Ruby Project of Mustang Resources Ltd (ASX: MUS) Reported by Christiaan Jordaan, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/27/2017

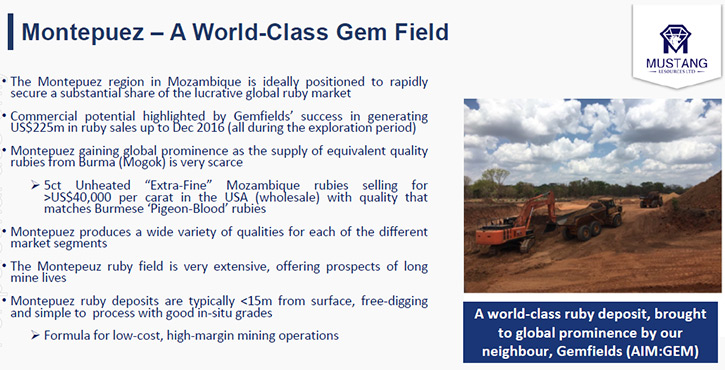

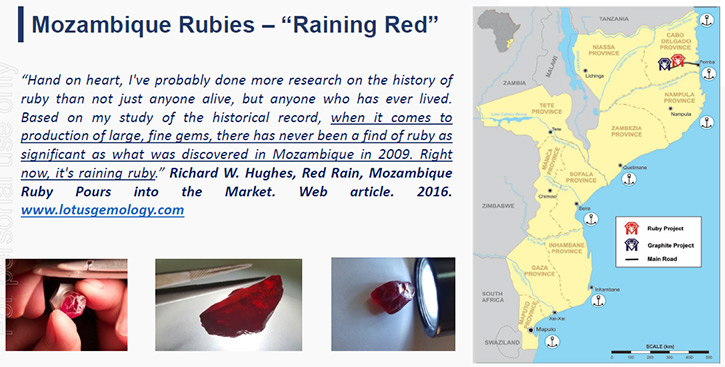

Mustang Resources Limited (ASX: MUS) is an emerging gemstone developer, focused on the near-term development of the highly prospective Montepuez Ruby Project in Northern Mozambique. We learned from Christiaan Jordaan, who is the managing director of Mustang Resources that they are currently one of the only two listed ruby mining companies in the world. According to industry expert Richard Hughes, Mozambique is the most significant ruby discovery made to date. The deposits are characterized by extremely rich primary mineralization. The secondary mineralization, where there's been intensive vertical weathering and redistribution of the rubies into secondary alluvial deposits and channels, contains really high quality rubies equivalent in quality to the best stuff Burma has yielded. More importantly, it is a brand new deposit only discovered in 2009, and it's also yielding these stones on a consistent basis. Mustang’s plans for 2017 include accelerating the drilling campaign, bulk sampling and generating significant cash flow in developing the market through initial sales. Mustang has already exported their first commercial parcel of rubies to the United States.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Christiaan Jordaan, who is the Managing Director of Mustang Resources. Could you give me an overview of your company?

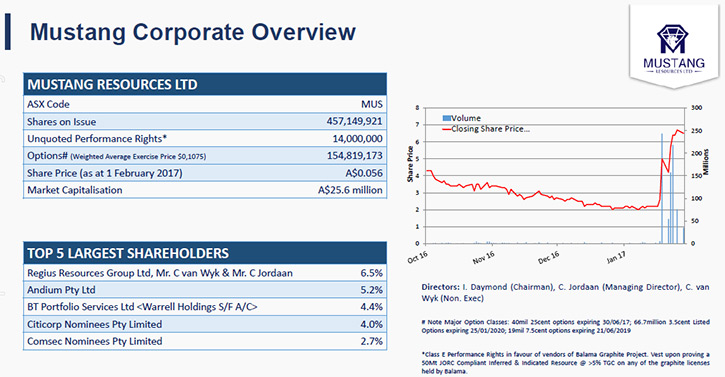

Mr. Christiaan Jordaan: Mustang Resources is listed on the ASX, and the ticker is MUS. We are currently one of the only two listed ruby mining companies in the world. Our current market capitalization is circa 40 million. Our neighbors, Gemfields PLC, listed on the AIM exchange, are about 3 years ahead of us in their development of the adjacent project, capitalized at about 450 million dollars Aussie equivalent. We're currently focused on the development of our Montepuez ruby project located in Northern Mozambique.

We've started bulk sample mining, we've successfully recovered our initial rubies, made a discovery of a deposit we call the alpha deposit, we're accelerating that and together with stones received from our prospecting teams, we've exported our first commercial parcel of rubies to the United States. Included in that, what really caught the market's attention, was the special stones which have two 24ct really beautiful rubies. So we're rapidly developing our flagship project. Lots of things still to come this year!

Dr. Allen Alper: That's exciting. Could you tell me a bit more about the deposits, where they're located, the quality of the stones, etcetera?

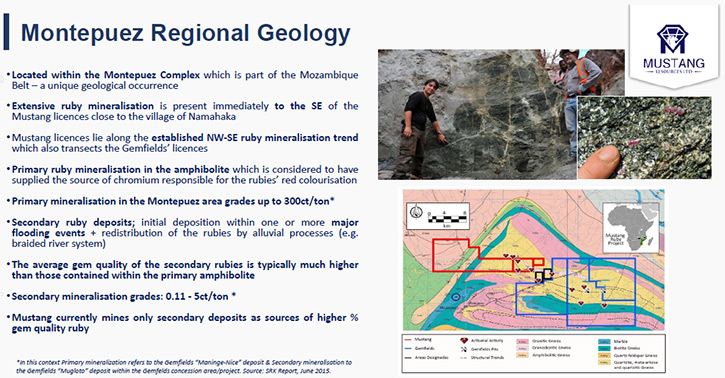

Mr. Christiaan Jordaan: We are located in the north of Mozambique about 200 kilometers inland from the port city of Pemba, near a town called Montepeuz. It is in what they call the Montepuez complex, which is a very unique geological occurrence where the right pressure, temperature, and fluid distribution occurred about 300-500 million years ago. It forms part of the East Africa origin or East Africa mountain building event and through work done by Gemfields and our Geologist Paul Allen, who's leading up our exploration program we are now starting to get a better understanding of what happened here. Paul used to be with Gemfields and helped them find their ruby deposit.

If you look at ruby deposits across the globe, you find others of East African origin in Tanzania, also ruby deposits and sapphire deposits in Madagascar. Also I think there are some corundum ruby deposits in Malawi. The more recent deposits, marble hosted deposits, are in Burma at Mogok and Mong-Tsu. You also find historical ruby deposits, which have been exploited in Vietnam and Cambodia, but those were formed about 30-50 million years ago, part of the mountain building event that formed the Himalayas.

So Mozambique has quickly captured the imagination of Gemologists and experts in the field. I think you'll find there's some interesting literature and work done by the GIA (Gemological Institute of America) particularly Mr. Vincent Pardieu, chief field gemologist, whom I've come to know quite well over the last year or so, and also work done by Mr Richard Hughes. If you want to read or understand anything about rubies and sapphire deposits across the globe, Richard must be one of the foremost experts. I had the good fortune of meeting him at the Tucson gem show a couple of weeks ago. He says that Mozambique is the most significant ruby discovery made to date.

In our belief and Gemfields also, it's going to change the future for rubies and allow it to capture a bigger market share in the broader gemstone market. The reason for that is the richness of the deposits. It's extremely rich primary mineralization. Also we're chasing a secondary mineralization where there's been intensive vertical weathering and redistribution of the rubies. Nature's done the hard work for us in breaking up all the bad quality stones and concentrating all the good quality stones into the secondary alluvial deposits and channels. Those contain really high quality rubies. Work done by GIA and others have shown those to be equivalent in quality to the best stuff Burma has yielded, but more importantly, it is a brand new deposit only discovered in 2009, and it's yielding these stones on a consistent basis.

So, in terms of availability of high quality rubies, Mozambique is going forward for the next 30 years plus.

Dr. Allen Alper: That sounds excellent. Very exciting! Could you tell me a little bit more about your plans for 2017?

Mr. Christiaan Jordaan: Yes, 2017 is going to be quite a busy year for us, we are advancing full tilt on a number of fronts. On the ground we've made that first discovery, which is the alpha deposit, but I think it needs to be stressed that it's just as the name suggests, it's just the first of many deposits. Already through the work of our prospecting teams, as well as through more recently auger drilling, we've discovered multiple deposits across our 160 square kilometers of lease area.

We haven't actually scratched the surface to date and have much more to deliver in the year to come, discoveries and resource definition. One of the core things we'll do this year is accelerate our auger drilling campaign. I just came back from a site yesterday and I'm pleased to report that it's picking up speed. The idea there is to delineate the full strike and full extent of this deposit. The alpha deposit is just a part of a bigger occurrence that we see as roughly striking southeast and northwest and connecting with the Gemfields deposits to the southeast of us.

We've followed that mineralization trend and seen that it continues straight through our leases. We are starting exploration work from the alpha deposit and extending outwards. Using quick and easy auger drilling, we've dug about 15-17 meters below the surface. We can map these gravel beds, these alluvial deposits. That will show the volume of this deposit, and our resources. People will quickly see it will have a long mine life. That's a key box for us to tick. Then through the bulk sample mining, we're currently undertaking, over the course of the next 12-24 months, it will build more confidence in the average grade, which is exactly the same methodology followed by our neighbors Gemfields from about the end of 2012 until the present.

So that's the geology and resource definition side of things. Importantly, due to the richness of this area, the high grades and the quality of the rubies that we recover, with the "exploration program" we are actually in a situation where we can generate significant cashflow in developing the market through initial sales. Market development is still something on which we're pushing forward. We're looking at what is the best marketing strategy for our stones. At this stage, we're leaning towards taking the really high-end stones, beneficiating them and vertically integrating our supply chain more, so we can sell directly to select wholesale customers and provide them with an ethical mine-to-market ruby.

There's a robust demand, especially in markets like the United States, which I saw first-hand at the Tucson gem show, where we can sell these high quality larger stones, larger than say, 5 carats, to wholesalers in the United States and elsewhere. We can give them that stamp of approval that they know exactly where these rubies are coming from, which is largely lacking for the colored gemstone industry as a whole. Then we'll also determine our run of mine production, defining the discreet grades for what we produce, and we'll look at channels to sell those into. A lot is happening in terms of resource definition, sales, and opportunities to consolidate the additional acreage around us. There's plenty that will be happening.

Dr. Allen Alper: It sounds exciting! It sounds like 2017 will be a fantastic year for you and your company.

Mr. Christiaan Jordaan: Absolutely. We also have our Balama graphite deposit. Not a lot of people know this, but we’re probably the largest landholder in graphite in the East African graphite belt. We have interests in seven leases, over which we have done electromagnetic helicopter surveys, and identified graphitic bodies. We've tested those with RC remote circulation drilling, defined and basically shortlisted the top grade ones and focused a recent diamond drilling campaign on the best areas. We're looking to define a JORC-compliant resource on our graphite, plus a metallurgy flow sheet, maybe a scoping study as well in the next Quarter. Then we’ll look at ways in which to unlock value by potentially splitting off the assets into a separate public vehicle (with in specie distribution to our shareholders), trade sell into an existing graphite-focus company or whatever is best.

Dr. Allen Alper: That sounds very good. Could you give our readers more information about your background, your team, your board?

Mr. Christiaan Jordaan: Yes, so I myself am the co-founder of the project with my business partner, Cobus van Wyk. We're two South African guys who've invested privately within Mozambique for the last 12 years now, where we've really built up strong relationships with the local government and with local businesses. We have entered into joint ventures on a number of projects and explored the country and have focused our own capital and our own resources and attention on unearthing what Mozambique has to offer. It's a very geologically rich country, under-explored and underdeveloped.

Our investment company is the founder of all the projects that Mustang currently holds. We are one of the top two or three shareholders in the company at the moment, so we have serious skin in the game, so to speak. Cobus and I are not technical people, but you can see us as mining entrepreneurs that have gone into Mozambique. We've pulled in the necessary technical expertise on the ground level. We've built up an operating team of guys, expatriate South African mining guys, all with extensive experience operating throughout Africa their whole lives in places like Sierra Leone, Zimbabwe et cetera. Therefore we have a very strong team on the ground running the project, which is key in Africa. We've pulled in Mr Paul Allan as our lead consulting geologist. He used to work for Gemfields in the first two years of their project in Mozambique, and we've pulled him into our team, so he's leading our geological exploration team on the ground, and he's a great asset to us.

Finally our chairman Ian Daymond is very well experienced in Africa, many, many years in Zimbabwe and other areas in Africa, and he's a qualified Australian lawyer.

Dr. Allen Alper: That sounds excellent, it sounds like you have a great team there. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

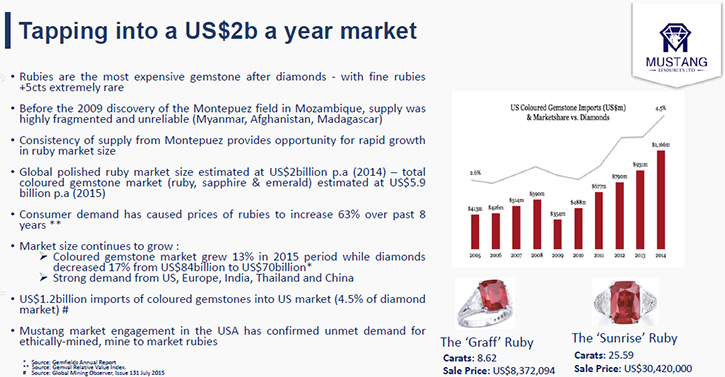

Mr. Christiaan Jordaan: I think it's a unique opportunity to gain exposure to the very fast growing colored gemstone market, and more importantly to the ruby market, which is growing very strongly if you look at recent statistics. If you actually look a little bit further back into history you will see that ruby, sapphire, emerald and diamonds had equivalent market share in the start of the 1900's. It is only because of the work of De Beers and the development and discovery of key assets in Southern Africa that they were able to develop that market and grow it to a 70 billion dollar industry. Whereas rubies have always been constrained by erratic supply from regions like Myanmar Madagascar, Afghanistan. Unstable environments.

With the discovery in Mozambique, we see the opportunity (lead by Gemfields) to emulate what De Beers has done for diamonds and really grow the ruby market from strength to feed the demand that is inherently there in culture and religion in the east and fast growing demand in the West. I think India and China are the main markets there, and also in the Western markets where you see millennials driving towards color and away from “boring diamonds”, as some of them would say.

So I think it's a fantastic opportunity to gain exposure to this industry. There are only two listed companies in this space - ourselves and Gemfields. We are early on in our development curve. We have much more room to grow from our side in becoming a larger company and a significant producer. One of the other key elements is the unique geology of the Montepuez gem field. Work through the materials that are publicly available, and read more information that's available from the GIA and others, like Richard Hughes and Lotus Gemology. It's a very prospective field that we are involved in.

Another key element is our operational team. My fellow director Cobus and I have been in Mozambique for more than 10 years. We've paid our school fees there and are really experts in how to develop projects in Mozambique with our own money. We are very much aligned with shareholders of our company in unlocking value. I think those are the key elements.

Lastly and most importantly is the potential to generate significant revenue whilst we're doing exploration. It's not your usual resources story where money is just going into the ground for 5-10 years before a mine actually is built. We are building the mine as we go. We actually have a smaller scale mine operating at the moment, which will be generating cashflow. In the very near term we'll be selling some of our first rubies in the next month. That cashflow will be re-invested into the business. Over the next 12-24 months if all goes well, we'll be looking to actually generate free cashflow.

One reason we can be so confident is what our neighbors, Gemfields have achieved over the last three years, during exploration. During their exploration period they sold 225 million dollars’ worth of rubies, and they have now ramped up to a full scale commercial mine. So it is a lot different from your usual resources projects.

Dr. Allen Alper: That sounds like excellent reasons our high-net-worth readers/investors should consider investing in your company, that's really terrific. Is there anything else you'd like to add?

Mr. Christiaan Jordaan: No, I think that covers a lot of the bases. It's great to have received your email and thanks for your interest in our company. For us it's key to gain more exposure, especially in the North American market, where we'll be selling a lot of our product. We actually have some American shareholders on the register from December's financing that we did. I spent a fair bit of time in the US for marketing and sales reasons, but also engaging with the market there. Institutional investors that I've spoken to in New York & San Francisco have been very receptive to our story.

Dr. Allen Alper: Well it sounds like you have a great story and a great property.

Mr. Christiaan Jordaan: Our rubies capture the imagination, that's for sure. It is a product people can relate to, it is something that just catches you.

http://www.mustangresources.com.au/

Level 10, 20 Martin Place, Sydney NSW 2000 Australia

+61 (0) 2 9239 3119

info@mustangresources.com.au

|

|