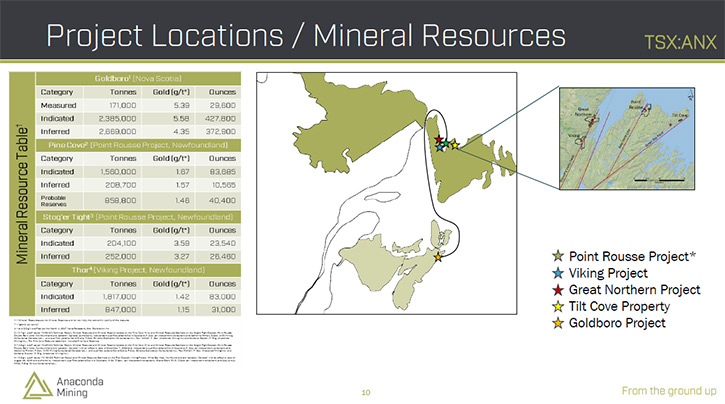

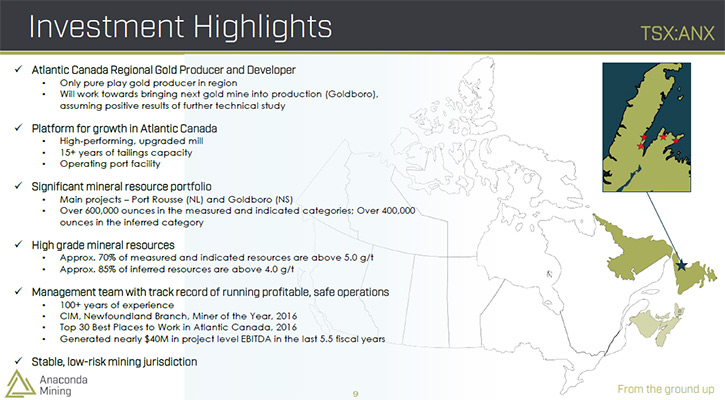

Anaconda Mining Inc. (TSX: ANX) is a growth-oriented, gold mining and exploration company, with a producing project called the Point Rousse Project and three exploration/development projects called the Viking and Great Northern Projects and the Tilt Cove Property in Newfoundland. We learned from Dustin Angelo, who is the President and CEO of Anaconda Mining, they are most excited about the acquisition of the Goldboro Property in Nova Scotia, which they hope to bring into production quickly by leveraging their existing infrastructure at the producing Point Rousse Project. The company has been producing around 16,000 gold ounces a year generating around $20 - $25 million Canadian in annual revenue. Bringing Goldboro into production, should significantly increase their production profile over the next couple years.

PDAC 2017: Dustin Angelo, President and CEO of Anaconda Mining

Mr. Allen Alper Jr: This Al Alper Jr., President of Metals News. We're here at PDAC 2017. I'm at the Anaconda Mining Booth interviewing Dustin Angelo, who is the President and CEO of Anaconda Mining.

Dustin, why don't you tell me all about Anaconda Mining from the ground up.

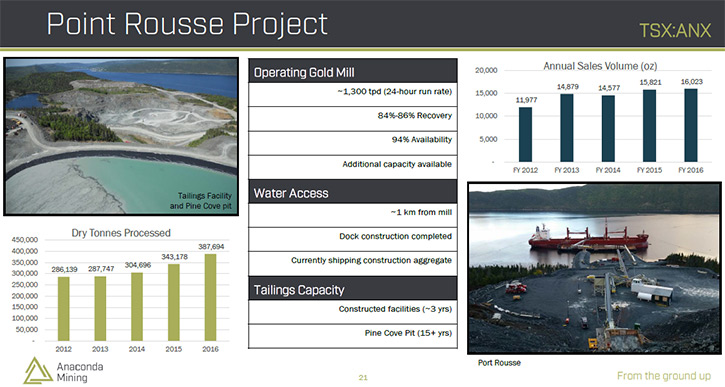

Mr. Dustin Angelo: Okay. Thanks for having me. Anaconda Mining is a gold producer in Atlantic Canada. We started off in Newfoundland, where we have one major project, the Point Rousse Project on the Baie Verte Peninsula, which is where we've been producing gold for about seven years at a rate of about 16 thousand ounces a year.

We've also picked up a few other projects on the Northern and Baie Verte Peninsulas that are in the exploration and development stages. Now, we have four total projects, which include the Point Rousse Project, which is our flagship asset, the Viking Project, the Great Northern Project and our Tilt Cove property which is east of our Point Rousse Project.

Mr. Allen Alper Jr: What projects are you the most excited about?

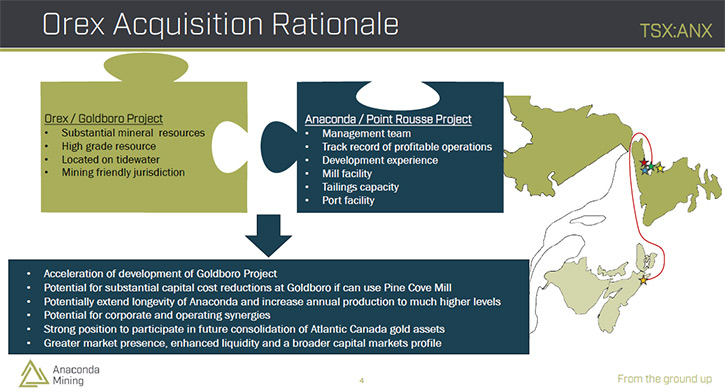

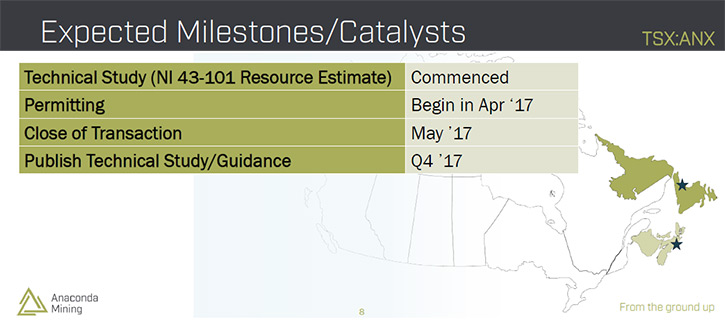

Mr. Dustin Angelo: We're most excited about our newly announced acquisition, Orex Exploration. They have a property in Nova Scotia called the Goldboro Project. It has a total of about 800,000 ounces of gold between all mineral resource categories - measured, indicated, and inferred. It's located on water, so we think we can leverage our infrastructure that we have at our Point Rousse Project in Newfoundland where we have a 1,300-tonne per day mill, plenty of tailings capacity, and an operating port. Utilizing this existing infrastructure, we expect to bring the Goldboro Project into production on a faster time frame. As a stand-alone project, the Goldboro Project would have to put in all of its own infrastructure like a full scale milling facility. We can use our infrastructure that's already established, so construction and permitting would probably take less time because you wouldn't be putting in complete facilities and using cyanide.

We've just announced the acquisition and are in early stages of planning, so it's hard to say, at this point, how long before we are actually in production. However, we know, since we already have established infrastructure, we should be able to do it on a faster time frame than if it were a stand-alone project.

Mr. Allen Alper Jr: Tell us a little bit more about the project. What's the infrastructure like? It looks very pretty.

Mr. Dustin Angelo: At our flagship project, the Point Rousse Project, where we've been mining for about seven years, we have a 1,300-tonne per day mill, the Pine Cove Mill. Last August, we completed a large scale automation project, where we automated the entire mill, and tied in all of the circuits to a central control room. That's the focal point of our infrastructure.

More recently, we started working on an in-pit tailings facility. We're in the process of permitting our current Pine Cove pit, which will mine out in the near future, to be an in-pit tailings facility. With that, we'll be able to store tailings for 15 plus years, based on our current through-put rate. It is a huge asset, because it's very costly to build tailings facilities and the permitting around them is usually lengthy. Because the facility is in-pit, the permitting authorities are looking upon it favorably. We expect to have the permits by about this summer.

We also have our port facility, which is a new addition to the infrastructure. Back in September, we launched a new venture with some other companies, where we're shipping our waste rock, as construction aggregate, to a project down in South Carolina. That facilitated the construction of a port facility adjacent to the Pine Cove pit right on the Baie Verte Harbour. Right now, we're using it to export the waste rock and Anaconda receives, for its portion of the deal, $0.60 per tonne. Essentially, we've taken a cost center and made it into a profit center.

Now, we have this port facility that's been established for exporting. For strategic purposes, we will ultimately re-engineer it in order to be able to import ore, for example, from Goldboro. There are gold projects in Atlantic Canada, that potentially are not viable on their own, as a stand-alone, where you'd have to build full scale infrastructure. If we can utilize our infrastructure, like we propose to do with Goldboro, those projects may become viable, acquisition targets for Anaconda.

So, we're pretty excited about the infrastructure and platform for growth we've built over the last several years. We've done a modest amount of production and a measured amount of exploration to build our own resource portfolio organically. Beginning with Goldboro, we are also looking at M&A as a way to jumpstart and build a resource portfolio for which we can ultimately leverage our infrastructure to its fullest.

We're optimistic about our two-pronged growth strategy. Now that we have this acquisition coming in, we think we can significantly increase our production profile over the coming years.

Mr. Allen Alper Jr: What kind of revenue are you getting from your current production? And, what are you looking at? Are you looking at any tolling, or are you using your own bulk sampling? What is your model?

Mr. Dustin Angelo: Everything that we've done so far has been for our own account, all of our own projects. We've been producing around 16,000 ounces a year, which over the last few years generates anywhere from around $20 - $25 million in annual revenue, depending on what the gold price is. Any financial figures I quote are in Canadian dollars.

We're still looking at ways that we can fill the mill ourselves. We haven't really looked at any toll milling options. There have been companies that have come to us in the past, even from places far afield, who potentially could move their ore to our site. We've had some conversations and some interest. But, our focus right now is trying to build our own portfolio. Then, mine and process that ore on our own.

Mr. Allen Alper Jr: What type of revenue are you getting? Are you then putting that back into exploration and development? Tell me a little bit about the revenue model.

Mr. Dustin Angelo: Sure. Over the last several years, we have taken all of our profits and put them back into our projects. We reinvested for the long term in such items as tailings facilities and mill automation. Then, we also put a lot of money back into the ground in terms of exploration.

When I first started with this project, about seven years ago, it was a turn-around situation. It took about nine months before we really got the mill commissioned, after an extensive upgrade, to where we could be profitable. Then, we had to pay off a substantial amount of debt, which we were successful in doing in about two and half years.

We got the Point Rousse Project to a point, where we were generating a lot of free cash flow. The performance of the mill was improving and we started to put money back into the company to find more ounces to keep the mill going. If you look at our cash cost, it's very similar, on a unit base, to what the gold price is because we took all of our cash, and we started to reinvest it.

We've done several different programs for exploration over the years to expand our resources. Of course, we spent money for capital expenditures as well.

So, the model, thus far, has been investing for the future and building a platform for growth, which is now coming to fruition. Until we did a flow-through financing last summer, we hadn't raised equity capital in the capital markets in about five years. So, we were basically self-funded.

It's all about continuing to invest in the project for the longer term, because we see great potential with the area. We have four different projects along areas that have fault structures and other key geological characteristics that suggest that there's a lot more gold that we can find, and we can produce and process in our mill. We continue to reinvest there.

Of course, there's the M&A side, and that's why Goldboro came into the picture. Now, with Goldboro, we'll have roughly around a million ounces of gold in our portfolio. About 80% of that is going to be high grade gold, over five grams per tonne. We're looking for not only ounces, but looking for quality ounces at a higher grade so that we can leverage the amount of ore we put through the mill. If it's higher grade, more goes to the bottom line, because we're dealing with a fixed cost structure. And, it leads to more profitability.

Mr. Allen Alper Jr: Sounds like you have a lot of confidence in Anaconda. Could you tell me a little bit about your share structure?

Mr. Dustin Angelo: Before the Orex transaction, we have about 209 million shares outstanding. It's about a $15 million market cap company. There's just about $1 million in debt, which is government funding, so it's low cost debt.

We have very supportive shareholders. We've have one institution that has about a 10% interest in the company. There are a handful of other investors that have been around prior to even when I came on board. They've been in the story for a long time, and they've been very supportive. I could probably make about half a dozen phone calls and find nearly 50% of the stock. Those folks have been very supportive of the company, very supportive of our plans. Without them, we wouldn't be where we are today.

Mr. Allen Alper Jr: We have a lot of readers, who are investors. What are the primary reasons our high-net-worth readers/investors should consider investing in Anaconda?

Mr. Dustin Angelo: Well, I think the transaction that we just announced is the biggest thing. We've married a significant amount of quality resources with an operating infrastructure and an experienced management team that has built mines before. We think that we can develop this project and leverage our infrastructure to bring the project into production on a faster time line and at a lower capital cost.

Those sorts of synergies should play out in the capital markets. Hopefully we'll see a re-rating of the company because we'll take Goldboro, which has been a dormant asset for a while, make it into a development project and layer it on top of existing production from the Point Rousse Project.

We think we have a team in place that can make it happen. If successful, we can significantly increase our production profile in the coming years, which should translate into a higher capital markets profile, more liquidity for the company, and therefore, a better stock price.

Mr. Allen Alper Jr: Excellent! Is there anything else you'd like to add?

Mr. Dustin Angelo: From a management stand point, we have a great team. We have a highly motivated work force. We do a lot in the communities, as well.

As I mentioned before, we were a turn-round situation from the beginning and were challenged from a cash perspective. As we worked our way out of that, we’ve been able to grow and give back to a lot of the stakeholders that helped us in the beginning.

We've given a lot to the Baie Verte community where the Point Rousse Project is located. In the last three to four years, we donated about $100,000 for various causes. We've helped repair the local regional hockey arena and we've made a five year commitment to the Baie Verte swimming program, in the amount of $65,000, to pay for swimming lessons. We try to stay prominent in the community and be part of the community. I think we've shown that through our dedication.

Mr. Allen Alper Jr: All that sounds very good. I'm very impressed with it, in fact. Thank you very much for your time.

Mr. Dustin Angelo: Thank you.

https://anacondamining.com/

150 York Street

Suite 410

Toronto, Ontario, Canada

M5H 3S5

Phone: (416) 304-6622

Fax: (416) 363-4567

info@anacondamining.com

|

|