Richard Kern, President and CEO of Iconic Minerals Ltd. (TSX‑V: ICM; OTC: BVTEF; FSE: YQGB): Acquiring and Exploring Precious Metal and Lithium Projects Primarily in Nevada, USA

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/22/2017

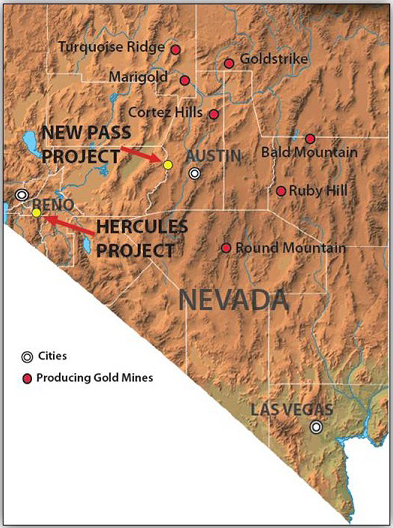

Iconic Minerals Ltd. (TSX‑V: ICM; OTC: BVTEF; FSE: YQGB) is an exploration company focused on acquiring and exploring precious metal and Lithium projects in North America, primarily in Nevada, USA. We learned from Richard Kern, President and CEO of Iconic Minerals, they have accumulated very significant gold as well as lithium projects. The Bonnie Claire Sarcobatus Valley lithium property, located about 60 kilometers south of Clayton Valley, encompasses 1,155 claims covering over 35 square miles and can have recoveries as high as 98%. Their gold exploration portfolio includes the Hercules property in the Como mining district, 17 kms from the famous Comstock Lode mine, the New Pass property in the New Pass mining district, and the Squaw Creek property located in the northern area of the Carlin Trend.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Richard Kern, President and CEO of Iconic Minerals Ltd. Could you give me an overview of your company?

Richard Kern: Yes. Iconic has been around for a while, and it has accumulated very significant gold as well as lithium projects. The gold projects have both 43-101 approved resources and one of them has a significant resource that's historic, not 43-101 approved.

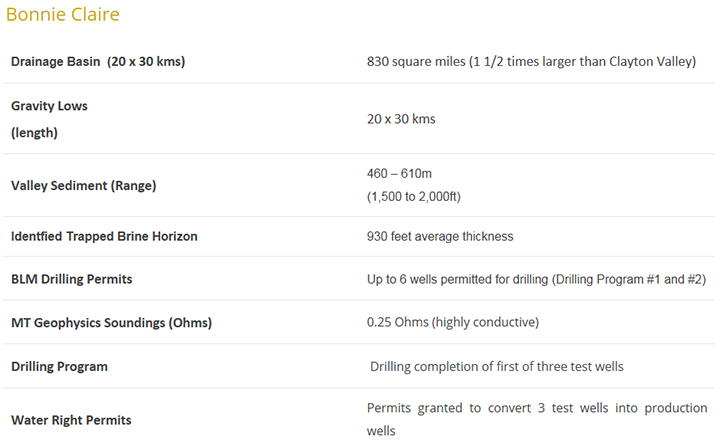

The lithium side of the business is fairly new. We've only been in that about a year, but in that year we've acquired a major project that's about 60 kilometers south of Clayton Valley, where the only mine is. In the year that we've been working on the project, we've drilled two holes. We've identified a 1500 foot thick zone of lithium-rich sediments, and although we haven't found lithium brines yet, we have really just started. We've drilled two holes a mile and a half apart, and we haven't tested the structures we think are the feeder structures for the brines. We're moving forward with metallurgy on the sediment-hosted lithium, and it should be an exciting year for us.

Dr. Allen Alper: That sounds great. Could you tell me a bit about your deposits, more about the gold?

Richard Kern: Yes. My favorite gold property Iconic has is called Hercules. It's very close to the Comstock Lode, which I'm sure you're very familiar with. Virginia City helped pay for the Civil War for the Union side, and was a very high grade producer of both gold and silver. Hercules, I believe, is the tail of the Comstock Lode. It has many of the exact same characteristics as the Comstock. However, it has never been significantly mined. It was actually discovered before the Comstock, but the high grade was discovered at Comstock and everybody went over there.

So, circumstances were such that the Hercules property has had very little mining done on it. There are non-43-101 resources, historic resources at Hercules between a half and a million ounces. We have very good surface and underground sampling. It's all permitted. It's ready to go. We're just waiting for the gold prices to go up a little bit before we move on it. We'll possibly get to it this year.

We also have a half-interest in a project called New Pass, which has 300,000 ounces of gold equivalent. That is 43-101 approved. It is open-ended, and we plan on doing more work on that. We have a couple other very good projects, but they do not have resources on them. That's the gold end of the spectrum.

Dr. Allen Alper: That sounds good. Could you elaborate a little bit more on what you plan to do for the year?

Richard Kern: On the Bonnie Claire project, the plan for this year is to do additional drilling and produce a 43-101 resource of the sediment-hosted lithium, which is at least 1500 feet thick. The two holes we have are over a mile and a half apart. They both have good thicknesses in them. With another hole or two, we should be able to do a very large resource estimate on the sediment-hosted lithium.

At the same time, we're doing some more geophysics to better define where the feeder structures are in the basin that we're working. The idea is these holes we drill will not only define the sediment-hosted resource, but will drill these faults that we think are probable hosts for lithium brine, which would be the same material that's mined at Clayton Valley. Before the end of the year, we hope to have at least a couple more holes done, some significant metallurgy done on the sediment-hosted portion of this, and a 43-101 report with resource written for Bonnie Claire.

Dr. Allen Alper: That sounds very good. Could you tell our readers more about your background, your team, and your board?

Richard Kern: I'm an exploration geologist. Have been for many years, more than I care to tell you. I've been very fortunate to be involved with some significant discoveries, principally in gold, a bit in copper. I started looking at lithium, when the first lithium boom occurred a few years ago, got up to speed, and then the boom was over for whatever reason. I put that stuff away, but now lithium has come back, so I got onboard right away.

Iconic controls three lithium prospects at the moment. We're just starting to work on two of them. Most of our emphasis is on Bonnie Claire. I've worked for majors, and I started working for myself about 15 years ago. I love mineral exploration. I don't think I can quit. I'm old enough to retire, but I have no intention of doing so.

Dr. Allen Alper: That sounds great. It's fun getting out there and finding minerals and exploring deposits. That's great, very enjoyable, and very rewarding. Keep doing it. I'm glad you're hanging in there and exploring. That's great.

Richard Kern: Thank you very much.

Dr. Allen Alper: Keturah Nathe joined us. Which of you would like to tell us a little bit about your board?

Keturah Nathe: I'll come in with that, Al.

Dr. Allen Alper: Okay.

Keturah Nathe: Our board of directors, we have Hewitt Tracey, who has over 22years in corporate finance world. He was a broker for a few different firms. His background is tech and resource.

We have Joe Charland, who has also been primarily based in mineral resources and also has had a prolific background as far as corporate structuring projects, moving projects forward, and corporate finance as well.

Then we have Jurgen Wolf, who has over 30 years of experience in corporate industry. His background is in manufacturing and construction. He has run his own companies very successfully.

Our CFO, Richard Barnett, has over 25 years of experience in all aspects of financial reporting for private companies, as well as public companies.

Dr. Allen Alper: That sounds very good. Could you tell me a little bit about your finances and capital structure?

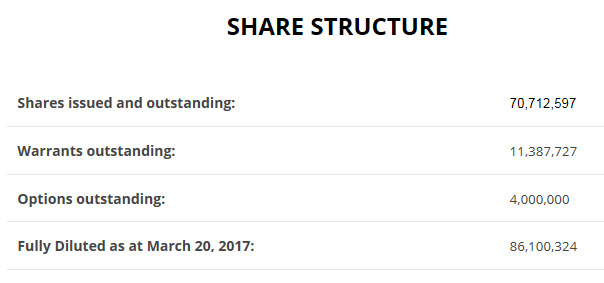

Keturah Nathe: Certainly. Right now, we have a fairly tight structure as far as what's being held in. We have about 30% held by insiders and management. We have about 70 million issued and outstanding. At this point in time, I would say we're undervalued as far as where we are in our project, and what we've accomplished. We believe this is going to be a pivotal year. We're very close to a 43-101. We don't have very many options outstanding. Four million options and about 11 million warrants, fully diluted is about 86 million.

Dr. Allen Alper: That's very good. I'm glad to see the management team is confident in the company and is willing to invest their own funds in the company. That's very important. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Keturah Nathe: We have two assets. We have the lithium assets and we have the gold assets. First the lithium. We have three large properties, about 69,000 acres in Nevada. This is a significant area because Tesla has its Gigafactory there, and there's only one producer, which is winding down their production sooner than later. It presents us with the opportunity to have the end user at our back door; we can provide them with lithium.

We are at a pivotal stage where we have a new discovery that allows us to have a sizeable resource.

We also have the two additional properties that we have yet to explore, but believe we have highly prospective brines. We're only six months away from a 43-101. In a short time frame, we should be able to determine the size of the resource, the value and the scope of it going forward.

We also have three gold properties. The flagship property, Hercules, has potentially up to, or more than, a million ounces of gold. We have a plan of operation in place. We can start drilling essentially next week. We're approximately six months away from a 43-101 on that site. The plan is to spin out the gold assets, unlock the values in each, as a project. The current shareholders would receive a dividend from that spin-off.

They would be getting two properties, two assets, in a short time frame, which we believe is going to add value to our company.

Dr. Allen Alper: Sounds like excellent reasons for our high-net-worth readers/investors to consider investing in Iconic Minerals. Is there anything else you'd like to add, Richard?

Richard Kern: About the lithium, how similar Bonnie Claire is to Clayton Valley. Everything we've done there indicates that we have the same type of mineralization as Clayton Valley. The only reason our stock isn't through the roof is that we haven't hit the lithium brine yet, but the sediments are the same, everything. The chemistry of the rocks is the same. The source rocks are the same. The configurations of the valleys are very similar. The only difference is we have not yet drilled the controlling feeder structures to the brine.

We've gone off on a tangent, chasing lithium in the sediments, which is a very good thing, but I know that the market would like to see us have a brine discovery. I think the fact we're going to drill on major structures with the next two or three holes bodes well, because I think there's a reasonable chance we're going to hit lithium brine in those holes. This should happen fairly early in the year if the dry lakes actually dry out. We've had a very wet winter here, so I'm not exactly sure when we get back into the dry lakes. It should be early spring. When we do that, there's a chance of a big win. I can't over-emphasize the additional potential we have.

In addition to that, the gold resources are already in place. It's just a matter of doing further definition and starting production. I've invested in Iconic in a big way, and I'm happy I'm here.

Dr. Allen Alper: That's great, and that sounds like you're going to have a very exciting and interesting year once you drill those holes and get more information. That sounds excellent. Is there anything else that either of you would like to add?

Richard Kern: There are only a couple of places where you get lithium in sediments other than clay. Those two places are Clayton Valley and Bonnie Claire. The problem with lithium in clay is it's hard to recover. We appear to have lithium carbonate being deposited in our sediments and not within clay, though we don’t have a final identification on all the minerals involved yet . That bodes very well for being able to determine a metallurgical process that will get it out fairly cheaply. Therefore, I can't emphasize enough how similar Clayton Valley and Bonnie Claire are. The implications of two ways to produce lithium in our valley makes it very high priority.

Dr. Allen Alper: That sounds very good.

http://iconicmineralsltd.com/

303 - 595 Howe Street

Vancouver BC V6C 2T5 Canada

Richard Kern, President and CEO

Contact: (604) 336-8614

Email: info@iconicmineralsltd.com

|

|