Pasinex Resources Limited (CSE: PSE; FSE: PNX): Expecting Production of about 40 Million Pounds of Zinc this Year, Interview with Steven Williams

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/17/2017

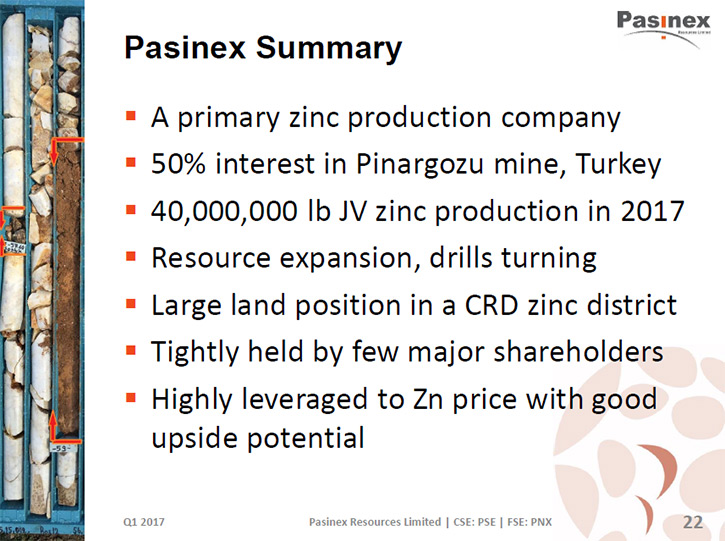

Pasinex Resources Limited (CSE: PSE; FSE: PNX) is a metals company which is a 50% owner of the high-grade Pinargozu Zinc Mine, which has produced for several years and, under its DSO Program, is shipping directly to zinc smelters/refiners in Europe from its mine site in Turkey. We learned from Steven Williams, who is President and CEO of Pasinex, that since last September they doubled the production of their mine, expecting production of about 40 million pounds of zinc this year. The company's major well sought-after product is zinc oxide, which is 32% zinc, and constitutes 85% of their production. The second product is a zinc sulfide product, sphalerite, which is 48-49% zinc. Zinc prices went up 75% last year and Mr. Williams believes that there's still some upside on the zinc price.

PDAC 2017: Sven Olsson Director, Steven Williams President and CEO and Joachim Rainer Director

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Steven Williams, who is President CEO of Pasinex. Well, you're having a great year this year.

Mr. Steven Williams: Yep.

Dr. Allen Alper: Zinc is well sought after, and you're in production. Give our readers an overview of what's going on. It's been, I know, a very exciting couple of years for Pasinex.

Mr. Steven Williams: Yeah. We did the hard work in the last couple of years, and we built the mine. We put in a third new adit in August/September last year, and that basically doubled our production. So now we're producing around 160 ton a day of direct shipping ore, 32% zinc, so it's very high grade, which is about 40 million pounds. That'll be the production we do, about 40 million pounds of zinc this year.

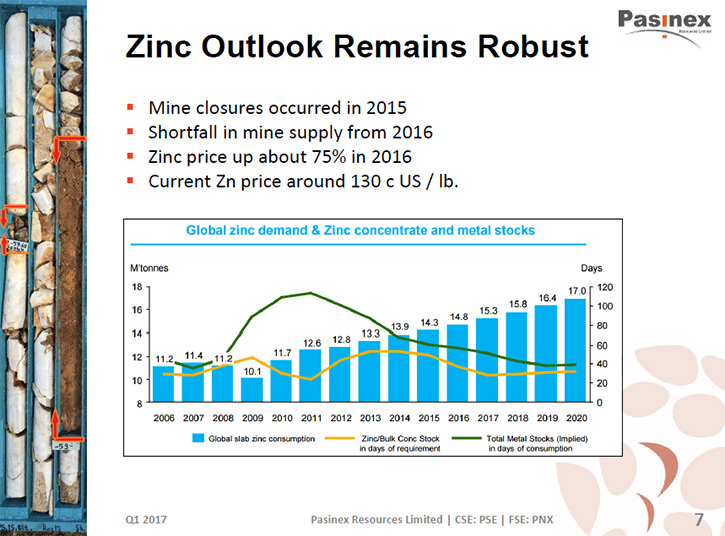

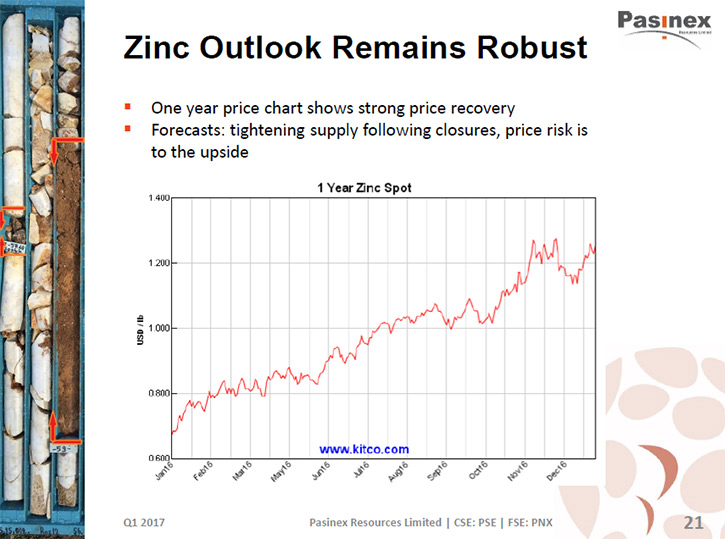

And so yeah, we've done a lot of the hard work, bringing on significant zinc production just as zinc prices started to really hit very high levels, so with zinc prices touching around US$1.30 per pound. It went up 75% last year. I don't think it's going to go up that amount this year, but I think there's still some upside on the zinc price. And we're bringing on zinc right at the right time, so it's fantastic. It's a case of focus in the tough times, and continuing to focus on what's important, which was building the mine. Now we and our shareholders can benefit from it.

Dr. Allen Alper: That sounds great. That's a great job. You stuck it out in the tough times and were prepared just right at the right time.

Mr. Steven Williams: Yeah, you know, 2015 was a horrible year. 2016 got better but still really tough times. We, like lots of juniors I've spoken with, couldn't raise money, share prices going down, bills going up, and just hanging on. We recognized our way through that was to build the mine. We're blessed by having this high-grade zinc deposit and direct shipping. We just hunkered down and focused on that. We stripped away a lot of the things like marketing and other costs. That doesn't mean we didn't want to do marketing, but there were limited funds. We stripped down to a minimum staff and just focused on building the mine. And that was the right decision. Now we're going to benefit from it, and our shareholders are going to benefit from it because zinc price is up, our production is up, and I think we've probably got another at least two, maybe three years of good upside on the zinc price, so it's fantastic.

Dr. Allen Alper: What is driving the zinc price?

Mr. Steven Williams: Definite supply-side shortage. It's really clear. With the closure of mines like Brunswick and Century in Australia, there are a couple of them, there are several that closed. It took a while from when the mines closed to when the zinc price finally took off, which was last year, and that was very much about particularly stocks of zinc metal, mostly in China. So there was an overhang of stock, but I can tell you that stock's gone now and the market is desperate. We're producing and selling. We have at least 25 different groups, mostly traders, wanting our product, knocking on our door constantly. We haven't had to go out and seek somebody to buy our product, they're coming to us, and prices are getting more and more competitive. The treatment charges on sulfides, zincs has collapsed like crazy, and that truly reflects the fact that the smelters and refiners are desperate for feed. And so it's a beautiful market right now. So as I said, it took a while to finally kick in, but it is real now.

Dr. Allen Alper: The product that you're selling is a concentrate?

Mr. Steven Williams: We have four products, but two major projects. Our major product is zinc oxide, which is the 32% zinc, and that's about 85% of our production. And Europe and Iran is where it's supposed to be going. Our second product is a zinc sulfide product, sphalerite. It's a sulfide product that's running 48, 49% zinc. That's mostly going into Europe, to the smelters in Europe. So those are our two major products right at the moment, and both well sought-after.

Dr. Allen Alper: Well that's great. Could you update our readers/investors on your background, your team, your board?

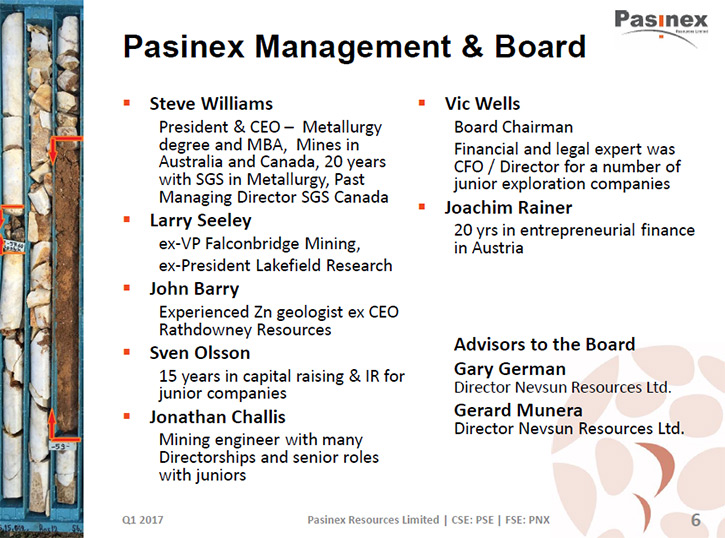

Mr. Steven Williams: Yeah, we're a technical team. Talk to me long enough and it'll be perfectly obvious that I'm a technical guy. I'm a metallurgist actually. I also got an MBA, so a metallurgy degree from Western Australian School of Mines in Kalgoorlie, West Australia, and then an MBA from Tulane University in New Orleans. I spent all my life in mining, various aspects of mining from mine operations through to consulting through to testing, all the aspects, and then lately into mine management roles. This is something I always wanted to do, when you're in mining, this is the ultimate of your career, to put it together, be a bit of an entrepreneur and get a company going, get a mine going. So that's what I am.

On our board of directors, one of the major guys is ex-Falconbridge, Vice President of Falconbridge, PhD in chemical engineering, similarly a mining technical guy. We've also have some marketing and finance guys, we've have an accountant, what am I missing? We have two other technical guys, we have a geologist. Our QP is an Irish geologist, strongly rooted in zinc. One of our other directors is a mining engineer. We're very much rooted in technical, very much mining guys, but we also have the accounting and the marketing side.

Dr. Allen Alper: That sounds great. I understand you have a Turkish partner.

Mr. Steven Williams: Yeah, the mine is a 50/50 joint venture. When I went into Turkey to build a mine I thought I should have a Turkish partner. Through the network, we ended up with our partners, called Akmetal, a Turkish mining company. People ask me, who has management and how does it work? We truly do share the management. We sit around a table and we discuss items and they'll do things, and we'll do things, but it's all built on communication, trust, respect. And as long as you have communication, trust and respect it works, and it works very well.

We have complementary skills. Turks are very good at mining. They love mining, they get in, they like to dig holes, dig rocks, and they're very good at it. Our skills are rooted in some of the technical aspects of mining, both in terms of geology and metallurgy, but also in terms of some of the business planning and strategy. And so those are complementary skills. We bring some of the management aspects, and they bring pulling it together and making it happen, and also obviously local relationships. So that's how it works.

Dr. Allen Alper: That sounds excellent, I'm glad. It sounds like there's great synergy between the two groups.

Mr. Steven Williams: Yeah, you've got to work at it, and I've got to tell you, and I think this is true of a lot of countries, there are some big cultural differences. We definitely see some aspects of life differently. We're used to doing things a different way. Turkey has a long and very proud history. Turks are proud of their history. So back to the communication, the trust and respect, you have to work at that. You have to keep working at it, and recognize that sometimes we're going to see things differently, and try to understand why we're seeing things differently, and then try to resolve each situation. So you have to work at it, but if you work at it the rewards are there.

Dr. Allen Alper: That's great. How is it operating a mine in Turkey?

Mr. Steven Williams: Turkey's the 15th-largest economy in the world; 78 million people, it's a young population, I think the average age is 29 or something. Turkey has a young, aggressive, wanting to grow and develop type of mentality. The government, a classic conservative, right-wing, business-focused government, recognizes that growth of the economy, growth of businesses is fundamental to the growth and success of Turkey, and so they have done a lot of things to liberalize commercial code, make it easier to do business, make it easier to move money in, move money out. In those aspects, Turkey is very good.

Also, another aspect where Turkey's very good is on infrastructure. One of the reasons we were able to get this mine going so fast is we didn't have to put any infrastructure in. We're three kilometers off the top of the mountain to a major road. Then it's an hour and a half down from where we are to the city of Adana, which is the fifth-largest city in Turkey, 1.8 million people. Then another hour down the road to the port of Mersin, it's one of the major commercial ports in Turkey on the Mediterranean. That's valuable infrastructure that enables you to get a project going fast and efficiently. That's worth a lot and that was worth a lot to us.

There are always issues, but you know, big picture, pro-business, pro-mining, great infrastructure - helps a lot to really getting going.

Dr. Allen Alper: That sounds great. Could you tell me a bit about your capital structure?

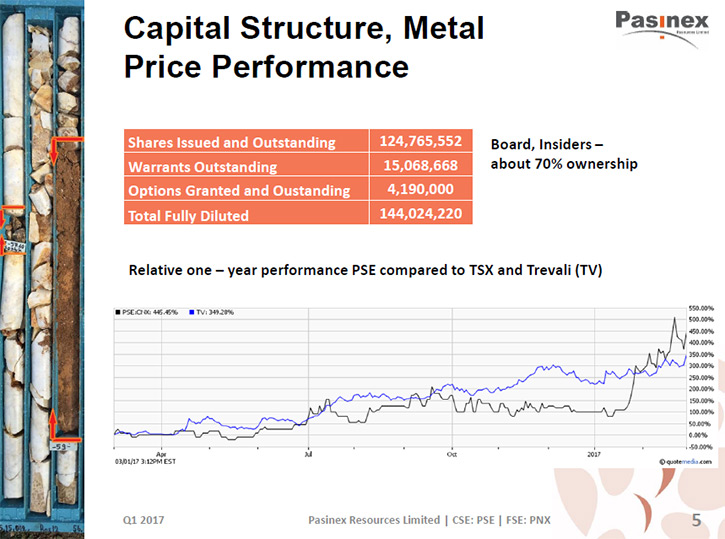

Mr. Steven Williams: Yeah, we're 124 million shares out now. In the tough times it was hard to raise money and you have to raise money at lower and lower share prices, so unfortunately the number of shares went up. But, we have some warrants that are coming due in June, and some coming due in August, that'll take us to 144 million shares totally fully diluted. Those warrants are all in the money, so I expect they will all get converted, and that'll bring in over a million dollars right there. The mine's starting to make money now, and with the warrants coming due, at this time we don't need to do any more placements. We're sitting okay.

Dr. Allen Alper: That sounds great. That's a great position to be in. What are the primary reasons our high-net-worth readers/investors should consider investing in Pasinex?

Mr. Steven Williams: Oh, zinc, number one. I think the zinc prices still have two or three years of being very solid. Really great times for zinc! We are producing 40 million pounds. We've done a lot of hard slogging, building the mine, so now we're going to, I believe, have some very good financial performance in the next couple of years. So great EBITDA is coming up, I believe, and just as the zinc price is peaking. We still have exploration upside, there's a lot more zinc to be found yet. So that's it. You want a strong zinc story right at the time when the zinc price is going up, there are not too many people you can look at except for people like us.

Dr. Allen Alper: That sounds great. Is there anything you'd like to add Steven?

Mr. Steven Williams: It's just a question of being blessed with a high-grade deposit, and doing the hard work in the hard times. I think now it's going to pay off, for the company and for our shareholders.

Dr. Allen Alper: That's great. It sounds very good. Excellent!

http://pasinex.com/

Steve Williams

President/CEO

Phone: 416.861.9659

Email: info@pasinex.com

|

|