Interview with Tyler Rice, President and CEO of Margaux Resource (TSX-V: MRL, OTCQB: MARFF): Previously Producing Jersey-Emerald Tungsten-Lead-Zinc Property, British Columbia, Canada

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/6/2017

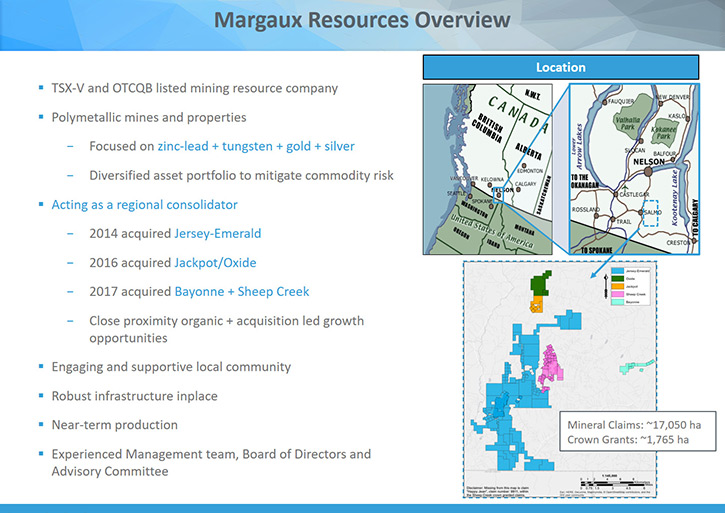

Margaux Resources Ltd. (TSX-V: MRL, OTCQB: MARFF) is a polymetallic exploration company focused on the exploration and development of previously producing properties in the Kootenay Arc, located in southeastern British Columbia, including the Jackpot/Oxide, Jersey-Emerald, Sheep Creek and Bayonne properties, on which Margaux has options. Margaux's management team has extensive experience in exploration, mine development and operations. We learned from Tyler Rice, President and CEO of Margaux Resource, that in 2014 they completed a drill program on the property and doubled the life of the mine based on a NI43-101 resource for tungsten, as well as hit high-grade lead-zinc and silver at surface, and a high-grade gold intercept. Mr. Rice lives 30 minutes away from the project as he believes you have to have boots on the ground. The company has been tightly held and now they are ready to go to market on a large basis as they advance their projects further.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Tyler Rice, President and CEO of Margaux Resource Ltd. Could you tell us a little bit about your property? I know it has zinc and lead and tungsten, and at one time it was mined until, I think, 1973, but could you give our readers a background on your property and why it's of interest and your plans for it?

Tyler Rice: Yeah, for sure. Margaux Resources acquired an option on the Jersey-Emerald property in 2014, primarily focusing on the tungsten aspect of the property. The property was the second largest past-producing tungsten property in North America, supplying the US war-time effort for their strategic supply of tungsten, and it also produced the second largest amount of lead-zinc in the province of British Columbia, which is significant given the world's largest past-producing lead-zinc mine, which was the Sullivan, is also hosted here in British Columbia. Historically it did eight million tons of lead-zinc, and 1.6 million tons of tungsten.

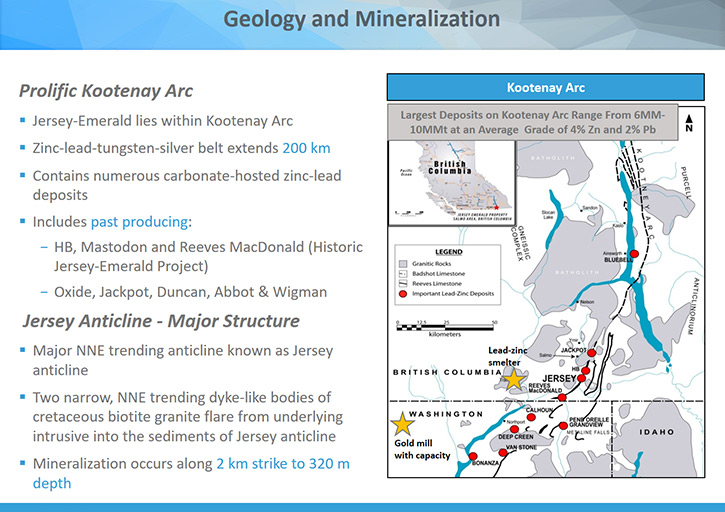

We completed a drill program on the property in 2014, whereby we doubled our life of the mine based on a NI43-101 compliant resource for tungsten. We also hit high-grade lead-zinc and silver at surface, and we had a high-grade gold intercept. We intercepted 25 grams per ton of gold over 10 meters. Just recently, this past fall, we did some follow-up work to identify further the extent of that gold intercept. In addition to that, we're becoming a consolidator within what's known as the Kootenay Arc, which is a very well-defined geological trend that goes from the north end of Washington up to the tip of Kootenay Lake.

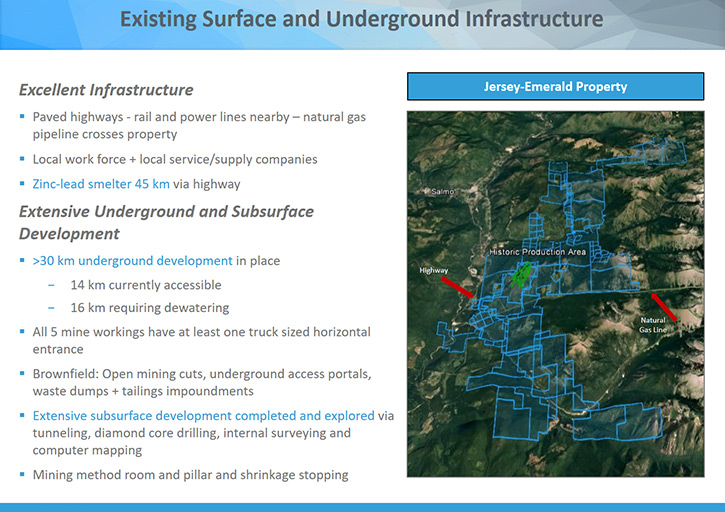

Teck Resources has a lead-zinc smelter in the city of Trail and they do over $2 billion in lead-zinc smelting per annum, so we feel that we're very strategically located to reactivate the historic workings that operated from 1920 to 1973 when it shut down. Teck is currently getting some resource from the Pend Oreille facility, which is south of the border from where we are located here in Canada near Salmo, BC. We have similar grades that are being mined and we feel very confident that we'll have the ability to bring our operation into production.

In addition to that, we acquired the Jackpot property, which was owned by Cominco, back in the day before it was let go back in the eighties. There's a historic resource of three million tons grading 5% combined lead-zinc that we'll be doing additional work to bring it into a NI43-101 compliant state.

Additionally, we just recently closed on a gold acquisition of the Sheep Creek and Bayonne properties, which are very proximal to all of our other acquisitions. The properties produced approximately 3/4 million ounces historically. There is a historic resource of 144,000 ounces, and we'll be looking to get back onto that property to prove up and increase a NI43-101 compliant resource.

I live in Nelson, BC, which is about 30 minutes away from the project. What I've found with my career is you have to have boots on the ground. You can't be a seagull, fly in, peck away, and fly out, and continue to see your project moving forward. My last major project was a healthcare company here in Canada, which we grew from my 9 offices to 50 in Canada, three in Columbia, and one in Beijing, and we sold that to a major multi-national healthcare company. Then I got into this project.

I've built out a very strong advisory committee, being a chartered accountant, or CPA as it's recognized now, I needed additional resources within the mining sphere, so we recently announced the addition of Steve Letwin, who is the President and CEO of IAMGOLD. We also have Chris Stewart, who is the former Chief Operating Officer of Kirkland Lake Gold, and currently the President of Treasury Metals. Also we have Dr. Rogerio Monteiro, the former Chief Structural Geologist of Vale. Lastly we added Dr. Victor Zhao, who is a former lead for Barrick in China. We have a lot of horsepower that we've added to the team, and we're looking forward to advancing our projects going forward in 2017.

Dr. Allen Alper: Wow, that's a very, very strong team you have. That's really great. Could you tell me a little bit more about the share structure and the capital structure?

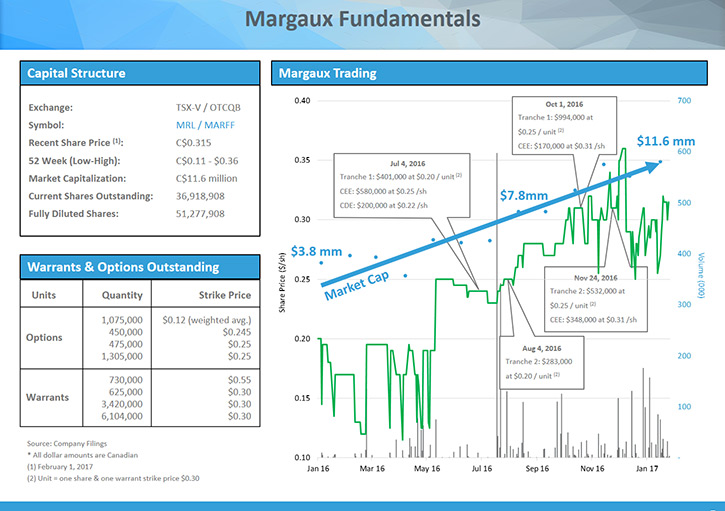

Tyler Rice: We're very tightly held with a low number of shares outstanding. I own 6% of the company.

We have approximately 37 million shares outstanding, approximately 51 million fully diluted, with the bulk of those being convertible at 30 cents. We're listed on the Toronto Stock Exchange, on the Venture, under MRL. We're also listed on the OTC, and we are DTC eligible under the ticker MARFF.

Dr. Allen Alper: That's very good. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Tyler Rice: The number one reason high-net-worth or any investor should be considering evaluating Margaux Resources is the fact that we're severely under-valued based on our historic resource. We are going through the process of bringing that into a NI43-101 compliant state. I feel we will be able to recognize that value within the market. In addition, we are already completing the baseline studies for environmental work to advance us to a near-current production opportunity.

We do have results being assayed right now for our recent gold target. In addition, we will be evaluating, further, the up-side on the Sheep Creek and Bayonne property. Also Kinross has a gold mill two hours south of us in Washington that is going into care and maintenance because they've run out of ore. So we're acquiring significant land positions in a mineral rich area where we have two potential customers.

Dr. Allen Alper: That sounds very, very good. Is there anything else you would like to add, Tyler?

Tyler Rice: We have a brownfield opportunity in the context of being a past producer, but we also have greenfield excitement, and we're looking to provide substantial shareholder return as we move forward into 2017.

Dr. Allen Alper: That sounds really excellent!

http://margauxresources.com/

Margaux Resources Ltd.

1600 - 510 5th Street SW

Calgary, AB, T2P 3S2, Canada

Telephone: 403.537.5590

|

|