Interview with Nigel Lees, President and CEO Sage Gold Inc. (TSX-V: SGX): A Canadian Near-Term Gold Producer

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/14/2017

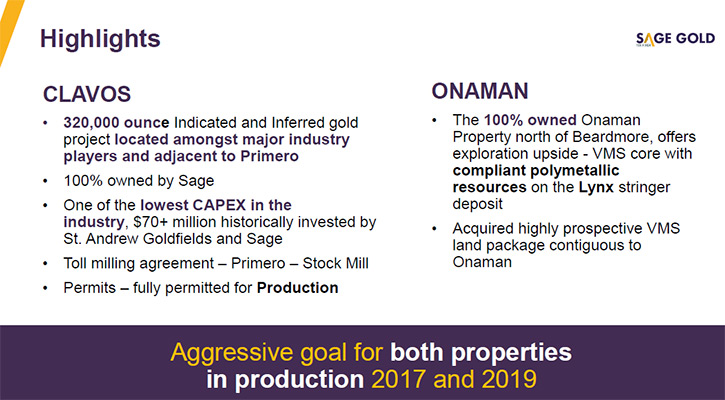

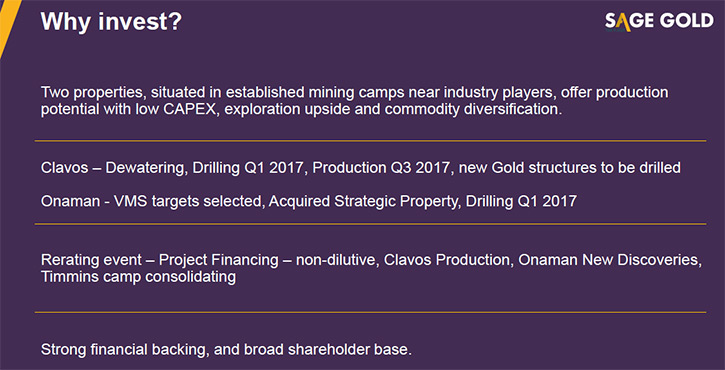

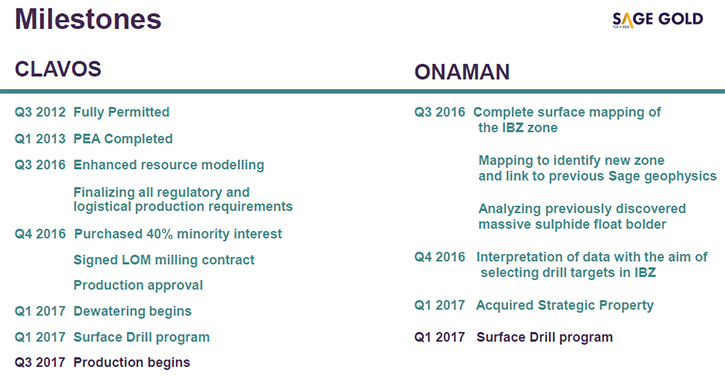

Sage Gold Inc. (TSX-V: SGX) is a Canadian near-term producer and mineral exploration and development company, with two key assets in Ontario: the 100% owned Clavos Gold property in Timmins and the 100% owned Onaman property in the Beardmore-Geraldton Gold Camp. We learned from Nigel Lees, who is president and CEO of Sage Gold, that they are one of the few companies to put a Canadian gold deposit in production this year. Clavos is a mine-ready project that will be operating once Sage finishes de-watering it. They expect this to happen in the latter part of the third quarter of 2017. At the same time, Sage is continuing the exploration at Clavos and they are optimistic they can develop a high grade zone below the current workings at a lower level. Mr. Lees believes this is going to be a very exciting year: the capex is extremely low, the grade is reasonably good, and he thinks that the risks are pretty low because there's a lot of infrastructure already there.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Nigel Lees, who is President and CEO of Sage Gold Inc. Could you give our readers an update and an overview of Sage, and what differentiates Sage Gold from other exploration companies. I see you've been doing great things this year, and things are going well.

Mr. Nigel Lees: It must have been the good article you wrote about us.

Dr. Allen Alper: I'm glad to talk with you again.

Mr. Nigel Lees: Thank you. It's nice to have a further conversation with you. The last one was in June 2016. Since then we've made a lot of progress. At that time, we were compiling a lot of information, including several mining models in order to finance Clavos, our gold property in Timmins, Ontario into production. In November 2016 we closed a complete financing package of $11.5 million to provide the capital to put Clavos into production, increased our interest to 100%, paid off secured debt and provide working capital for the company.

Dr. Allen Alper: That's fantastic. Could you update our readers on the property, on the resource, and your plans going forward?

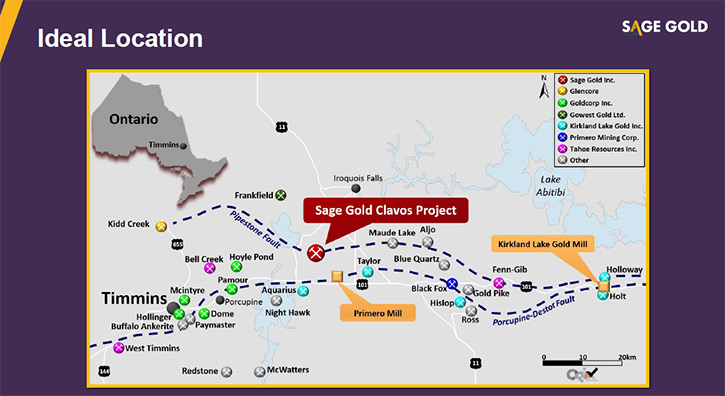

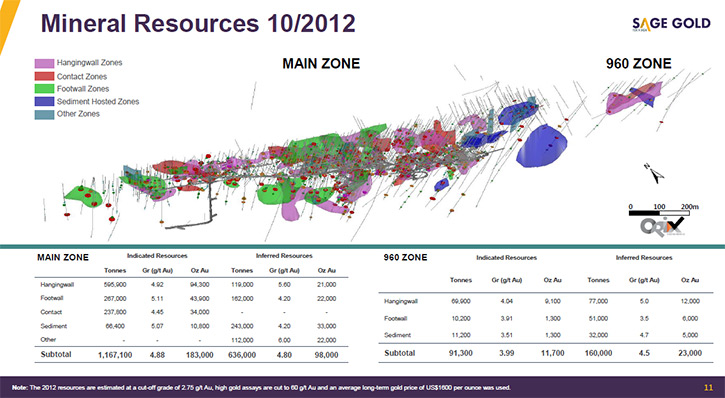

Mr. Nigel Lees: Yes. Clavos is in Timmins, Ontario, which is one of the great gold districts in Canada, if not in the world - tremendous infrastructure. The Clavos deposit is a gold deposit of about 320,000 ounces of resources, with a grade of just under five grams. It's a deposit acquired from St. Andrew Goldfields Ltd. (recently merged with Kirkland Lake Goldfields). St. Andrew invested over $60 million developing the project in the period of about 2005 to 2007. It was a time when the gold prices were approximately US$600 an ounce. They put a tremendous amount of infrastructure both on the surface and underground. We had the great benefit of acquiring a 60% (now 100%) interest a few years ago at a modest cost. Since then we have spent over $5 million on compilation, drilling, a new resource, and a PEA.

Dr. Allen Alper: That sounds great. What are your plans? When do you think you'll actually start production?

Mr. Nigel Lees: We started to de-water at the beginning of the year, and that's progressing nicely. We're following that with rehabilitation of the underground. There's a portal and underground workings going to a depth of about 300 meters. From everything we can tell, it's in excellent condition. When the dewatering has been completed, we plan to definition drill from the underground to tighten the spacing between the existing drill holes. This will be followed by exploration drilling from the underground.

We plan to stockpile mineralized material and ship to the Stock mill owned by Primero Gold with whom we have a life of mine milling contract. It is 10 kilometers away by a private road. The mill is familiar with Clavos material and has ample capacity to process. We're moving along right on target. We expect to be shipping to the mill in the latter part of the third quarter of this current year.

Dr. Allen Alper: That sounds excellent! Really exciting! Besides that, you're doing some exploration work on the old mine property.

Mr. Nigel Lees: Yes. We are drilling from the surface right now. Our target is the gap between the main zone and the 960 zone. We have completed the first two holes. If we're successful in developing or extending our resource, then we plan to drift along from the main zone into the 960 zone. If we can drift in ore, it's obviously going to be more profitable.

There are 2000 intercepts above the cutoff grade of the resource, which weren't included in the previous resource. We're doing an internal resource with those 2000 intercepts. Eventually they'll be incorporated in a formal 43-101 resource and we’re very hopeful the combination of existing surface drilling, plus the deeper drilling in the main zone and the inclusion of the 2000 intercepts will increase our resource.

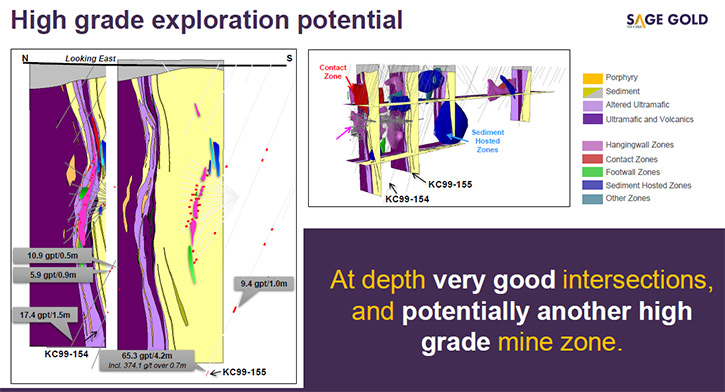

Below the current workings, Kinross, who had the property briefly in the period before and including 2000, drilled several deeper holes, down to about 750 meters in 2001. Our current workings go down 300 meters, so we will be drilling from the underground deeper. What is very interesting and very exciting is that some of those drill holes were very high grade. I'll give you an example of one. There's a Kinross hole which is KC99-155, which assayed 65.3 grams over 4.2 meters. That is an extremely high grade gold intercept with a good width.

Dr. Allen Alper: That's amazing! That was really high grade!

Mr. Nigel Lees: It's really high grade. They drilled several more holes, not as good, but certainly very high grade. So we're optimistic we can develop a high grade zone below the current workings at a lower level. What is often characteristic of the Timmins geology in the area, is that as you go deeper very often the grade improves, and I think this could probably be a good example of that.

Dr. Allen Alper: That's excellent!

Mr. Nigel Lees: Al, may I just tell you how we got to this point of production? We put together a financial package of $11.5 million; $1.85 million in equity of which $1 million purchased the 40% minority interest in Clavos, so we now own 100%; and $9.65 million which funded the repayment of secured debt and approximately $7.25 million for Clavos capex. The funding was with a private equity group based in Singapore and New York.

Dr. Allen Alper: That's amazing! Amazingly low capex for a project!

Mr. Nigel Lees: Isn't it? We have to thank our predecessors.

Dr. Allen Alper: Right. There was quite a bit of money put in by your predecessors, millions right?

Mr. Nigel Lees: Yes, in aggregate it's probably close to $100 million of which our immediate predecessor invested over $60.

Dr. Allen Alper: Wow, that's excellent! It sounds like your company is well-positioned now to go forward and it looks like the time is right, too, in the marketplace.

Mr. Nigel Lees: I think so. I'm bullish on gold. I think we just completed a pullback in the gold price, and I believe we've got a bull market for a few years. Given an opportunity to put Clavos successfully into production, expand the resource, and increase production over time, we will have a bright future

Dr. Allen Alper: I think so, too. Could you refresh the memory of our readers on your background and your team?

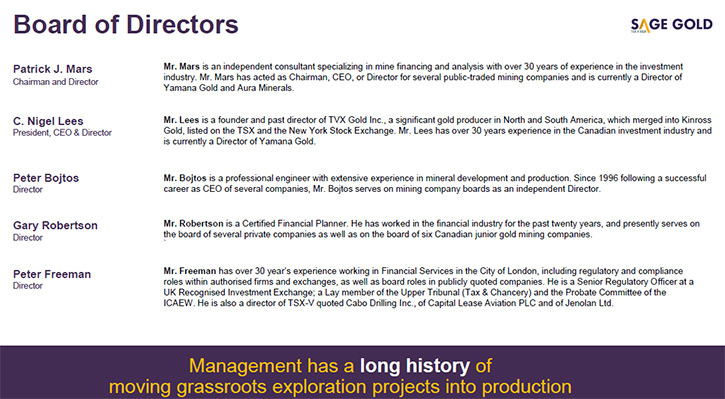

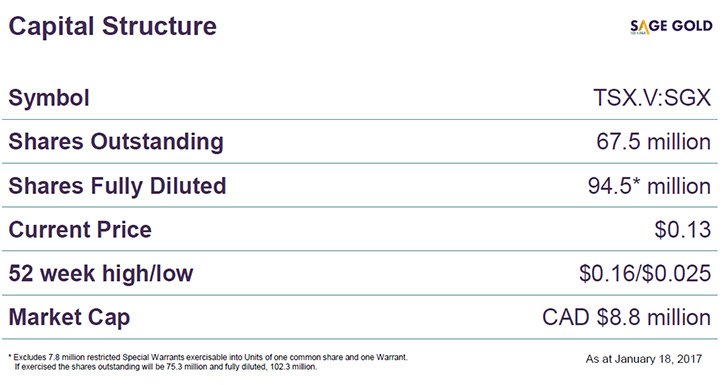

Mr. Nigel Lees: Yes, indeed. I started in the merchant banking business in the UK. I came to Canada, as a research analyst in one of the largest banks and investment firms in Canada. I wasn't a mining analyst. I was a generalist, but I became very enamored with gold and the role of gold in the monetary system. I made investments on the gold side, and started off investing in a company in the jungles of Brazil, which became the second-largest gold producer in South America after a few years. I've helped Sage grow from an early stage, into a small mining company. The market cap is still only about $8.8 million.

I'm also on the board of a major international gold mining company, one of the 10 largest global mining companies.

Dr. Allen Alper: That's excellent! You have a great background, and you have a rather influential board, too, I believe.

Mr. Nigel Lees: Yes, we have a good board. There is a diversity of talents and experience including mine management, geology, finance and business.

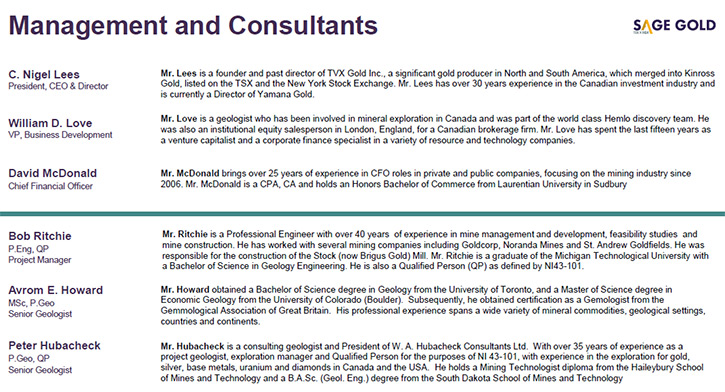

Within the management group, Bill Love with a background in geology, finance and venture capital is the vice president of business development. Bob Ritchie, a highly experienced mining engineer is the project manager of Clavos. In his many managing and consulting roles, Bob Ritchie has mined in Chile, Peru, Brazil, China, and the U.S. He is very familiar with mining in the Timmins Camp.

Peter Hubacheck, who manages the exploration program at Clavos and Avrom Howard, who manages the Onaman exploration program, are both highly accomplished and experienced geologists.

Dr. Allen Alper: That's great! Two very good properties you have and moving forward with exploration at both of them, the VMS and your gold property, Clavos. Excellent!

Mr. Nigel Lees: Right.

Dr. Allen Alper: Could you tell me a bit about your capital structure?

Mr. Nigel Lees: Yes. We have about 67 million shares outstanding. The shares trade at roughly 13 cents, so it's about an $8.8 million dollar market cap. Fully diluted, we have about 94 million shares outstanding. Our stock has done well over the last year. Al, since the last time we talked last year, the stock has more than doubled. Our secured debt has been paid off, our cash position is strong and the Clavos capex is in place. In addition, we have earmarked funds for drill programs at both Clavos and Onaman, currently underway.

Dr. Allen Alper: That sounds great! It sounds like your company is very well-positioned to go forward in 2017. It should be an outstanding year for your company. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Nigel Lees: I think you've spotted it. I think it's going to be a very exciting year. We have one of the few gold projects in Canada that actually will be in production this year. The capex is extremely low; the grade is reasonably good; and we think that the risks are low due to the existing infrastructure. A life of mine milling agreement is in place. The mining jurisdiction is excellent. Added to these factors there is a good opportunity for increasing resources and expanding production.

There are other opportunities for acquisitions in the area, including contiguous exploration projects, and gold deposits in the area. We have a team, the ability to finance and put mines into production.

The Onaman property, also in Ontario, offers a great volcanogenic massive sulfide (VMS) exploration and development opportunity with historic resources of zinc-silver-lead±gold and a 43-101 copper-silver-gold resource.

Our focus over the near and medium term is Clavos.

Dr. Allen Alper: That sounds fantastic! Those sound like very good reasons for our high-net-worth readers/investors to consider continuing to invest in Sage Gold. Is there anything else you'd like to add, Nigel?

Mr. Nigel Lees: We believe, with our market cap's eight and a half million dollars, Sage Gold is undervalued in comparison to its peers.

Dr. Allen Alper: That sounds excellent!

http://www.sagegoldinc.com/

200 University Avenue

Suite 1301

Toronto, ON M5H 3C6

Canada

Nigel Lees

nlees@sagegoldinc.com

|

|