Endeavour Silver Corp. (NYSE: EXK, TSX: EDR): A Mid-Tier Precious Metals Mining Company with Three High-Grade Silver-Gold Operating Mines and Three Development Projects in Mexico, Interview with Brad Cooke, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/17/2017

Endeavour Silver Corp. (NYSE: EXK, TSX: EDR) is a mid-tier precious metals mining company that owns three high-grade, underground, silver-gold mines in Mexico and produced 9.7 million ounces of silver and equivalents in 2016. We learned from Bradford Cooke, Founder and CEO of Endeavour Silver that last year they had $157 million in revenue and their new focus, thanks to the turnaround in the markets these past few months, is to grow their business by building three new mines in Mexico. Mr. Cooke is a gold and silver specialist and according to him the purchasing power of the dollar, Euro, Yen are going sharply lower in the next three to five years and that's the main reason to own precious metals.

PDAC 2017: Bradford Cooke, Founder and CEO of Endeavour Silver Corporation and Dr. Allen Alper, Editor-in-chief of Metals News

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Bradford Cooke, Founder and CEO of Endeavour Silver Corporation. Could you give our readers/investors an overview of Endeavour Silver?

Mr. Brad Cooke: Absolutely, Allen. Endeavour Silver is a 13-year-old company based in Vancouver, Canada, with three operating silver and gold mines in Mexico. Those are the core assets of the Company.

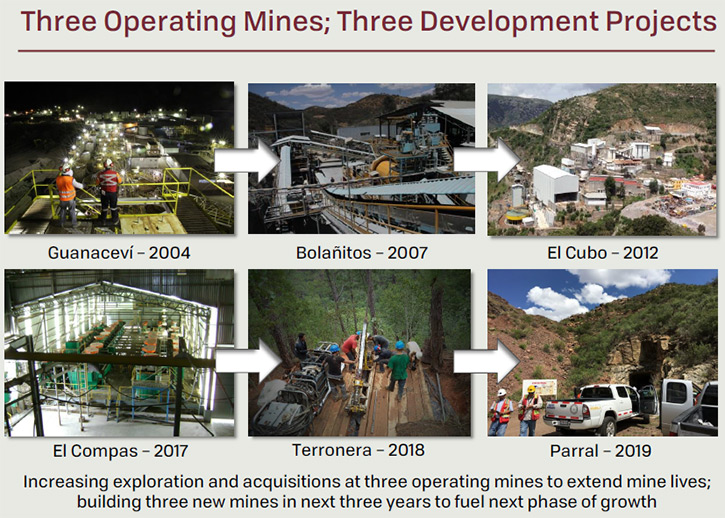

Last year, we had production of just under 10 million oz silver and equivalents that generated $157 million in revenue. Thanks to the turnaround in the markets in recent months, we have returned our focus to growing our business by building potentially up to three new mines in Mexico over the next three years. That gives us one of the most compelling growth profiles in the silver mining sector. We have a nice combination of good core assets operating today and strong organic growth.

Dr. Allen Alper: Could you tell me about your operations, a bit more information and then your exploration opportunities?

Mr. Brad Cooke: Yes, in terms of the operations last year, we produced around five and a half million ounces of silver and 57 thousand ounces of gold. On an equivalent basis that's just shy of 10 million ounces of silver equivalents.

We are forecasting about the same production this year from the Guanacevi, Bolanitos and El Cubo mines and then we're going to see a nice 50% growth over the next three years by developing the El Compas, Terronera and Parral projects into our next three mines.

The other bonus of building new mines is that they have lower cost profiles than the existing mature mines. Not only will we grow our production, we should be able to shrink our costs.

Dr. Allen Alper: That sounds excellent. What are the costs now and what will they be?

Mr. Brad Cook: All-in sustaining costs last year were about 12 and a half dollars per ounce of silver produced net of the gold credit.

We're forecasting a little bit higher this year in the 14 dollar per oz range. But that's because we're spending more on sustaining the mines and we include our sustaining costs of exploration and development in the all-in sustaining costs. But with the new mines coming on stream each should have all-in sustaining costs below 10 dollars per oz of silver production.

Therefore, our consolidated costs should also come down below that 10 dollar per oz range.

Dr. Allen Alper: That's excellent. Could you tell our readers a little bit about your background, your team and your board?

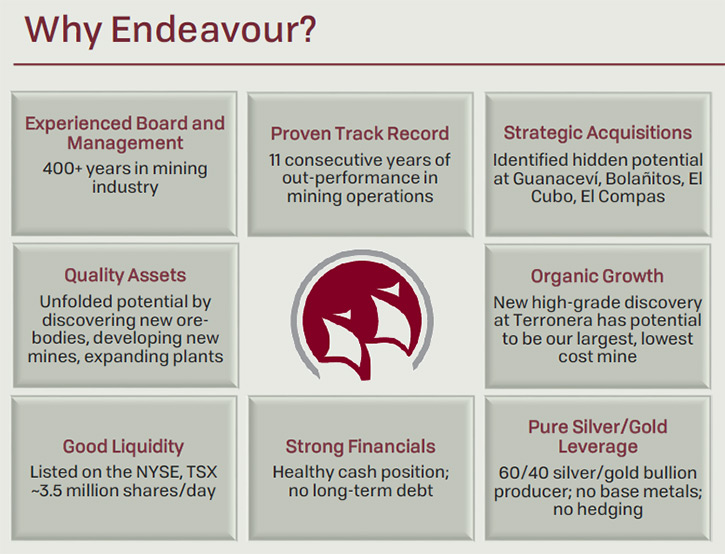

Mr. Brad Cooke: Well, Allen, you're sitting here at our booth surrounded by some of the members of my team. We're dominated by Mexican talent. I myself am an exploration geologist with a M.Sc. degree in geology and 40 years of experience in the exploration and mining industry.

Godfrey, our President and COO, was the first to join me in Mexico in 2003. I founded the company and went to Mexico in '03 looking for strategic silver and gold assets to try and build the company. Gold was barely 300 dollars per oz at that time and silver was still flat around four bucks per oz. So, it was very good timing to start a silver mining company.

We acquired and built not only some core assets, but also put together a great management group. Thomas Iturriaga-Hidalgo just joined us as the VP of Operations. Luis Castro was one of the early employees working on the discovery holes, now he runs our entire discovery team as VP of Exploration.

Our directors on the board are all seasoned mining executives who bring to Endeavour their own track records of success at major mining companies.

Dr. Allen Alper: That's great. Congratulations. Good job!

Mr. Brad Cooke: So, we have a good core group. We're still growing as a group, because if you're going to grow the company, you need to grow the management team.

Dr. Allen Alper: Could you tell me a little bit about your share structure?

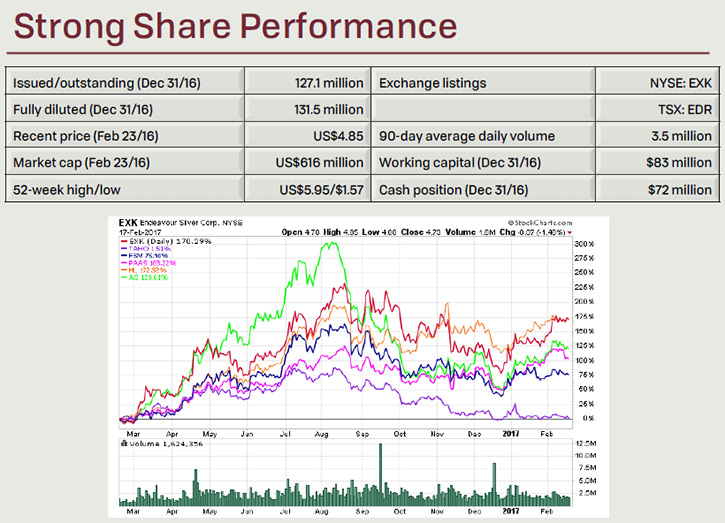

Mr. Brad Cooke: Yes. We have approximately 127 million shares out. Because we build mines and generate cash flow, we went more than six years between equity financings. We did an equity raise last year primarily for our growth so now we're fully funded for two of the three mines.

So, the share count had been relatively flat for almost seven years and our next financing will be a small debt raise to build one of our three new mines.

Dr. Allen Alper: That is amazing. Most companies’ shares, as you know, were diluted during this period.

Mr. Brad Cooke: It's important in the mining business to achieve a certain level of size, or critical mass of your cash flow. Because there's a basic underlying cost to running a public company. We achieved that critical mass very quickly with Endeavour. So we're very fortunate in that sense.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Brad Cooke: Well, I am a gold and silver specialist so I have more faith in gold and silver than I do in the dollar, the Euro and the Yen.

I think we are in the final three to five years of this financial and commodity cycle where countries with unpaid debts are finally going to have to reconcile that by printing more and more money to pay off debts.

Therefore, the purchasing power of the dollar, the Euro, the Yen are going sharply lower in the next three to five years and that's the main reason to own precious metals as a store of value. Any person with investments should have part of their portfolio in the gold and silver sector.

You know, not so long ago, it was very difficult to buy investments in gold other than the major mining companies and they offered three benefits to investors.

Back in the '80s and '90s, an investor who wanted to have gold in their portfolio bought Anglo, Goldfields, Newmont, Barrick, all the big golds because they offered not only liquidity, you could get in and out of those stocks, they offered leverage, more than one-to-one ratio to any move in the price of gold, and they offered growth, by discovering and building new mines.

But if you look at the major gold and silver mining companies today, you don't need them for liquidity or leverage because you can buy the ETFs And they don't have any growth, so why own them?

So, I think the sector where you can find that nice combination of liquidity, leverage and growth is the junior and mid-tier producers. Endeavour is a growing mid-tier precious metals producer and I think that it would be a very nice fit for the portfolio of any high-net-worth individual.

Dr. Allen Alper: That sounds like an excellent analysis and reason to consider investing in Endeavour. Could you tell me, what are your thoughts on what's going to happen with silver and with gold and what's driving it?

Mr. Brad Cooke: Wall St. is basically ignoring gold and silver. The current wisdom is that President Trump is going to make America great again and the markets have already discounted that with a nice run in the equity markets in America.

But, the economy's actually not there yet, it’s growing but slowly. President Trump is still in his first, what, 60 days and it's very early days yet. The economy is not showing signs of faster growth yet. But we are seeing rising inflation from all the increases in money supplies around the world. So I think it's a little bit too much, too soon in the broader equity markets, and gold and silver are being neglected, when they have a very valuable role to play. I don't think the Fed's going to raise rates three times this year, which is what the US Fed is advising and what Wall street is buying.

If the US Fed interest rates don’t increase three times this year, what do you think is going to happen? The equity markets are going to turn over because they moved too fast and the precious metals are going to really start moving again. I think it's a very good year to have precious metals.

Dr. Allen Alper: That sounds like a good analysis. Very good. Could you tell me, is there anything else you'd like to add Brad?

Mr. Brad Cooke: Well, some people are concerned about Mexico and I just want to say that is one of the best jurisdictions in the world in terms of finding new deposits. It's one of the fastest jurisdictions for permitting new deposits and while there are certainly pockets of security risk and political risk in Mexico, we're not operating in any of those areas, so we're a very happy Mexican company.

Dr. Allen Alper: That sounds great! Excellent!

http://www.edrsilver.com/

Meghan Brown, Director Investor Relations

Toll free: 1-877-685-9775

Tel: 604-640-4804

Fax: 604-685-9744

Email: mbrown@edrsilver.com

|

|