Red Cloud Klondike Strike Inc: Innovative Financing Alternatives, Growth Opportunities, and Market Exposure for Mining Companies (PDAC 2630)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/28/2017

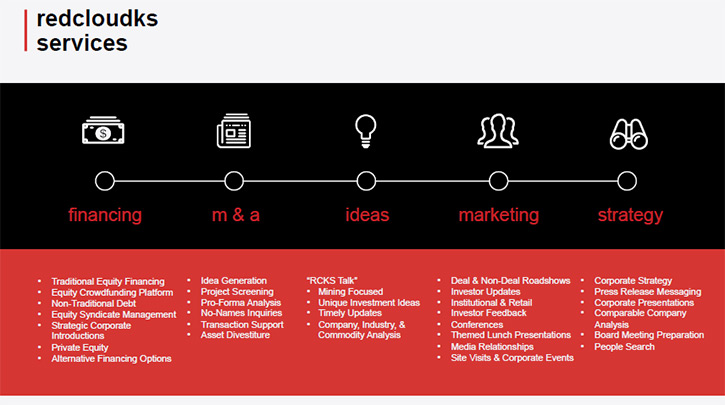

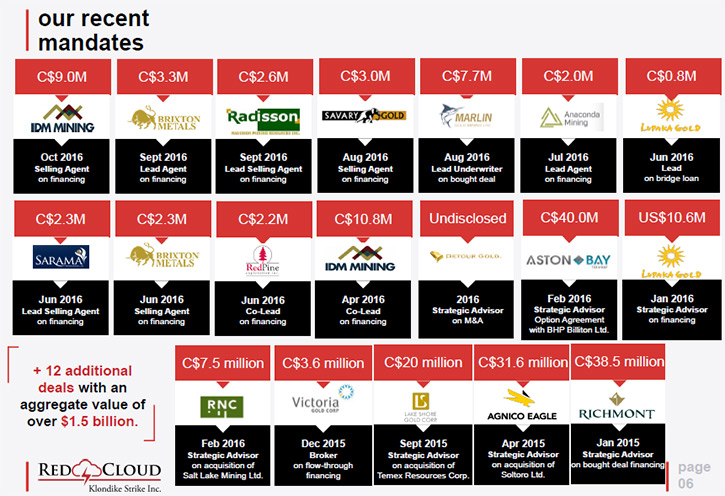

Red Cloud Klondike Strike Inc. (“RedCloudKS”) is an exempt market dealer focused on providing unique and innovative financing alternatives, growth opportunities, and market exposure for select mining companies. We spoke with Chad Williams who's the Founder, President and CEO of Red Cloud Klondike Strike and also to Katherine Fedorowicz, VP Marketing and Investor Relations. We learned from Mr. Williams, formerly a top-ranked mining analyst, an investment banker and CEO of Victoria Gold, that he started Red Cloud Klondike Strike five years ago and has since helped well over 200 mining companies access capital. Here are the five approaches utilized by Red Cloud: help raise money (in the traditional broker sense as well as via its online financing platform), help buy or sell assets, provide strategic advisory services, research analysis, and non-deal roadshows for these mining companies. According to Mr. Williams, Red Cloud focuses on solid mining companies that have great assets and technical expertise but need assistance on the capital market side.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Chad Williams, President and CEO of Red Cloud Klondike Strike Inc. and Katherine Fedorowicz, Vice President – Marketing & Investor Relations So Chad, could you give me an overview of your company, what services you perform for the mining industry and give our readers an idea of what your company does?

Katherine Fedorowicz: Maybe just a little history on why you started the Company as well.

Mr. Chad Williams: Sure. Thank you first of all, Dr. Alper, for the opportunity to be interviewed by you. I started Red Cloud as an idea about five years ago. I was a mining analyst and an investment banker on the capital market side. I was also a CEO of a gold mining company called Victoria Gold from 2007 to 2011. Incidentally Katherine and I worked at Victoria Gold together.

The need that I saw was that many of the brokers were conflicted. Whenever I wanted to talk about an M & A idea they were unwilling to sign a confidentiality agreement. There were many conflicts on Bay or Wall Street in the brokerage community because if we wanted to talk about M & A they often had a conflict of interest with other clients. In addition, we didn't get a lot of assistance from them unless we were about to do a financing. So I figured there was a need for a capital market's advisory service that would help mining companies navigate the market and would be a lot more tied in to the mining company and grow with it rather than being transaction oriented, which is the nature of the capital markets firms on Bay Street and Wall Street.

We are five years old now. We've worked with well over 200 mining companies. There are five things we do for these companies. 1. We help them raise money. 2. We help them on M & A in terms of buying or selling assets. 3. We provide general strategic advisory services, much like a management consultant would provide to a regular business. 4. We have a research analyst and product. 5. We do non-deal roadshows for these mining companies.

Our focus is to work with the top mining companies in terms of quality. The typical client would have a very strong project, with solid technical expertise, but need assistance on the capital market side.

So that's Red Cloud in a nutshell.

Dr. Allen Alper: I'm very impressed. I looked at your clientele base for whom you’ve been raising funds. It's very impressive work you’re doing.

Could you mention briefly some of your clients and some of the services you've performed for them?

Mr. Chad Williams: Sure. I'll try to give you an example of our clients and the different services we’ve provided.

For example, many of these things are not public of course on the M&A side in particular, but we are helping the Tyhee Gold Corp.’s management in the sale process of their company. Tyhee has a gold deposit in the North West Territories of Canada and we have been working with them to optimize the value of their assets.

On the financing side, we have assisted a company called IDM Mining raise capital through our involvement in several IDM financing syndicates. On the strategic advisory side, we assist a small company called Red Pine Exploration. We actively and continually market our clients, mainly via non-deal roadshows. For example, we are currently marketing a company called Excellon Resources. And finally, on the analyst side, our analyst Derek McPherson covers 20 different mining companies. Just to pick a few names Derek would cover,

Katherine Fedorowicz: GoldQuest, Brixton Metals, Austral Gold.

Mr. Chad Williams: So those are some names.

Dr. Allen Alper: Yes and I notice some of your clients we've done featured articles on like Sarama, Brixton Metals and Radisson, so we have a lot of synergy. It looks like you're doing an excellent job. Really great! I'm surprised that you've been able to do that in five years, particularly since the last five years have been rather difficult.

Mr. Chad Williams: Yeah, we get that a lot. We've grown from an idea, to having 20 people working here. People say, "How are you able to do it, in what's been a very difficult market". The reality is obviously by choosing high quality names. They do well, even in a poor market, and we work extremely hard for our clients. The joke that we have is that we perform small miracles every day. That's what we do for a living and sometimes we're successful and that's why we continue to have a good and growing business.

Dr. Allen Alper: Brilliant! Could you give our readers a little more on your background and your team? I notice you have a mining and financial background.

Mr. Chad Williams: Sure. I'm a mining engineer with an MBA. I used to be a mining analyst with some of the larger brokers here in Canada including a bank or two. Then I became a mining investment banker and in 2007 I joined a mining company as the CEO of Victoria Gold, and during a very difficult time from 2007 to 2011, essentially the financial crisis, we grew that company from a $25 million market cap to well over $500 million market cap. Katherine was there and Ed Thorose who works at Red Cloud as well was also there. It was a very, very difficult time, but you just persevere and just keep going and by doing good things at some point the momentum works in your favor as opposed to against you.

Dr. Allen Alper: That's excellent. That's very impressive. The team you've put together and your background and accomplishments in the last five years. Such a short time! One thing I'm curious about is how you came up with name Red Cloud Klondike Strike Inc.?

Mr. Chad Williams: It's a mouthful isn't it? The Red Cloud part, which was the original name of the company, actually is named after Red Cloud the famous first nation warrior of the 1850's. And the Klondike Strike part comes from the fact that we developed and launched our online financing platform with help from a technology company that had named it Klondike Strike. For regulatory reasons and for simplicity reasons, instead of having Klondike Strike as a subsidiary of Red Cloud for example, we just named everything Red Cloud Klondike Strike. So that's the story.

Dr. Allen Alper: I like that. Very strategic! Is your company private or public?

Mr. Chad Williams: We're private. We're employee owned.

Dr. Allen Alper: I thought it was private, but part of Katherine’s job description is investor relations, so I was curious about that.

Katherine Fedorowicz: The marketing services we offer to our clients are mainly focused around non-deal roadshows and investor relations activities, including assistance with marketing communication, materials preparation and, given my Investor Relations focused background, I work on those accounts.

Mr. Chad Williams: She does public relations for Red Cloud, but investor relations for our mining clients.

Dr. Allen Alper: Excellent! Is there anything else either of you would like to add?

Mr. Chad Williams: No, I think it's a good introduction and we look forward to working with you in the future.

Dr. Allen Alper: Sounds great.

http://www.redcloudks.com/

79 Wellington St. W.

TD Centre South Tower

Suite 1630, PO Box 148

Toronto, Ontario, M5K 1H1

|

|